Junior Gold Stocks: Half Year Report Card

Has gold topped out, or is it beginning a new leg higher?

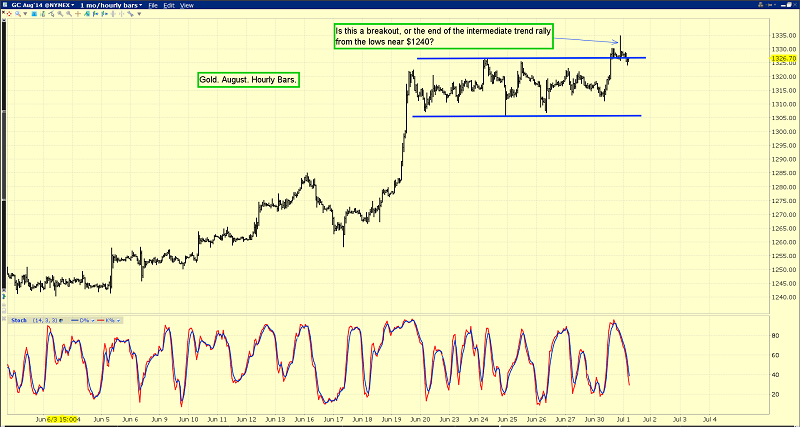

That’s the hourly bars gold chart. A persuasive argument can be made that gold staged an upside breakout last night.

The range of $1305 - $1326 was decisively penetrated to the upside, and gold traded as high as $1335.

In 2013, I asked my subscribers, who I refer to as “golden marines”, to focus their buying in the $1228 area, with an emphasis on gold stock. Gold is now about $100 above that key buying area.

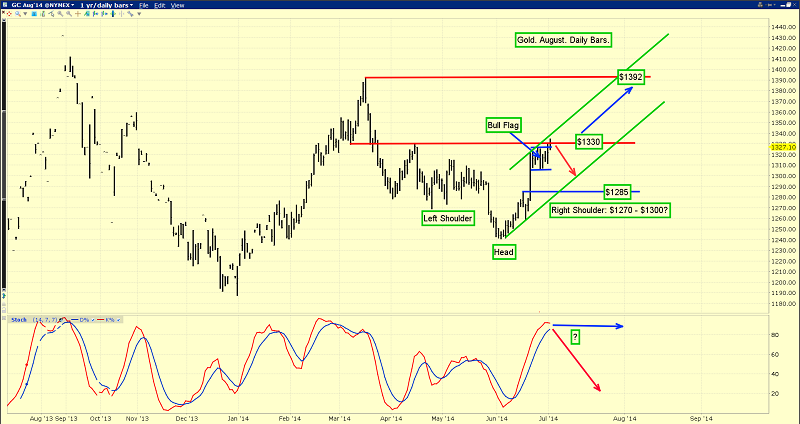

I’ve highlighted a bull flag pattern breakout on this daily gold chart. Even if the flag pattern fails, and the 14,7,7 Stochastics oscillator suggests it could, that failure would likely create a powerful right shoulder, completing a bullish inverse head and shoulders bottom pattern.

I don’t think it’s that important for investors to try to guess whether gold is topping out in the short term, or beginning a new leg higher. I would argue that an obsession with calling minor trend tops and bottoms can destroy wealth, rather than build it.

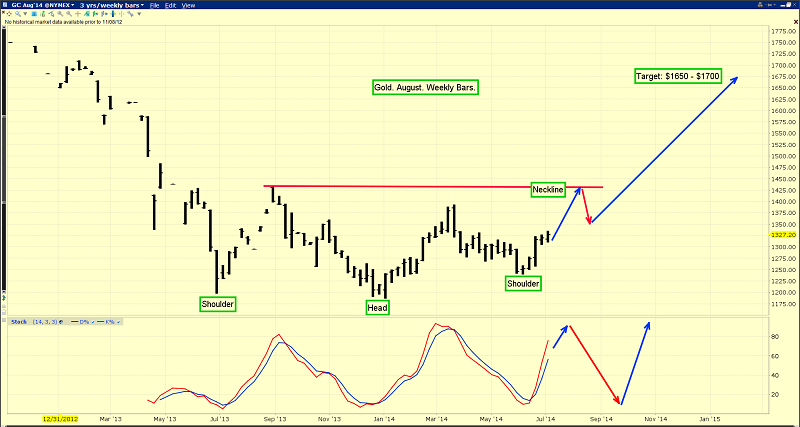

It’s much more important to stay focused on the very bullish big picture. This weekly chart shows the 14,3,3 series Stochastics oscillator in rising mode, and a giant inverse head and shoulders bottom pattern dominates the chart.

India’s new government budget is scheduled to be announced on July 10. That’s a key date for any citizen in the world gold community. Many gold dealers believe Prime Minister Modi will announce a significant reduction in gold import duties and regulations.

I agree. The current gold price rally could take a needed breather as the budget is announced. It would be a classic case of “Buy the rumour, and sell the news.”

Regardless, it’s critical that these restrictions and duties get reduced, and I believe the very bullish picture presented by the weekly and monthly gold charts suggests that Modi is set to release an enormous amount of pent-up Indian demand, over the next six months.

Also, the US Employment Situation (jobs) report is scheduled for release on Thursday, and Janet Yellen makes a key speech in Washington on Wednesday.

Gold often sells off as the jobs report approaches, but that hasn’t happened this time, adding to the overall bullish sentiment in the air.

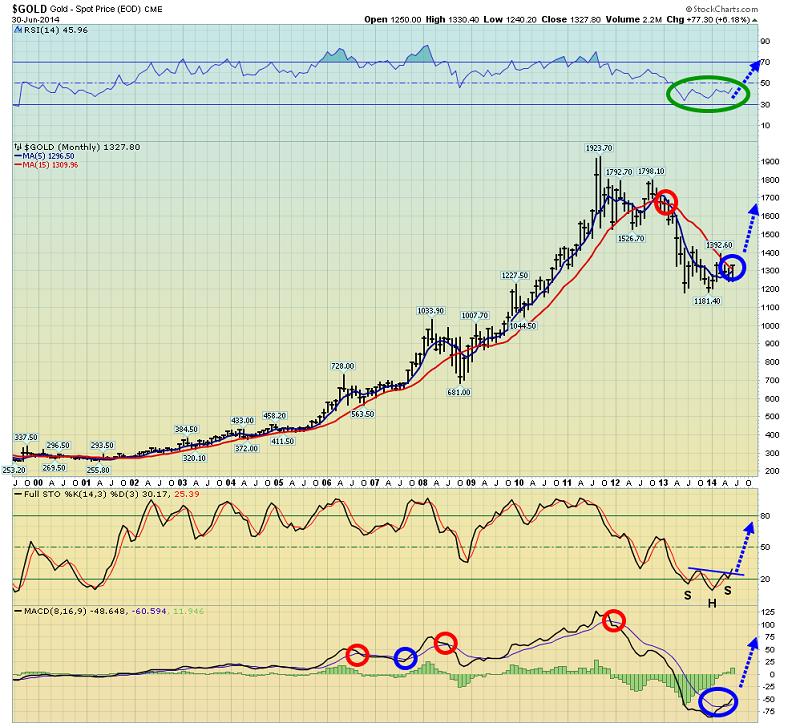

This monthly gold chart looks spectacular. Note the RSI oscillator at the top of the chart. It is making new highs, and that’s bullish.

The 14,3,3 series Stochastics oscillator has burst to the upside, from a bullish inverse head and shoulders bottom pattern.

The 8,16,9 MACD indicator is now flashing a key buy signal. Note how rare these signals are, and the size of the price movements that tend to follow them.

The key 5,15 moving average series is also on the cusp of a “king kong” sized buy signal.

What about geopolitical price drivers? See above. While short term oscillators may be overbought, the longer term charts suggest that “team top caller” could sustain a serious beating, particularly if events in Iraq and the Ukraine worsen. On that note, please click here now.

Looking at the key geopolitical gold price drivers, it’s apparent that the upcoming holiday week-end may not be a very pleasant one for the gold bears.

I want to take a moment to discuss the Bitcoin phenomenon. This daily bitcoin chart is very bullish.

Some analysts have tried to compare bitcoin to gold. I think that’s a mistake, but there is a role for bitcoin to play, as a global reserve currency. Here’s why: Central banks generally refuse to be audited, and they have treated gold, generally speaking, with a fair amount of disrespect.

Gold is the ultimate form of money, and I’m not sure that central banks deserve to hold any of it. The ultimate form of money should be in the hands of citizens, not governments. Part of the reason I own bitcoin is because I believe central banks will ultimately embrace it as part of a global reserve currency.

Regardless, bitcoin is a minor holding for me, and I view it like a junior stock. It’s a speculation. From a perspective of risk, it shouldn’t be compared to gold, any more than a junior gold stock should be compared to gold.

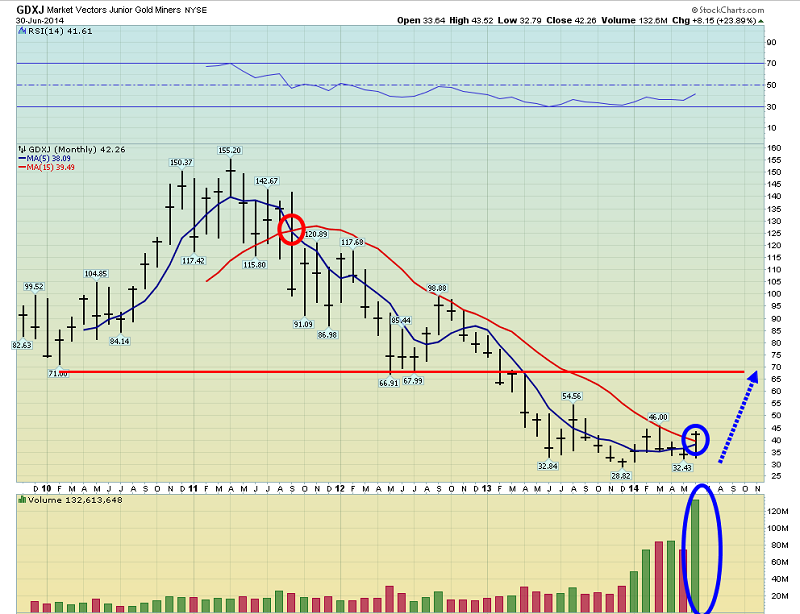

The big picture for speculative junior gold stocks is very bright, because inflation is beginning to rise in the West, and India is probably only ten days away from officially ushering in a gold jewellery “bull era”! This monthly GDXJ chart is important. The 5,15 moving average series is on the verge of what could be a “generational” buy signal.

Yesterday’s close was critical, because it was not just the end of the month, but the end of the quarter. Junior gold stocks staged a spectacular ending to the first half of the year, on massive volume. This chart suggests the second half of 2014 will be even better!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Leader” report! Which of the senior gold stocks has the best track record of leading the gold price, on the upside? I’ll show you the four contenders to that crown, and cover the relative merits of each of them.

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: