Keep Your Eye On The Gold Price

Strengths

-

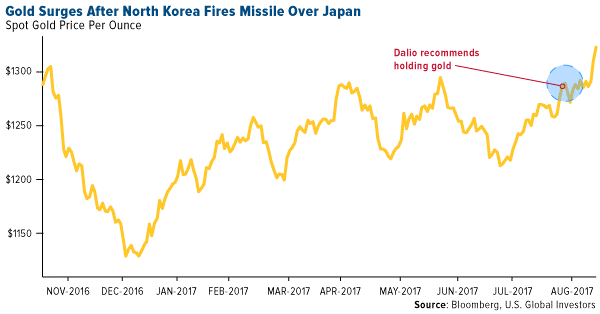

The best performing precious metal for the week was palladium up 5.86 percent on speculation that automobile sales will jump to replace ruined vehicles in Texas, post Hurricane Harvey. That rally could be short lived as the auto inventories are high and all the water damaged vehicles along the Gulf Coast will simply have their catalytic converters recycled here in North America. Gold traders and analysts surveyed by Bloomberg are bullish for an 11th week straight, reports Bloomberg, as the yellow metal broke above the $1,300 an ounce. In addition, gold futures headed for the first close above $1,300 an ounce this year following no real news from Jackson Hole. As the dollar dropped, demand for the metal rose.

-

North Korea fired a ballistic missile over Japan early this week, sending gold to its highest level this year, reports Bloomberg. Hedge fund billionaire Ray Dalio “may feel vindicated as gold trades well north of $1,300 an ounce” on the news, the article continues. Earlier this month, Dalio wrote about holding up to 10 percent of a portfolio in gold, warning of rising risks.

-

U.S. Treasury Secretary Steven Mnuchin spoke about a weaker U.S. dollar helping to boost trade this week, allowing gold to hold its gains as the greenback dropped, reports Bloomberg. According to Naeem Aslam, chief market analyst at Think Markets U.K., gold is poised for further gains and could reach $1,370 this month.

Weaknesses

-

Gold ended up lagging its peers in the precious metals space but still gained a respectable 2.60 percent for the week. Sibanye Gold canceled its dividend, reports Bloomberg, after debt ballooned while the South African producer swung to a loss. Following Sibanye’s $2.2 billion purchase of Stillwater Mining, it will focus on cutting borrowing costs. In Indonesia, mining company Freeport-McMoRan has agreed to give a majority stake of the Grasberg mine back to the Indonesian government; a 51-percent stake. The deal is meant to bring an end to years of rising public anger over American control of one of the mining industry’s crown jewels, the New York Times reports. However, major issues still linger, including what the Indonesian government might have to pay for that stake.

-

Another political crisis is deepening in Guatemala, reports Bloomberg, as the courts blocked President Jimmy Morales’ attempt to expel a UN-backed, anti-corruption chief. Morales ordered the expulsion of Ivan Velasquez, just days after he said he was investigating the president for illegal campaign financing (Morales failed to properly report at least $825,000 in contributions in 2015), the article notes. Tahoe Resources has had its mining license suspended in Guatemala.

-

The bailout of Russia’s second largest private bank, Otkritie FC, signals the failure of a strategy to have private lenders compete with state giants and dominate the industry, reports Bloomberg. “It’s no secret that many Russian private banks are ill-prepared to meet international standards of accounting, risk control and even simple business strategy,” said Anastasia Nesvetailova of City University in London. Otkrite’s unexpectedly low credit rating due to its loan portfolio and the failure of a rival triggered its downfall, “leading to a run on deposits that drained 527 billion rubles,” the article continues. In addition, the bank bought a diamond mine from its own shareholders for $1.45 billion. Switching over to the U.S., President Trump is set to undo another Obama-era initiative, reports Bloomberg, lifting his predecessor’s ban on giving local police department’s military-grade equipment.

Opportunities

-

According to BMO Technical Analyst Russ Visch, gold’s price rally could trigger a major, long-term buy signal for the metal if prices close above $1,375 an ounce, reports Bloomberg. If such a breakout happens, Visch believes this would shift the long-term trend back to bullish, opening an initial target of $1,705 an ounce. And when it comes to gold stocks, Mark Steele writes that BMO Capital Markets continues to “recommend an allocation toward gold shares, as painful as that has been so far this year, but impactful in a time like this where U.S. yields and yield curves continue to trend lower, and gold is an alternative to that experience.”

-

ABN Amro Bank lifted its price estimate for gold after the metal broke through $1,300 an ounce. The bank now sees the yellow metal rallying to $1,400 in the third quarter of 2018, reports Bloomberg. Similarly, Citi said in an email this week that gold could have upside bias for the rest of this quarter, especially if the geopolitical climate deteriorates. As a side, North Korea has stated that the missile over Japan earlier this week was a “prelude” to containing Guam.

-

According to The Daily Prophet, it’s time to start paying attention to gold. Whether it’s a weak dollar, tension from North Korea or hurdles from tax reform, “the list of worries continues, but the point is that there’s no shortage of risks facing investors,” Bloomberg writes. Even Thomas J. Lee of Fundstrat Global Advisors (who had the most bullish forecast for the S&P 500 for most of last year), is worried of stocks breaking down. Jim Rickards, best-selling author of Currency Wars, is not giving up on gold. Rickards noted that gold is one of the best performing assets of 2017 and in an interview added that the yellow metal could eventually touch $10,000 an ounce.

Threats

-

Are central banks nationalizing the economy? That is a question raised by the Mises Institute, and related to an article recently ran in the Financial Times, stating that “leading central banks now own a fifth of their governments’ total debt.” The figures are staggering – for example, right now the Bank of Japan is a top 10 shareholder in 90 percent of the Nikkei. The report explains that “believing that this policy is harmless because ‘there is no inflation’ and unemployment is low is dangerous.” At the extreme, total debt has soared to 325 percent of GDP in Japan. “Government-issued liabilities monetized by the central banks are not high-quality assets, they are an IOU that is transferred to the next generations, and will be repaid in three ways: with massive inflation, with a series of financial crises, or with large unemployment,” the article continues.

-

When it comes to India’s $45 billion gold industry, Anand Ghurgre, who owns a family jewelry shop in Mumbai, has seen the past and future colliding, reports Bloomberg. “We still operate the way my father did for 50 years,” Ghugre said, explaining that transactions were usually done in cash and not always recorded. This way of doing business is under threat due to Prime Minister Modi’s financial reforms including demonetization and a new goods and services tax. This, combined with a younger generation that shops online, could usher in a wave of takeovers and mergers in their stock market, perhaps drawing attention away from gold, the article continues.

-

Mohamed El-Erian noted that based on historical models, gold’s responsiveness to recent geopolitical tensions, as well as its price, appear weaker than would have been expected, reports Bloomberg, and for understandable reasons. “The precious metal’s status as a haven has been eroded by the influence of unconventional monetary policy and the growth of markets for cryptocurrencies,” the article continues. El-Erian noted that gold’s traditional role could be re-established down the road as central banks are just beginning to unwind their unconventional policies and cryptocurrencies are certainly more vulnerable to unsettling air pockets. Government policies may emerge that target these cryptocurrencies with regard to tax evasion and anti-money laundering laws.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of