A Key CPI Report & Winds Of War

“If I were the Fed chair, I would have raised rates early in the fall. When we get this broad-based increase and it starts making its way to wages, you’re behind the curve and you need to start moving.” - Ethan Harris, Head of Global Economics Research, Bank America, Feb 7, 2022. The bottom line:

Inflation is on the move!

Heavyweight economist Ethan Harris predicts the Fed will play catch-up and hike eleven times over the next two years.

I’ve been adamant that commodities, gold/silver, a bit of crypto, and Chindian markets will be the winning investment strategy for the next 10-20 years… and I’m becoming more adamant about it.

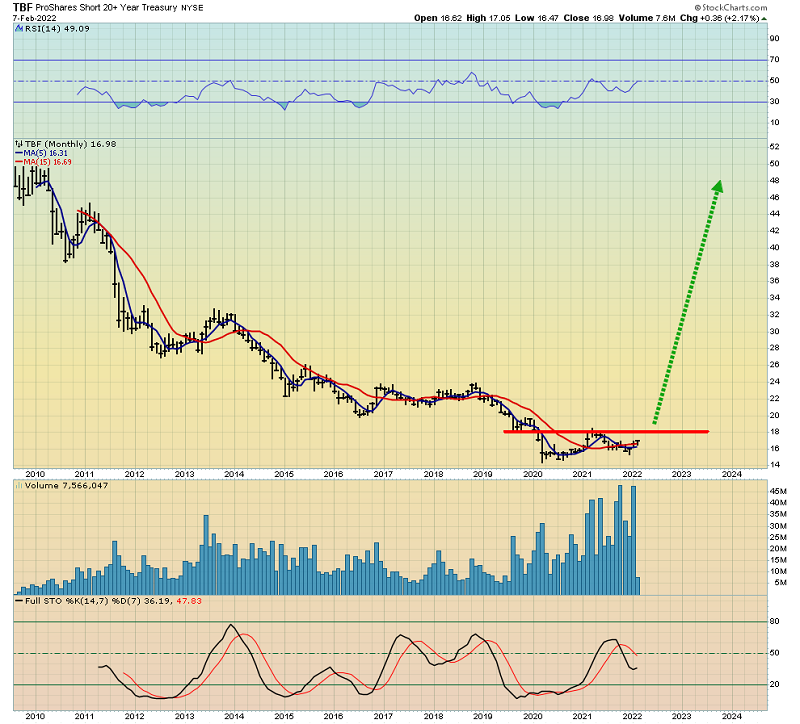

I rarely recommend that conservative investors engage in speculation, but if ever there was a potential “no brainer” play…

Buying an unleveraged bear bond ETF like TBF-NYSE in the face of relentless interest hikes is probably it.

The daily gold chart. There’s a loose symmetrical triangle in play. $1835 is modest resistance and $1750 is support.

The US CPI report will be released on Thursday, and it may determine whether gold trades at $2089 next, or whether there’s a “pitstop” at $1566, enroute to $3000.

When institutions notice that repeated rate hikes are failing to temper inflation, there will be panic buying of gold and silver. Until that happens, gold bugs can focus on shorting the bond market and buying a wide array of commodities.

The energy ETF. When fundamentals become exceptionally strong, as they are for energy markets now, overbought oscillators are no longer sell signals. Instead, they function as powerful buy signals!

The horrifying Dow chart. Amateur investors like to imagine they can outperform the market indexes, and they often do… until market breadth disintegrates and there’s a crash.

The P/E ratios for bank stocks are around 10, but for most stocks that amateur investors own, these ratios are in the “Icarus Zone” of 40-200. It’s very similar to the market in 1928.

Some of the “darling” stocks that investors bought “for the long term” are already down 50%-70% from their highs, and they’ve been down for a year. The coming avalanche of rate hikes is going to turn their financial bonfire into a gulag. I expect the stock market gulag to last for 10-20 years, but it could be longer, given the “end of empire” card now being played in America.

What do eleven rate hikes do to the real estate market? Well, investors who are leveraged will likely be wiped out.

If the Fed hikes eleven times in the next two years (and then more), what happens to credit card rates? What happens to the purchasing power of the average citizen? What happens to the debt-obsessed government?

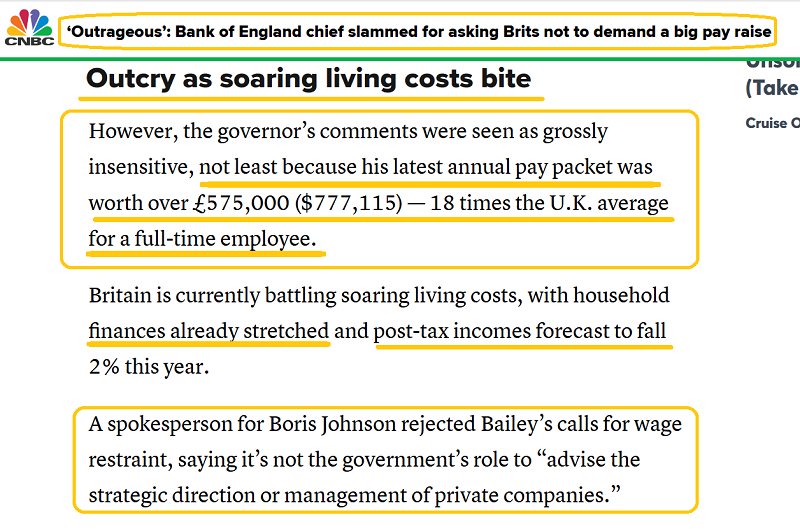

If BOE chief Bailey makes the outrageous statements he’s making now when the situation becomes much more dire, the danger of rioting and civil war becomes a real possibility.

The man is gorging on almost $800,000 a year of printed, borrowed, and extorted taxpayer funds. He’s refusing to take even a one cent pay cut himself while demanding the poorest of the poor live even more poorly. He’s doing this while the inflation he was mandated to control is poised to go completely out of control.

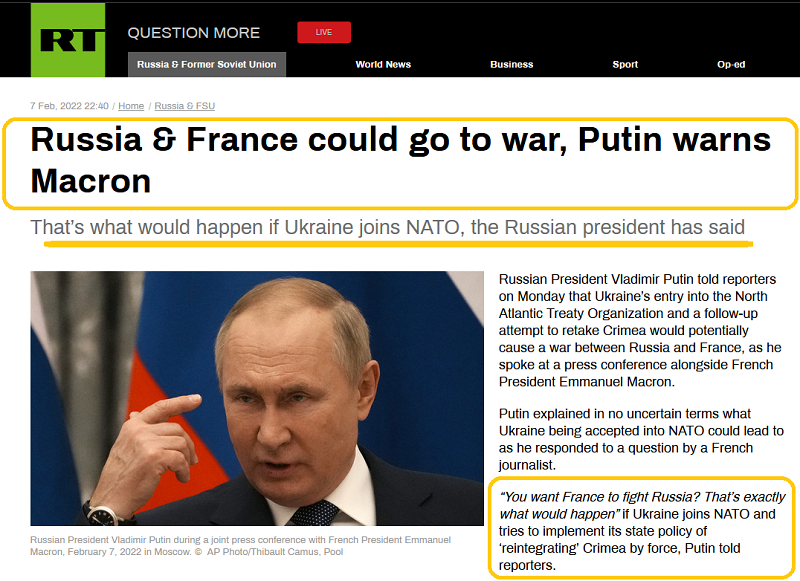

The 2021-2025 time frame is a potential war cycle, and it’s both civil and global.

A look at the global war factors in play. Parts of Mexico have become “Mad Max” zones, and there are endless waves of “illegal immigrants” caused by the US government’s failed and morally bankrupt war on drugs. The “fix” for Cuba has been to pound the citizens with decades of sanctions.

If the US government can’t even manage normal relations with its own neighbours, has failed in Asia and the Mid-East with all its regime change wars, then it should be obvious that the outcome of serious conflict with Russia could be the biggest American government failure yet…

And another reason to own lots of gold.

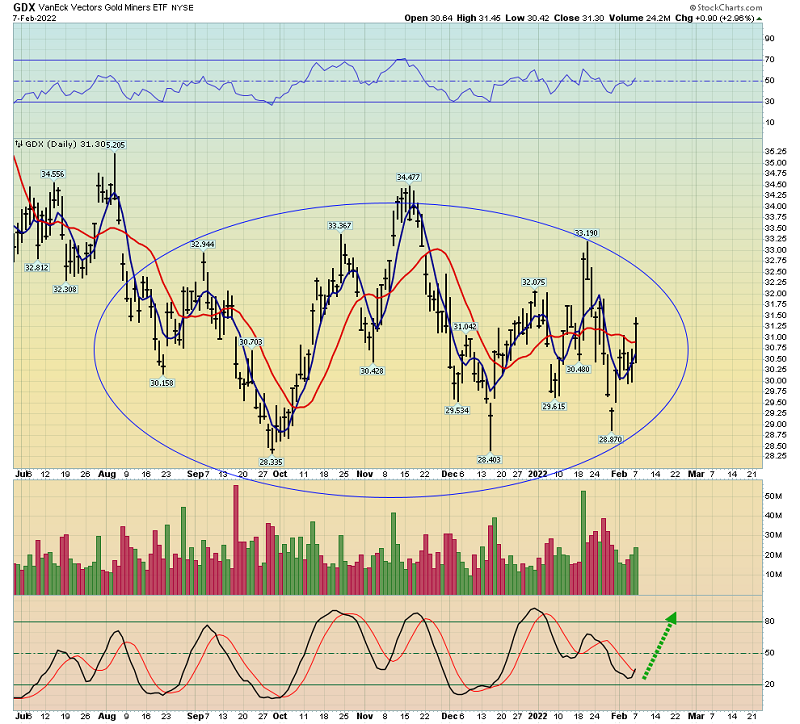

Watching wet paint dry is more exciting than looking at this daily GDX chart but…

The weekly GDX chart is a lot more enticing.

A monthly close over $35 would define a breakout from the bull wedge pattern as solid. In the interim, grub stakes in bond market bear funds, commodity bull funds, and a toe in the crypto waters is likely the best way to create immediate wealth… in what promises to be the most volatile year in America since the 1970s!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Junior Mining Power Plays!” report. I highlight eight “junior rocket” stocks that have big volume and big price action right here and now, with powerful tactics for investors who are ready to get richer!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: