The Long and Short on GLD

Currently, traders are equally divided between the bull and bear camp, both with very convincing arguments why this and why that. Naturally, that is what makes a market. I have received many emails lately, and most of these folks are neither bulls nor bears, they are simply confused. Keeping it simple is easier said than done, and keeping it simple is precisely what we do.

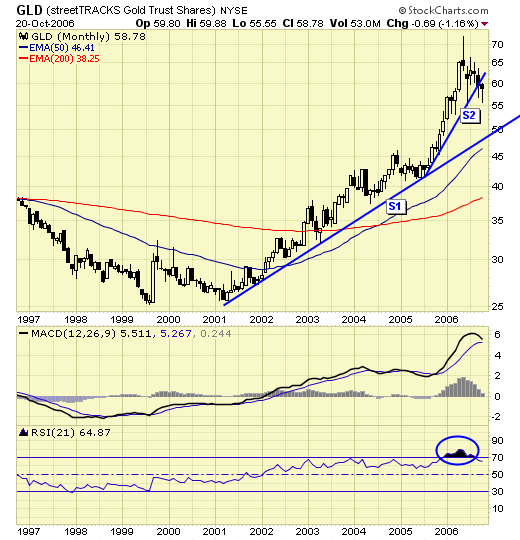

First, we look at the long term.

Yes, the bull market is alive and well. In fact, prices can drop tomorrow all the way to $38 ($380 gold) and it will not change a thing. The configuration is bullish, and long term investors buy when prices find support at either the 50 or 200ema. This is the essence of our trading model. It is not a question of if, but when this will happen. All prices eventually test these EMA support/resistance, in all time frames. But don't take this as advice to short the market, we do not execute trades on the monthly charts.

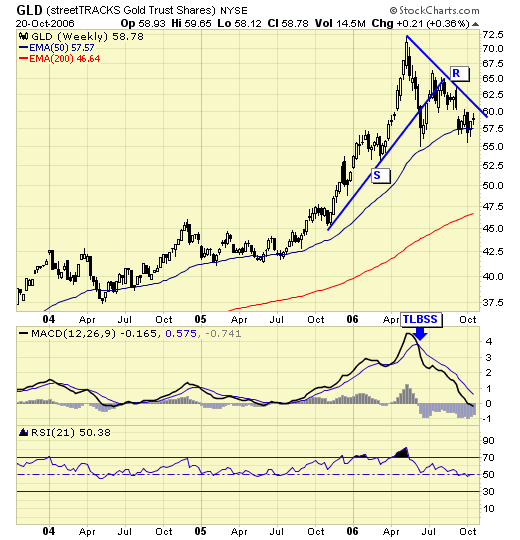

Then we look at the intermediate term. Weekly GLD is on a sell signal, with prices currently testing 50ema support. If successful, we will have a buy signal here, although we will probably have bought when that happens, using a shorter time frame. If support fails, a test of the 200ema support will be next. Again, do not short the market based on this intermediate term outlook, we only execute trades on the daily chart, next.

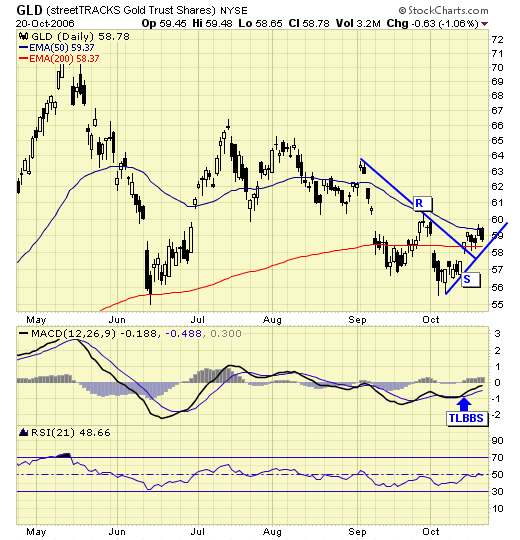

The daily chart is our short term time frame and where all of our trades are executed on. We had a buy signal on 10/13 at $58.57, and we will stay long until support fails.

Summary

We have made 40% profits on trading GLD so far this year, and part of that success is due to the fact that we ignore the noise and focus only on price action. We do not hold long or short hoping for some of those outlandish price targets to be reached some time in the future. We live and trade the now, and gold is currently struggling at the $600 level. If support holds, we may see a 10 to 15% profit potential from our current set up. If support fails, we are testing the June low and the longer time frame will come into play. We follow price action and will go with the flow, money flow that is.

********