Macroeconomics And Metals

There are a multitude of macroeconomic discussions I have heard by “experts” in the metals world over the last few years. Quantitative easing, supply and demand, fiat money and fractional banking, the Fed’s “plan” to destroy the US Dollar; yes, the issues have run the gamut. Analysts have been using their models based upon these macroeconomic frameworks to discern where metals are headed. And, more often than not, the conclusion reached through this “analysis” ends in immediate bullishness.

There are a multitude of macroeconomic discussions I have heard by “experts” in the metals world over the last few years. Quantitative easing, supply and demand, fiat money and fractional banking, the Fed’s “plan” to destroy the US Dollar; yes, the issues have run the gamut. Analysts have been using their models based upon these macroeconomic frameworks to discern where metals are headed. And, more often than not, the conclusion reached through this “analysis” ends in immediate bullishness.

But has anyone recognized how superficially we determine who these “experts” are in this industry? I have been told that certain people are viewed “experts” because they have a lot of money. But, do we realize that some of them have become wealthy from selling metals to the masses from the highs all the way down? Is that really a reliable gauge of “expert” status?

Then we look to those who can speak intelligently about the macroeconomic issues mentioned above. They utilize a lot of technical jargon in their articles and interviews, which are designed to dazzle and amaze, and, boy, it sure sounds impressive. The average person will listen to this supposed “expert” speak about matters for which they have little understanding, and surmise that “this person really sounds like they are knowledgeable.”

But, does being knowledgeable about macroeconomics or being wealthy relate to being able to determine the next directional move in the metals market? I think too many have learned the hard way that the answer to this question is a resounding “no.” What happened to classifying an “expert” as one who is right a lot more than they are wrong?

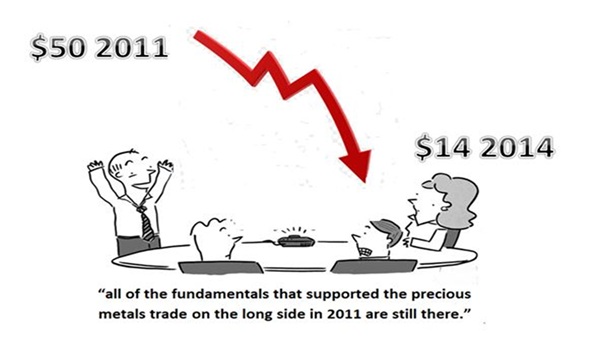

Folks, the metals market has lost its way. Silver has now lost 70% of its value from the 2011 while market “experts” have been suggesting you buy all the way down, and all based upon macroeconomic fundamentals. Macroeconomic fundamentals have been an utter failure in not only being able to identify the top in 2011, but in suggesting people buy all the way down during that 70% decline.

Some within the mainstream are even starting to recognize this. Not too long ago, Brian Kelly from CNBC’s Fast Money, when presenting his famous representation of the miners market in the depiction of the “vomiting camel,” noted quite emphatically that metals simply do not trade on fundamentals.

Anyone who is honest about the market reaction to QE3 knows that the market went in the opposite direction almost everyone expected based upon the “fundamentals.” I say “almost everyone” because we were shorting the metals market at the time despite everyone warning us how wrong we were to do so.

This past week, we have seen gold and the miners basically decimated, and are now trading at levels most would not have fathomed not only in 2011, but most could not conceive of these levels even last year, despite our warnings.

But, the market is nearing the end of this 4-year correction. From a sentiment standpoint, we are seeing the mainstream media publishing articles about gold being dead, or comparing gold to a “pet rock.” While the gold-bug “experts” will never change their mantra, the majority of the market is almost bearish enough to view this 4 year correction as just about being over. While I don’t think the bottom has yet been struck, I believe that anyone now attempting to short the market is playing with fire. Rather, it is time to prepare your buying list as the holiday sale is just about upon us.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of