The March Reversals - Part 2

I have documented this amazing phenomenon a year ago, and for those who have not read my previous article, a little background is needed before reading this special report. You can do so at this link: https://www.gold-eagle.com/editorials_05/chan030505.html

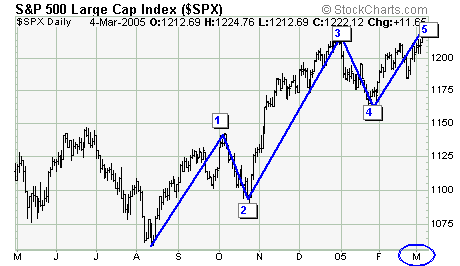

Lets go back to March 2005 first…

March 2005 - here we are, does it appear that we are at a bottom, or a top? Elliott wave fans can quickly recognize the 5 waves up since Aug 2004, because we just made a higher high this first week of March.

One year later…

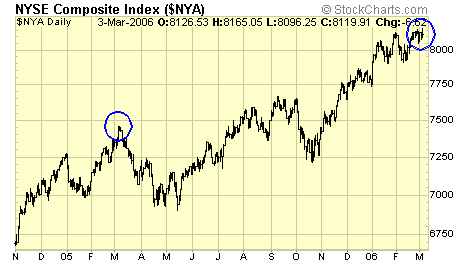

We did pick that top in March 2005, and it was followed by a six week ABC correction and up the bull went again. This is typical bull market action as illustrated in my other article "signatures of a bull market", which can be found at the archive section. We are now approaching that March reversal period again, and the $SPX appears to be in the process of completing another top. Some analysts are calling for a major top and the sky will fall because of this and that. We will not make any judgment and we will not offer any opinion, we simply let the market tip its hand. We follow the markets, not predict them.

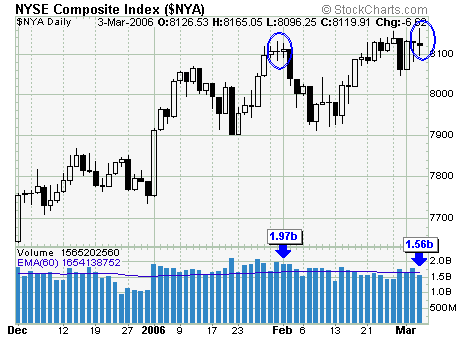

The big board made a new high today, but reversed. Is this the top and the March reversal?

A simple volume analysis suggests that unless today's high is exceeded on stronger volume, today's high will hold. $NYA made a high on 1/31 at 1.97 billion shares, and today's new high was made at 1.56 billion shares, a 20% reduction in volume. Watch these numbers.

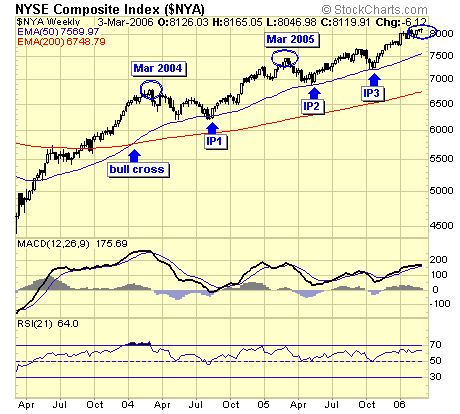

Staying with the big board, these "March reversals" are actually intermediate tops within this bull market, which has been followed by major buying opportunities marked as IP1, IP2, and IP3. If this trend continues, we are only a few weeks away from another major buy signal. How does all this affect other markets? The following charts will show you although the intermediate tops vary from sector to sector, the buy signals on the $NYA serve well for all sectors, except bonds which is slightly ahead of the crowd.

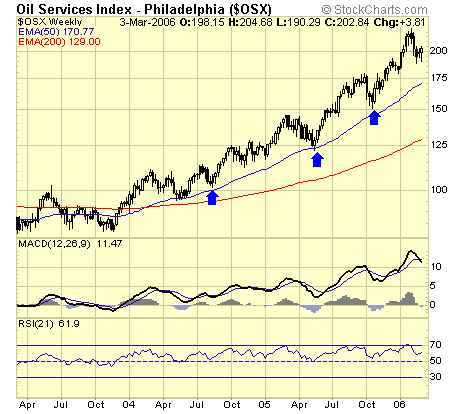

The IP1,2 & 3 are also major buy signals for the energy sector.

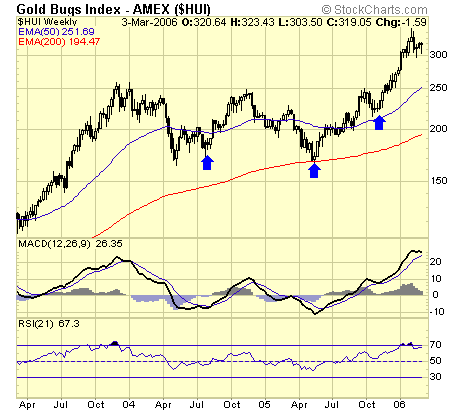

Ditto for the gold bulls.

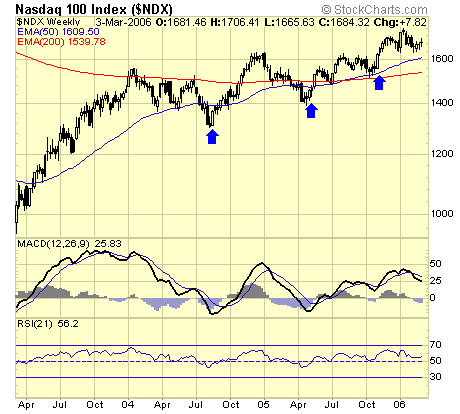

And the tech sector.

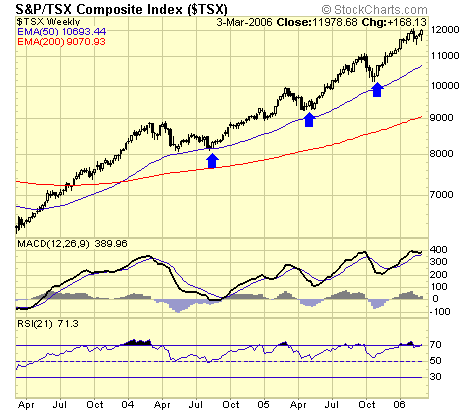

In the great white north too….

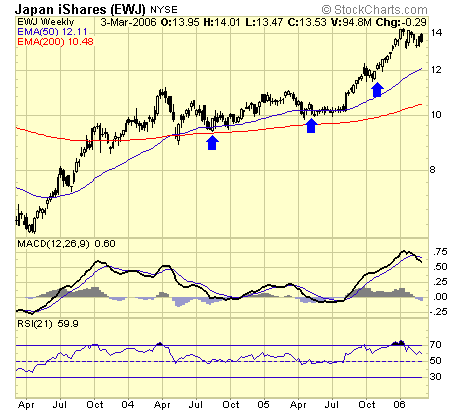

Even in the land of the rising sun.

Bonds too, but bond buyers are savvy traders, always ahead of the crowd. Bond prices tend to bottom first, common sense isn't it? Rising bond yields is not market friendly, we know that much.

Summary

From my observation, we are now in the time frame of an intermediate top, prices could edge higher still, and if they do, watch the volume. Higher prices not confirmed by higher volume is a bull trap, a big one this time of the year. Investors and traders are better off to be patient and wait for the next major buying opportunity in all sectors.

Jack Chan at www.traderscorporation.com

7 March 2006