Market Update – Could Commercial Real Estate Trigger the Next Crisis

A deeply inverted yield curve suggests the stock market is far from its final bottom.

A collapse in commercial real estate could be a massive black swan.

The economy keeps rolling despite record Fed rate hikes - how long can it last?

Inverted Yield Curve

Below is a 30-year chart of the S&P 500. In the bottom panel, I show inverted yield curve (2s vs. 10s). A bear market in stocks almost always follows a prolonged inversion; when the 2-year rate stays above the 10-year yield for several months. After the initial inversion, it usually takes two or more years to reach a final bottom in stocks. As I write, the yield curve is DEEPLY INVERTED!

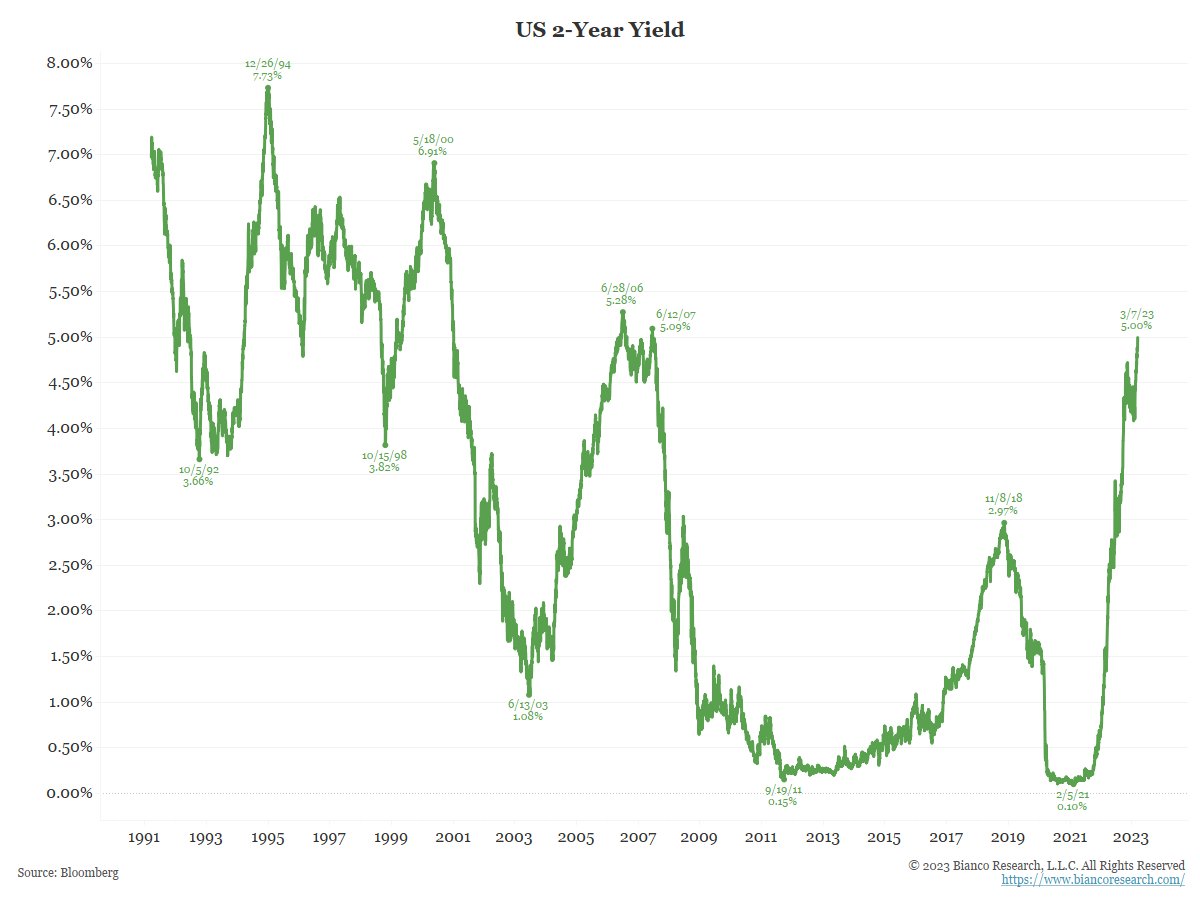

2-Year Treasury Yield

The yield on the 2-year Treasury exceeded 5% for the first time since 2007. To put this in perspective: the last time rates were this high was pre-GFC (great financial crisis).

source: https://twitter.com/biancoresearch/status/1633191506118078464/photo/1

Commercial Real Estate Crisis?

I'm starting to see distressed prices in Real Estate Investment Trusts (REITs) amid increasing defaults. The potential for many more writedowns and bankruptcies (especially in office and retail) is high as the world adjusts to life after covid. We need to take the potential for a crisis in commercial real estate seriously as we head into late 2023 and 2024. With crisis comes opportunity - for those that have done their homework.

Fed Rate Hikes

The Fed raised its fund's rate from 0.25% to 4.75% over the past 12 months. A year ago, I didn't think the Fed could get rates above 3.00% without crashing everything - yet here we are. Is the economy more resilient to higher interest rates than everyone expected, or are the dominoes about to fall?

I have two theories on why the economy is yet to enter recession:

Locking in ultra-low financing (mortgages below 3%) in 2020 and 2021, combined with $6 trillion in Covid stimulus, is still supporting businesses and consumers.

The Fed didn't get serious about hiking rates until June 2022. Typically, a rate hike takes about 12 months to work its way into the economy. Implying the real economic pain may not begin until the second half of 2023.

Crypto Crisis Continues

Silvergate Capital said they would wind down operations and liquidate following last year's crypto collapse. They were one of the largest crypto banks out there and provided a lot of liquidity. Prices reached a low of $2.83 on Thursday after hitting $239.26 at the November 2021 peak.

Bitcoin Breakdown

The Silvergate liquidation was enough to trigger a breakdown in bitcoin below the 200-day EMA. Continued downside below $20,000 would support the beginning of another sell-off across crypto. Prices would need to close back above the 200-day EMA to invalidate today's breakdown.

Gold Update

GOLD CHART: Gold formed a small swing low, and prices are trying to stabilize. Closing back above $1860 would be short-term positive, whereas dipping below $1800 would encourage more downside. I'm still looking for an April low.

Take Away: With interest rates repricing a higher terminal rate, it now looks like the pause in precious metals could last a bit longer – maybe into April. The next major move in gold will come when interest rates start falling.

*********