Metals Show Strength Relative To The USD Index

Gold, silver and mining stocks moved higher yesterday. However, the size of the rally was not huge…and it was another day during which the PM sector didn’t decline. The back and forth movement together with decreased volatility appear to be temporary as this kind of performance is something that we’ve seen during both consolidations and bottoms. This begs the question: Which way will the precious metals sector go?

Before replying to this question, let’s emphasize that it’s not the most important question at this time. The most important thing to keep in mind is that earlier this year precious metals likely rallied as a correction after a very big decline, but the final bottom has probably not been seen so far as the investors’ sentiment hasn’t reached extremely bearish levels. Now it appears that the recent big corrective upswing is over and metals and miners are moving lower. Consequently, whether we have a short-term correction from here or not is not extremely important if we are going to see lower precious metals prices in the coming months.

Let’s take a look at the charts (chart courtesy of http://stockcharts.com).

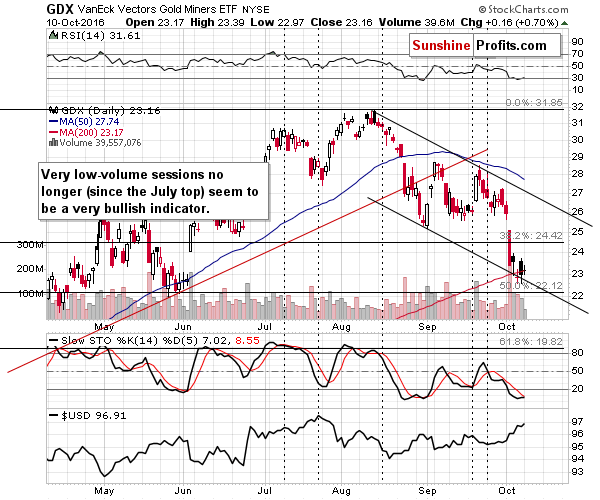

Starting with mining stocks, we see that they moved a bit higher on very low volume. This had previously meant that a bottom was likely in, but it changed when the uptrend changed into a downtrend (and even a bit before as the final top was formed in August, but the rally had more or less ended in July – the move above the July lows in August was insignificant). We now have a situation in which very low volume may imply nothing (e.g. a rally in late July and mid-September) or a decline (like in mid-August). The overall implications are now neutral.

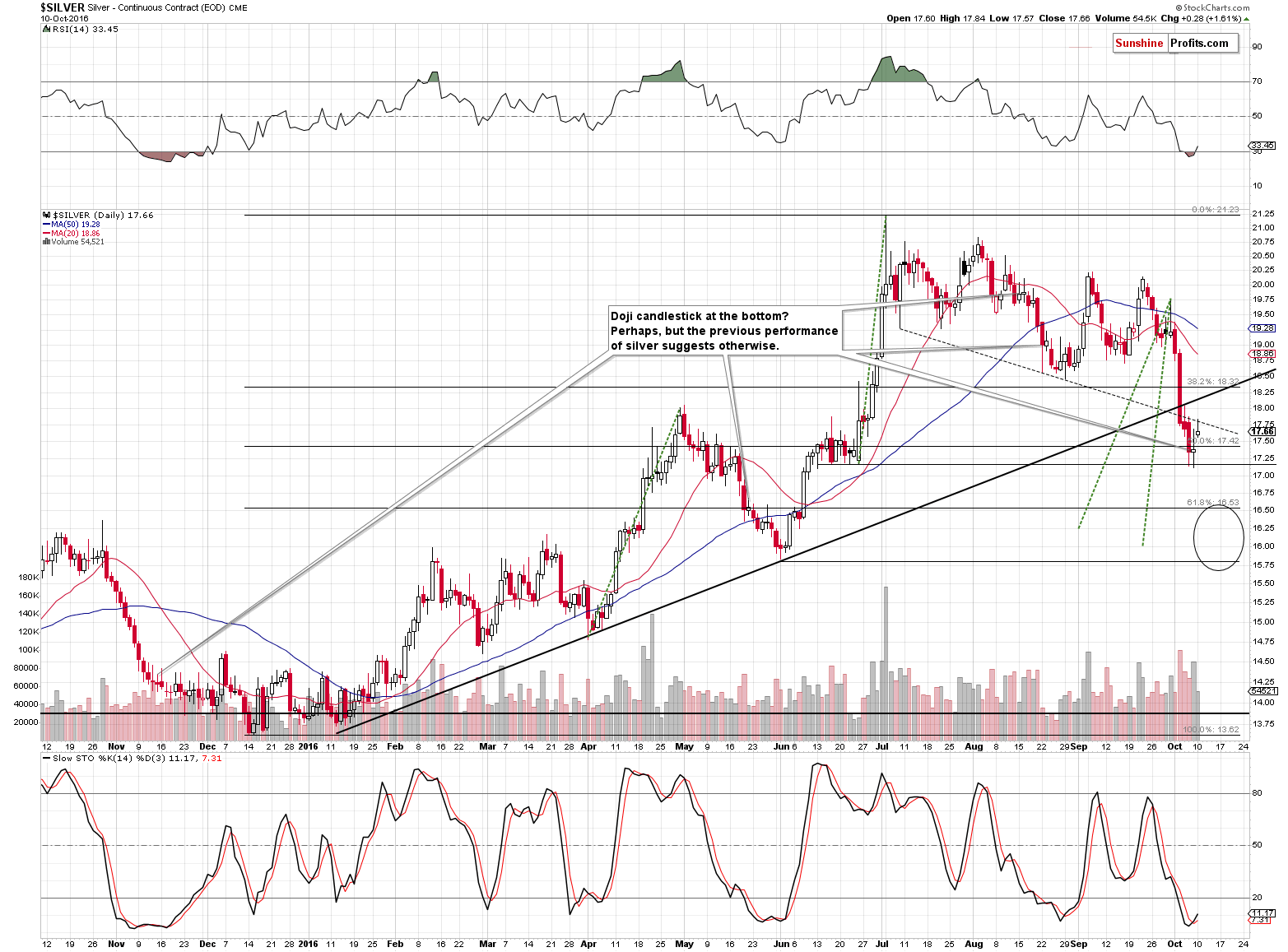

What happened in silver? It rallied and outperformed both gold and miners, which can be viewed as a bearish sign (silver tends to outperform in the final parts of a rally or right before the plunge in the case of horizontal trends), especially that silver didn’t invalidate any breakdown. The white metal moved to the declining, dashed support line and moved back down. That’s a verification of a breakdown, not its invalidation. The bearish implications remain in place for the medium term.

On a side note, we received a question about the support in silver created by the 200-day moving average. Our reply is that this moving average in silver is not really effective as support. Please note that during the 2011 - 2016 decline, silver moved below it several times and it only served as support in mid-October 2012 and April 2016 (and once approximately in early 2016). On all other occasions (late 2011, early 2012, late 2012, early 2013, early 2014, mid-2014, mid-2015, late 2015), silver more or less ignored the 200-DMA. Consequently, since nothing happened in the majority of the cases, we don’t think it’s a major factor this time either. Other factors (discussed today and in the previous several alerts) seem to be much more important.

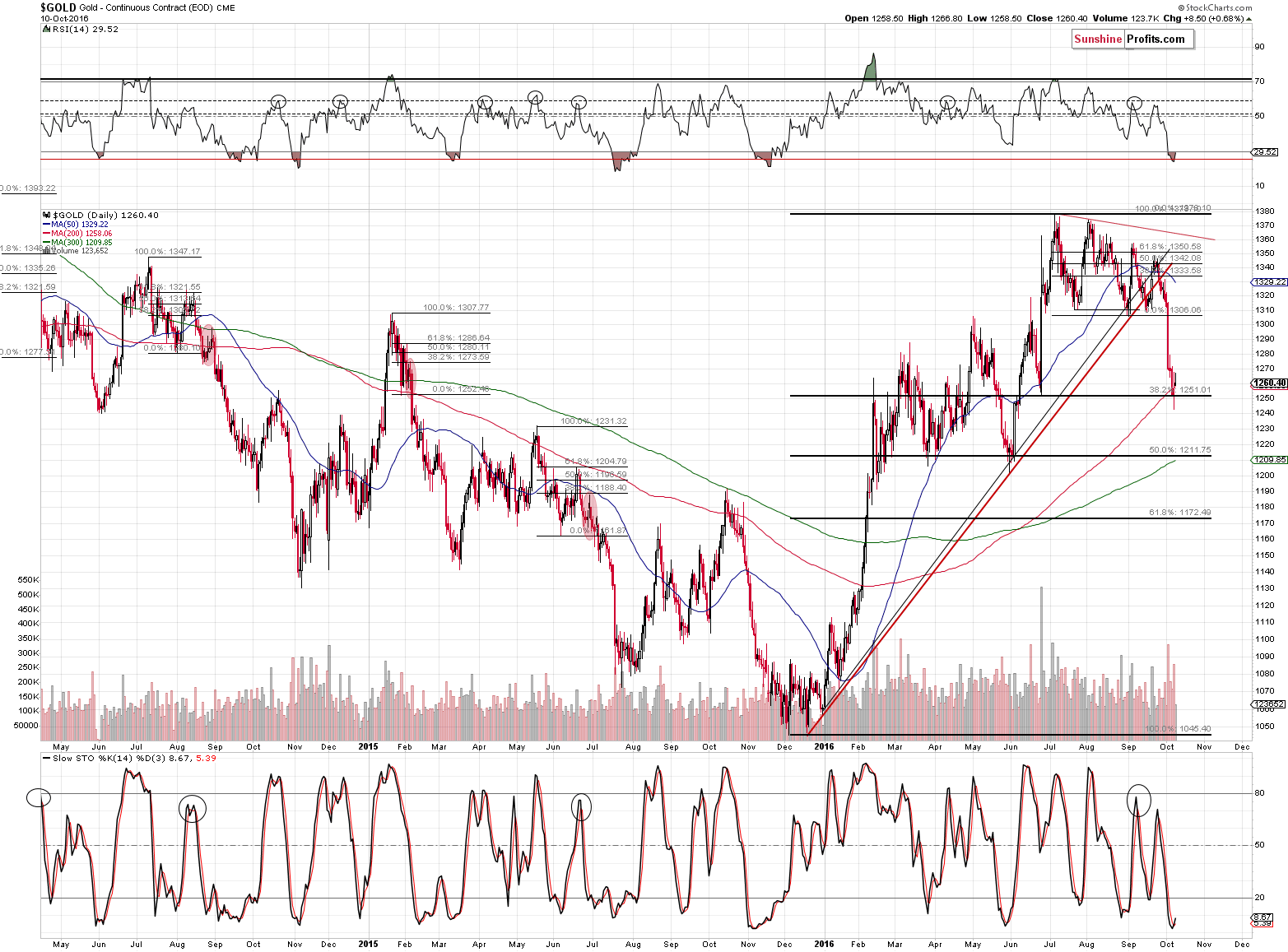

Gold moved a bit higher on relatively low volume. It appears to be a pause after a huge decline, not a big, volatile comeback. Still, it’s not a bearish confirmation by itself.

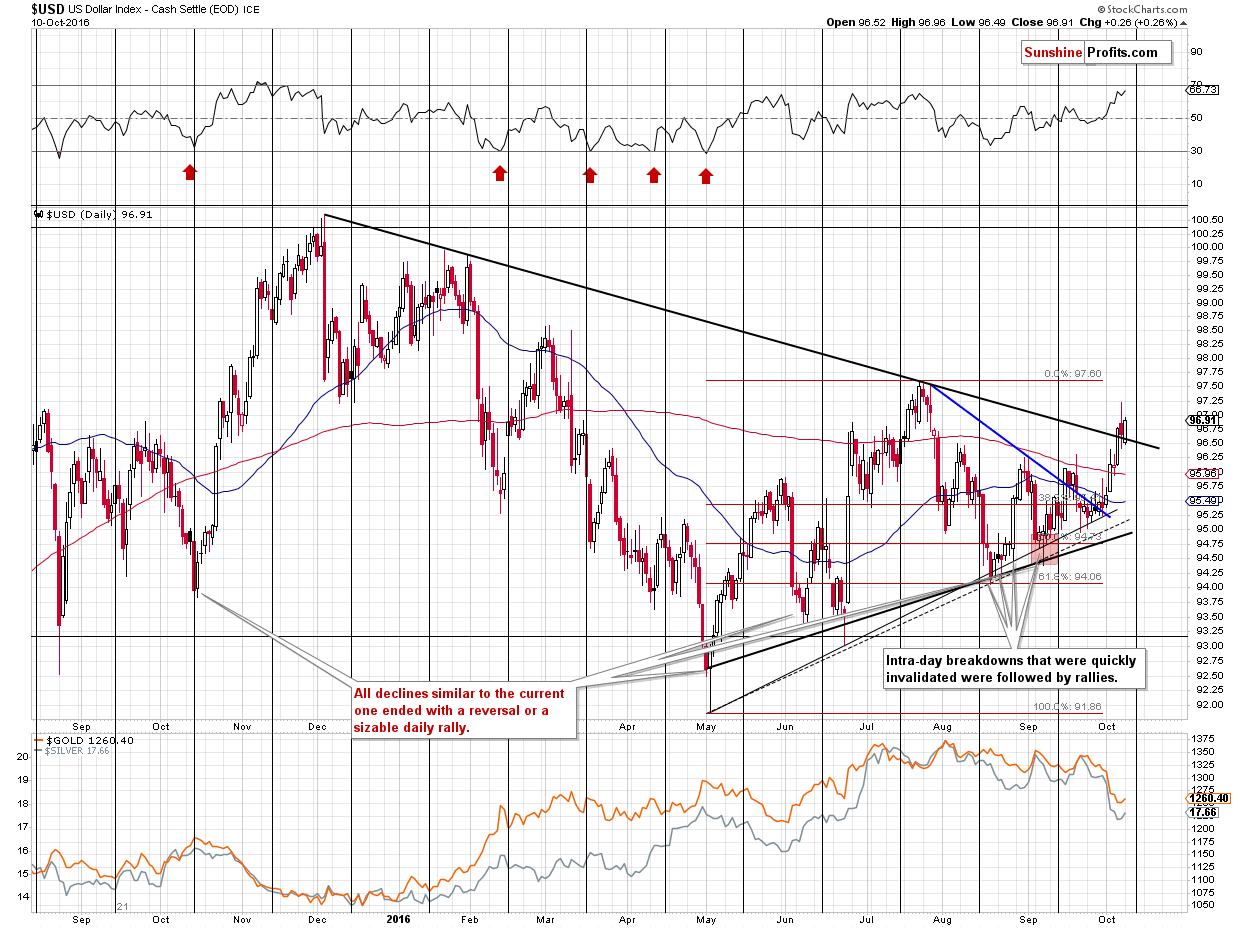

The key thing right now appears to be the situation in the USD Index and its relationship with metals.

Until today’s pre-market action, it didn’t seem like a big deal that metals moved a bit higher despite a move higher in the USD. The size of the phenomenon was limited and PMs were likely to pause regardless of what’s going on in the USD.

However, in today’s pre-market trading, USD moved higher by over 0.60 so far today and metals didn’t respond almost at all. The next strong resistance for the USD Index is at the July tops (at about 97.60) and this is exactly the price level that USD managed to reach today.

Consequently, we could see a reversal – especially that the turning point is just around the corner. As a reminder, turning points work on a near-to basis, which means the next one already has bearish implications (especially in light of today’s rally).

If gold and silver don’t want to respond to USD’s rally, they are quite likely to respond to USD’s decline (the above indicates that people don’t seem to be willing to sell at this time, which means that buyer can easily outnumber them).

In addition to the above, we just saw a confirmation (third consecutive close) of the breakout above the declining black line. This line stopped the rally in July (which was the biggest rally in the USD this year) and we just saw a confirmed breakout above it, which is a big deal. As discussed earlier, the cyclical turning point is just around the corner, so the USD may not be able to rally very high (the July tops seem to be a probable target) before a turnaround and a corrective decline, but still, the outlook for the following weeks has just improved. This means that the implications for the precious metals sector became more bearish for the following weeks, but at the same time, we could see a rebound in PMs and miners as the USD corrects.

Consequently, we the odds for decline’s continuation in the following days declined from about 70%-80% to about 45%, which is means that keeping a short position opened at this time is too risky.

If we get a rebound in gold, silver and miners, we will probably re-enter the positions at higher prices, and if we don’t see a significant rebound, we’ll (probably – unless other factors change) get back to the short positions when gold and silver once again respond to USD’s signals, which means getting back in the positions at lower risk. Either way, exiting the short positions at least temporarily and taking profits off the table appears justified from the risk to reward point of view at this time.

Summing up, due to the recent strength in the precious metals relative to the USD Index and the likely turnaround in the latter (perhaps after an additional rally, but since PMs no longer react USD’s upswings, it doesn’t really matter), it seems that exiting the short positions and taking profits off the table is now justified from the risk to reward point of view. We had originally featured these short positions on September 30. On that day, gold had closed at $1,317 and the closing prices for silver and GDX were $19.21 and $26.43, respectively. Yesterday, GDX closed over $3 lower, silver closed over $1.50 lower, and gold closed over $50 lower. In case of the DUST ETF, the profits are almost 50%.

We may have a good opportunity to re-enter the short position at higher prices, but if the risk/reward ratio suggests opening long prices, we’ll likely proceed as well. We will be monitoring the market for opportunities and report to our subscribers accordingly. If you’d like to join them, we invite you to subscribe to our Gold & Silver Trading Alerts today. If you’re not ready to subscribe today, we invite you to sign up to our free gold mailing list – you’ll receive our Gold & Silver Trading Alerts for the first 7 days as a starting bonus.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Gold Investment & Silver Investment

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,