Midas Touch Gold Report

Market Update

Since my last report, Gold has continued its volatile range trading between $1,225 and $1,280. Although the bulls are still somehow in control, there is no clear trend -- and you might do yourself a big favor if you just stay at the sidelines here.

Since my last report, Gold has continued its volatile range trading between $1,225 and $1,280. Although the bulls are still somehow in control, there is no clear trend -- and you might do yourself a big favor if you just stay at the sidelines here.

Regarding the stock-market it is still not clear whether we are indeed already in a bear market or whether the nasty start into 2016 was just a correction. The expected recovery since mid of february has definitely been impressive. And with negative interest rates and expansive money policies there are strong reason to be invested in the stock-market. But overall uncertainty is high and therefore volatility remains at nerve-racking levels. Short-term stocks are overbought, but I do like the biotech sector. It´s down nearly 40% and might benefit the most in a stock bubble mania. I have added two ETFs to the watchlist...

Another sector which is getting my attention is agriculture. Especially the grains are interesting and promising. I am issuing a new buy recommendation here!

Overall keep in mind that we are approaching a timeframe which is not very supportive seasonal wise.

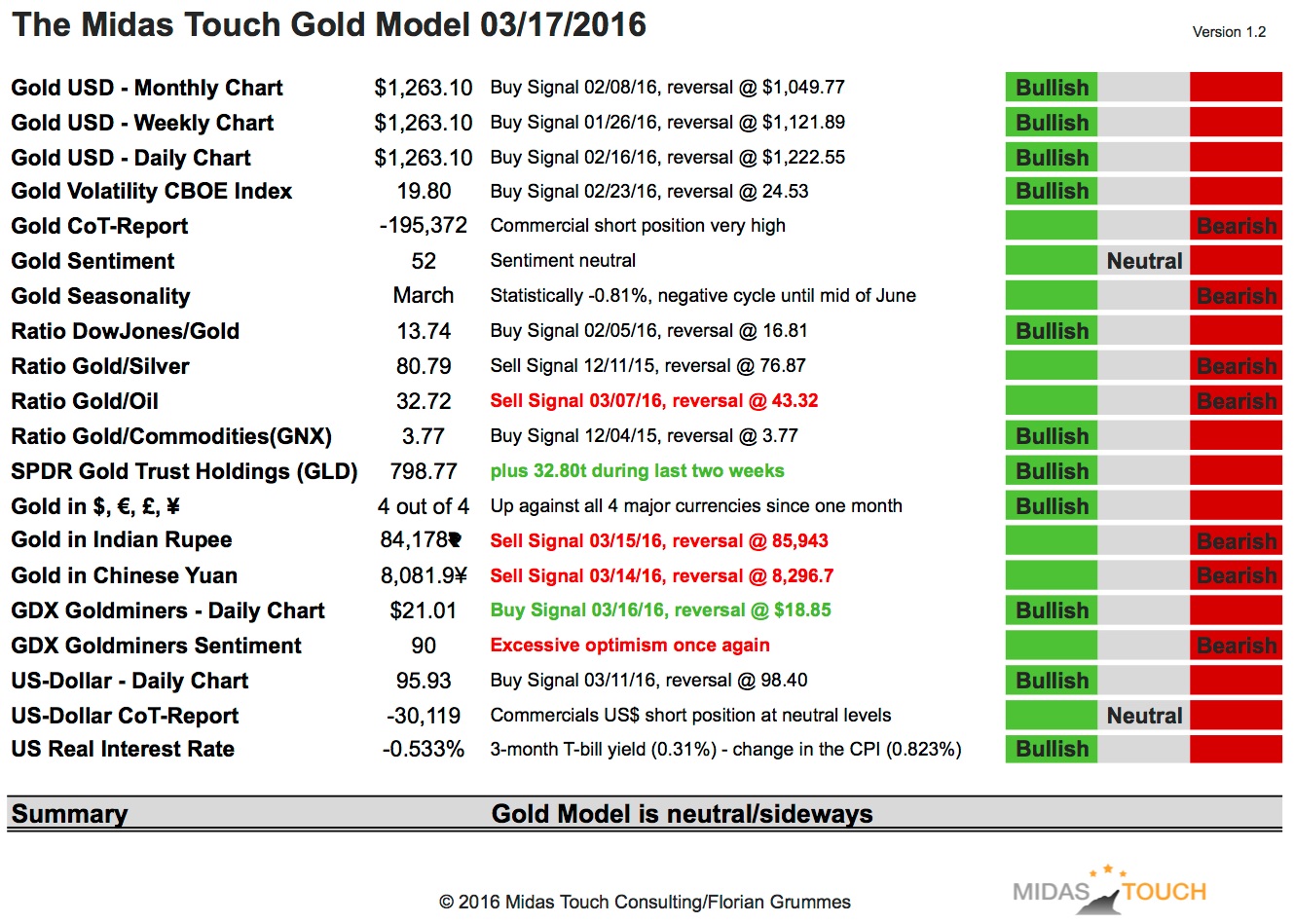

The Midas Touch Gold Model neutral since March 14th

Compared to last week we have two new bullish signals:

SPDR Gold Trust Holdings

GDX Goldminers

And four new bearish signals are coming from:

Ratio Gold/Oil

Gold in Indian Rupee

Gold in Chinese Yuan

GDX Goldminers Sentiment

Overall the model has been moving between bull and neutral mode during the last five weeks. Most of the time it´s been bullish. From a trend following perspective Gold is still bullish in US-Dollar. But the negative seasonal outlook as well as the very high commercial net short position delivering strong bearish signals.

The model´s conclusion is to stay at the sidelines.

Gold volatile range trading

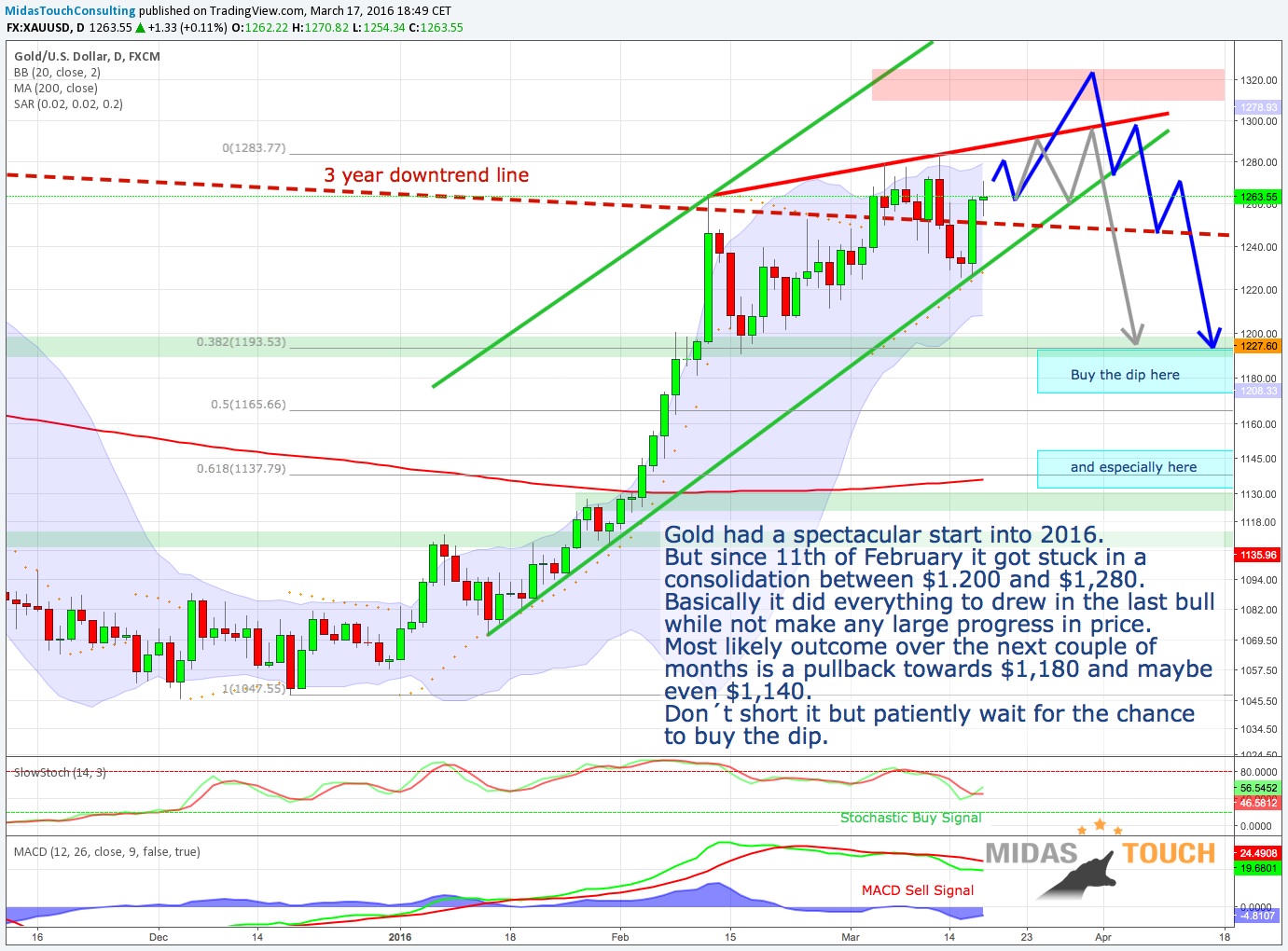

Gold had a spectacular start into 2016 but since 11th of February it is basically stuck in a volatile consolidation. After breaking out of a pennant on march 3rd it failed to push through the resistance zone between $1,270 and $1,280. After a marginal new high last Friday a larger pullback seemed to have finally started but with yesterday´s FOMC meeting the bulls are clearly back and have been able to push Gold towards $1,270 once again. Basically all that Gold did during the last five weeks was drawing in many new and speculative ETF buyers without making any significant progress in its price while the commercial hedgers have ramped up their shorts into this wild back and forth range trading.

From a technical point of view this weeks pullback has been the first and successful test of the new uptrend line. If Gold indeed is running in this trend channel it should not fall below $1,232 anymore. On the upside the next target is $1,325. Note that Gold remains short-term overbought for quite some time already, but a young bull can stay overbought much longer too. More concerning are the negative divergences forming in the RSI and MACD. Also on a weekly basis Gold has not yet managed to sustainably break out of the three year downtrend channel which currently sits around $1,250. This makes $1,250 a pivot point and its no wonder that we can observe such a fierce battle here.

It would not be a surprise seeing Gold rallying until $1,325 only to start a massive correction from there. But also a whipsaw consolidation over the next couple of months is quite possible. Another option would be a bearish rising wedge with another marginal new high followed by a severe sell off. Generally the most likely outcome will be a test of the 200MA until summer. That would mean a pullback towards $1,180 and maybe even $1,140. But so far there are really zero sell signals and if you have missed the train you simply have to be patient and wait for the chance to buy the next larger dip. I am pretty sure it will come until summer. Another important advise is not to short this market. A young bull will do everything to confuse and kill the bears.

Action to take: Nothing. Stay at the sidelines but plan to buy with both hands once Gold is pulling back towards its 200MA ($1,136). Practice patience!

Investors should buy with both hands if Gold moves below $1,150 again until you have at least 10% of your net-worth in physical Gold and Silver.

If you are afraid of missing out something you can buy physical silver here, It´s cheap, hated and seems to have started a new uptrend. It´s not as strechted as Gold and the Gold/Silver-Ratio recently peaked at 84.

Track-Record: We got stopped out of our gold short position on January 4th at $1,083 for an outstanding gain of $97/contract or 8.2% (=8.08R).

Long-term personal believes (my bias)

Officially Gold is still in a bear market but the big picture has massively improved and the lows are very likely in. If Gold can take out $1,307 we finally have a new series of higher highs. If this bear is over a new bull-market should push Gold towards $1,500 within 1-3 years.

My long-term price target for the DowJones/Gold-Ratio remains around 1:1. and 10:1 for the Gold/Silver-Ratio. A possible long-term price target for Gold remains around US$5,000 to US$8,900 per ounce within the next 5-8 years (depending on how much money will be printed..).

Fundamentally, as soon as the current bear market is over, Gold should start the final 3rd phase of this long-term secular bull market. 1st stage saw the miners closing their hedge books, the 2nd stage continuously presented us news about institutions and central banks buying or repatriating gold. The coming 3rd and finally parabolic stage will end in the distribution to small inexperienced new traders & investors who will be subject to blind greed and frenzied panic.

If you like to get regular updates on this model and gold + bitcoin you can subscribe to my free newsletter here: http://bit.ly/1EUdt2K

© Florian Grummes 2015 all rights reserved

Hohenzollerstrasse 36, 80802 Munich, Germany

Disclaimer & Limitation of Liability

The above represents the opinion and analysis of Mr Florian Grummes, based on data available to him, at the time of writing. Mr. Grummes's opinions are his own and are not a recommendation or an offer to buy or sell securities. Mr. Grummes is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in the Midas Touch. As trading and investing in any financial markets may involve serious risk of loss, Mr. Grummes recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Florian Grummes is not a Registered Securities Advisor. Therefore Mr. Grummes's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction. The passing on and reproduction of this report is only legal with a written permission of the author. This report is free of charge. You can sign up here: http://eepurl.com/pOKDb

Hinweis gemäß § 34 WpHG (Deutschland):

Mitarbeiter und Redakteure des Midas Touch Gold Newsletter halten folgende in dieser Ausgabe besprochenen Wertpapiere: physisches Gold und Silber, Bitcoins sowie Gold-Terminkontrakte.

Imprint & Legal Disclosure

Anbieterkennzeichnung gemäß § 6 Teledienstgesetz (TDG)/Impressum bzw. Informationen gem § 5 ECG, §14UGB, §24Mediengesetz

Herausgeber und verantwortlich im Sinne des Presserechts / inhaltlich Verantwortlicher gemäß §6 MDStV

Florian Grummes

Hohenzollernstrasse 36

80801 München

Germany

E-Mail: [email protected]

Website: www.goldnewsletter.de

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at:

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at: