Monetary Metals Supply And Demand Report

For those who are speculating on the dollar—i.e. most people—there was good news this week. The dollar rose almost a milligram, to 28.3mg gold. That’s a big gain, and welcome news for those who keep all of their eggs in the one dollar basket, perhaps because they don’t want to risk any of it on pet rocks.

Yes, Jason Zweig at the Wall Street Journal actually said that. He couldn’t be more wrong—and yet he had a point. Wrong? Let me count the ways.

One, per his title, he compares gold to a pet rock. A pet rock is either a useless knickknack, or else a fraud that preys on the irrational psychology of people in crowds. Gold is honest money, and the extinguisher of debt. Just because governments have banned it from the monetary system, does not make it either useless or a fraud.

Two, he quotes a Barclays researcher saying that investors have become disillusioned with gold. Well, gold is not an investment. Even if one accepts the mainstream premise that gold is a commodity that you buy so you will make money—i.e. dollars—when it goes up, this is speculation. It is not investing. Our whole financial world is now stoned on the drug of zero interest rates. With no yield to be had, capital gain is all.

Three, he says to own gold is an act of faith. Boy is this backwards! To go all-in on the debt of bankrupt governments is the real act of faith. And that is what one does, if one holds dollars or euros or pounds, etc.

Fourth, he refers to inflation (by which he means rising prices) a few times. Gold purportedly has magical powers to fight inflation, but gold isn’t a “panacea” for it (straw man, much?) He later says gold is viewed as a hedge against inflation, but it does not go up as much as the alternatives (whatever those may be).

I could go on, but I will stop here. Despite the cornucopia of errors, there is an excellent point buried in Zweig’s blog post.

Suppose, as Zweig says, that everyone—or at least the current marginal gold trader—views gold as a speculative vehicle. In this view, it’s only useful to make bucks. Then, of course its price action is about as rational as the path of the planchette on a Ouija board. Everyone has the same price charts, and the same technical tools. Everyone can see the same trends. So when it is going up, it goes up. And when it is going down, it goes down.

Of course, this may temporarily describe market conditions. But it in no way objectively describes gold.

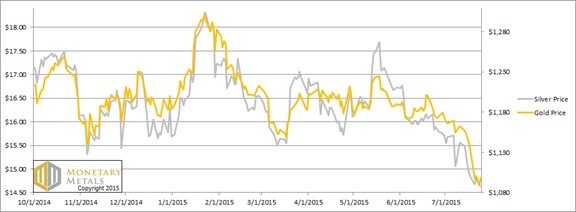

The price of gold dropped further this week, especially last Sunday night. We would guess that margin calls in China forced some liquidation. The price of silver did not drop as much, which is interesting in itself. Whomever was forced to liquidate either did not have a silver position, or else they have greater faith in that the price of the white metal will rise.

The question is: did these hapless Chinese folks sell futures or metal? And we do not have to guess the answer to this question. We have the data to show it. Read on for the only accurate picture of the supply and demand conditions in the gold and silver markets, based on the basis and cobasis.

First, here is the graph of the metals’ prices.

The Prices of Gold and Silver

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved down this week.

The Ratio of the Gold Price to the Silver Price

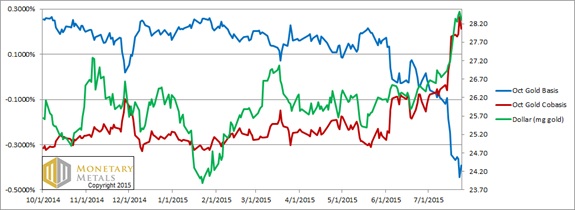

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Note that we transitioned to the October contract, as First Notice Day for the August future approaches.

Look at the price of the dollar rising (i.e. the price of gold falling) and along with it the scarcity of gold rising. This answers the question we posed up top. The price action this week was driven by selling of futures.

Our comment last week now seems well-timed:

“Is this a good time to bet on gold? While other events could continue to dominate the fundamentals (temporarily), we can think of worse times for this trade.”

Other events—we suspect credit conditions in China—did dominate. And the attractiveness of a gold position increased this week. The fundamental price is now more than $100 over the market price. This is no guarantee that the market couldn’t go lower. The basis is not a timing indicator. It is helping us measure value.

The December contract, by the way, also entered backwardation this week.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The silver price dropped about 20 cents (i.e. the price of the dollar, measured in silver rose to about 2.12g silver). However, the co-basis actually fell. The December co-basis is nowhere near backwardation.

The bottom line is that the fundamental price of silver fell even more. It is now dead even with the market price.

We think it’s best to continue approaching silver with extreme caution. While the time is long past for shorting it (we never recommend naked shorting a monetary metal!) it is not the time for betting on silver either. We want to see either one more price drop, or else a steady increase in the scarcity of this metal to the market.

© 2015 Monetary Metals

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the