The New Deal Is A Bad Old Deal

So far, the current economic situation, together with the response by major governments, compares with the run-in to the depression of the 1930s. Yet to come in the repetitious credit cycle is the collapse in financial asset values and a banking crisis.

When the scale of the banking crisis is known the scale of monetary inflation involved will become more obvious. But in the politics of it, Trump is being set up as the equivalent of Herbert Hoover, and presumably Joe Biden, if he is well advised, will soon campaign as a latter-day Roosevelt. In Britain, Boris Johnson has already called for a modern “new deal”, and in his “Hundred Days” his Chancellor is delivering it.

In the thirties, prices fell, only offset by the dollar’s devaluation in January 1934. This time, monetary inflation knows no limit. The wealth destruction through monetary inflation will be an added burden to contend with compared with the situation ninety years ago.

Introduction

Boris Johnson recently compared his reconstruction plan with Franklin D Roosevelt’s New Deal. Such is the myth of FDR and his new deal that even libertarian Boris now invokes them. Unless he is just being political, he shows he knows little about the economic situation that led to the depression.

It would not be unusual, even for a libertarian politician. FDR is immensely popular with the inflationists who overwhelmingly wrote the economic history of the depression era. In fact, FDR was not the first “something must be done” American president, a policy which started with his predecessor, Herbert Hoover. But the story told is that FDR took over from heartless Hoover who had failed to step in and rescue the economy from a free-market catastrophe, by standing back and letting events take their course instead. Nothing is further from the truth: Hoover was an interventionist to his fingertips. The last of the laissez-faire presidents was Calvin Coolidge, Hoover’s predecessor.

A few years ago, the BBC broadcast a programme extolling the virtues of FDR and his new deal. Stephanie Flanders, at that time the BBC’s economics correspondent, reiterated the myth about Hoover being a non-interventionist and FDR having all the correct reflationary policies. In a piece to camera at the Hoover Dam, no less, she recounted how it was an example of FDR’s new deal stimulus. While it wasn’t completed until 1936, building started in 1931 as a project by the eponymous Hoover, pursuing the same interventionist policies as FDR before FDR’s landslide election. It was never FDR’s project, the clue being in the dam’s name. Research by Flanders and the BBC was either biased, deficient, blind or all three.

The myth that has even drawn in Boris is so powerful it has intelligent people swearing the earth is flat. The FDR fairy-story is fundamental to the modern state’s interventionist stance; the very reason for its existence and its welfare commitments to the electorate. Wishful thinking about FDR’s pioneering role is now the pervasive theology. But the way the world is viewed cannot change the facts, and to quote FDR and his new deal as the template for economic policy is to repeat the errors that led to the longest and deepest depression in American history.

If in a few words one was to sum up why the state fails in its interventionist quest, it would be its inability to understand change. Free markets change all the time. Businesses and whole industries evolve and disappear in a natural process of selection driven by the consumer. The state’s response to a crisis is always aimed at a return to normality; normality being an unchanged state from before the crisis. The state protects yesterday’s jobs and yesterday’s businesses. Worse, by preventing evolutionary change at the heart of a dynamic economy it deprives it of the resources required to evolve. And that’s why the depression lasted into the Second World War.

The back-story to the depression

Before Hoover, US presidents understood a hands-off policy would let the economy rapidly fix itself. The post-war 1920—1921 depression in America was allowed to run its course. It lasted just eighteen months and was the prelude to a period of technological revolution that gave enormous benefits in the quality of life for all Americans. Following President Harding’s death in 1923, Coolidge was elected the new president. While Coolidge enforced a strict laissez-faire policy, he was either unaware of or ignored the monetary policies of Benjamin Strong at the Fed, which, to be fair to Coolidge, was only a decade old. The Fed’s monetary policy was the cause of an inflationary boom which ended in a stockmarket bubble in 1929.

In 1927, Coolidge announced he would not be standing for a second term, and Herbert Hoover was elected President in 1928 nearly a year before the stock market crisis occurred.

Fuelled by a free market approach and the stimulus of unbacked credit, when Hoover took office in March 1929 the economy was, in the epithet of historians, roaring. We can now begin our comparison with the present day. Boris Johnson became Prime Minister after a similar inflation-fuelled period; but the more important correlation is with Republican Donald Trump, whose interventionist policies imitate Hoover’s from his time as Secretary of Commerce in Harding’s administration onwards. Hoover deported immigrants and Trump builds a wall, both reasoning they take American jobs. And like Hoover, Trump uses tariffs to protect farmers and businesses from foreign competition deemed unfair.

The combination of a massive credit expansion in the 1920s and the Smoot-Hawley Tariff Act passed by congress in October 1929 — the month of the Wall Street Crash — serves as a template for the condition of America’s economy today. Apart from some differences in timing, the most significant difference is in the money. Before April 1933 the dollar was freely exchangeable by the public for gold at $20.67 to the ounce; today the dollar is unbacked. Prices were stable, today they rise.

By passing the Smoot-Hawley Act at the top of the credit cycle, Congress ensured a sharp downturn in the economic outlook, persuading bankers to call in their loans. The economy began to contract, and interventionist Hoover went to work. To quote from his memoires;

“…the primary question at once arose as to whether the President and the Federal government should undertake to investigate and remedy the evils… No President before had ever believed that there was a governmental responsibility in such cases. No matter what the urging on previous occasions, Presidents steadfastly had maintained that the Federal government was apart from such eruptions . . . therefore, we had to pioneer a new field."

Hoover called a series of White House conferences with industry leaders and bankers to persuade them to invest and maintain wages in order to keep consumer spending going. Like the neo-Keynesians of today, Hoover believed consumer spending was vital for the economy, but failed to make the connection with production, which is always first in temporal order, and provides the product for consumption without which it cannot happen. Hoover’s view on maintaining wages is reflected today in minimum wage rates, which innocuous though they may seem render certain activities uneconomic.

As is the case today, the Fed was ready to inflate. According to Murray Rothbard, the Fed

“…was just as ready to try to cure the depression by inflating further. It stepped in immediately to expand credit and bolster shaky financial positions. In an act unprecedented in its history, the Federal Reserve moved in during the week of the crash—the final week of October—and in that brief period added almost $300 million to the reserves of the nation’s banks. During that week, the Federal Reserve doubled its holdings of government securities, adding over $150 million to reserves, and it discounted about $200 million more for member banks.”

Monetary policy was a doppelganger for the Fed’s policies today. In today’s money, $300 million is about $26bn, using gold as the conversion factor. Today’s stimulus is a thousand times greater in real terms — so far.

In 1932 Roosevelt won a landslide against Hoover, and as was the custom at the time he took office the following March. Only a week before, an assassination attempt on Roosevelt struck the wrong man who died shortly afterwards. Banks were failing. Farmers were in revolt. The numbers of unemployed were increasing alarmingly. Hoover’s reflationary policies had failed, and he was said to be the least popular man in America on inauguration day. Fast-forward eighty-eight years and we see President Trump following in Hoover’s footsteps in this election year; and we can be pretty sure Joe Biden — if he is not asleep at the wheel — will cast himself as the new FDR with his version of the new deal.

Roosevelt then delivered his inaugural address, which included the famous line, “So, first of all, let me assert my firm belief that the only thing we have to fear is fear itself.” His speech was followed by the Hundred Days, the first time a president had set such a schedule.

In Britain, Rishi Sunak, the new Chancellor, is now pursuing his version of a Hundred Days announcing subsidies and new support as the occasion demands, financed by monetary inflation. Admittedly Sunak remains a free marketeer but has yet to prove his measures are temporary. Meanwhile, President Trump is destroying his administration’s finances in an attempt to contain the economic fallout from the coronavirus in his election year.

They say that repeating a failed action in search of a different outcome is a sign of madness. Hoover and Roosevelt were pioneers of today’s failed economic policies and it is their post-war successors who are arguably certifiable. But the problem is deeper than that, with the public voting for the same failed policies, so even an economically literate politician has to deliver solutions in that context. It is what makes history repetitious. Instead of economics, psychological factors drive politics, including the public desire for the state to provide easy solutions to economic and personal difficulties. But the lesson from the Hoover era is that we stand on the precipice of an economic collapse as a result of a combination of excessive credit creation in the years before and the introduction of trade tariffs. And that was before the coronavirus was added to this lethal mix.

The psychology suggests that this time the politicians and the monetary authorities will pursue much the same course as before, even more aggressively. So far, the evidence supports this thesis, and it allows us to anticipate mistakes yet to be made.

The credit cycle and the banks

A notable feature of the Wall Street crash and the onset of the depression were bank failures. Not only had the 24,000 American commercial banks extended unbacked credit throughout the 1920s, but their reserves were to an extent, fictitious. This arose from double counting cheques in the process of clearing, remaining in the cash reserves of the bank upon which it was drawn while being immediately credited to the receiving bank’s cash reserves.

But when the public began to withdraw cash in increasing amounts this false liquidity was exposed. The initial banking panic began in November 1930 in Tennessee when a correspondent network in Nashville collapsed after the Bank of Tennessee closed its doors, forcing over 100 institutions to suspend operations. And as the contraction in bank credit continued, additional correspondent systems imploded. That was only the start of it. The Bank of the United States in New York in December was followed by a new banking crisis in Chicago the following June, this time involving real estate. In 1932 over 2,000 banks closed, and in 1933 a further 4,000.

The banking scene is very different today. Instead of many thousands of small one and two-branch banks the system is dominated by large international behemoths, global systemically important banks — the G-SIBs. They operate under the rules and regulations of the Basel Committee, currently Basel III, administered by national regulators.

Aping the crookery of double-counting floating cheques, today’s banks game the system, this time aided and abetted by the regulators, who, so long as the forms are correctly filed, are happy to look the other way. Indeed, as their stress tests have shown they would rather gloss over the issue of inadequate capitalisation.

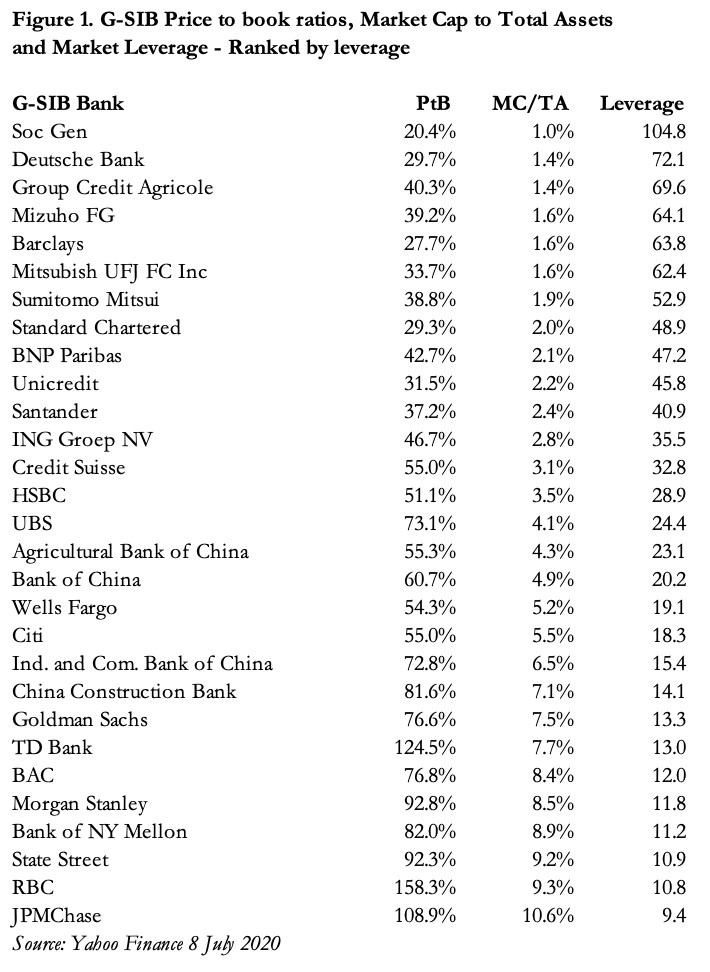

The full weakness of the global banking system is illustrated in Figure 1, which shows the leverage between total assets on the G-SIB balance sheets and their market capitalisation. The regulators persist in using the relationship between total assets and balance sheet equity instead, despite the market valuing a typical bank’s equity at considerably less than book value.

Bank equity valuations on 8 July have benefited from the liquidity-driven rally in global stock markets, with Deutsche Bank’s shares, for example, almost doubling from a low of €4.50 in mid-March. The recovery is not a sign of new-found strength but merely reflects the severe disconnection between rising financial asset values and a collapsing economy, which will almost certainly lead to a substantial adjustment to the detriment of financial asset values.

The full weaknesses of the current system are described in a paper on the big UK banks, jointly authored by Dean Buckner and Kevin Dowd. Figure 1 was constructed using the methodology in that paper. It is a strongly recommended read for anyone seeking to understand the severe risks associated with not just the UK banking system, but the G-SIBs in all jurisdictions plus other significant banks not on the G-SIB list.

With a fundamentally weak global banking system, over-leveraged and virtually guaranteed to collapse as current financial and economic conditions deteriorate, a new banking failure could make the first wave of bank failures in 1930 Nashville look like a vicar’s tea-party. The failure of just one major bank anywhere in the world is likely to degenerate into a widespread panic, because global regulation has ensured they all game the system similarly and they all share the same weaknesses to greater or lesser degree.

In another potentially fatal error, following the Lehman crisis the G-20 agreed new rules designed to ensure that the costs of future bank failures are to be carried by bond holders and large depositors as well as shareholders, and not governments. Fortunately, this bail-in route is intended to be optional, but there is a risk that in a widespread banking crisis one or more of the G-20 members will go down the bail-in route, probably for banks not on the G-SIB list but smaller and no less significant banks. With some bailing-out and some bailing-in, simple nationalisation and preservation of all customer deposits becomes less likely, prompting a collapse not just in the banks bailed in, but a panic in all bank bonds and major deposits which would otherwise be protected in a clean bail-out.

Putting the bail-in uncertainty to one side, instead of a series of bank failures between 1930-33 today’s global banking interdependence suggests one major crisis is more likely, which arguably has already started given the liquidity injections that have taken place since last September, commencing in the repo market.

A difference from the thirties is that cash money today is a lower proportion of overall money supply, payments being overwhelmingly electronic. Depositors queueing up to withdraw their funds in old fashioned bank runs cannot be ruled out, but today failing banks find funds transferred from them far more swiftly by electronic means, particularly from larger account balances lacking depositor protection.

One reason that central banks have encouraged the abandonment of cash is to lessen banks’ vulnerability to old fashioned bank runs. Instead, by acting as back-stop liquidity provider, even when other banks reduce credit lines to a stricken bank, the intention is that no bank need fail. By the creation of bank reserves through QE and using the repo facility to provide overnight liquidity, commercial banks are already drawing on this support, without which there would almost certainly have been a banking crisis already.

On this basis, bank failures are already here, only they are hidden from public view. All that’s needed is for bank bond holders and large depositors to wake up fully to the risks to their capital for the banking crisis to become public. And that’s why the values of financial assets cannot be permitted to slide, because if they were to do so the whole financial system would rapidly collapse.

Money differences

In the 1930s the dollar was exchangeable for gold until one month after Roosevelt’s inauguration, when he signed an executive order banning the ownership of gold and gold certificates. It was a prelude to the devaluation of the dollar to $35 to the ounce the following January, the rate at which US citizens were forbidden to own gold. Apart from that devaluation, and despite its demonetarisation from gold the dollar retained its objective exchange value, while the depression led to falling prices for traded goods and commodities.

Falling prices were the natural consequence of the contraction of bank credit, the imposition of trade tariffs and failing price support operations. Instead of inflationary unbacked bank credit contracting, it was sound money in the form of a gold-backed dollar that took the blame. The inflationists were in control in both fact and of the narrative, but they couldn’t quite discard gold altogether — that didn’t happen until 1971.

Today there is no backing for government currencies, being entirely fiat. There is therefore no restriction in the deployment of an inflationary tax to balance the government’s books. Measured in gold, the dollar has already lost 98% of its purchasing power since the late sixties, and now its supply is being increased at an unprecedented rate.

The mistake being made by central banks is to not understand that money is merely the mechanism for converting an individual’s labour into consumption. It is the means by which we compare one good against another. It is not, as modern economists seem to think, a means for individuals to evaluate the cheapness or dearness of a good in isolation. If that was the case, then current and prospective prices would broadly have the effect they expect.

The failure of monetary policy, therefore, is in large measure due to the error of not understanding the true role of money in the economy. It wasn’t the increased purchasing power of the dollar in the 1930s which contracted the economy, but the withdrawal of bank credit combined with trade tariffs. Similarly, the falling purchasing power of the dollar today will not, on its own, stimulate consumption. This is not to merely dismiss the distortions in the market from changes in the quantity of money, which are damaging in many other respects. But above all, the debasement of the currency impoverishes the creative economy, the exact opposite of the effect intended.

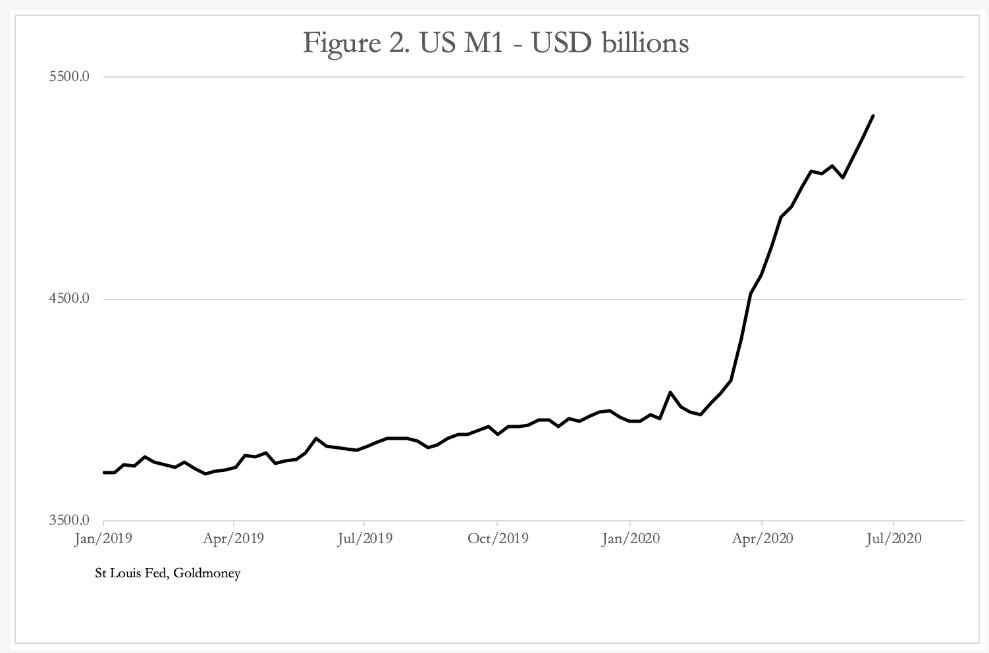

It remains to be seen how far the destruction of fiat money will go, but as Figure 2 shows, M1 money has already jumped sharply — by 104% annualised between 24 February to 22 June.

Conclusion

Unfortunately, governments in the developed nations are making the same mistakes dealing with the current economic crisis as they made ninety years ago. As was the case between 1930—1933 we can be almost certain of a banking crisis. This time it will be global and almost certainly will require banks to be taken into public ownership. The cost will be immense, and it will be paid for by inflationary means.

The scale of it will mean an unprecedented destruction of wealth — hardly the basis for economic recovery. At the same time statist preservation of existing production for fear of unemployment will hamper, not help economic recovery; and, so long as fiat currencies retain any exchange value, there can be no economic revival.

Indeed, the most important difference from the 1930s is the money, which could well collapse entirely. Guided by the pre-Keynesian economic theory of the Austrian school, of the economic consequences we can be certain. The political consequences in the long run can only be guessed.

Alasdair Macleod

HEAD OF RESEARCH• GOLDMONEY

Twitter: @MacleodFinance

MOBILE: +44 7790 419403

Goldmoney

The Most Trusted Name in Precious Metals tm

NEW YORK | ST. HELIER | TORONTO

Publicly Traded Symbols: CA: XAU | US: XAUMF

© 2020 GOLDMONEY INC. ALL RIGHTS RESERVED. THIS MESSAGE MAY CONTAIN CONFIDENTIAL OR PRIVILEGED INFORMATION. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE ADVISE US IMMEDIATELY. THIS MESSAGE IS FOR GENERAL INFORMATION ONLY AND SHOULD NOT BE CONSTRUED AS AN OFFER OR SOLICITATION OF AN OFFER TO BUY SECURITIES OR ANY OTHER FINANCIAL INSTRUMENTS. WE DO NOT PROVIDE TAX, ACCOUNTING, OR LEGAL ADVICE, AND RECOMMEND THAT YOU SEEK INDEPENDENT PROFESSIONAL ADVICE IF NECESSARY. WE CONSIDER INFORMATION IN THIS MESSAGE RELIABLE BUT WE DO NOT REPRESENT THAT IT IS ACCURATE, COMPLETE, AND/OR UP TO DATE AND IT SHOULD NOT BE RELIED ON AS SUCH. OPINIONS EXPRESSED ARE OUR CURRENT OPINIONS AS OF THE DATE APPEARING ON THIS MESSAGE ONLY AND ONLY REPRESENT THE VIEWS OF THE AUTHOR AND NOT THOSE OF GOLDMONEY INC OR ITS SUBSIDIARIES UNLESS OTHERWISE EXPRESSLY NOTED.

Notice: This email may contain confidential or privileged information. If you received this email in error or believe you are not the intended recipient, please notify the sender immediately and delete this email without forwarding or opening any attachments. Thank you for your cooperation and attention.

********