A New Platinum-Gold Alloy Is The World’s Most Wear-Resistant Metal

Strengths

· The best performing metal this week was palladium, up 2.50 percent despite money managers flipping to net bearish positions in the futures market with Friday’s update. Gold traders have switched back to a mostly bullish outlook, as of Thursday’s afternoon survey, for the yellow metal this week, as it appears the price is nearing its floor, according to the weekly Bloomberg survey. Gold finally posted a weekly gain for the first time in seven weeks for the biggest weekly gain since March amid a protracted U.S.-China trade war and after the speech by Federal Reserve Chairman Jerome Powell. Gold miners, as measured by the Philadelphia Gold & Silver Index of mining companies, set its lowest 14-day RSI reading in 31 years, writes Bloomberg. This demonstrates that gold mining stocks are as oversold as they’ve been since the crash of October 1987.

· Chris Howard, director of precious metals at the United Kingdom’s Royal Mint, said this week that they’ve seen “a substantial pick-up in business which was further triggered when gold went below $1,200 last week.” Howard also shared that physical gold demand has increased more than 25 percent so far in the third quarter compared to the second quarter of this year. In the face of greater U.S. sanctions, Russia bought more gold in July than in any other month this year. The Russian central bank purchased 26.1 tons of the yellow metal last month, bringing its total holdings to 2,170 tons valued at $77.4 billion, according to the International Monetary Fund. Although much attention has been drawn to outflows of gold-backed ETFs in the U.S., the Chinese-listed Bosera Gold Open-End ETF has seen over $1 billion in inflows so far this year. Bloomberg writes that this is the second-most popular ETF backed by a precious metal, demonstrating that gold investments are flowing out in the West and flowing into gold funds in the East.

· Government think tank Niti Aayog has suggested that the Indian government slow the import duty on gold from the existing level of 10 percent in order to reduce gold smuggling into the country. Aayog also recommends that the GST rate be slashed from the current 3 percent level. Principal advisor Ratan P. Watal wrote in a recent report that “a reduction in the customs duty in the past in India has been argued to support tax compliance coupled with a significant reduction in the quantum of gold smuggled into India.”

Weaknesses

· The worst performing metal this week was silver, largely unchanged by the end of the week as hedge funds boosted their bearish silver view to a 19-week high. At the start of this week the naysayers were pushing their negative views on gold with a vengeance. Investors and analysts have questioned why gold prices aren’t higher due to rising geopolitical risks and why gold has been replaced by the U.S. dollar as the safe-haven investment. SkyBridge Capital told Bloomberg this week that the next big buying opportunity for gold might come when the Federal Reserve transitions to a looser monetary policy from the current tightening cycle now. However, senior portfolio manager at the firm Tony Gayeski said that “we’re a long way from that”, referring to another round of quantitative easing. Bloomberg reports that ETFs tracking gold have seen outflows for 13 consecutive weeks to mark the longest run in five years.

· Several assets are now hitting record net short positions: gold, 10-year Treasuries and now the euro went net short last week. A buildup of speculative short positions in the U.S. Treasuries market could set up traders for pain ahead, according to Jeffery Gundlach of DoubleLine Capital. According to the latest data from the Commodity Futures Trading Commission, net short positions on 10-year Treasuries from hedge funds have hit the highest level on record. In the currency futures, speculators are now net short euros for the first time since May 2017, writes Brown Brothers Harriman. Lastly, the bears have the upper hand in the gold futures market as speculators have the first net short position since late 2001.

· Mining companies in the Democratic Republic of Congo have established a Mining Promotion Initiative to discuss concerns about new mining code in the country that negatively impacts miners who account for 80 percent of cobalt and 90 percent of gold production. These companies are working together to addresses issues in the new Congo mining code which they believe could discourage further investment in larger and small sustainable projects.

Opportunities

· The dollar saw its biggest selloff in a month today when the People’s Bank of China (PBOC) and the Federal Reserve “delivered a one-two punch”, reports Bloomberg. Katherine Greifeld writes that “the PBOC announced that banks would resume a ‘counter-cyclical’ factor when calculating the yuan’s daily reference rate, restraining the influence of market forces that have been driving the currency lower versus the greenback.” Federal Reserve Chairman Jerome Powell said in a speech at the annual Kansas City Fed policy symposium today that “there does not seem to be an elevated risk of overheating” and that he sees little sign of inflation surging past the central bank’s current 2 percent target. The speech was seen as dovish by many and could indicate that interest rate hikes are less likely to happen.

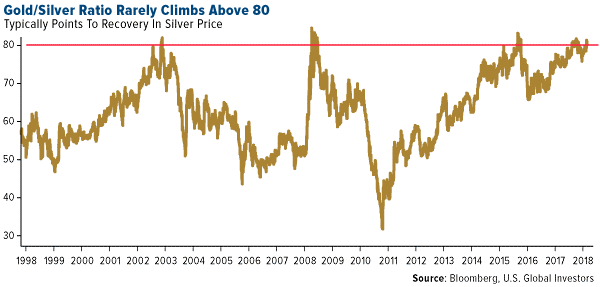

· ANZ strategists Daniel Hynes and Soni Kumari wrote in a report that they “see gold prices stabilizing at current levels, with the probability of a short-covering rally increasing substantially.” Gold prices could be back on their way up and so could silver due to a heightened gold/silver ratio. The gold price is currently 81 times higher than silver right now, which is a level that’s only been reached on four occasions since the mid-1990’s, reports Bloomberg. When the gold/silver ratio previously exceeded 80, silver rallied three of the four times.

· A new platinum-gold alloy created by U.S. scientists is now the world’s most wear-resistant metal. This new alloy is so wear-resistant that if you made tires out of it, they would have to skid around the Earth’s equator 500 times before wearing out the tread, writes India Today. The new alloy is 100 times more durable than high-strength steel and could have many new potential uses.

Threats

· According to JPMorgan Chase & Co.’s August survey of credit fund managers, the percent of those with bullish outlooks is just 20 percent, down from 63 percent in July, writes Bloomberg. Another signal of credit downturn is that credit card issuers have lowered the limits for subprime consumers by 10 percent as their losses mount. This amounts to a 3 percent decrease in the average borrowing cap on new credit card accounts to $5,649. TransUnion found that the share of credit card loans that are at least 90 days past due rose to 1.53 percent in the second quarter, which is still below the 2.71 percent delinquency rate for the same time 10 years ago. The Citi economic data index showed this week that the average correlation between the U.S. and other economies hit an all-time low and the sharp decline is not sustainable. This could suggest that either global data will improve or that the U.S. economy will slow down.

· New developments this week in Special Counsel Robert Mueller’s probe involving Russian interference in the 2016 election could have negative impacts on the market. Allen Weisselberg, first an accountant for President Donald Trump’s father and then chief financial officer of the Trump Organization, has received immunity from federal prosecutors in their case against President Trump’s former lawyer Michael Cohen. Cohen pleaded guilty to several charges this week and told prosecutors that President Trump directed him to pay women for their silence regarding alleged affairs ahead of the 2016 election. Frank Agostino, an attorney who formerly prosecuted U.S. tax cases, told Bloomberg that “because there are tax implications to all these transactions, it even opens up Trump’s tax returns to state and federal prosecutors.”

· South African gold producers remain deadlocked with labor unions over wage demands. Sibanye Gold, the top producer in the country, said that if wage demands went into effect, the sector would be forced to close more mine shafts since they cannot afford the union’s proposed wage increases, as they struggle to control overall operating costs.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of