Obvious Capital Consumption

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay.

Enterprise Car Service

Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day. He finds that he makes a comfortable living. He grosses $250 a day, minus $50 in gas, or $200 net. He works the standard 220 days a year, so he takes home $44,000. Not a bad living.

One day, the transmission breaks. It costs $1,000 to repair. Early has no choice but to pay. He arranges with the shop to get his car back and work it off that week. He does not eat for that week, but he pays and is back to normal.

Early goes on a few more years, earning $44,000 a year. Writing $44,000 on his tax returns, and paying tax on it. Spending what’s left after taxes on $44,000.

You can see where this is going. One day, the car stops working. There are so many problems with it, that it makes no financial sense to repair it. But unfortunately, Mr. Enterprise did not think about the future of his enterprise. He has not set aside the money to replace his capital asset. So when he arrives at the sorry day when it becomes worn out, his little enterprise is done.

Socialism Seeks Out Capital, to Destroy

This, folks, is a microcosm of socialism. Socialism inherits capital assets from a previous system, and consumes it. During the consumption period run by the Chavezes, the people hail it and say it is “working”. But when the capital assets are consumed, then the Maduros take the blame. The people think if only they could somehow get another miracle worker like Chavez.

But there was no miracle, only the consumption of Early’s car. Times a hundred million. Everyone is doing the same thing.

Socialism is systematic consumption of capital, wholesale destruction across the entire economy.

Of course, we in the nominally capitalist Developed World, are not so short-sighted as Early or the primitive socialists. Oh no—we have a much more sophisticated system! We have markets for goods and services, and a market of sorts for bonds. But the monetary system is run by the fiat of the central bank. We are forced to use irredeemable credit as if it were money.

Sophisticated Socialism

In order to juice up GDP—and let’s be candid, asset prices—the central bank is issuing credit at dirt-cheap rates. Businesses can use it to buy cars and all other capital assets. However, their competitors can, too, and at ever dirtier-cheaper rates. The net result is to incentivize many others to go into the car-driving business also.

So this is a system that, almost by design, makes it too easy to buy capital assets and too hard to keep them maintained and set aside replacement cost. These are flip sides of the same coin. If it is too easy to buy the capital asset, then by its very nature, businesses will be overstimulated to buy capital assets. They will be overstimulated to overbuild overcapacity.

If there is overcapacity, then prices will be soft and revenues to these businesses will be under pressure. They can cut prices, to increase sales volume. But then margins are under pressure.

As an aside, this very dynamic is praised by consumers and economists alike. It tends to push prices down. Who doesn’t love lower prices? And the propagandists for the regime can claim low inflation. All agree that the purchasing power of the money is holding up.

But something else is not holding up. To see it, ask what do business managers do when revenues are weak? They postpone maintenance, capital upgrades. And they don’t pay down the debt that financed their capital assets. So what happens when the capital asset reaches end of life, but the debt remains (or has grown)? Sooner or later, they face the same problem as Early.

It is an obvious fact that cars and all capital assets have a finite life. They wear out, just by being used to produce the good or service for which they were made. Everybody knows this. Business managers are not stupid. That is not the problem here.

The problem is that our perverse monetary system imposes perverse incentives. It seduces business after business to borrow to buy capital assets, because the credit is dirt cheap. But then it lowers the price of credit, and the next business borrows at lower cost to buy the same capital asset (or a bigger, or a fancier).

Everyone struggles to service their debt. And under the pressure of this struggle, business managers neglect the things they know they should do. They fail to maintain their capital assets, and ultimately fail as stewards of their investors’ capital.

Like Early, they need to make a profit, to pay workers’ wages, to take home salaries, and pay executive bonuses. To make sure there is no confusion, let us say that these are necessary and proper activities, without which a business cannot succeed. The thing that’s improper is the monetary system, and its perverse incentives.

We often say that the central bank is an important component of a socialist system, noting that it is Plank #5 in the Communist Manifesto. And now, as we see above, a central bank does the same thing as the more openly socialist system that ruined Mr. Enterprise: it causes businesses to consume their capital.

Socialism’s Consequences

As we saw in the microcosm of Early, if you do not set aside money—this is not profit—as you operate, then when your asset is worn out or depleted, you are finished. Our monetary system incentivizes Early’s behavior at massive scale.

Our monetary system imposes a sophisticated socialism, “and does it in a manner which not one man in a million is able to diagnose.” These are the words of John Maynard Keynes, the vicious bastard who designed the plan to destroy our civilization. The plan we are still following today.

Sophisticated socialism will fail just like simple socialism. It’s just that it seems like more fun while the capital holds out.

This is why we need to return to the gold standard to excise this socialist cancer in our system.

Supply and Demand Fundamentals

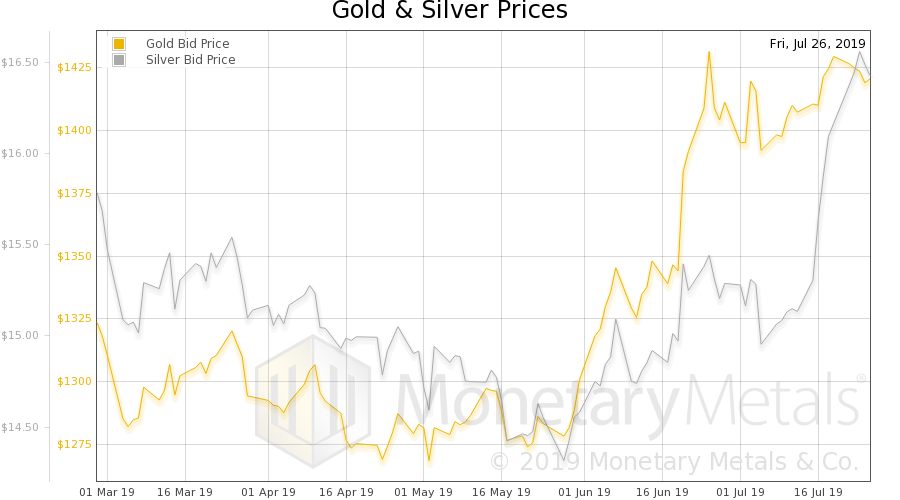

The price of gold fell seven bucks, but the price of silver was up $0.16. In other words, the gold-silver ratio did a little more reverting to that long-forgotten mean.

Some story or other of a bank spoofing orders in the gold market came up this week. Spoofing is when a trader enters a large bid or offer on an exchange, and quickly cancels it. The purpose is to try to manipulate the price. Of course, market makers must be constantly entering and canceling bids and offers, as they track multiple markets and try to keep the prices of gold in the spot and futures market connected, plus GLD and other exchange-traded funds, plus other instruments.

But let’s concede that in this particular story, the trader had both intent and effect. He moved the price a few pennies or a dollar, for a moment. Long enough for him to make his daily profit quota.

We encountered some folks on social media trumpeting this story as proof positive that gold is manipulated. This is a textbook example of the Motte and Bailey Fallacy. Like in a medieval fortification, the motte is an easily defensible position and the bailey is where people want to live. Or in argumentation, the bailey is the conclusion that the arguer wants to sell.

In the gold manipulation conspiracy theory, the bailey is the tempting idea that the price of gold ought to be much higher. Say, $50,000, which is not even the extreme claim we have seen. This is an extraordinary claim, to say the least. Extraordinary claims require extraordinary evidence (and we have argued that this evidence does not exist, many times).

So the motte and bailey fallacy used, when opportunity arises. Consider the case of this spoofer (we did not take note of which bank, which trader, or when this occurred). So this guy played a game to scalp a few pennies from other market participants who were active in the market at that moment. Is this bad behavior? We won’t debate that point right, and for purposes of this discussion let’s concede yes. Yes, it’s bad. Yes this guy is a bad guy who did a bad thing. This particular profit he got in the zero-sum game of speculation was illicit.

OK, that is the motte. No one can argue it didn’t happen (assume the evidence persuades the regulators to bring charges, and he is convicted). But the question that always arises with motte and bailey is: so what? Does this prove that the price of gold is long-term suppressed very far below what it ought to be?

That’s the indefensible baily. And the purpose of this fallacy is to avoid the need to defend the baily. They just assert the motte, and the bailey is assumed to be proven.

This fallacy occurs in many other political debates, by the way.

Monetary Metals is excited to be bringing the first gold bond to market. Please contact us if you are interested in investing.

Now let’s look at the only true picture of supply and demand for gold and silver. But, first, here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio dropped substantially again this week.

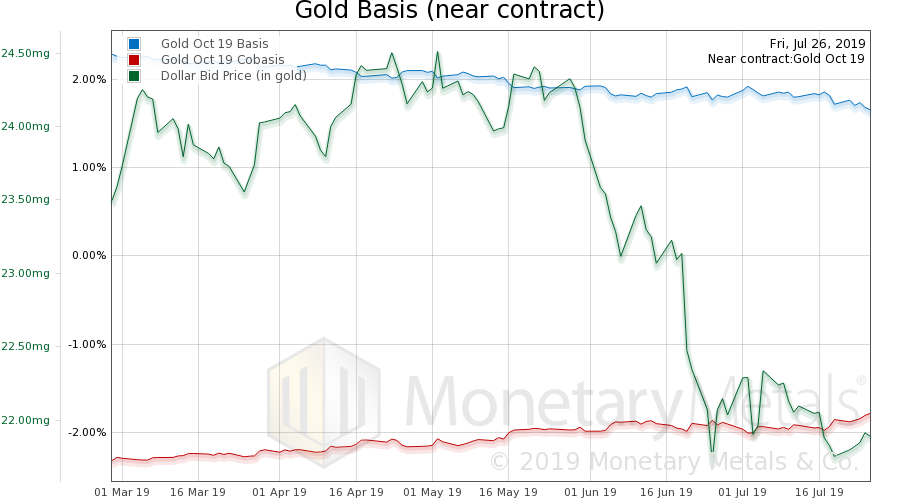

Here is the gold graph showing gold bais, cobais and the price of the dollar in terms of gold price.

That scarcity (i.e. cobasis) just seems like it wants to perk up. Last week, we noted that:

“…the fundamental is below the market price for the first time since the end of 2017 (which was a brief spike down in the fundamental, a flash in the pan).”

This week, the Monetary Metals Gold Fundamental Price is back up to $1,421. So much for that flash in the pan.

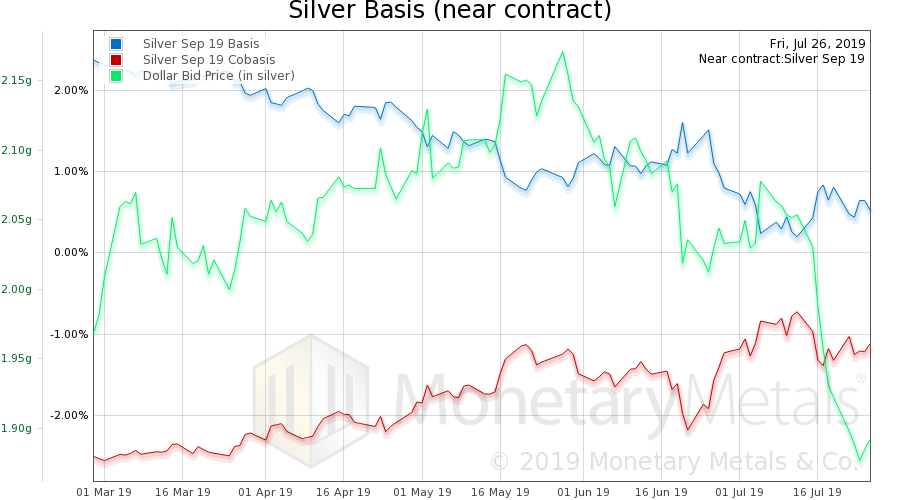

Now let’s look at silver.

The scarcity as depicted in the near-month contract is up a bit, but not the silver basis continues. So while the price of silver diverged to the upside from gold, the fundamentals moved a bit in the opposite direction.

The Monetary Metals Silver Fundamental Price dropped 29 cents to $16.21. That’s not a huge amount, but puts the silver fundamental price below the market price.

*********

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the