Palladium Price On Its Way To $2,000

Strengths

- The best performing metal this week was platinum, up 3.57 percent as money managers increased their bullish outlook and took their net long position to a 22-month high. Gold traders remained bullish on the price outlook for bullion even amid trade optimism early in the week, according to the weekly Bloomberg survey. Turkey’s gold reserves rose $348 million from the previous week and are up 38 percent year-over-year. Turkey is taking big steps to increase gold consumption. The nation’s Treasury is writing changes that would allow the certification and standardization of scrap of unregistered gold people might carry when they enter the country, reports Bloomberg. Turkey is a top consumer and its jewelry industry was one of the few to report an uptick in demand for the yellow metal last quarter.

- Gold has remained resilient this week in the face of many developments that could have rocked the price. Bullion rose after the Federal Reserve signaled it would keep U.S. interest rates on hold, then rose again after jobless claims rose. Gold fell on Thursday after the initial U.S.-China trade deal was announced, but held its own on Friday after weighing the impact of a weaker dollar, reports Bloomberg. Michael McCarthy, chief market strategist at CMC Markets, said in an interview that there are “two currents that are pushing and pulling gold at the money” – the trade war breakthrough and a weaker U.S. dollar.

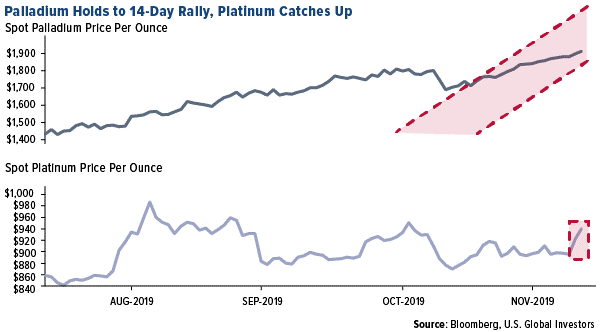

- Palladium continues to soar and is headed for $2,000 an ounce. The precious metal is now more expensive than gold has ever been, surpassing bullion’s $1,921 record. Palladium is surging in response to power cuts to South African miners, the second larger supplier. Platinum is also seeing a boost from the mine shutdowns, as South Africa is the number one supplier. South Africa’s mining index hit an 11-year high due to gains in producers. Platinum miners have risen 199 percent year-to-date while gold producers are up 98 percent year-to-date, according to Bloomberg.

Weaknesses

- The worst performing metal this week was gold, up 1.11 percent, despite an initial trade deal being announced. Gold fell on Thursday from a one-month high after President Trump said the U.S. was very close to a “big deal” with China, reports Bloomberg. Due to high prices for gold in India and an increase in import taxes, smuggling is on the rise. The India Gem and Jewellery Domestic Council said smuggled inflows of gold could increase 30 percent to 40 percent this year to 140 tons. Bloomberg reports that customs officials caught 30 passengers on one flight alone trying to smuggle 16.5 pounds of the precious metal into the country.

- South African platinum-group metals output fell for a third straight month in October due to ongoing power outages. According to Statistics South Africa, output dropped 4.8 percent from a year earlier. Petra Diamonds began halting mining operations in the country after receiving a notice from the power company to reduce its power load. Bloomberg reports that both Impala Platinum Holdings and Sibanye Gold Ltd. were also impacted by government notices of power shutoffs.

- Alamos Gold fired more than 200 workers at its Kirazli project in Turkey due to ongoing permit renewals. Bloomberg reports that construction has been on hold at the project for about four months and that Alamos will reinstate the workers once mining permits are renewed.

Opportunities

- Goldman Sachs said that investors should diversify their long-term bond holdings with gold due to “fear-driven demand” for the metal, reports Bloomberg. Analysts including Sabine Schels write in a note last Friday that “gold cannot fully replace government bonds in a portfolio, but the case to reallocate a portion of normal bond exposure to gold is as strong as ever.” Goldman’s Jeff Currie said in a Bloomberg TV interview this week that he likes “gold better than bonds because the bonds won’t reflect de-dollarization.” Mark Mobius said that if he were to invest $100,000 today, he would allocate 10 percent of it to physical gold. Citigroup is bullish that gold has room to grow due to little possibility that the Fed will raise interest rates in 2020. Russ Koesterich, portfolio manager at BlackRock, said in a Bloomberg interview that “any shocks to equities are likely to come from concerns over growth and, or geopolitics. In both scenarios, gold is likely to prove an effective hedge.”

- Inflation could have room to grow in 2020 and some are calling it an underappreciated risk heading into 2020. Jason Bloom, an Invesco strategist, said he almost ran back to his desk to buy inflation-protected Treasuries after asking an audience of 150 advisors if they were worried about inflation and none of them said yes. Goldman says we could see a rise in inflation due to higher commodity prices from dropping inventories and low capital spending on new production. Jeff Currie, quoted earlier in this section, said in a Bloomberg interview that “we are finally cleaning up the excess of the industry, which is why we like being long.” Presidential candidate Elizabeth Warren said this week that she would install dovish policymakers at the Fed is she were to win the election.

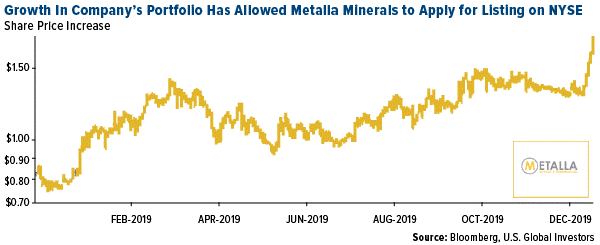

· In an example of a “smart” gold transaction, Barrick Gold sold an 83.25 percent stake in the Massawa project in Senegal to Teranga Gold for $430 million in cash and shares. Teranga’s flagship mine is just 25 kilometers from the Massawa project, making it a smart buy for Teranga with infrastructure and processing nearby, reports Bloomberg. Pending and completed gold M&A has reached around $33 million so far in 2019 – the highest amount since 2011. Metalla Royalty & Streaming Ltd. announced this week that it has applied to list its common shares on the New York Stock Exchange under the ticker symbol MTA. Metalla is a precious metals royalty and streaming company that has seen its share price increase significantly since the start of the year, along with the gold price.

Threats

- Howie Lee, economist at Oversea-Chinese Banking Corp., said in a note that “we see little reason for gold to return above $1,500 an ounce.” They expect an improvement in global growth to push gold lower, potentially dropping to $1,400 an ounce in the fourth quarter next year. “Without further cuts on interest rates, gold lacks the impetus to rally higher.” Morgan Stanley is also cautious on gold due to improving global growth in 2020, reports Bloomberg. Analysts including Susan Bates wrote in a note that “a weakening U.S. dollar is likely to lend some support, and an uncertain trade outcome remains a key upside risk.” They forecast gold at $1,499 an ounce in 2020.

- Bloomberg Economics tabulated that U.S. business debt exceeds household debt for the first time since 1991. Fed Chairman Jerome Powell noted in October that leverage at public and private business is historically high and they are monitoring it. What is out of step here is that with corporate debt ballooning, business investment has fallen for the past two quarters. Almost like a Ponzi type scenario: Borrow from Peter to pay Paul so you can buy back your stock to make the per-share metrics inflate or pay the shareholder a dividend from borrowed money.

More on South Africa’s power troubles... On Monday, Impala Platinum Holdings had just two hours to get thousands of workers back to the surface at its 1 kilometer deep shafts when the utility company announced power cuts. Eskom Holdings SOC Ltd., the state-owned utility, shut down South Africa’s key mining industry for a full 24 hours this week and the rolling blackouts threaten to tip the economy into recession, reports Bloomberg. Johan Theron, a spokesman for Impala, said “we can’t operate like this, but if we don’t cut the power, the national grid collapses.”

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of