Platinum & Palladium Forecasts For 2015

Platinum Group Metals

Platinum Group Metals

The platinum group metals (PGM) are platinum, palladium, ruthenium, rhodium, osmium and iridium, which are usually produced together. The uses of PGM’s include jewelry, computer hard disks, fiberglass, alloys and as catalysts.

Why Is Platinum So Precious And Considered The Rich Man's Gold?

It is simply a matter of relative scarcity. Per the Platinum Guild International, platinum is the "most precious" of the precious metals for the following reason:

The annual supply of platinum is only about 130 tons - which is equivalent to only 6% (by weight) of the total Western World's annual mine production of gold - and less than 1% of silver's yearly worldwide mine production. Another amazing platinum trivia is the fact that more than twice as much steel is poured in the U.S. in only one day than the total world's platinum production in one year – platinum is indeed scarce!

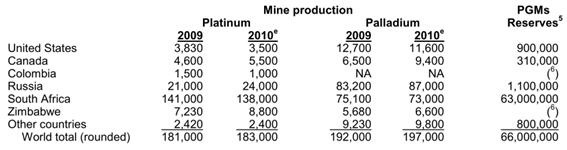

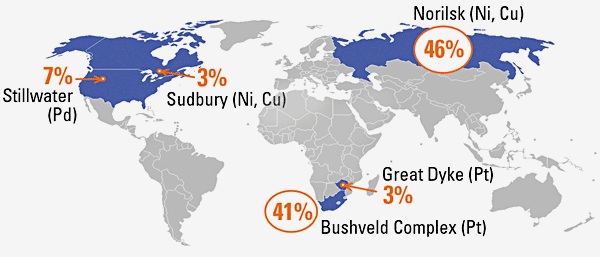

World Suppliers of PGM

The United States Geological Survey lists the top producing countries for platinum group metals as South Africa, Russia, United States, and Canada.

See more HERE.

South Africa Dominates Global PGM Production & Reserves

South African mines not only account for 75% of the world’s yearly PGM production, it also holds 95% of the global reserves of PGM.

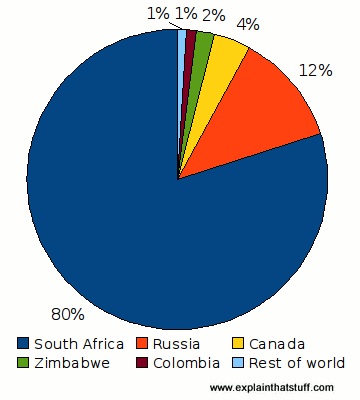

Platinum Production Sources

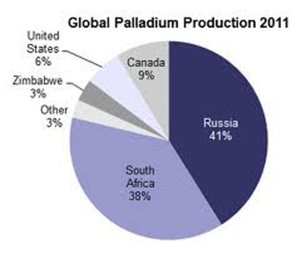

Percent Source Of World’s Largest Palladium Mines

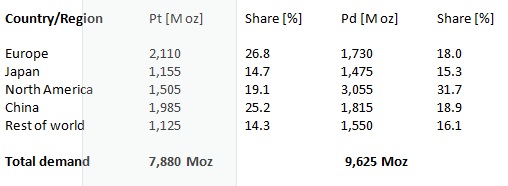

PGM Consumption By Region (2010)

Platinum (Pt) Palladium (Pd)

---------------------------

Source: http://www.polinares.eu/docs/d2-1/polinares_wp2_annex2_factsheet1_v1_10.pdf

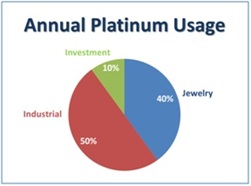

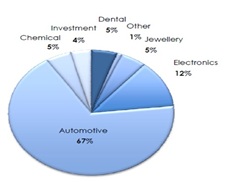

Platinum Usage Palladium Usage

http://www.theaureport.com/pub/na/platinum-fire-sale-on-the-rich-mans-gold

Investment Prospects For The Rich Man’s Gold

Since 1970, platinum has on average commanded a 30% price premium over gold. However, as the following chart demonstrates, from 2000 to 2008, platinum spent much time trading over 1.8 times gold price.

http://www.theaureport.com/pub/na/platinum-fire-sale-on-the-rich-mans-gold

Market Sources Expect To See the Following In 2014-2015

- Persistent high gold price with bull trend renewal in sight

- Global recovery of auto sector, especially in China and India

- Platinum & Palladium Supply/Demand Deficits at all-time record highs

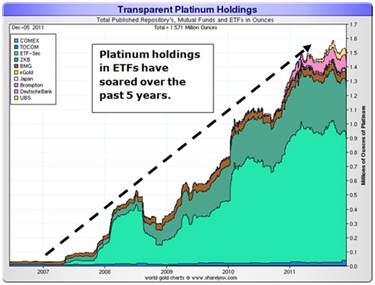

- Platinum investment demand growing through ETF and physical possession

- Ongoing limitations and potential disruptions to supply (i.e. Labor Strikes in S.A.)

Per precious metals analyst John Lee CFA, “…the current situation bodes well for platinum. Look for it to trade substantially higher and back at a premium over gold, once the bull market in precious metals begins its cycle anew”. Moreover, it is anticipated that the current crisis in the Euro currency and run-away US deficits, platinum might just regain its reign as the Rich Man’s Gold in 2014-2015 period.

------------------

Platinum & Palladium ETF holdings jump to record highs

The above chart of Platinum ETF Holdings demonstrates an astounding Compound Annual Growth Rate (CAGR) of +78% in each of the years from 2007-2012. Moreover, Platinum and palladium ETF holdings jumped to new record highs in 2013. See:

http://www.mining.com/platinum-palladium-etf-holdings-jump-to-record-highs-86138/

Platinum & Palladium Supply/Demand Deficits at all-time record highs in 2014

Industry consultants Johnson Matthey Plc said in recent report platinum consumption will beat supply by 1.22 million ounces while the palladium shortfall will widen to 1.61 million ounces, from 371,000 ounces last year and the eighth year in a row of deficits.

That would constitute the largest market deficits ever, based on Johnson Matthey data going back to 1975 for platinum and 1980 for palladium.

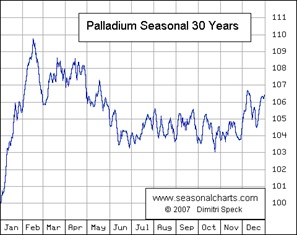

Based upon the past 32-years record, there seems to be no notable seasonality to PLATINUM’s value change as its price appears to rise on-balance all year long:

However PALLADIUM demonstrates a seasonally variable price trend. PALLADIUM’s best seasonal price rise period is December, January and February.

Platinum Physical ETF: PPLT chart - http://tinyurl.com/k8mrdrt

Palladium Physical ETF: PALL chart - http://tinyurl.com/m6yg6uy

PLATINUM & PALLADIUM FORECASTS

Platinum and Palladium Forecast are based upon the following premise:

Platinum and Palladium Forecast are based upon the following premise:

“Since 1972 to 2007 there have been 14 bull and 13 bear market cycles in Gold (20% rises/declines preceded by a 20% decline/rise). The average bull market in Gold has lasted 434 days with gains of 94.89%. The average bear is a bit longer at 538 days with average declines of 33.37%.”

The current gold bear correction has lasted nearly TWICE AS LONG as the average (i.e. the present gold bear market is already today 960 days old…indeed very long in the tooth). Moreover, during the current correction gold has declined -38% from its intraday record high of $2,020 in October 2011 (which already surpasses the average bear market decline of -34%).

Source: An Analysis of Gold Bull & Bear Markets From 1972 to 2013

Based upon the 42-year record of Gold’s Bull & Bear Markets since 1972, we may expect GOLD to double in value during the next 16 months (To Wit: By the end of 2015). Additionally, PLATINUM price may be expected to again run a 30% premium to the price of gold. Similarly, PALLADIUM is expected to double in value in the same time frame.

- GOLD Forecast to reach $2,500 by yearend 2015

- PLATINUM Forecast to reach $3,250 by yearend 2015

- PALLADIUM Forecast to reach $1,680 by yearend 2015

********

Noteworthy Related Editorials:

Platinum: The Rich Man's Gold (Written in May 1997)

PALLADIUM Price Forecast Factors

Gold Price Prediction Based On Technical Analysis & China Demand

The study of history, while it does not endow with prophecy, may indicate lines of probability.