Playing The A-Game With Gold

Time is a very important consideration for investors. Amateur gold bugs always want to know where the price of the metal is going, and by what date.

In contrast, the professional gold bug has much more patience. The important weekly gold chart. Note the action of the key 14,5,5 Stochastics oscillator at the bottom of the chart. It’s overbought and on a sell signal.

I don’t like to see investors lose in the gold market. To be a consistent winner, the investor must have the odds consistently in their favour. Here’s where the odds stand right now:

Gold is not at a fresh support zone of size like it was in late November and early March. There is an inverse H&S bottom pattern, but the right shoulder lacks symmetry with the left.

Inflation has clearly arrived, but the first wave looks exhausted and the “hawk talk” from “Fiat Fed” has the overleveraged hedge funds liquidating COMEX market positions with a loss of confidence.

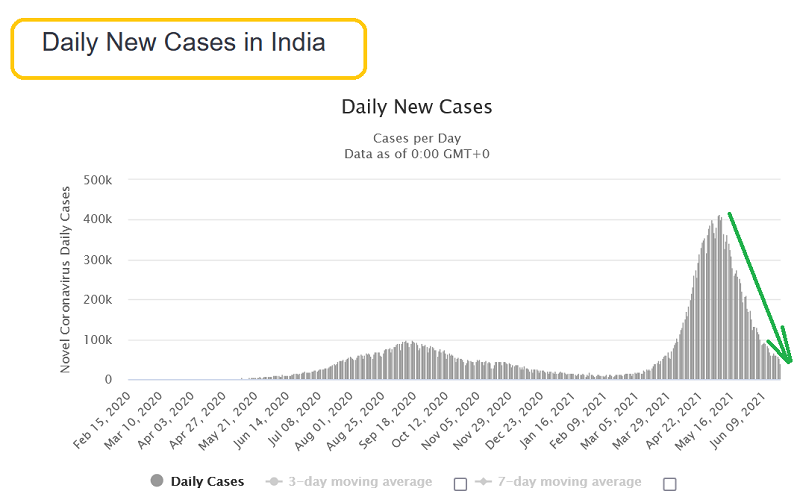

Indians bring their A-game to the gold market table, both in terms of timing and tonnage. As Corona fades, the Indian buyers will return to the jewellery shops and buy with size… when the timing is perfect. For now, Indians are gold market “nibblers”. That should be the modus operandi for gold bugs in the West too.

The bottom line is that gold looks “OK” here. The odds of a surge to $2089/$3000 are as good as a swoon to $1566/$1450, but investors who want to participate in great plays like the ones I outlined in November and March… they need to show the patience of a professional investor.

The next “get richer” opportunity in gold lies ahead for investors, but it’s not quite here today. The “wait” is really what makes an investor great.

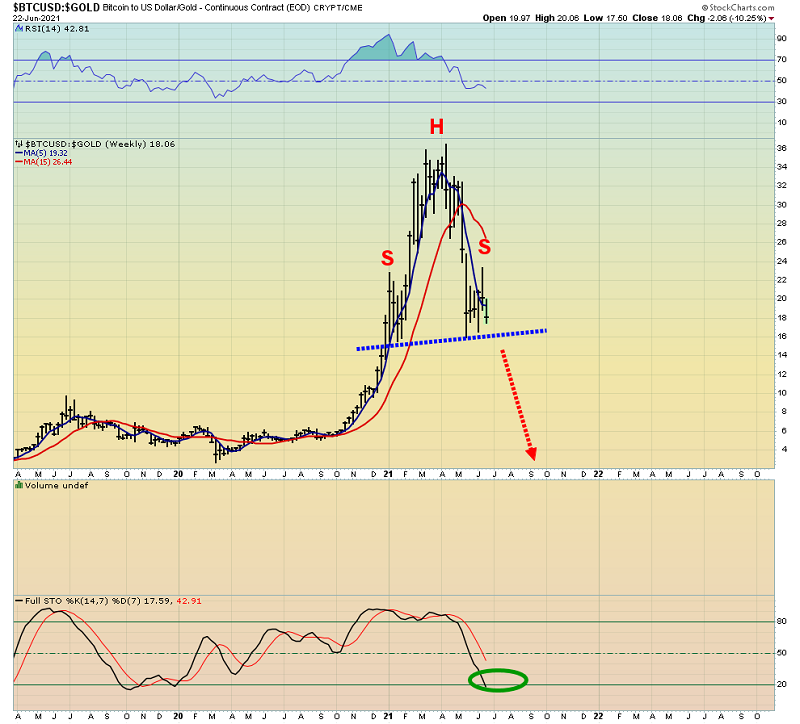

What about the world’s other private money, bitcoin? Well, bitcoin has little trouble staging incredible rallies against the ultimate pillar of socialism, the fiat dollar, but how does it look against gold?

Clearly, it will be some time before the crypto bugs can be sure their bitcoin hero is “here to stay”. I highlight key tactics, including selling lots of crypto for gold before the chart looks like it does now, in my crypto palace newsletter.

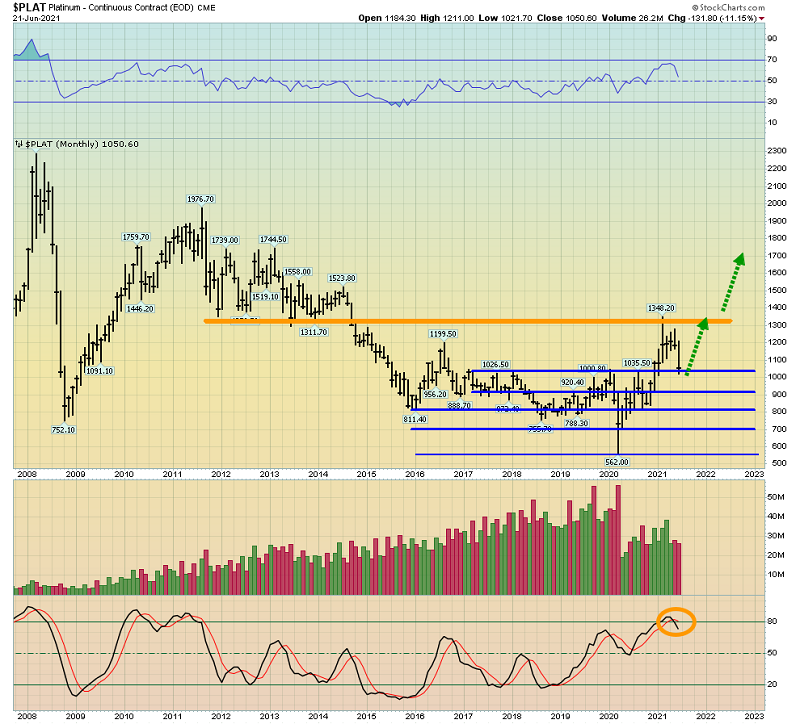

Platinum is probably a B-grade asset. That’s still good. It’s much better than the stock market, which has degenerated into a welfare wagon for rich socialists who worship the Fed soup kitchen.

I’ve laid out some key buy zones for platinum on the chart, and the price is at a big one now. The $1000 area is an important round number support zone. A decent “grub stake” amount of capital could be deployed here, and then more every $100/ounce down.

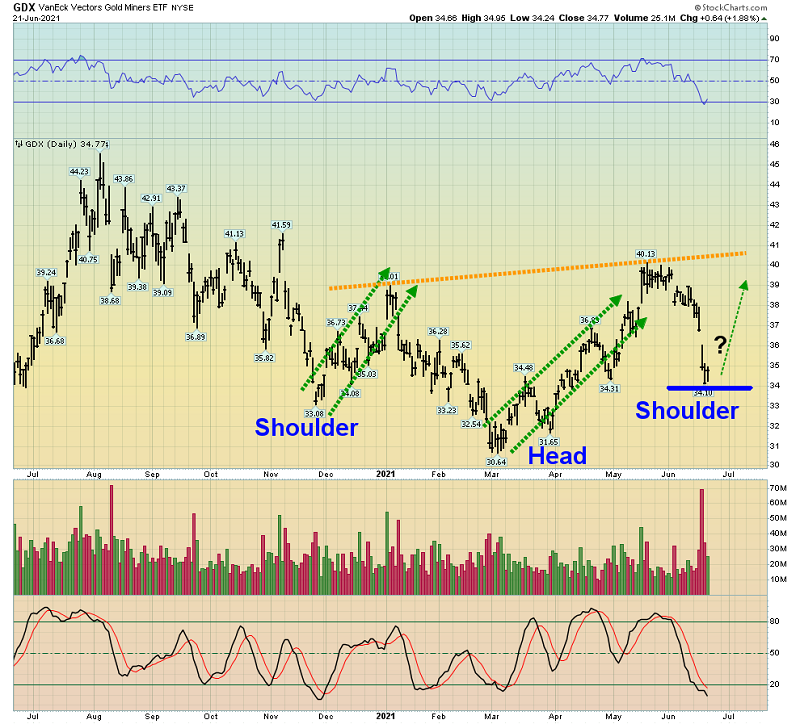

The GDX daily chart. Is there an inverse H&S pattern in play, or is it now really more just a shape than an actual chart pattern?

There are enough questions in the bullion market to warrant caution. The bottom line for the miners:

I’m 100% comfortable holding my existing positions but the risks that come with new buying should be managed with put options and/or stop-losses.

Gold is the ultimate asset. It’s not “getting away” when it rallies and it’s not “finished as a safe haven” when there’s a reaction.

There hasn’t been a bear market in gold since the relatively short 1980-2000 bear cycle, but there have been many bear markets in investor fortitude since then, and there will be many more.

The amateur gold bug should think as a sculptor and demand the maximum number of technical, fundamental, and cyclical winds to be at their back… when buying with anything resembling size.

The daily GOAU chart. Investors with no GOAU can buy this right shoulder low with no stoploss or put options, but investors who hold GOAU already should wait for a more pristine entry opportunity. It will happen.

While GOAU does look better than GDX, a stoploss under the $19.50 low is probably the best way to manage current risk and maximize potential reward.

A swoon to $1566 would be depressing from an emotional standpoint, but it is a price zone that would be an A-grade buy opportunity, seized by both India and the commercial traders on the COMEX. A move above $1966 for gold would turn that price into a massive support zone. Obviously, that latter price is the one to cheer for!

My focus will be the miners rather than bullion when it’s time to buy, because they tend to rally 20%-30% very quickly. I urge investors to consider the compounding effect of that percentage gain over time.

Investors who only want to participate in Grade A buy opportunities for the miners should focus on those two zones ($1566 and $1966) and forget about what seems important in the interim.

In a nutshell, gold is the world’s only Grade A asset. To give it even more sheen, gold, silver, and associated miners should be bought by investors working with precision to bring their A-game to the table!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Right Shoulder Tactics” report. I highlight miners showing outstanding relative strength here in the gold bullion right shoulder zone, with key actionable tactics for each mighty stock!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?

*********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: