Possible Implosion Of Euro Currency In 2017 And Its Impact On US Dollar

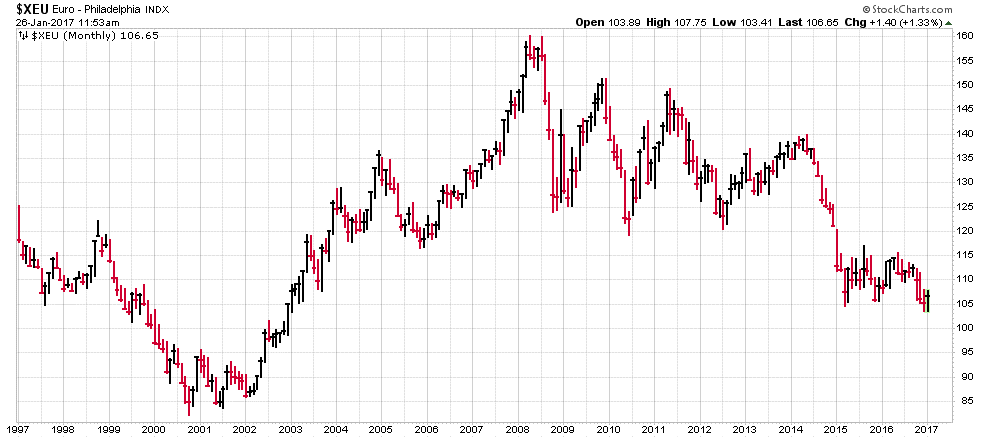

One of the immutable pillars of strength of any nation is its currency. Indeed the currency is the life blood of any economy. Unfortunately, the Euro has been suffering since 2008 to date. Moreover, its value recently weakened to a 14-year low…and projects a gloomy retest of its 2000 bottom at about 82.

The Euro Is Long In The Tooth

The Ill-Conceived Birth Of The Euro

The Euro Currency is an historic anomaly. It is the monetary conception of the European Union (EU), which is a politico-economic union of 28 member states…located primarily in Europe. It has an area of 4,324,782 km2 (1,669,808 sq mi), and an estimated population of over 510 million. In effect the ill-fated EU is a mishmash of cultures, languages, educational levels, cuisine, cultures and ethnic standards. To be sure there is little common ground for just a single currency. Indubitably, it is as immiscible as oil and water. Consequently, very few pundits view the EU as a lasting, viable and economically feasible union.

Indeed the EU has numerous sources of growing weaknesses. However, there are two that are forcibly driving the eventual dissolution of the EU and implosion of its Euro Currency. To be sure the first to be considered is the EU’s Achilles Heel, namely the PIIGS (i.e. the five weakest members of the EU). The second most damaging weakness undermining the EU and its Euro is their relentlessly crumbing (near insolvent) banking sector.

Daunting Debt Of The PIIGS

The economic and fiscal problems in the PIIGS nations have been the primary cause of weakness in the Euro relative to the Dollar.

The PIIGS Are Finally Headed To Slaughter

The countries comprising the PIIGS are Portugal, Italy, Ireland, Greece and Spain. All five countries face insurmountable structural economic problems and the possibility of defaulting on their humongous Euro debts. Greece is in the most imminent danger of default as a result of years of government exorbitant spending that exceeded revenues.

Investopedia Critical Views On Greece, Spain And Italy

“Standard & Poor's slashed Greece's credit rating to the lowest in the world. S&P's view is that any restructuring of the debt would impose less favorable terms than the debt being refinanced, and would eventually result in a de facto default. The possibility of defaults by Greece and other PIIGS nations has put downward pressure on the euro.

Adding fuel to the fire, Fitch Ratings cut the sovereign credit ratings on Spain and Italy by two notches and one notch, respectively. It also maintained its negative outlook on both countries which means that more downgrades could be forthcoming absent substantive changes in fiscal policy.”

Eventually, the debt default of one or two of the PIIGS would surely cause a domino effect driving other EU members to follow suit down the financial toilet of insolvency. Without question this does not inspire investor confidence. Au contraire mon ami!

EU’s Rapidly Crumbing (Near Insolvent) Banking Sector

Many European biggest banks have lost half their stock value in 2016. Here is a list of some of the worst performing big bank stocks over the past year:

Barclays: Down 49%

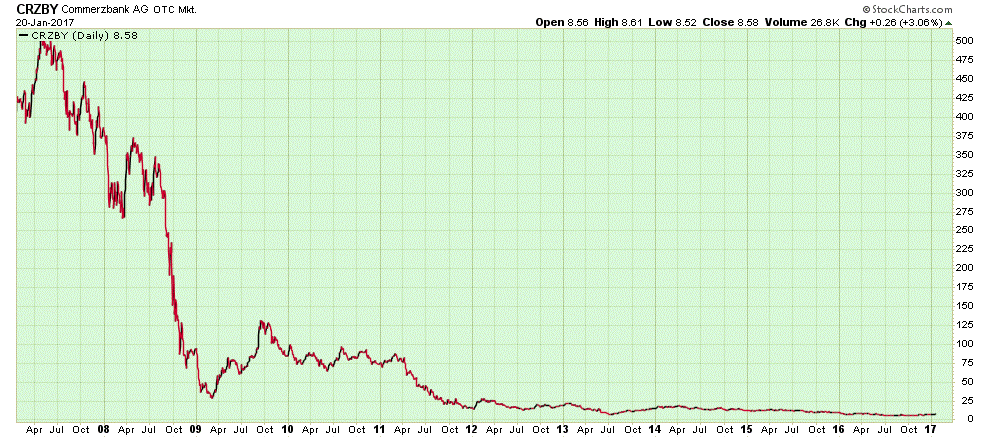

Commerzbank: Down 55%

Credit Suisse: Down 60%

Deutsche Bank: Down 65%

Unione di Banche Italiane: Down 67%

UniCredit: Down 69%

Allied Irish Banks: Down 70%

Banco Popular Espanol: Down 71%

Banca Monte dei Paschi di Siena: Down 85%

(Source: http://money.cnn.com/2016/08/02/investing/europe-banks-stocks-slump/ )

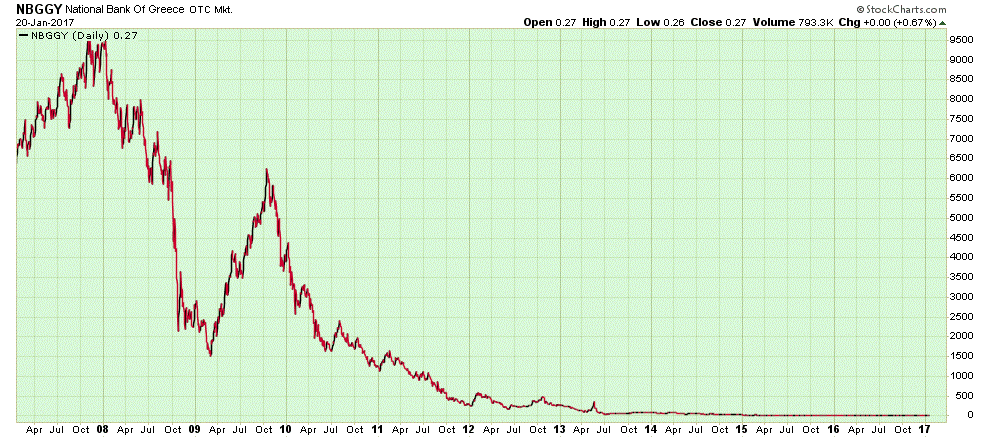

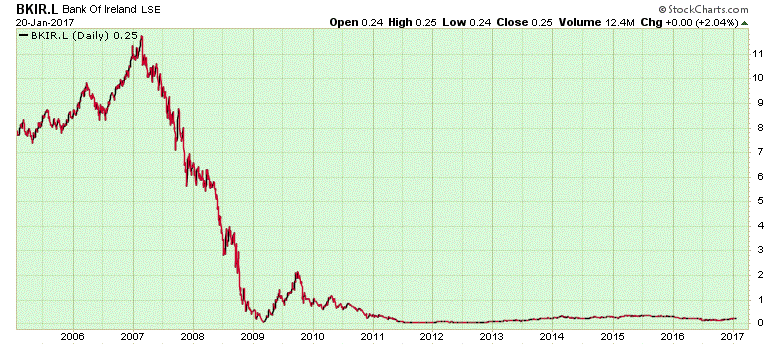

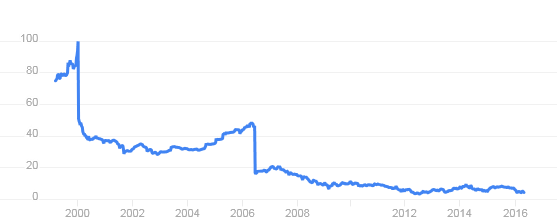

Any still skeptical reader need only view the following bank disaster charts to be convinced the EU will most probably dissolve as its Euro Currency plunges in value. Here are the stock values of four major EU banks, whose stocks have been trashed…to nearly worthless!

National Bank of Greece (2007-2017)

Bank of Ireland (2005-2017)

Commerzbank (2007-2017)

Banco Popular (Italy)

The above abominable stock price record of major EU banks makes any prudent investor and well-informed depositor cringe with the excruciating fear of losing their life-long savings and retirement nest eggs. Furthermore, neither the EU banks nor the Euro Currency provide any reasonable nor rational assurance of monetary SURVIVAL. To wit: it’s the equivalent of An ill-fated Financial Titanic…leaving port ( https://en.wikipedia.org/wiki/RMS_Titanic )

Conclusion

The impending collapse of Euro Union and Euro Currency will cause many millions of investors to flee to safe havens. Understandably, the implosion of the Euro Currency will cause a panicked stampede of countless millions of Europeans to the US Dollar…thus vaulting the latter’s value into the stratosphere.

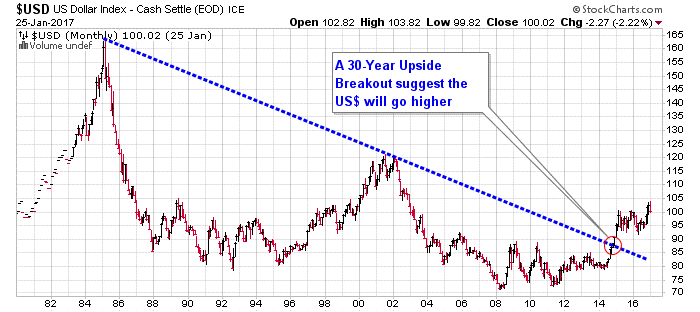

The following chart shows a 30-year upside breakout of the US Dollar Index, which suggests the greenback will probably rise higher…as the Euro relentlessly falls.

Moreover, a Donald Trump Presidency will likely strengthen the US greenback

-----------------------------

Related Articles

US Dollar Will Strengthen As Fed Funds Rate Rises

US Greenback To Reign Supreme Through 2017

Financial Armageddon Looms On The Horizon As The EURO UNION IMPLOSION Nears

Bankrupt Banks Brutally Bleeding…Worldwide

Additional References

Here's What Will Happen if the Euro Fails

Deutsche Bank's Biggest Risk? $46 Trillion in Derivatives Exposure

********