Precious Metals Forecast – Lessons From Palladium Going To Da Moon

It’s close to the tops when everyone and their brother knows that the sky is the limit. Palladium has seen a spectacular run recently, leaving more than a few wondering how much upside potential is still left in.

But why should gold investors care about such a tiny market? Can a gold-to-palladium ratio be successfully used to gather hints about the upcoming gold move? The answer is yet. Today’s article looks into palladium performance to unearth a precious clue for precious metals investors.

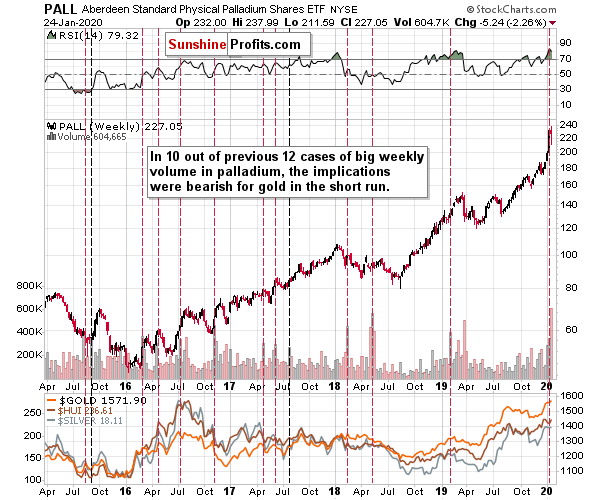

Palladium’s Rise on Huge Volume

Palladium soared recently and last week’s volume was – once again – exceptional. While the price move itself might or might not indicate anything special for the major parts of the precious metals market: gold, silver, and senior mining stocks, the volume reading does.

In 10 out of 12 previous cases when palladium rallied on a weekly basis and it happened on big volume, the implications were bearish for gold in the short run (not necessarily in the immediate term).

Given the pace at which palladium has been moving higher, RSI well above 70 and the big volume, the current situation is similar to what we saw in early 2019. Gold, silver, and mining stocks declined after the huge-volume week in palladium. After the daily volume spike in palladium, gold moved higher on the next day and then it started a short-term decline.

The problem here is that the volume was really “once again” huge. The problem stems from the sharpness of the recent rally and its parabolic nature. In these movements, it’s easy to tell that the situation is extreme, but it’s hard to tell when the move is really ending. The valuations are already ridiculous from the very short-term point of view and the volume was already extreme. However, how can one know that the valuations won’t get more extreme in the next few days, or the volume doesn’t become even bigger? That’s what happened last week. We previously reported that the volume was huge – it was – but compared to what we saw previous week, it was nothing special. We can’t rule out a situation in which the volume on which palladium moves this week, is even bigger.

So, while palladium seems to be topping here, it’s unclear if it has indeed topped or that it will soar some more before finally sliding. The top is very likely close in terms of time, but it’s not that clear in terms of price.

The implications here are bearish for the next week or two, but they are rather neutral for today and tomorrow.

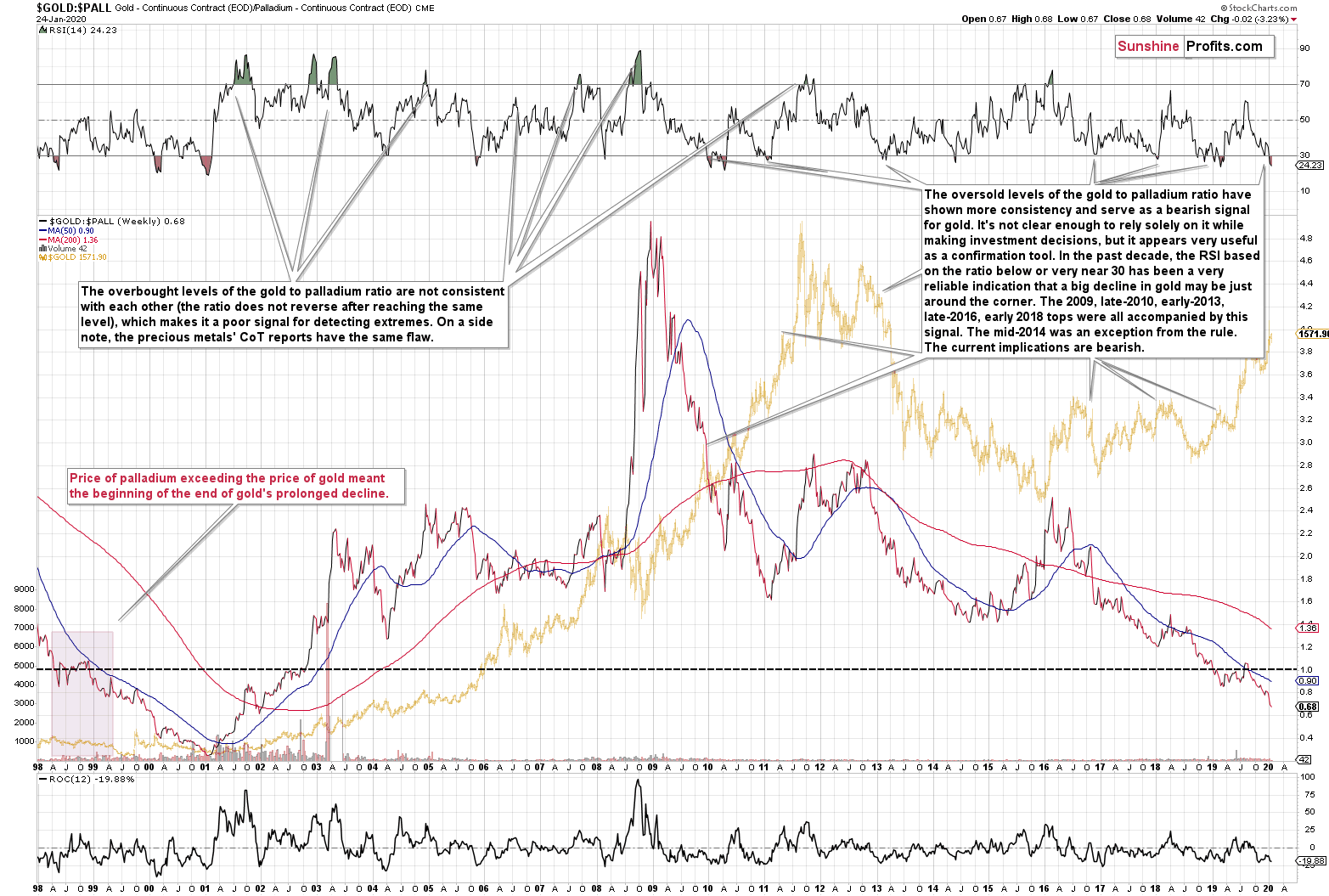

And what can palladium’s performance tell us if we compare it to the one of gold?

Palladium-to-Gold Ratio Speaks

There was only one situation when palladium became more expensive than gold and the gold to palladium ratio fell below 1. Once that happened, the ratio then corrected for a few months and then declined to new lows. The same thing happened in the past months. The previous time when we saw that was… early 1999. As you may remember gold entered a declining period lasting well into the summer doldrums.

The oversold status of the ratio – with RSI below 30 – suggests weakness in gold in the medium term. We marked similar cases on the above chart. And yes – the late-2012 top was also confirmed by this indication.

Summary

Palladium’s steep rise made on exceptional volume sends a warning sign to the precious metals investors. The fact that an already large volume has been overcome is no reason to cheer for the bulls. When a top is being made, it’s accompanied by there being no one left to buy – just see for yourself how little have the bulls accomplished on a weekly basis. Can you imagine what palladium prices would do once the excitement wears off?

Gold investors better pay attention too, as the lesson from the gold-palladium ratio speaks clearly. Having sent the same lesson in early 1999, the yellow metal entered times of lower prices. The ratio’s oversold RSI reading confirms the bearish-gold takeout just as well today as it did in late 2012.

The following months are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the king of metals, forecasting gold’s rally without a bigger decline first is thus likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,