Preferred Gradients Demonstrated – Their Implications And Some Insights Into Current Markets

The TASSA presentation was at the monthly meeting of the Technical Analyst Society of Southern Africa. Some of the monthly charts used there, up to date till January 2016, have now become very relevant, as February runs into its close. Timing of the invitation to do the presentation at the monthly meeting was by chance very good. The charts used were all monthly close and the majority of them showed markets near or at the point of making very long term changes in trend. This applies in particular to gold, silver, the DJIA and the US dollar.

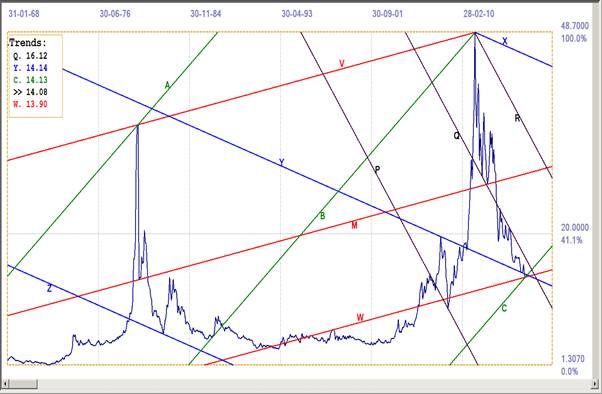

The monthly chart of the silver price, below, is a good chart with which to begin. It very simply illustrates that there is a kind of structure in market prices where certain gradients and their Fibonacci derivatives play a most important role. The construction of the chart, as it was demonstrated live on the auditorium screens, was the same methodology for all of them.

Silver monthly: Master gradient M (x-x). Other origins ‘o’. Line P parallel to line M; line F is a shallower derivative of line M. Channel pair ABC has ratio 401:599. Accuracy of lines F and C to chart where they cross at chart low: F: 0.04%; C: 0.60%. Line B at second top: 0.15%. Line P at second top: 0.09%

An analysis begins with the definition of the master gradient. Here, line M was generated through the two unique points marked with an ‘x’. This trend line is anchored by two ‘bifurcated tops’ – a top formation that looks like an ‘M’, with two not necessarily even peaks and a lower ‘centre’ in between the two peaks. These two are really extreme examples of this kind of pattern, and developed with great volatility. Line P is parallel to master line M, from the top on the left, as indicated by the ‘o’.

Line F, also from the top on the left, has a gradient that is shallower than the gradient of line M by the Fibonacci ratio, 1.618034. It misses the second point of line M by 0.04%, 33 years after its point of origin. Two similar spike tops served as points of origin for lines A and C. Their gradient is also derived from that of master line M. Line B has its origin in an ‘elbow’ during the long flat trend, but then passes ay 0.15% from the second spike top, to make it a unique trend line.

Channel ABC, fitting to or close to three unique points on the chart, displays a channel ratio of 401:599. It is almost exactly the 400:600 ratio, the third most common channel ratio that is observed. Even more common is 500:500 ratio of an evenly divided channel, or one divided in the Fibonacci ratio, 382:618. Ratios are the most important means to confirm the credibility of an analysis.

=======================================================

Silver monthly: Same master line as before. All other lines derived from line M. Channel ratios are: VMW: 400:600; ABC: 497:503; XYZ: 499:501; PQR: 398:602 (NB. Line B same as line in previous slide) Note how the three major channel pairs span most of the full chart with high accuracy.

The first silver chart – without the steep channel pair - is expanded here by the addition of the three other channel pairs ABC (497:503), VMW (400:600) and PQR (398:602); all three therefore very close to well known ratios and thus validated as important. Observe that these channel pairs enclose all of or major portions of the whole chart history; they can be assumed to have significant power over the full development of the silver price.

The position of the three lines in each channel can be assumed to be correct, else they would not have their accurate channel ratios. Lines W, Y and C therefore offer a firm support for silver at its December 2015 close when silver was fixed at $13.82. At that point, line W is just 0.1% away from the price chart. The trends table in the upper left of the chart shows the values of the trend lines for the end of February. By January 2016 silver had already closed in on line Y and has since accelerated.

With this background, the description of the other charts can be kept to essentials. All follow the same method of a master line and its Fibonacci related derived trend lines. Please note the comments at the bottom of the chart; they show how accurate the fit of the lines to the chart is as well as the channel ratios that are important for the credibility of the analysis. Then consider what the analysis means for the medium term future!

DJIA Monthly close: Master gradient M (x-x). First validation: at A and B line M passes through the centres of the two ‘bifurcated lows‘; similar shape to a ‘W’. The centre of such a chart pattern – a low or a top (‘M’) - is important for preferred gradients. Second validation: the good fit of channel KL ( 3x steeper than line M by the Fibonacci ratio.) Line A from the 1929 top is another 3x steeper than channel KL (thus almost 18 times steeper than line M)

The above chart is the monthly close of the DJIA from 1900 to the mid 1960s. Master line M is defined between the two points market with an ‘x’ – one is the first low of the new century and the second is the top of the 1929 bull market. The first anchor point is not a major trend change, as is the second point. However, channel KL, at 4.2 times steeper than line M (3x steeper by the Fibonacci ratio) fits nicely around the bull channel from the late 1940s to the early 1960s – more than sufficiently so to validate line M as a preferred gradient. Also observe the bifurcated lows at points indicated with X and Y.

Line A is generated from the top of the 1929 bull market and is again more than 4 times steeper than channel KL – which makes it 18 times steeper than the master gradient of line M. Changing the gradient so many times is certain to magnify any small error that might be associated with either of the two points used to defined the master gradient. Should the analysis be carried forward to today, any acceptable accuracy of line A to some unique point or points along the way will be truly amazing, in terms of accuracy as well as the role of preferred gradients.

The chart below reveals the full monthly history of the DJIA since 1900 to the end of January 2016. Line A passes very close to the 2011 top in the DJIA. Only a small spike sticks out above the line. It will be shown in a subsequent chart that the little spike is a ‘false break’ through the line. The extensions of the other lines in the chart above can also be seen, low down on the chart. This gives an idea of the magnitude of the change in the DJIA since the early years of the century! Look how steep they were originally!

Full 116 year history of DJIA monthly close. Line A, from the top in 1929, passes just below the all-time high in February 2015. This might seem to be a small error in the preferred gradient, after 85 years, but the break higher is false.

The chart below shows detail from the latter portion of the complete chart above. The first point used for the master line on that chart seems insignificant, as if it was selected – in combination with the 1929 top – to produce a derived line, all of 18 times steeper, that would intersect the 2011 high. As a matter of fact, that is how that master line was selected – by ‘reverse engineering’. Doing so of course meant the good fit along the tops could not be used to ‘prove’ anything. However, consider the full development shown in the chart below above removes any doubt at all that the analysis was rigged to prove a point; there are just too many things that are unique about that analysis.

Firstly, line D – with its origin uniquely in the top of the 1987 bull market – passes within 0.025% of the January 1994 then all time high in the DJIA – a very close fit, using an 18 times steeper gradient derived from one that comes from the early years of the century! It then passes within 0.01% of the 2009 spike low - which resulted from the ‘timely’ decision by the Federal reserve to pump trillions of dollars into the financial system. Why they did so at that point in time – with a month’s grace – just after the February close of the steep bear market was 0.01% away from a trend line that comes from 1987? This is well beyond the ability of reverse engineering; it is clear evidence of structure in prices.

DJIA monthly close. Line A from 1929 top. X and Y are bifurcated low and top. Line D has anchor (1) in top of 1987 bull market. Passes by Jan 1994 high within 0.025% and the Feb 2009 low (3) within 0.01% to be a unique line. Channel ratios: ABC : 481:519; BCD: 481:519. This can only be if line A is in its correct place, the DJIA making its first reversal at line A only 0.015% away from the trend line. It then turned lower, only to rally and try to meet line V, with a temporary false break above line A – brief false breaks to just meet other PGs occurs frequently. Cannot be coincidence

This uniqueness is amply confirmed by lines B and C – both of which have their anchor points in one of the two prominent bifurcated patterns of this part of the price history. That makes their positions also unique, similar to the location of line D. The ratios of channel pairs ABC and BCD are exactly the same to the third decimal at 481:519 – a ‘strange’ ratio that is confirmed by appearing at least twice on the same chart.

The high accuracy of the two channel ratios and the symmetry this imposes on the chart confirm that line A is exactly right in its location; the small spike above line A at the top is a false break, probably an attempt to reach line V. Channel VW is much steeper than the very steep line A, from long ago; it is in fact 122 time steeper that master line M!

Yet channel VW fits the post 2009 bull market like a glove. Extreme accuracy indeed! Line W, with its anchor in the 2009 low, passes by the recent September low in the DJIA, followed by the rebound higher, close enough at 0.18% of the full scale of the chart to present extraordinary evidence of the accuracy of the preferred gradients.

The trend table shows that the value of the bottom of bull channel VW at the end of February will be 16836. The DJIA has been already below that key support for all of February, but has rallied this past week to within close distance of line W – and could reach it on Monday, February 29, with a gain of just 200 points. Of course, a definite break above line W that lasts long enough to the end of March will imply the bull market could resume. Time will tell.

Euro-dollar Monthly close: (1971-1998 adjusted from USD-Dmark). Adjustment justified by the channel ratio of channel ABC: DCB: 499:501. Channel pairs XYZ and YZM are 382:618 and 384:916 resp. There is reason to believe the euro has bottomed at support and should turn bullish

This chart of the euro-dollar exchange rate begins in 1971, well before a currency like the euro existed. It was constructed by having fortuitous access to a monthly chart of the old Dollar-Dmark exchange rate and ‘marrying it with the post 1999 euro-dollar rate. An overlap of about 7 years made this adjustment quite accurate.

The master line, through the two recent lows, span the two regions of the chart and the good fit of the derived gradients offer credible evidence that the chart presents a well-defined, very long term structure on the relations hip between the US dollar and the European currencies. If the chart holds true, the euro has reached long term support against the US dollar and should strengthen from now on and do so for quite a long time; after all, the charts spans 45 years and a trend can last a decade, or longer.

Gold Monthly close: Master line M between a low and a top, similar to the DJIA. Channel ratios: XYZ: 383:617 (Fib ratio) AMB: 381:619; MBC: 449:551; BCD: 448:552. Channel pairs MBC and BCD have ‘strange’ ratios, but validate each other. Line F is (almost!) a watershed line – passing cleanly through the chart, acting as support and resistance

Gold, perhaps more than silver – at least until quite recently – is the most manipulated market in history. During the 1960s the London Gold Pool, working on behalf of the US dollar, did its best to ensure that the price of gold did not increase beyond where it was fixed against the dollar at $35/oz. Then Nixon was compelled to cut the link between the dollar and gold and there was only a minor gap before the manipulation started again.

Yet, despite the manipulation the gold price, the price fits well within a long lasting set of preferred gradients. Channel MBCD is symmetrical, with the channel ratio of the channel pair MBC equal to 449:551 and that of channel pair BCD practically the same, 448:552. This again is evidence that when a ‘strange’ ratio crops up with a good fit to the chart, there has to be another channel pair with a similar ratio.

Further, channel pair XYZ, spanning the larger part of gold’s price history, has the Fibonacci ratio as the channel ratio. Line F is close to being a perfect ‘watershed line” – a line that cuts through the chart with minimal places where the chart is penetrated, yet acting as important resistance and support on both side of the break. Only a very brief and minor break near the point of origin spoils the watershed quality a little.

The combined effect of these three preferred gradients – lines Y, F and D – is to present recent support for gold that has to be considered as substantial. If the support holds, given the steep rise of line D, in monthly terms!, gold is now at the beginning of a long term bull market; one that perhaps could last even a decade or longer.

USD Trade Weighted Average (Month): TWEXMM on Federal Reserve FRED database. Monthly average of the daily trade weighted USD rate against major trading partners. Thus a 42-year function of many forex rates weighted by volume of trade with different countries, which in turn is a function of national economies. Accurate! Flabbergasting!

The final chart, above, is of the Trade Weighted US dollar Index (Major currencies). A daily index for the US dollar that is compiled by the Federal Reserve using the dollar’s exchange rates against a basket of major currencies. Prior to 1999, the basked also contained currencies of the major European countries, but after 1998 these were all replaced by the euro. This chart therefore also spans the change from country currencies to a combined European currency.

The weights used to bring the separate currencies into the basket are the trade volumes between the US and the different countries. That adds a serious complicating factor to the mix that combines into the index; even though their should be some relationship between an exchange rate and what changes in the level of trade results from changes in the exchange rate, it is difficult to imagine that the relationship will hold accurately true over more than 40 years, so that the chart above can be constructed!

To complicate matters even more, despite the fact that the figures for trade volumes most likely are constant for the duration of a month, the chart uses monthly averages of the daily data. If after explanation how the index is calculated, would you the reader have though that there can be any long term consistent structure in the data?

The master gradient connects a low and a top way back before the mid-1980s, very much like the master gradient on the DJIA. also between a distinct low and a major top, just like the DJIA. Yet its derived gradients also fit the chart like a glove.

This complex combination of currencies and their economies as reflected in their trade volumes, hit strong resistance at the end of January. Evidence so far, just before the end of February, is that the resistance has held – so far. A trend reversal here will confirm the conclusion of the earlier analysis that the euro may have bottomed against the dollar. Here too a new trend that spans many years might be starting right now.

Conclusions

It would be most interesting to hear argument in support of the fact that the analyses presented here are the result of coincidence. Such argument has to include motivation for national economies to also behave in a manner that delivers strange coincidences.

An analogy with chess will serve well: chess is a ‘small’ game with simple rules; yet it is possible to spend years learning the complexities of the game to where one can be considered a ‘master’. Preferred gradients are similar; simple rules that in combination leads to great complexity. There is so much more to learn!

********

(c) daan joubert 2016-02-19 mailto:preferredgradients -@- gmail.com

All rights expressly reserved

Explore preferred gradients further – on your own!

A simple program in simple BASIC to analyse market prices using preferred gradients can be downloaded, with supporting materials – including Tutorials - at no cost from the web folder at: https://od.lk/fl/M18yMTAzNTczOV8 The data files in that folder are used in the Tutorials, of which the first two are available now and they relate to the examples used in this presentation.

The program is still under development and updates will be uploaded from time to time. If you use the program and have problems, check for an update first before sending in a report – the problem may already be solved. There are NO GUARANTEES for the results produced by the program – at the moment it can be used to begin to explore and learn the capabilities of the program.

(c) daan joubert 2016-02-27 mailto:preferredgradients -@- gmail.com

All rights to the original material expressly reserved