The Real Sentiment in Gold

Many traders have written me lately, a little worried that perhaps the sentiment among gold traders have reached a frantic level, according to some sources. And that, does not bode well for gold from a contrarian point of view.

What is a contrarian?

A true contrarian is someone who recognizes an opportunity when the crowd is clearly on the wrong side of the market and acts accordingly.

Which is the right side and which is the wrong side of the market?

Bullish sentiment during a bull market is natural, embrace it.

Bearish sentiment during a bull market is a contrarian play, buy it.

Bearish sentiment during a bear market is natural, flow with it.

Bullish sentiment during a bear market is a contrarian play, sell it.

If you know that gold is in a long term bull market, read on. If you have trouble seeing that gold is in a long term bull market, you need help.

SENTIMENT in gold

I have two sources regarding sentiment readings on gold. One is from the pros, and the other from the amateurs.

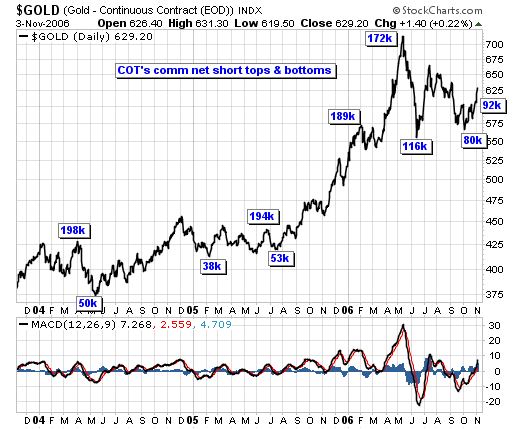

The COT data reveals the constant battle between the commercials and the speculators. Commercials are in the futures markets for the purpose of hedging, a sound business practice in such a volatile market.

The specs are in the market purely for profits, and the momentum trading can drive gold prices to dizzying heights, and also sending them plunging when they decide to book profits. Therefore, a reading of their current positions relative to previous positions will reveal just how much froth there is in the market, which is a fairly reliable sentiment source. Commercials net short positions dropped to a low of 80k recently, which is still higher than previous major bottoms, but considering gold is now $200 higher, this reading of 80k is definitely a very low sentiment level, and has a long way to go before reaching a frenzy level again.

Next, I look at the retail investors.

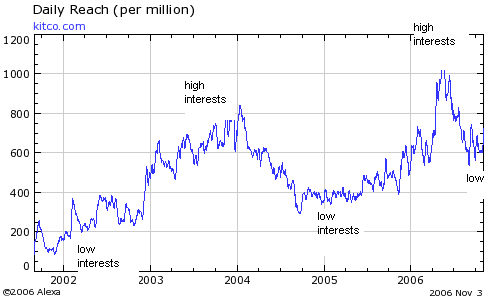

This chart is the traffic count of the most visited gold website, Kitco.com. It is ranked at 2570 of all websites, which is higher than any other gold related website as far as I know. Correct me if I'm wrong. Naturally, traffic increases as the interests in gold rises, which is when the price of gold is rising. Conversely, traffic decreases as the interest in gold drops due to falling gold prices. In a long term bull market, interests from the public should continue to increase, and like price itself, we should see series of higher highs and higher lows in a chart. Currently, the interests in gold is higher than previous low levels, but the plunge from the recent peak in May has decidedly placed the public in a low level of interests.

Summary

There are many commercial sources where we can get sentiment readings. Much of the info we see and read these days are recycled, repackaged, and resold to the public. We have to be aware also how these readings are taken. Often folks vote with their hands and not with their pocket books. The COT data continues to be a reliable source, the futures market is where the market makers make a living.

The traffic count on Kitco.com is unconventional, but paints a pretty good picture of the public's interests in relation to current gold prices. My conclusion is that the current sentiment is bearish, and during a long term bull market, that is a contrarian play. Be long or be wrong.

********