Reality Doesn't Matter. Just Enjoy the Poppies

President Trump said he anticipates the US will soon be able to end income tax altogether because of all the revenue that is streaming in from the Trump Tariffs. In fact, there will soon be so much revenue that he will be able to send free gifts as dividends from that revenue to tax payers!

Speaking during a Thanksgiving call with U.S. service members, Trump said tariffs imposed on foreign imports have brought in “hundreds of billions of dollars,” encouraged companies to relocate manufacturing to America, and created enough fiscal capacity to consider deep tax cuts.

He said a portion of the revenue is expected to function “as a sort of dividend to our people,” while much of it would go toward reducing the national debt. “Over the next couple of years, I think we’ll substantially be cutting and maybe cutting out completely … income tax,” Trump said. “The money we’re taking in is going to be so large.”

Reality, obviously does not matter when you apparently have the ability to speak it into being by telling lies, which will cause reality to alter to fit the lie. That is how magic works.

The reality is that tariffs have brought in $320-billion in revenue, as of November. The reality is that, as reported here a few days ago, that the US also stacked up about $250-billion of national debt just for October alone. Worse still, the reality is that this deficit was after including all the revenue from tariffs that month. So, I can’t find a way to make Trump’s math work.

Making the math even harder, less than half of that $320-billion was actually from Trump’s tariff increases; the rest came from the tariffs/duty that customs was already collecting prior to Trump. However, the math gets even worse:

The Tax Policy Center estimates Trump’s 2025 tariff actions will generate about $2.3 trillion from 2026-2035 and add roughly $256 billion to federal receipts next year, though it warns the projections come with “high uncertainty.”

So, with all the tariff revenue that is now screaming in, we still currently ran about a $250-billion deficit just for the recent month of October. Yet, somehow taking in a total of barely over $250-billion in the whole of next year is going to eliminate all the deficits in all the months of that year, even though this October’s tariffs only whittled down the deficit by half.

In fact, just look at the Toal figure of $2.3-trillion in Trump Tariffs to come over the course of a ten-year period. Since that’s less than our current annual deficit, clearly Trump is using some serious mathemagic!

But it gets worse. Trump also just promised we will be able to eliminate the income tax, which is also already being added in with the tariff revenue before we get to a that deficit of about $250-billion just for this past October or around $3-trillion for the present fiscal year. So, with the tariffs and the income tax (and all other taxes), we are still falling behind each month by as much as the total the tariffs bring in; yet, the tariffs will enable us to eliminate the income tax.

Trump needs to buy more smoke and mirrors or get us to eat a lot more hopium because the illusion isn’t working for me. But it gets worse because, not only can Trump the Magnificent conjure all of those promises into being, in spite of the reality we are actually seeing, but he is also going to give a dividend from that tariff revenue to American tax payers that, at $2,000 per taxpayer will be roughly equal to what the monthly deficit already is.

The Trump miracle, if it all works as promised, is far bigger than multiplying a few loaves and fishes to feed thousands. He’s going to give enough free money to millions tax payers to buy many lunches out of what is left from US tariffs that don’t even eliminate the US monthly deficit with the full help of all other tax revenue and do it with one hand tied behind his back by wiping out most of that other tax revenue! What more can you ask for? And you don’t have to pay for any of it!

Of course, Trump is counting on tariffs to skyrocket in order to make this magic possible. He anticipates that the frontrunning that stockpiled as much as possible to avoid raising prices will be running out soon, so then businesses will have to buy more foreign goods. (Ignore the reality that this will drive prices even higher and the reality that most have burned through their stockpiles by now.)

But even that math is hard to work because he claims in the same breath that all of these tariffs are causing a huge amount of manufacturing to shift to the United States, which, if true, means tariffs will be going down because no tariffs are charged on goods manufactured inside the United States.

But, hey, if it all works out as promised so that the manufacturing rolls back to the US, but the tariffs skyrocket anyway, you may get some of that money you are paying in tariffs syphoned from your own pocket into your own hand as a free gift from the Donald.

Jobs tell a stark reality that differs from the poppy-field dreams

Still shy on government data (by design, I suspect), we have to lean more heavily on ADP for our employment stats. The news there was bad today. For the third month this year, private payrolls didn’t just fall short of delivering the job gains necessary just to keep the economy steady with population growth, but actually reduced the number of jobs out there. This time, by a net loss of 32,000 jobs. However, reality was worse than that for many because larger businesses added a net 90,000 jobs overall (still a lot fewer than they added before all the tariffs), so the full loss was taken by small businesses with fewer than fifty employees who saw a net loss of 120,000.

With worries intensifying over the domestic jobs picture, ADP indicated the issues were worse than anticipated. The payrolls decline marked a sharp step down from October….

“Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment,” said ADP’s chief economist, Nela Richardson. “And while November’s slowdown was broad-based, it was led by a pullback among small businesses.”

This is because mom & pops and the other little guys are less able to absorb the cost of tariffs and much less able to negotiate their foreign suppliers’ prices down—something that even the big-muscle stores have had only small success with. That is because a good number of those foreign suppliers have said, “Rather than come down a lot in price to offset your tariffs over there, we will spend the profits we would lose by cutting prices on developing other foreign markets and sell into them at full price.” That’s why China is now selling more stuff than ever, just not to the US.

As a result of not even having the limited negotiating power that big stores have, mom and pops are now going out of business a lot faster than last year, as reported here earlier. The small enterprises have already held on as long as they could. They made it through the first few months of tariffs, hoping the tariffs would go away; but the numbers of those that are now folding, indicate tariffs as the most likely cause. Of course, deportations of cheap labor could be raising their costs, too.

All of this will multiply because, as more businesses go down, the economy overall goes down, which causes another wave of businesses to collapse. That can easily keep repeating for a year or two.

Stocks love bad reality and hate good reality

The response of the stock market was predictable for its insanity. The market, again, jolted up 400 points on the Dow because the bad economy means the Fed will be creating more easy bailout money for the casino to play with.

Dow closes 400 points higher as ADP jobs data strengthens Fed rate cut hopes

In a world that was not constantly manipulated by the Fed and the government, stocks would not rise when economic news says that businesses are doing so poorly they have to fire a lot more people and are still going out of business. It’s been clear for a very long time now that the stock market cares a lot more about how much easy money the Fed will be funding it with than with how well businesses are doing and are likely to do in the months ahead.

Markets are pricing in an 89% chance of a cut next Wednesday, which is much higher than the odds from mid-November, according to the CME FedWatch tool.

When stocks rise under the present dimming reality as business are falling harder and harder, it is only because the casino sees that it will soon have more money to play with, not better hopes of more profits to owners. Some stock analysts try to say it is because the easy money will goose the economy, but that is empty thinking, or just denial of obvious truth. Whenever the Fed has lowered rates going into a recession, we went a lot further into recession before things turned around. Right now, with tariffs driving up business taxes and deportations driving up their operating costs, it will take a lot of Fed easy money to offset all of that and turn the sinking ship back into a floating ship.

In reality, the stock driver is bigger hopiated dreams of more money for the gamblers, which will cause them to keep bidding stocks far above the reality that exists behind the companies they are bidding upward. Many of the best-performing stocks are already priced far above business reality anyway, even if business was not now declining.

“The market is hinged on the Fed, and so if they don’t cut, it’s not going to turn out well,” Welch added.

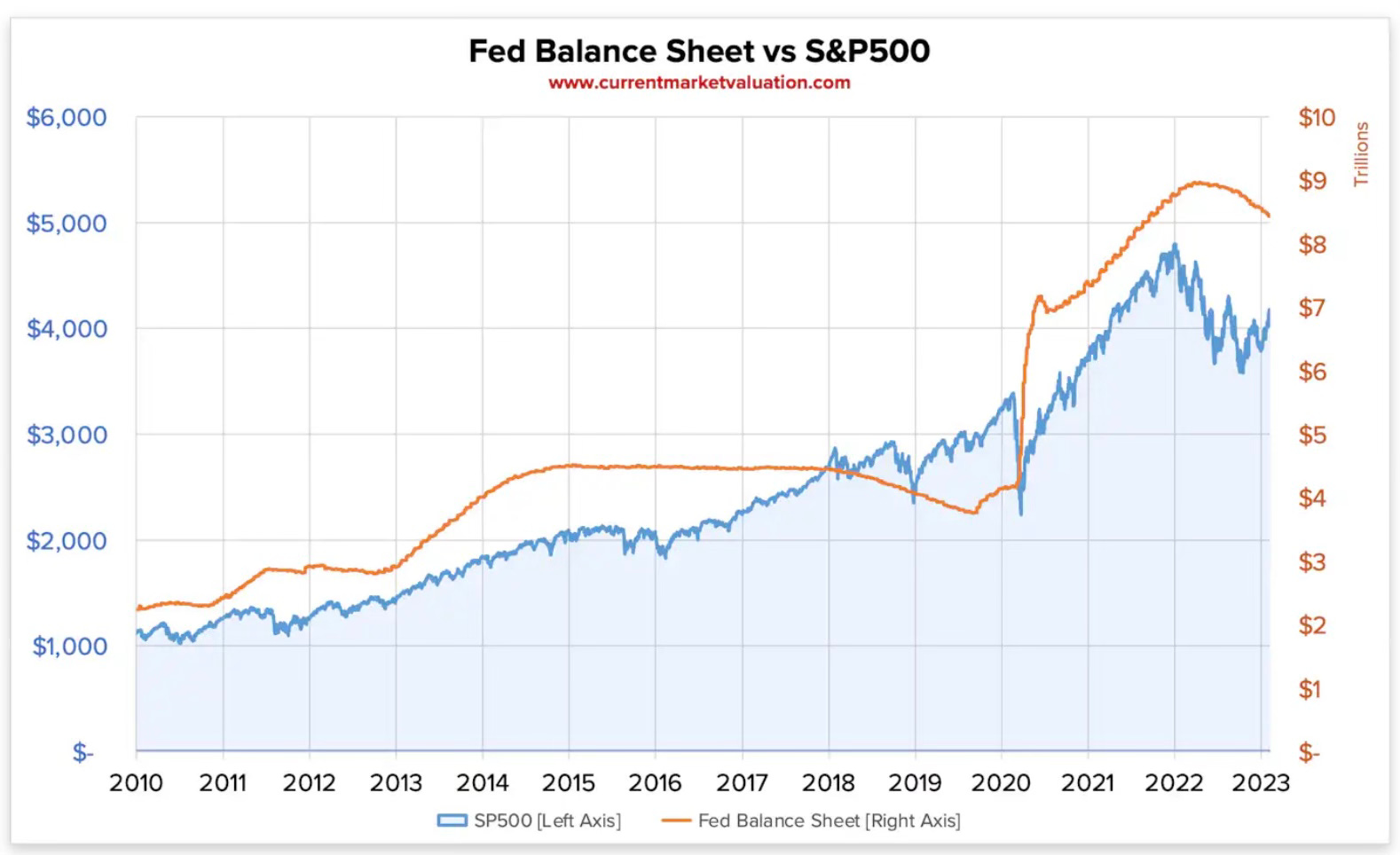

It’s been hinged on the Fed, at least, since 2008. So, of course, it will come unhinged IF the Fed fails to deliver the cheap money. Whenever the Fed has started raising its balance sheet to increase liquidity among banks and thereby push money supply, stocks have risen. When the Fed has backed off, stocks have become troubled and eventually fallen. The stock action often comes ahead of the actual Fed action because the Fed announces its change of plans ahead of the actual change and often hints at the change well before the announcement, and the market responds to the promise; but the correlation is still easy to see:

A lot of the market is purchased with borrowed cash, often raised via corporate bonds, which companies issue in order to buy their owns stocks back because the gains from the buybacks beat the cost on the bonds when the Fed gets bond prices down enough by increasing the size of its balance sheet (QE).

While the market went up because the bad news meant more practically free money, that still didn’t help AI and other high-tech stocks, which generally took another tumble today, as I started saying awhile back was imminent

Making the money magic work for you (but remember magic is all illusion when it does work)

Now, the silver lining in all of this for those failing mom & pops is that, after they go out of business due to their rising tariff taxes, they will be getting a promised dividend check for as much as $2,000—one for mom and one for pop! In fact, we are all supposed to get a $2,000 dividend check once we are out of work or our businesses fold. That is some relief down the road from all the inflation the tariffs are already creating.

Even Trump had to acknowledge the inflation for a brief bit, which he called “an affordability issue” after the Democrats somewhat bested the Republicans in the last election. However, now he is back to calling “the affordability issue” fake news. So, eat cake because in mathemagic world you can eat your cake and have it, too. People only feel like they are feeling a lot of inflation because no one is telling them how bang-up great the economy is doing. You have to speak the magic words to crystalize the illusion.

Apparently, someone forgot to speak the words of “affordability” over the businesses that are now laying off workers, rather than hiring, and forgot to speak the words over the people who were laid off, and especially forgot to speak the words over the businesses that ridiculously thought they had to declare bankruptcy and/or shutter their doors.

If they would all just forget the reality they think they are seeing and just listen to the dream the president presents, all would feel quite fine. The poppies are lovely this time of year. (Maybe not where you are … but somewhere!) So, sleeeep!

********