The Return Of Gold As Money? Don't Hold Your Breath!

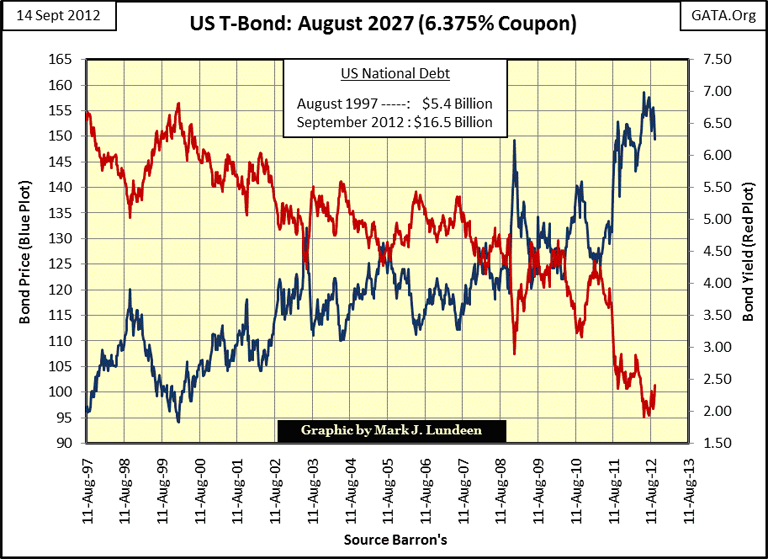

This week Doctor Bernanke promised to monetize as much of the US Treasury and mortgage markets as it takes to restore "stability" in the economy. Expectations of an open-ended QE3 have been anticipated for months. One would expect a promise by the Federal Reserve to keep bond prices high, and yields low would have been good news in the T-bond market. But someone with a lot of T-bonds in their portfolio has been selling since the end of July. The T-bond below has seen it current yield (Red Plot) rise from 1.94% in late July to 2.41% at the close of the week, two full days after Doc B's QE3 announcement. This is the bond's highest current yield since late May.

You can be sure I'm not the only one noticing that the bond market is giving Doctor Bernanke's QE3 the Bronx cheer. Maybe someone else believes it's only a matter of time before we see double-digit T-bond yields again. It hashappened before. Never forget that there are some really smart people in the market. And what separates the smart money from the dumb? Knowing to sell at the top; not at the bottom.

The stock market liked the news this week, but I didn't. Market commentary for the stock market has changed greatly since the 1980s. Long ago, companies, and the investors who owned their shares, were made or broken by the talent, or lack of it in a company's management. This has been the story line for the financial media since the 1920s, as well as positioning ones money in a growing market sector - but not anymore! I find it hard to listen to CNBC, as all they talk about is what the Federal Reserve, or ECB is going to do to "stimulate" economic activity. Yeah sure, they sometimes do have guests who manage a large publicly traded company, but it's obvious that they do this to fill airtime when they can't fill the time slot with a former employee of the Fed.

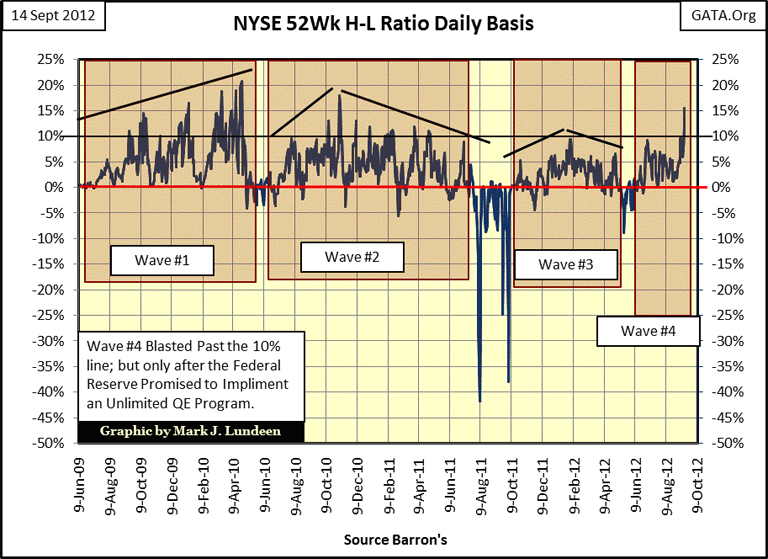

Well let's see how the stock market took this week's news of perpetual monetary inflation. Wow! The NYSE 52Wk H-L Ratio looks like a young man running wild in a harem! It's been two years since the guys at the NYSE have been thisexcited. The ratio cleared the 15% line; impressive. If the NYSE can keep this up for a few months, as it did in Wave #1, the stock indexes may have a significant bounce from here. But if it does, just remember that the market is going up for all the wrong reasons, and I want no part of that.

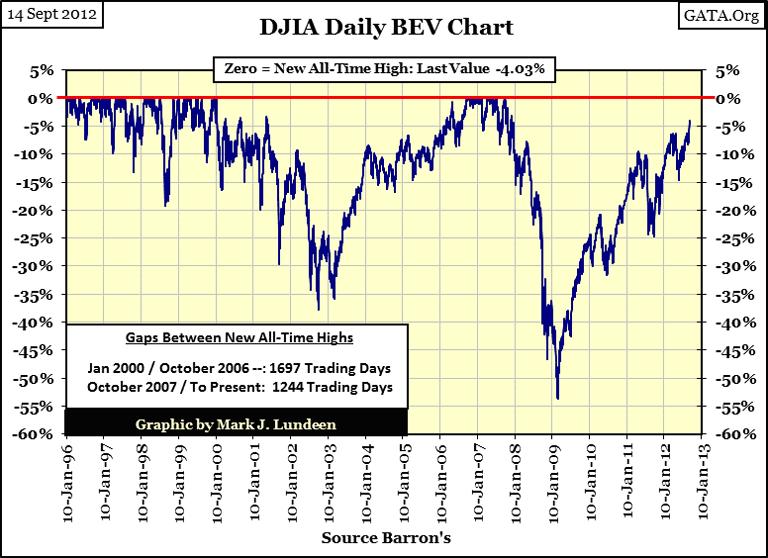

The Dow did alright too. I'm almost a believer that a new all-time high for the Dow Jones is just right around the corner. After 1,244 trading days since the Dow Jones last all-time high in October 2007, this old geezer of a bull market isnow just 4 BEV points away from making history. Can the old bull do it? It had better!

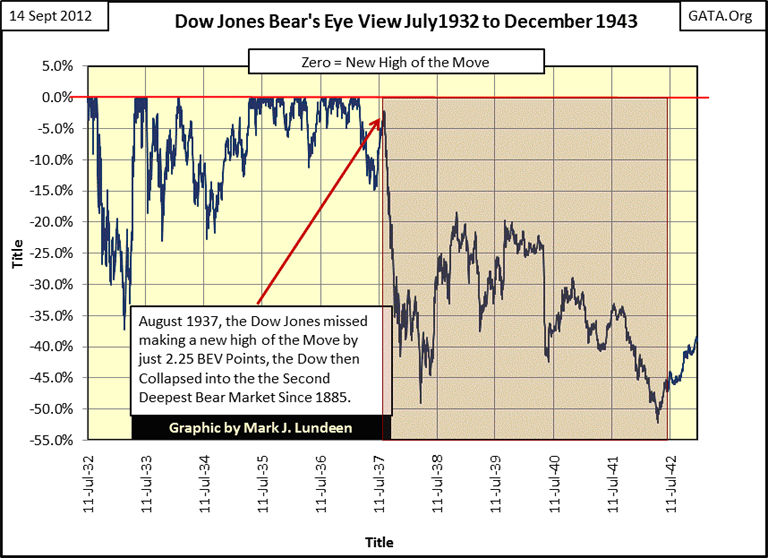

The current Dow Jones situation reminds me of what happened during the 1932-37 bull market (next chart). This depression era bull contained the largest ever one year gain for the Dow Jones. From July 1932 to July 1933 the Dow Jones gained 153%, and then continued on with a very respectable performance until March 1937, when it had a minor 15% correction. From the bottom of its 1937 correction, the Dow Jones came back to within 2.25% of making a new high of the move, but that wasn't to be. Instead, it reversed, and began a five year decline which finally bottomed in the second deepest bear market since 1885.

No one saw this coming, but that is what happened from 1937 to 1942.

Can the Dow Jones do something like this again? Sure it could! But the question really is; how likely is something like this to happen again? I'd say very likely, and for the same reason.

Market historians frequently comment that the 1937-42 bear market was the result of President Roosevelt's unabated meddling in the economy, and the affairs of private business. He kept changing the rules companies had to comply with, as well as the tax laws. It seems to me that our current "bull market" in stocks is similarly flawed.

Obama's new health care law is laced with 25 new taxes, not that anyone in congress had time to read it. It was 2500 pages released less than 24 hours before it was brought up on the floor to vote. The new taxes will soon be enforced by 17,000 freshly hired new IRS agents in January, but not a single health benefit goes into effect until 2014. This will be a major drag on the economy, not to mention other unintended consequences such as states cutting their medical services to the poor and dumping them on the universal coverage offered by the federal government.

The "mark to fantasy" accounting exception granted to banks in Obama's February 2009 Housing Relief Bill will extend the life of inefficient, unviable banks while allowing them to become even larger systemic risks instead of going bankrupt, and extend the housing bust by encouraging banks to maintain a huge "shadow inventory" of REO's instead of selling them into the market and allowing prices to settle to pre-bubble levels.

Sarbanes-Oxley in 2002 added a nightmare web of bureaucratic hoops for US businesses to jump through.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 was supposed to end bailouts, end "too big to fail," and increase transparency in the financial industry. Instead it created a host of new regulatory agencies and bureaucratic red tape, and ended most free checking accounts.

The Financial Services Modernization Act of 1999 (Gramm-Leach-Bliley) enabled the stock market bubble and housing bubble, bond market bubble, and the massive derivative bomb many times larger than global GDP. By repealing Glass-Steagall it removed protection against too big to fail and conflicts of interest that had been in place since the Great Depression.

Yes, I would say that there has been more than sufficient government meddling to cause a repeat of the catastrophic 1937 to 1942 bear market. This potential connection between the 1937 and 2012-13 stock market is just something running around in my head. It would be poetic seeing our Dow Jones fail to break above its all-time high of October 2007, while being only a few percentage points from doing so, just before it too enters a horrendous bear market decline. No guarantees here, this is just something I'll keep checking up on until the Dow Jones sees a new all-time high, as that would invalidate the comparison, but not the potential disaster in the stock market.

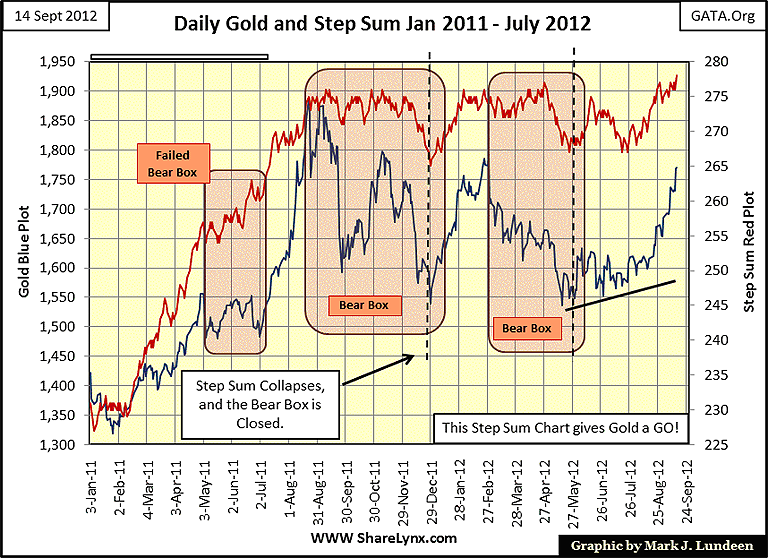

Let's look at gold and silver's step sum charts. Gold (Blue Plot) and its step sum (Red Plot) are looking really good.

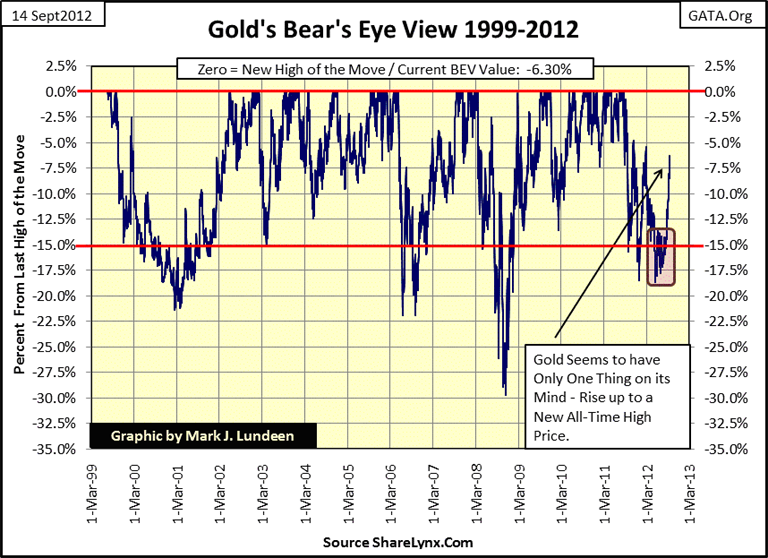

I'd say more, but it's early Saturday morning and I'm getting tired. So here is gold's BEV Chart. It's pretty obvious it isn't just the NYSE 52Wk H-L Ratio that's running around in a harem! From these levels, gold could move on to a new all-time dollar high in a single trading session. It's already reached new highs this week in the Euro, the Swiss Franc and the Indian Rupee.

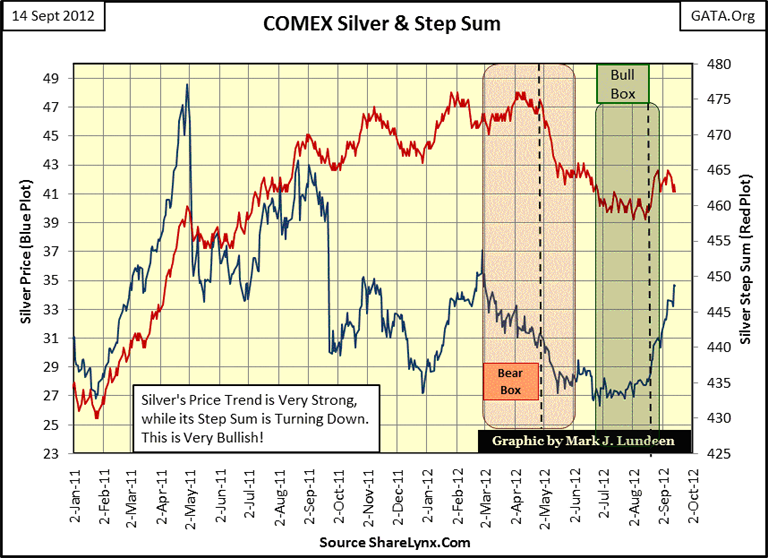

Now on to silver's step sum chart; which is a chart I'm falling in love with. Look at silver's price trend; it's totally ignoring its sagging step sum plot. This is really great, as it means that the floor traders are getting more bearish as the price of silver goes higher. This chart is telling us that they will likely be punished for their caution, as silver should get a nice kick to the upside when these large traders reverse their bearish positions in the silver market. I suspect that next week we'll see silver at even higher prices, and the floor traders will be back in the bull's camp (meaning that silver's step sum will reverse to the upside).

For your information, I never give trading or investment advice. But you can take my comments for what they are worth to you. As long as you take your losses with no tears, or expectations of reimbursement from me, you can keep 100% of your profits for yourself. In the entire World Wide Web, there isn't a better deal.

Next is silver's BEV chart (below); since July it has moved up from its BEV -45% line to above its -30% line. Silver had to move 30% in its price to make up those 15 BEV Points, making most of these gains in less than three weeks! My gut (and experience as a market observer) is telling me that such a move cannot go on without being corrected sometime soon. Should silver break above its BEV -20% line without a notable correction, it would be most remarkable.

If you're trading silver contracts, you're taking risks to which I'd never want to be exposed. But that is just me, someone who believes in holding something tangible and real with no plans to sell it for many years to come. If silver does correct back to its -40% line, I really don't care. But if you're trading silver futures contract - you will! So be careful out there.

As our lawmakers are still legally bound by the old gold standard, the recent Republican proposals for a return to the gold standard should be treated with suspicion. When Nixon closed the gold window in 1971, it was supposed to be only a temporary suspension. That "suspension" has now lasted for 41 years.

The legal basis for our current monetary policy is still the 1945 Bretton Wood Monetary Accords, an international treaty ratified by the US Senate. Congress has yet to repeal this treaty. That makes President Nixon's presidential order to stop redeeming gold for US dollars in 1971 illegal. So, for your information, the old $35 an ounce gold standard is still law. Not that Doctor Bernanke cares. As an international monetary renegade, Doc B respects no monetary law but his own whimsical monetary theories. This is also true of the world's central bankers whose countries signed the Bretton Woods Agreement after World War 2. Europe's central bankers would monetize their grandmothers' rocking chairs before they'd let their banking system's worthless assets deflate.

So why have these highly intelligent, well educated central bankers chosen to abandon the system of gold backed currency which existed during the most prosperous periods of our history? The political necessity of keeping voters back home happy with big government spending programs, the same political programs any effective gold standard is designed to prevent! The popular demand for "something for nothing" from the government killed the Bretton Woods' $35 an ounce gold standard. Today, any new "gold standard", should it become law, would soon be set aside for the same reason.

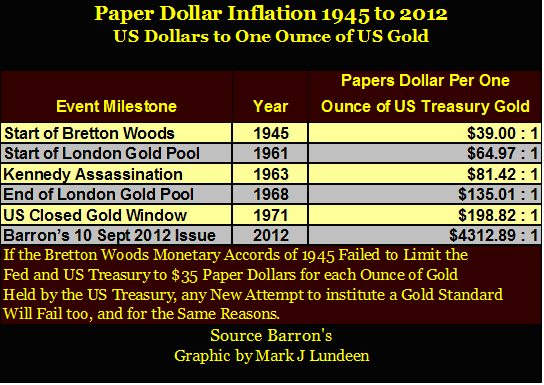

Look at the table below. The current law only allows $35 paper dollars for each ounce of gold held by the US Treasury. Yet as of this week, there are now $4312.89. To my knowledge, I'm the only market commentator who regularly shows this table, and charts on the growth in the CinC. However, the general public doesn't care to know the specific reasons why gold is now going for $1769, and not $35, or feel a sense of outrage over what the Washington has done to our money, and our world! Until the "man on the street" does, no gold standard can withstand Washington's monetary printing press.

It's important to know that Congress really needs to do nothing more to implement a "new gold standard" than to decide to once again follow the current law of the land. But crafting new legislation is always fine political theatre. The polemicists in the 24/7 news channels would love to cover the mindless babble flowing from the floor of the senate, while the actual bill to be voted on is crafted behind closed doors by congressional aides. So, the final gold standard legislation would most likely be similar to the healthcare bill: 2,500 pages of law that no one will, or can read, full of pork-barrel freebies from Members of Congress to those who keep them in office. With the world as it is today, the chance of returning to the gold standard of the 18th and 19th century is precisely zero%, because memory of the monetary and social chaos of the 16th and 17th centuries (the Reformation) are long forgotten. In the history of mankind, no society has chosen gold as a monetary standard until gold as money becomes an act of desperation.

And in 2012 we are not yet desperate enough to do this.

Long ago, the classical-gold standard operated in an economy where government was impotent in the financial markets, and in the daily affairs of its citizens. Businessmen routinely told politicians to mind their own business, with no fear of reprisal from the IRS or concern of a regulator stopping by for a surprise inspection. And if the truth be told, most politicians during the gold standard were wisely happy for their irrelevant, yet prestigious positions in society. The public appreciated the fact that a political system that couldn't do anything * FOR * you was also a political system that couldn't do anything * TO * you.

Since Ben Franklin signed the Declaration of Independence, this understanding of the role of government in the lives of its citizens was the accepted idea of American liberty. You can see this fact in the history of gold coinage. No gold coin struck by the US Mint ever had the likeness of an American Politician on it. Rather, they all had Lady Liberty, an Indian Chief or even a buffalo proclaiming that "in God we Trust", implying that Americans didn't trust their elected officials - and for good reason. Today, that is no longer true. Currently, US coinage displays the faces of politicians on them; lying in the pockets of aging Americans who believe that Washington's Social Security System will provide for them in the years to come. This is a bad sign, as is the naming of air-craft carriers after politicians, either dead or living. The old names for capital ships were better anyway: the "Kitty Hawk" or Midway just have a nice ring to them.

During the classical gold standard, banks refused to extend credit to consumers. For the gold standard to work, "buy now, pay later" consumerism must stop, leaving consumers with only their paychecks, savings, and investment income to spend. If one insists on living a life burdened with debt, one will just have to go to Mr. Knuckles for a loan.

People long ago understood that government wasn't there to provide for them in their time of need, including their old age. So they saved their money (gold) to take care of themselves in the years to come. Of course not everyone did, but poverty in 19th century America was understood as a moral, not necessarily an economic problem. Back in the days when a twenty dollar bill could be exchanged for a $20 gold double eagle coin, parents would read Aesop's fable of the Ant and the Grasshopper to their children at night before saying their prayers. Today, with $4312 paper dollars for each ounce of US Treasury gold, most parents don't. And long ago, children were taught the bible to instill a moral basis for a proper work ethic, as God frowns on "sluggardly" behavior.

"How long will you lay there you sluggard? When will you rise from your sleep?" -- Proverbs 6:8-10

"Sluggards do not plow in season; so at harvest time they look but find nothing." -- Proverbs 20:3-5

During the 19th century, at the zenith of the gold standard, the only Federal agent who ever knocked at the door of the average citizen was an employee of the US Post Office. They were almost always welcomed. As the gold standard prevented the creation of consumer debt, there were no bill collectors to write people nasty letters, so long ago; letters arriving in one's mail box were most often of a personal, and pleasant nature.

The gold standard, will by necessity, put an end to the federal school loan program, so expect the high priests of education to do everything in their power to extol the virtues of debt, and the absolute necessity of a managed monetary system and economy. Any professor of economics who supports the return of gold backed money does so at the risk of losing his tenured position in our university system, because currently most funding for "higher education" is made possible by monetary inflation.

Mortgages must become another four letter word in the world of finance, and politics too. This would actually make housing affordable once again, but only to those who are willing to save money for a decade or more. Until then, there was no shame paying rent, thus providing income to a retired couple, or a widow and her children.

Here are a few quotes from long ago, by people who understood the old gold standard and the political and social stability that came from it.

Bankers once supported the gold standard:

"Gold is money, and nothing else is." -- JP (Pierpont) Morgan

Labor too, once understood the importance of honest money:

"If money is good and would be preferred by the people, then why are legal tender laws necessary? And, if money is not good and would not be preferred by the people, then why in a democracy should they be forced to use it? We [the American Federation of Labor] believe in a financial policy that will neither depreciate our currency at home nor abroad. We believe in an honest dollar. Gold is the standard of all great civilizations. We [the American Federation of Labor] believe in a financial policy that will neither depreciate our currency at home nor abroad." -- January 1896 issue of the American Federationist, the house organ of the American Federation of Labor (AFL)

So did politicians:

"Of all the contrivances for cheating the laboring classes of mankind, none has been more effective than that which deludes them with paper money." -- Daniel Webster

"Gentlemen, I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst yourselves, but when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter, I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I intend to rout you out, and by the grace of the Eternal God, will rout you out." -- Andrew Jackson (to a committee demanding an early renewal of the charter for the Second Bank of the United States)

"So far as I can discover, paper money systems have always wound up with collapse and economic chaos. When you recall that one of the first moves by Lenin, Mussolini, and Hitler was to outlaw individual ownership in gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty. -- Congressman Howard Buffett (Father of Warren Buffet) from a 1948 issue of the Commercial and Financial Chronicle.

Even the attorney general for the arch enemy of the gold standard, Franklin Delano Roosevelt (FDR), had to pay his respects to the thing he intended to destroy - honest money.

"Gold is not an ordinary commodity. It is a thing apart, and on it rests our form of civilization, the whole structure of our finances and the welfare of our people. Gold is affected with a public interest. These contracts [bond clauses for payment of interest and principle in gold] therefore deal with the very essence of sovereignty, for they require that the Government must surrender a portion of that sovereignty." -- Walter J. Cummings: Attorney General for the Roosevelt Administration arguing before the Supreme Court for the negation of gold clauses in the bond market (1935).

Sovereignty as enshrined in the American Constitution was specific and limited. But the "New Dealers" of the 1930s, wanted to expand government beyond what the gold standard would allow, so they inflicted honest money with a fatal wound, and made ownership of gold, and gold coins illegal.

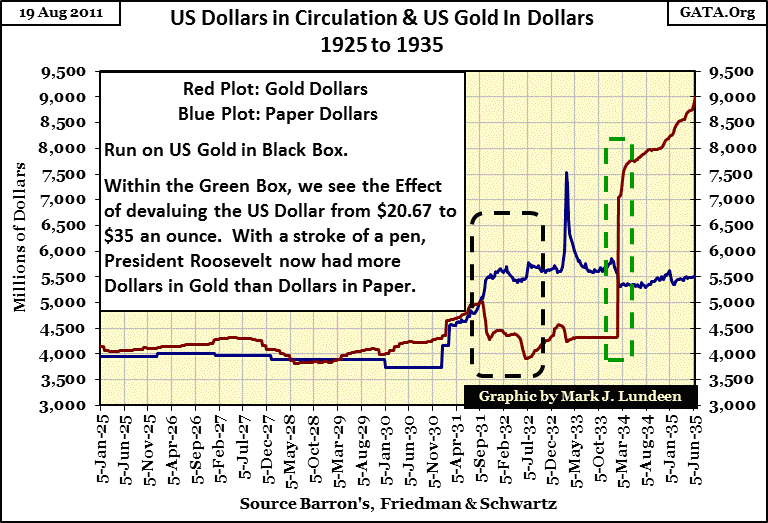

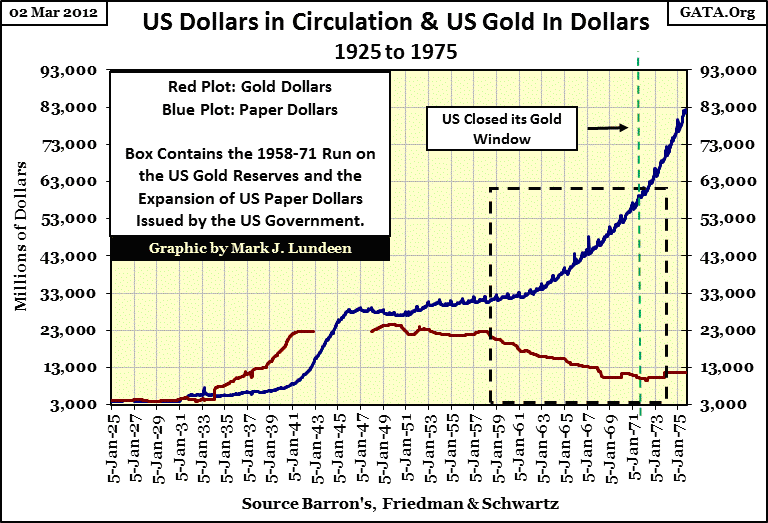

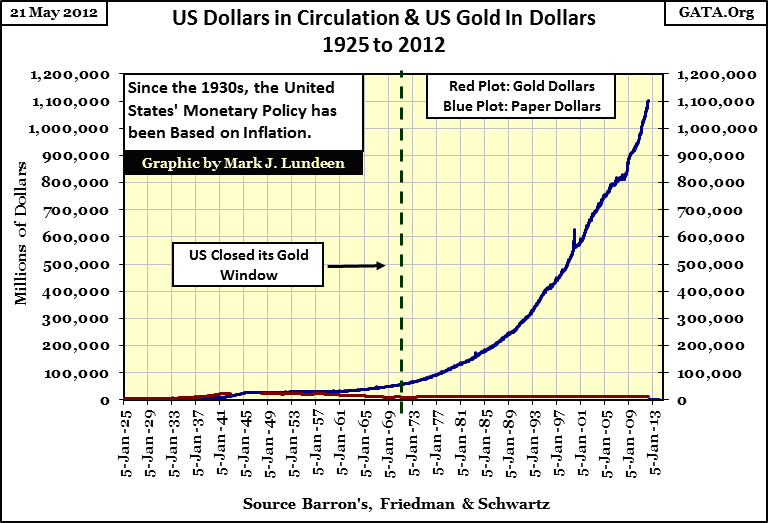

Here are some charts using the data from old issues of Barron's, who have faithfully published monetary statistics from US Treasury since the 1920s. In them, we see how the old gold standard was terminated; week by week, as Washington continued printing paper money far in excess of the gold held by the US Treasury (Red Plots). A new gold standard would not be able to withstand the US Treasury's printing press any better.

Note above how dollars in gold (Red Plot) usually outnumbered dollars in paper (Blue Plot) from 1925 to 1931. The large spike in gold dollars resulted from the revaluing of gold from $20.67 to $35.00 an ounce. Gold dollars continued to increase until the start of World War 2, as Europe transferred its gold to the NY Federal Reserve bank, far away from Adolf Hitler.

This chart as the same data as the first, but includes data up to 1975. Here we see the huge inflows of gold from Europe, and the tremendous increase in paper money circulation (CinC) during the war. The US Government published no data on its gold reserves (most came from Europe) from 1941 to 1948. President Truman was the only President who reduced the number of paper dollars in circulation. Every president since Truman chose to supplement Washington's budget with inflationary funding. Beginning in 1958, France began demanding an ounce of US gold for each $35 paper dollars that found their way into the Bank of France. This began a gold run on the "US gold supply", the same gold that came into the United States, from Europe, before the war.

What really happened is this. France was happy to have its gold in NY, as long as the US Treasury made good on its Bretton Woods commitment of issuing only $35 paper dollars for each ounce of gold it had. But after ten years of monetary malfeasants (see chart above), France demanded its gold back.

In 1971 (vertical green dashed line), the US Treasury refused redeeming its paper dollars for gold. President Nixon is always blamed for this. But this chart proves that every president since Truman was just as responsible for the failure of the Bretton Woods' gold standard.

This is what happened to Bretton Woods $35 an ounce gold standard. As things are now, this is how the "new gold standard" will also end. Promises from Washington aren't worth the paper they are written on.

[email protected]