Russian Bear Roars. Will It Awake Gold Bulls?

The current military tensions and the Fed’s sluggishness favor gold bulls, but not all events are positive for the yellow metal. What should we be aware of?

It may be quiet on the Western Front, but quite the opposite on the Eastern Front. Russia has accumulated well over 100,000 soldiers on the border with Ukraine and makes provocations practically every day, striving for war more and more clearly. Last week, shelling was reported on Ukraine’s front line and Russia carried out several false flag operations. According to Linda Thomas-Greenfield, the U.S. Ambassador to the United Nations, “the evidence on the ground is that Russia is moving toward an imminent invasion.”

Meanwhile, President Biden said: “We have reason to believe they are engaged in a false flag operation to have an excuse to go in. Every indication we have is they're prepared to go into Ukraine and attack Ukraine.” Of course, what politicians say should always be taken with a pinch of salt, but it seems that the situation has gotten serious and the risk of Russian invasion has increased over recent days.

Implications for Gold

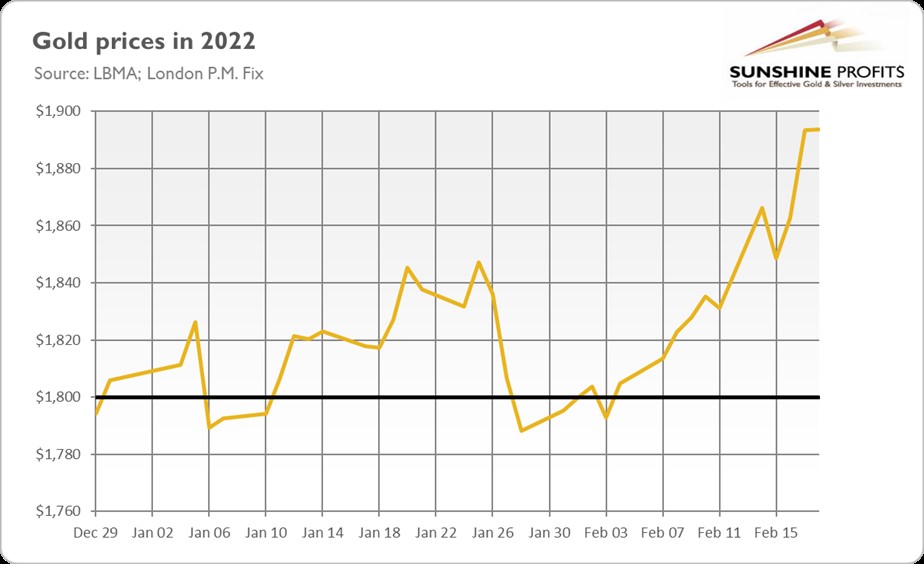

What does the intensifying conflict between Russia and Ukraine imply for the gold market? Well, the last week was definitely bullish for the yellow metal. As the chart below shows, the price of gold (London P.M. Fix) rallied over the past few days from $1,849 to $,1894, the highest level since June 2021; And he gold futures have even jumped above $1,900 for a while!

Part of that upward move was certainly driven by geopolitical risks related to the assumed conflict between Russia and Ukraine. This is because gold is a safe-haven asset in which investors tend to park their money in times of distress.

It’s worth remembering that not all geopolitical events are positive for gold, and when they are, their impact is often short-lived. Hence, if Russia invades Ukraine, the yellow metal should gain further, but if uncertainty eases, gold prices may correct somewhat.

To be clear, the timing of the current military tensions is favorable for gold bulls. First of all, we live in an environment of already high inflation. Wars tend to intensify price pressure as governments print more fiat money to finance the war effort and reorient their economies from producing consumer goods toward military stuff. Not to mention the possible impact of the conflict on oil prices, which would contribute to rising energy costs and CPI inflation. According to Morgan Stanley’s analysts, further increases in energy prices could sink several economies into an outright recession.

Second, the pace of economic growth is slowing down. The Fed has been waiting so long to tighten its monetary policy that it will start hiking interest rates in a weakening economic environment, adding to the problems. There is a growing risk aversion right now, with equities and cryptocurrencies being sold off. Such an environment is supportive of gold prices.

Third, the current US administration has become more engaged around the world than the previous one. My point is that the current conflict is not merely between Russia and Ukraine, but also between Russia and the United States. This is one of the reasons why gold has been reacting recently to the geopolitical news.

However, a Russian invasion of Ukraine wouldn’t pose a threat to America, and the US won’t directly engage in military operations on Ukrainian land, so the rally in gold could still be short-lived. If history is any guide, geopolitical events usually trigger only temporary reactions in the precious metals markets, especially if they don’t threaten the United States and its economy directly. This is because all tensions eventually ease, and after a storm comes calm.

Hence, although the media would focus on the conflict, don’t get scared and – when investing in the long run – remember gold fundamentals. Some of them are favorable, but we shouldn’t forget about the Fed’s tightening cycle and the possibility that disinflation will start soon, which could raise the real interest rates, creating downward pressure on gold prices.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care

********