A Shocking Gold Price Rally

The 2021-2025 war cycle, inflation, energy transition, and empire transition are a perfect “golden storm”.

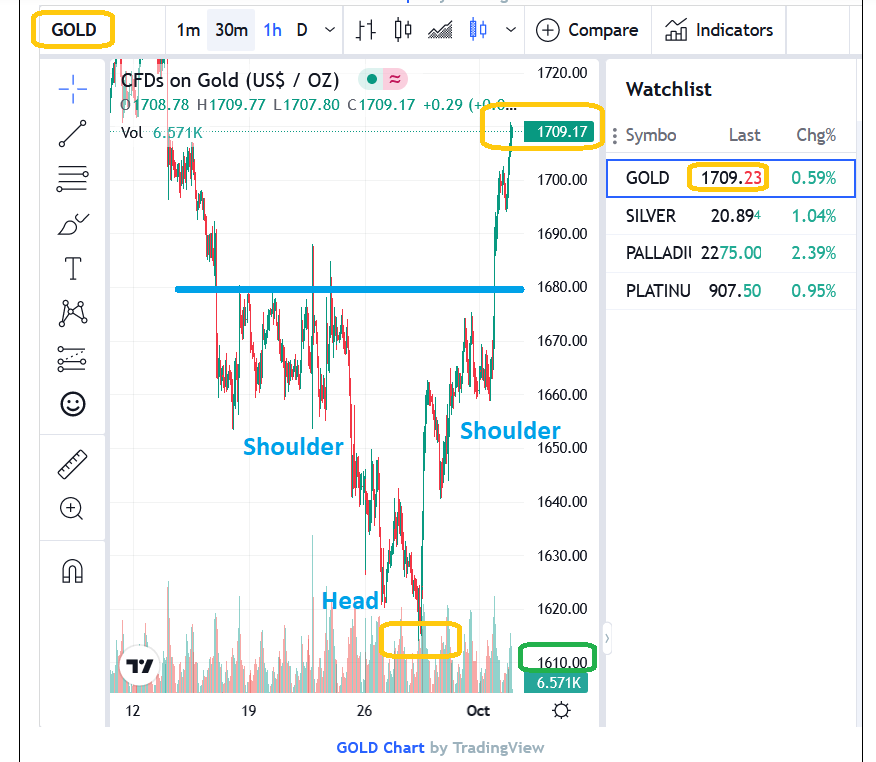

The intensity of these four gold price drivers is astounding. It’s the reason I urged Western gold bugs to consider the move under $1675 as potentially a false breakdown that could be reversed violently… and to buy the miners and silver as gold approached $1610.

majestic gold chart

A week after I suggested the false breakdown/buy into $1610 scenario, it’s played out even more gloriously than I envisioned.

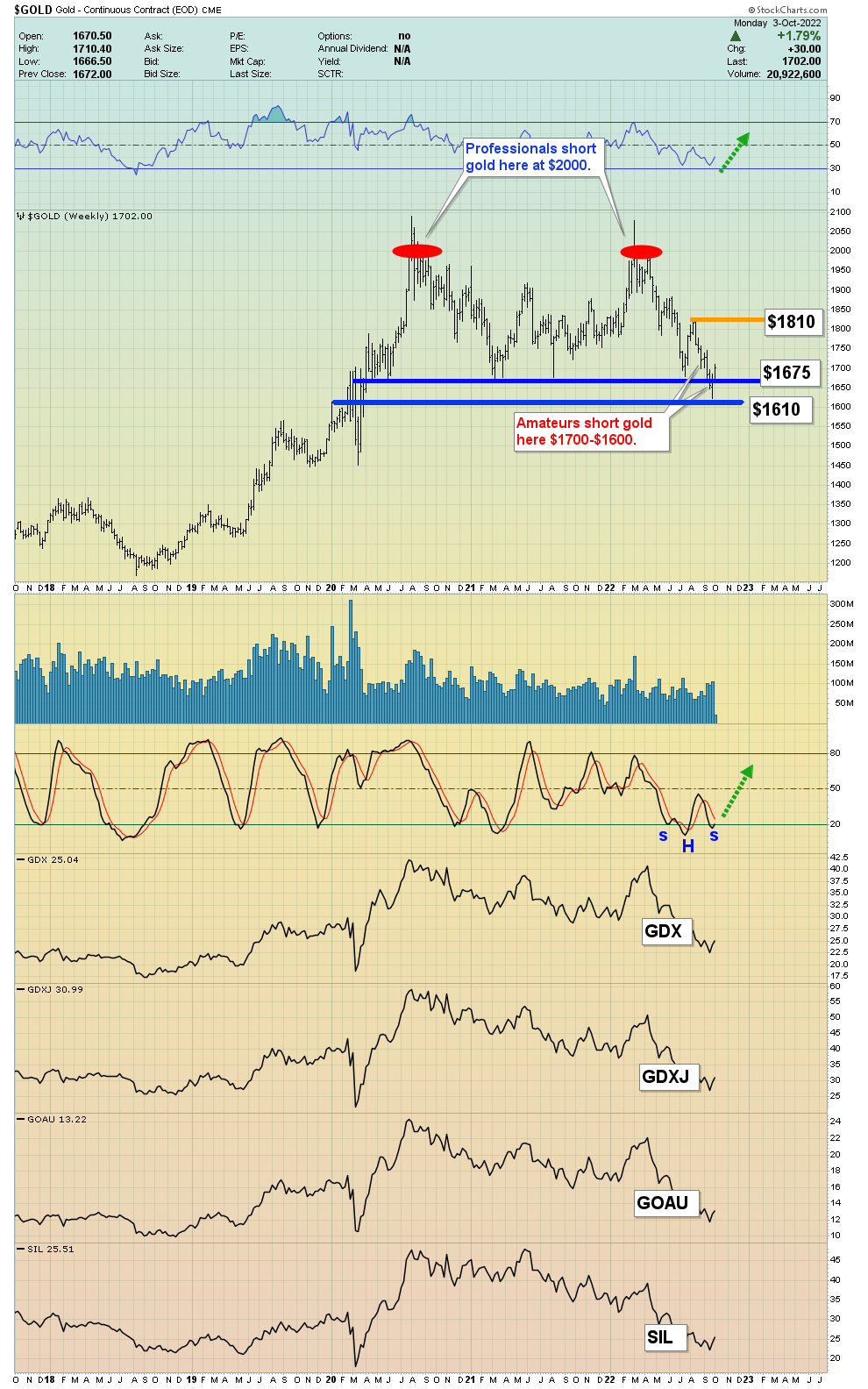

For a look at the weekly chart, please see below.

Gold’s mighty rally from the $1610 buy zone has been so powerful that $1675 is becoming support again too!

Note the fabulous inverse H&S pattern on the Stochastics oscillator at the bottom of the chart. This is a very positive chart, but certainly not something that could be called the greatest chart in the history of markets.

To view one that arguably is...

The right side of the chart is a bit droopy, but it has the shape of a continuation pattern rather than a reversal.

It clearly reflects the big fundamental drivers in play!

Unlike the world’s richest man who is the defacto and sensible leader of the green energy revolution, the fiat-obsessed governments of the West have no interest in peace for the poorest nation in Europe…

Even if their sanctions and wars freeze millions of their own citizens to death in the winter of 2024 and create riots bordering on the civil war in 2023.

Western government war-mongering is relentless. It happened in Vietnam, Panama, Iraq, Syria, Libya, and many other nations. It’s now reaching a hideous crescendo in Ukraine.

Tomorrow’s OPEC meeting (that brings perhaps a million bbl/day supply cut) roughly coincides with the US government’s promised end to the one million bbl/day draining of the nation’s strategic reserve.

The bottom line: The price of oil, and global inflation, are poised for a fresh surge to the upside!

bullish oil chart

There was a bull wedge breakout yesterday and a move above $85 resistance could usher in a thunderous rally back to the $130 area highs.

What about the oil stocks?

enticing XLE chart

Note the beautiful gapping action and the bullish triangle in play.

Oil stock enthusiasts may feel compelled to buy more of their favorite stocks right now… and rightly so!

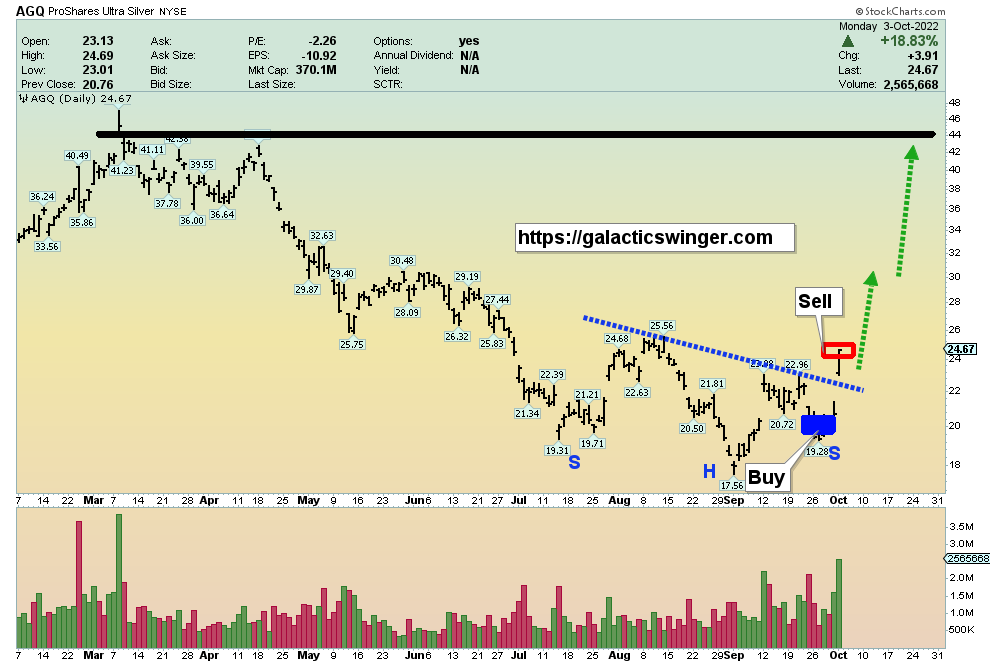

AGQ leveraged silver chart

While silver has been the superstar this week and looks to be heading “much higher”, there’s profitable fun to be had in trading this awesome metal too.

The stock, commodity, bond, and gold markets are gyrating wildly, and I’ll dare to suggest that action is about to intensify.

All gold bugs should probably own at least a token position in silver bullion too. The sky is the limit for silver bugs and for those investors who bought silver into my gold $1610 buy zone, there’s not much to do here… except to shout, “Hi ho, hi ho, it’s up the chart I go!”

SIL chart

A run to $31-$32 looks to be the play for October.

As the US government’s war against Russia continues to go off the rails, the citizens of the world will soon turn to silver bullion. The vile QE central bank programs have created a much bigger class of middle and poor earners.

Silver has always been the metal of the common man and it likely always will be so.2023 will probably be themed on a “Hi, Ho, Silver!” mantra.

If gold is the metal of kings, are gold stocks the stock for kings too? Perhaps, and on the rally from my gold $1610 buy zone, many miners already look like they deserve a crown and a throne.

GOAU ETF chart

A fresh breakout is in play.GOAU should be able to reach both $15 and $18 in October before there’s a swoon, and then it’s onto the “glory years” of the war cycle, in 2023, 2024, and 2025, when all the miners come alive and thrive!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Chomping At The Golden Bit!” report. I highlight eight gold miners that could see fast 50% gains on a rally from the gold $1610 zone, and I include key tactics to profit from the action!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: