Soft Inflation Data And A Concerned Draghi. How Will Gold Like It?

U.S. consumer inflation has moderated recently. Trade wars go on. What the Fed will do now? Let’s not forget the recent ECB monetary policy meeting. It carries implications for both EUR/USD and gold. Just what are they?

Inflation Slows Down in May

The CPI rose just 0.1 percent in May, following an increase of 0.3 percent in April, the government said on Wednesday. It was the smallest hike since January. The core CPI, which excludes food and energy prices, also increased 0.1 percent, for the fourth month in a row. Although the monthly numbers do not portend a revolution, May indicates eased inflationary pressure, mainly because of falling energy and used-vehicle prices.

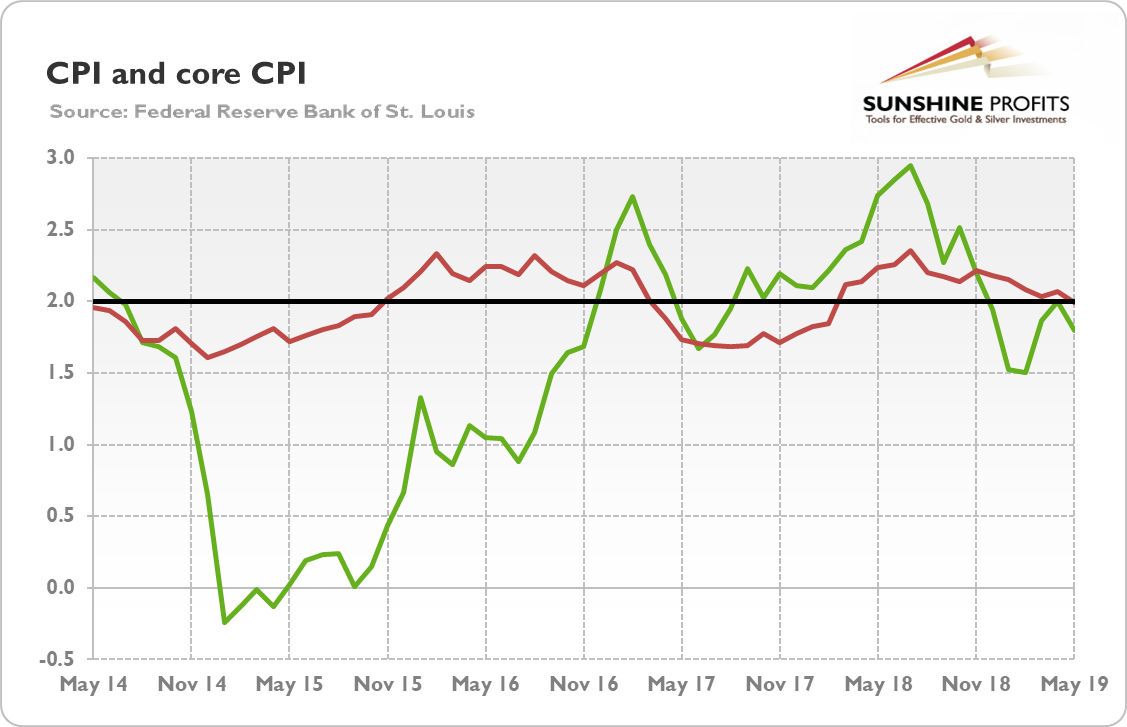

More importantly, over the last 12 months, consumer prices increased 1.8 percent, compared to 2 percent jump in April. It means that annualized inflation has softened. The index for all items less food and energy also slipped, from 2.1 percent to 2 percent. The slowdown in the annual CPI rate was thus caused not only by falling gasoline prices, but also by weaker price increases in the health care. As the chart below shows, the core CPI is now right in line with the Fed’s target.

Chart 1: CPI (green line, annual change in %) and core CPI (red line, annual change in %) over the last five years.

ECB Turns More Dovish in June

Last week, the Governing Council of the Eurpean Central Bank held a monetary policy meeting. While not a game-changer, one thing is quite important. The ECB postponed again the possible beginning of the interest rate hiking from the end of 2019 to the mid-2020:

The Governing Council now expects the key ECB interest rates to remain at their present levels at least through the first half of 2020, and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term.

Moreover, Draghi said at the press conference that the members of the Governing Council discussed what to do in case of adverse contingencies. He admitted that “several members raised the possibility of further rate cuts. Other members raised the possibility of restarting the asset purchase program, or further extensions in the forward guidance.” It implies that the European central bankers are getting more worried about the state of the Eurozone economy and may adopt even more dovish stance in the near future, especially should the euro appreciate against the US dollar.

Implications for Gold

Inflation eased. Will the Fed cut the Federal Funds Rate now? Not necessarily. The analyzed softening in inflation is probably too small to change the Fed’s stance on monetary policy . It’s maybe soft enough to justify a rate cut, but not as low so as to require an intervention. As long as the GDP grows at a steady pace, the unemployment rate stays low, and the trade wars do not trigger a crisis, the US central bank can just stand pat. However, given sliding oil prices in June, the CPI rate may remain soft, or even ease further before eventual rebound. Although it still would not be a problem for the economy, the doves within the FOMC could ring the bell and call for action then. The moderate inflation in itself is not positive for gold, which is considered to be an inflation hedge, but a more dovish Fed could support the price of the yellow metal. However, the Fed is not the only central bank in the world. The ECB might adopt an even more dovish stance. If that happens, the EUR/USD may decline, pulling gold down.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********