A Special Report for Canadian Investors

Foreign Content 30% Ceiling Has Been Removed... (finally)

The Federal Budget bill eliminating the foreign content limit for registered, pension and other tax-deferred retirement plans received Royal Assent on Wednesday, June 29th, 2005.

Because of this you will see all RSP clone version of foreign funds be rolled into their pure foreign content family member (ie. CIBC Nasdaq index RSP will be rolled into CIBC Nasdaq Index).

This long awaited change is very good news for Canadian investors and traders. Now you can park 100% of your money in American stocks, ETFs, and mutual funds, within your RRSP portfolio. What is most significant for many of our Canadian subscribers, is that you can participate 100% in the tech sector with ETFs such as QQQQ and SMH.

The QQQQ is an ETF, which stands for "exhange traded fund", for the Nasdaq 100. It is a fund traded as a stock, which is basically a basket of the top 100 stocks within the Nasdaq index. Excellent diversification, excellent daily volume for instant fills and very little slippage. While the QQQQ, or affectionately known as the "cube", is currently exactly where it was on January 1st, our trading model has banked 20% profit already for the year so far.

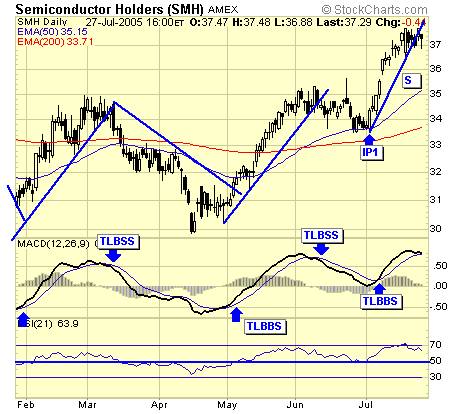

SMH - is the ETF for semi conductors, another excellent instrument for the technology sector. Our trading model has recently issued a major buy signal (IP1), and if past history is a guide, we are looking at upside of 30 to 50%.

With the lifting of the restriction on foreign contents, we are removing XIT.TO from our roster. This Canadian tech ETF is very illiquid, and terrible slippage. Worst of all, it is heavily weighted with Nortel. The single performance of one stock affects greatly on this ETF, and we are glad to dump it. However, there is a small drawback if you intend to trade the QQQQ and SMH within your RRSP portfolio, because your RRSP can only be in Canadian funds, every transaction on a US stock, ETF, or fund will cost you due to the exchange rate. Canadian banks are the biggest bloodsuckers outside of Transylvania, and each transaction could cost anywhere between 1 and 2%. A round trip on a trade could cost near 4%. OUCH. This applies to RRSP accounts only, because investment accounts in US funds can stay in US funds in between transactions. A simple way to avoid working for the banks is to purchase a Nasdaq index fund from a Canadian bank. Here you have the full benefit of trading the Nasdaq index, but in Canadian dollars, therefore no exchange necessary. And these bank funds are no load, with fairly low management fees, and are redeemable or switchable into another fund anytime with no penalty or front/back load commissions. There is a one time registration fee of about $40, check with your banks to confirm these details.

Most of the Canadian major banks have a full line of mutual funds which include index funds such as the Nasdaq, SP500, and DowJones. You can see that this CIBC Nasdaq index fund mimics the QQQQ, and performs almost exactly. This fund is up 15% from the May bottom, and the QQQQ is up 16% in the same time frame. Close enough.

Summary

The Canadian government has finally done the right thing and this new "free trade" is welcomed by all investors. Now the pressure is on Canadian banks to allow US funds within an RRSP account, but don't count on it, the profit is too good to pass up. Of the three sectors of energy, precious metals, and technology which we provide buy/sell signals for subscribers, only the technology sector has been difficult to trade due to the 30% restriction. The door is now wide open to allow Canadian investors/traders to fully participate the next bull market in technology, which according to our current trading models, is already underway.

Jack Chan at www.traderscorporation.com

29 July 2005