Spinning Italy’s Distressed Debt Into Gold

Serious gold investors know that May has historically been a weak month for the price of the yellow metal. For the 10-year and 30-year periods, the month delivered negative returns. The general decline in enthusiasm comes before the late summer rally in anticipation of Diwali and the Indian wedding season, when gifts of gold are considered auspicious. In the past, the fifth month has provided an attractive buying opportunity.

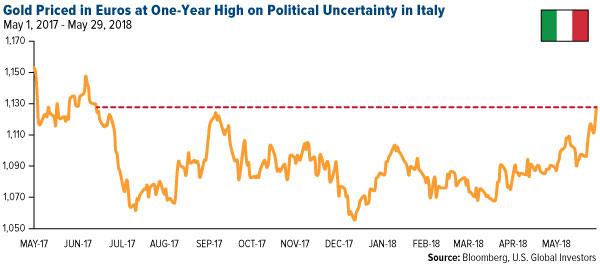

This particular May, the price of gold also had to contend with a stronger U.S. dollar, which appreciated against the euro as political strife in Italy spread throughout the entire continent. Priced in euros, then, gold is performing well, having closed at a nearly one-year high of 1,125 euros on May 29.

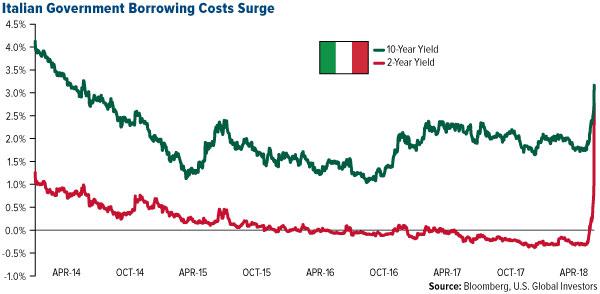

Italian government bond yields surged dramatically following President Sergio Mattarella’s decision to block the opposition parties’ pick for economic minister, a euroskeptic who supports Italy’s exit from the eurozone. The two-year bond in particular plunged the most since the creation of the bloc’s common currency in 1999.

With no working government at the moment, it appears likely that Italy will hold another election soon, raising the odds that either the Five-Star Movement or the League—both populist, anti-establishment parties—could take control. Although at opposite ends of the political spectrum, the two parties have expressed interest in at least opening an earnest discussion on the idea of ditching the euro.

Déjà Vu All Over Again

Italy’s appetite for change fits into what I see as a global trend right now. Based on what I’ve heard during my travels, middle class taxpayers, in the U.S. and elsewhere, are increasingly fed up with special interests and entrenched bureaucrats. As a result, the U.K. elected to end its complicity with failed socialist rules and regulations from Brussels. Donald Trump, an outsider and disruptor, was recognized by American voters as the right candidate to take on the beltway party.

Similarly, it’s possible that Italy could end up being next to say addio to further European Union (EU) control and take back its own economic and political destiny.

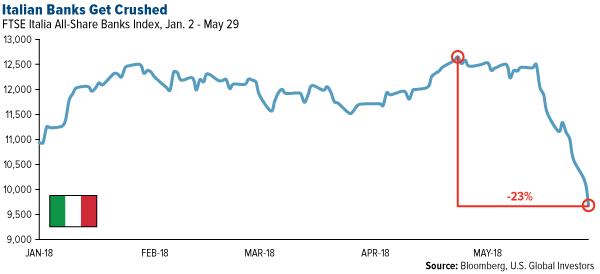

That said, the fear of another government debt crisis, similar to Greece’s, has naturally rattled markets. Because Italy, the eurozone’s third-largest economy, already has the highest debt-to-GDP in the bloc after Greece, and because Five-Star and the League both support ending austerity and challenging Brussels’ limits on government borrowing and spending, financials were the worst performing sector in the U.S. market, falling close to 4.5 percent for the week ended May 29. The Euro Stoxx Banks Index was down 5 percent for the same period. Italian banks fared even worse, collapsing nearly 25 percent since their high in late April.

Gold Seeing a Boost on Safe Haven Demand

Gold is trading above $1,300 an ounce again, but there could be bigger upside the more investors realize the full and global implications of Italy’s political turmoil.

The country’s public debt currently stands at 132 percent of GDP, and ratings agencies are reviewing a possible downgrade of its credit rating. Should it default on its billions of dollars in loans, a chain reaction could quickly spread to financial markets all over the world.

This is a worst-case scenario, but it’s for these reasons I think it’s prudent to have a 10 percent weighting in gold, with 5 percent in physical gold and the other 5 percent in high-quality gold stocks, mutual funds and ETFs.

Curious to see how some are gaining exposure to gold and precious metals? Click here!

The EURO STOXX Banks Index is a free float market capitalization index which covers 30 stocks of banks market sector leaders mainly from 12 eurozone countries: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. The FTSE Italia All-Share Banks Index is a free float market capitalization index of Italian banks.

*********

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of