A Stock Market Addicted To Stimulus

Was former Fed Chairman Paul Volcker correct when he said concerning quantitative easing that its “beneficial effects…appear limited and diminishing over time”? That’s the $85 billion question that Wall Street is asking right now. An honest answer to this question by current chairman Bernanke will do much to allow the economy to heal itself of the wounds inflicted by the excesses of the last 10 years.

It became clear starting in May that the bond market is pricing in, by way of increasing yields, “the complete elimination of quantitative easing, even though elimination is the ultimate goal” in the words of Barron’s columnist Gene Epstein. The Fed thus finds itself confronted with a paradox: it commenced its quantitative easing (QE) policy to help the economy stabilize and regain its strength, yet the mere threat of withdrawal of stimulus after more than four years has spooked investors. Judging from the reaction of the stock market since last month, it’s clear that Wall Street can’t live without QE.

This begs the question of how effective QE has been in allowing the economy to build structural strength since the job market is still weak and middle class incomes haven’t recovered since the credit crisis began. The middle class is the backbone of the economy and without its active participation no economic recovery can be considered effectual.

After four-and-a-half years of QE we can draw some conclusions about QE’s usefulness. First, QE can be likened to a stimulant administered to an auto crash victim who needs time and rest, above all, to regain health. The stimulus may trick the body into thinking that recovery is happening faster than nature intended, but the attempt at short-circuiting natural processes only provides a temporary metabolic boost and does nothing to address fundamental health issues.

Secondly, QE does indeed, as Volcker suggested, provide only diminishing returns. The recent experiences of China and the U.S. as well as Japan’s 20% stock market plunge bear this out. QE has also failed to provide the promised boost to employment and has resulted mainly in increased consumption among higher end consumers; its benefits have largely passed over middle and lower class consumers.

Finally, the basic assumption that QE would benefit corporations, which in turn would use the increased revenues to expand their workforce, has proven to be a false. While QE did indeed expand corporate profits by boosting stock prices, those profits were used by corporations to cut their workforces through various efficiency measures. Moreover, the profits of the largest multinational firms were hoarded in overseas banks instead of being directly re-invested into domestic production. America’s working force has seen precious little of those record profits while the corporate state has expanded at the expense of working class taxpayers.

As if all of that weren’t enough, we’re now faced with the perverse possibility that a “tapering” of the Fed’s stimulus measures may result in considerably lower stock prices down the line. This in turn would undo a substantial part of the recovery on the high-end of the economic scale, thereby undermining the entire 5-year experiment with QE.

While it’s true that American households now have a cumulative net worth of $70 trillion, a new record, those gains are mainly due to the benevolent effects of QE in increasing retirement funds and real estate values. Robert J. Samuelson, writing in the Washington Post, pointed out that before the 2008 financial crisis, Americans tended to spend about 5 cents of every dollar they gained in housing and stock wealth. They now spend half that amount at best. The reason for this, said Samuelson, is that households still haven’t recovered from the losses they suffered 5-6 years ago. Meanwhile house prices are still 22 percent below their 2006 peak values.

More importantly, psychology plays a major factor in curtailing consumption among U.S. households. “Careless optimism has given way to stubborn cautiousness,” writes Samuelson. “Americans learned the hard way that houses and stocks are risky assets,” he says, and they’re no longer borrowing against their wealth the way they used to. He calls this a “stunning shift in behavior” and points out the predicament it creates for policy makers, viz. how to promote growth when people have embraced a defensive posture while “building barriers against hazards they can’t foresee.”

Bernanke’s recent suggestion that the Fed may start “tapering” the stimulus later this year throws in sharp relief his failure to recognize not only Wall Street’s addiction to stimulus, but also the deflationary counterforce of the 120-year cycle. The Fed has succeeded in re-inflating stock and real estate values because it fought relentlessly against this long-term cycle for over four years. To relent now would be to allow deflation to have its way heading into 2014 when the cycle finally bottoms.

Gold

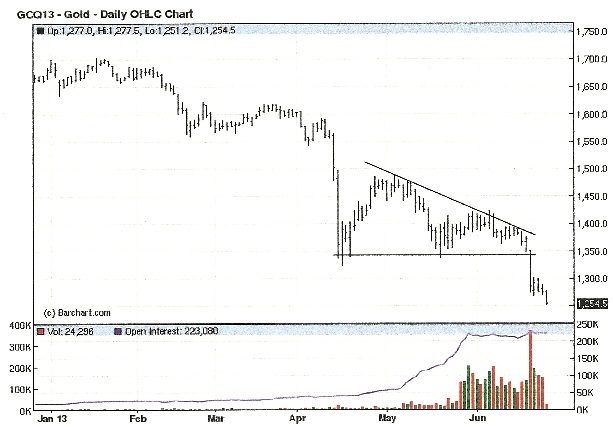

In a previous commentary we examined the gold futures daily chart (basis August) and noted the prominent “descending triangle” formation. An analyst with Bank of America drew widespread attention to this pattern in a recent forecast, and the triangle projected a downside move to approximately the $1,250 area based on chart measurements. Gold in fact reached – and slightly exceeded – the $1,250 minimum downside projection as you can see here, hitting $1,245 in overnight trading.

Keep in mind that the $1,250 area is the minimum downside projection. It wouldn’t surprise to see additional spillover weakness over the next few days as investors’ emotions get the better of them. There is still a lot of unloading taking place by smaller investors who loaded up on gold back in April and this is being compounded by the deluge of bearish research reports being released almost daily by major banks (as mentioned above).

Investors will need to exercise patience and wait for the gold market to bottom out on its own time. We’ll be closely monitoring the market for clues that the capitulation has finally ceased and a new accumulation phase begun (which will eventually take place once the weak hands are completely out of the market).

********

2014: America’s Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to – and following – the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America’s Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form – namely the long-term Kress cycles – the worst part of the crisis lies ahead in the year 2014. The book is now available for sale at:

http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter.

Cliff Droke is the editor of Gold & Silver Stock Report, published each Tuesday and Thursday. He is also the author of numerous books, including most recently, “2014: America’s Date With Destiny.” For more information visit www.clifdroke.com