Is A Bear Market Even Possible?

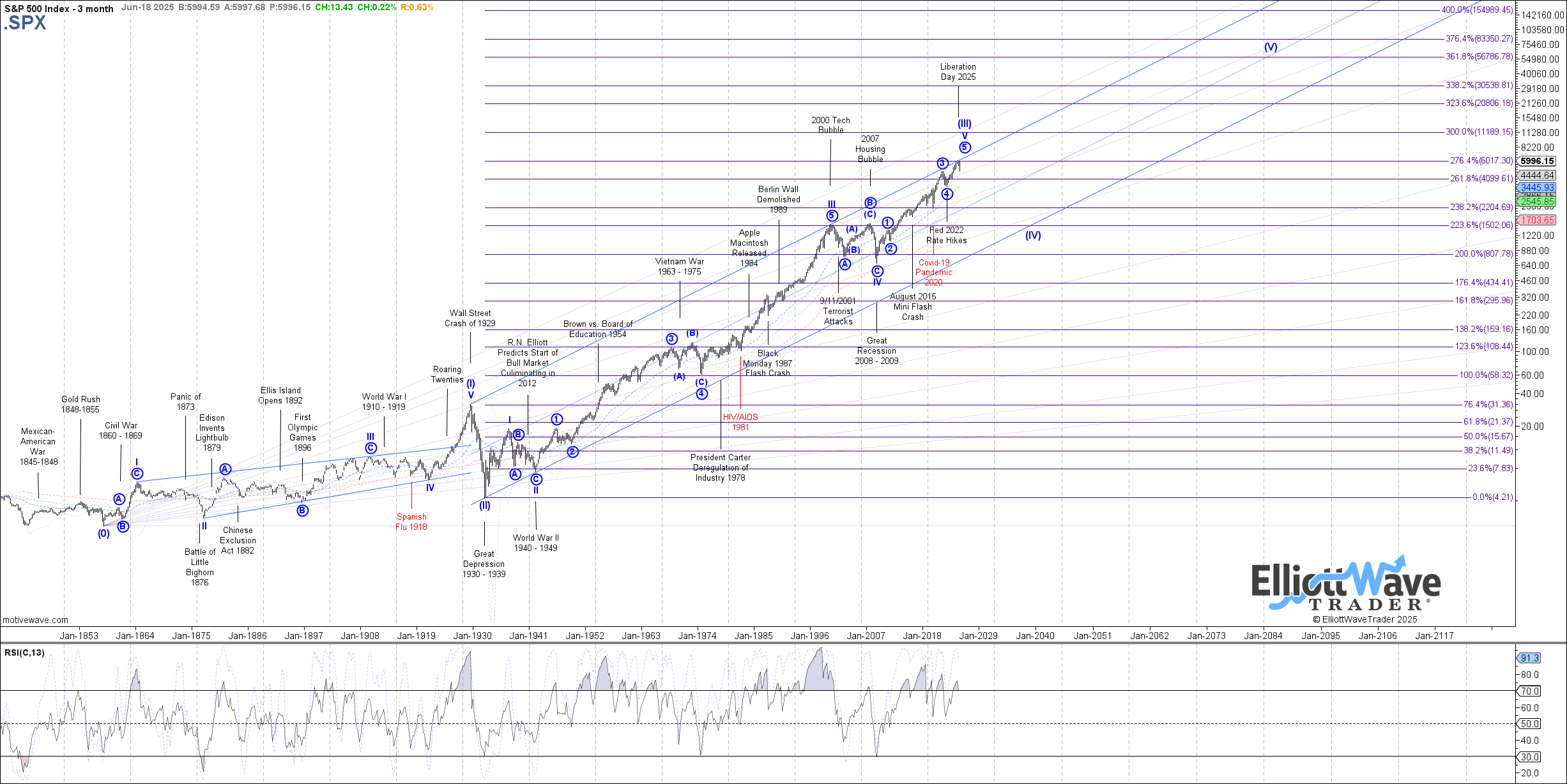

My broader view on the S&P500 (SPX) is that we are coming to the conclusion of a rally, which can represent a major long-term top in the United States equity market. This would conclude an almost 100-year bull market which began at the bottom of the market crash of 1929. In fact, this could usher in a bear market that would rival the one seen in Japan, which lasted for well over a decade.

Not only has this market has done a phenomenal job of convincing investors that such a scenario is impossible, but it has attracted new investors with thoughts of constant profits since the market has "always come back” in a Pavlovian manner. This will likely be a bane to the average investor once the bear market begins.

French writer Jean-Baptiste Alphonse Karr seems to be the first person quoted (in 1849) as proclaiming that “the more things change, the more they stay the same.” As I am sure many understand, he was providing insight into the fact that, while events and circumstances may seem to change in our “modern” era, the underlying driver of human sentiment does not. This truly encapsulates how our financial markets work.

Currently, we are hearing how “this time is different” again. Most analysts are pointing towards AI as the reason for this newly found and ubiquitous confidence in the stock market. But, anyone who has traded or invested in the stock market for more than a decade or two knows quite well how fallacious this perspective to be.

So, while many of these newly minted bulls are certain of this market’s infallibility, on my travels this summer through Europe and the United States, I cannot tell you how many people have told me that their children in their teenage years or their early 20’s have taken up trading, because, as their children have put it, “it is so easy to make money.”

Yet, analysts are really not much different. The only real difference is they try to come up with “reasoning” for what their hearts tell them to do. As Ben Franklin astutely noted, “so convenient a thing it is to be a reasonable creature, since it enables one to find or to make a reason for everything one has a mind to do.”

So, as I have read a number of missives of late which explain why this market has so much higher to go, many of these analysts seem to be basing their expectations on earnings. So, I am going to take a moment to comment on some of their analysis.

One author started with the following premise: “You see, great investors aren’t focused on the moment. They’re trying to discern what the environment will look like a year down the road.” All this statement did was make me wonder if he truly believed that investors are omniscient or clairvoyant? But, I digress. Let’s get to the heart of their “reasoning.”

Most of these investors claim that companies are beating their earnings estimates this year. And, they go on to explain that, based upon these earnings estimates, the market should be heading to 7000 (or higher) by the end of the year.

While it is possible and they may be right about the market having much further to go, I do not think it is probable. Nor do I think that following earnings in a linear manner is an appropriate way to prognosticate the stock market.

First, anyone who has been involved in markets long enough knows quite well that the earnings season is nothing more than a game. Analysts will often lower expectations right before earnings so that the reported earnings can easily beat those expectations.

Second, I do not believe utilizing earnings in a linear fashion to project stock market targets, as is done by most analysts, is an accurate manner to prognosticate the market, especially at the major turns. I have written about my view in detail, and you can choose to read it here:

While I know many of you may not want to read that full article, I do want to quote certain pertinent items to drive home my point. Finance professor Robert Olson published an article in 1996 in the Financial Analysts Journal in which he presented the conclusions of his study of 4000 corporate earnings estimates by company analysts:

“Experts’ earnings predictions exhibit positive bias and disappointing accuracy. These shortcomings are usually attributed to some combination of incomplete knowledge, incompetence, and/or misrepresentation. This article suggests that the human desire for consensus leads to herding behavior among earnings forecasters.”

In Daniel Crosby’s book The Behavioral Investor, he noted the following:

“Contrarian investor David Dreman found that most (59%) of Wall Street consensus forecasts miss their targets by gaps so large as to make the results unusable – either undershooting or overshooting the actual number by more than 15%. Further analysis by Dreman found that from 1973-1993, the nearly 80,000 estimates he looked at had a mere 1 in 170 chance of being within 5% of the actual number.

"James Montier sheds some light on the difficulty of forecasting in his “Little Book of Behavioral Investing.” In 2000, the average target price of stocks was 37% above market price and they ended up 16%. In 2008, the average forecast was a 28% increase and the market fell 40%. Between 2000 and 2008, analysts failed to even get the direction right in four out of the nine years.

"Finally, Michael Sandretto of Harvard and Sudhir Milkrishnamurthi of MIT looked at the one-year forecasts of 1000 companies covered most widely by analysts. They found that analysts were consistently inconsistent, missing the market by an annual rate of 31.3% on average.”

So, considering the game that analysts play each earnings season, as well as the facts brought to light by these various studies (and, yes, there are many more such studies), do we really believe that projecting earnings linearly into the future is going to “discern what the environment will look like a year down the road?” I think not.

So, again, while these analysts may be right that we rally into the end of the year in a linear fashion to 7000 or higher, I do not believe this to be probable. Nor do I believe that this time is different. Human nature has not changed in a millennia, and it is human nature which drives financial market prices. And, no linear analysis will ever be able to determine when human nature will decide to change direction, as linear analysis only presupposes that the current trend continues unabated. How did that work out in 2007 or in early 2020?

While the market has certainly exceeded my expectations based upon the standards we apply, I will not attempt to justify it based upon reasoning. And, why would I? If the market is driven by emotion, why would I attempt to reason within an emotional environment? This is akin to attempting to reason with your spouse while they are being emotional. How well does that work for you?

Rather, when I see a market that has not seen more than a .236 retracement since mid-April, it tells me that the extreme madness of the crowds has taken over, and the market is likely very stretched to the upside. So, we need to seek out clues as to when the crowd eventually runs out of room.

To view the rest of the article providing our detailed analysis of the US equity market, join ElliottWaveTrader for a free 15-day trial (no credit card required for first-time registrations).

In conclusion, while some of you may have viewed me of late as a perma-bear, I can assure you that is not the case. I do not know any perma-bears who were going aggressively long at the bottom of the Covid crash or in October of 2022, or near the bottom of the April 2025 decline. Rather, I am viewing this market rally with a healthy dose of concern, as the much longer-term pattern off not just the 2008 low, but off the 1931 low seems to be coming to a conclusion. Therefore, I will continue to approach the market with that healthy dose of concern and caution in all my analysis, as well as a large cash position in my own accounts. Please recognize this when reading my analysis.

*********

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of