Stock Price Forecast When The Fed Stops QE3

Investment Banker, Robert Lenzner paints a grim future: The Five Year Bull Market May Soon Be Over

Investment Banker, Robert Lenzner paints a grim future: The Five Year Bull Market May Soon Be Over

”Consider the record. From early 2009 when the S&P500 index bottomed at 700, the broad stock market average has hit new record peaks above 1900, nearly a tripling of stock prices. This astounding performance would never have happened had the Fed not been pouring $85 billion every month into Treasury securities and mortgage backed bonds, which pushed down interest rates and buoyed bond prices as well as stock prices.”

“…the bull market of the last 4+ years has a lot to do with FOMC stimulus (ie Quantitative Easing - QE). If history is any guide, its removal would figure to be a profound negative for equity prices.”

“The Fed already has reduced its monthly purchases from $85 billion a month to $35 billion a month. At this rate of reducing purchases by $10 billion a month, the Fed is likely to be flat in its acquisitions by the end of September.”

********

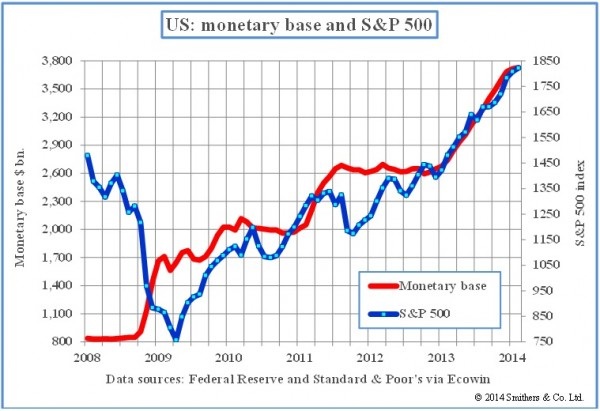

QE consists of the US Federal Reserve buying assets, which expands the monetary base. The above chart shows that the expansion of the Fed’s balance sheet has moved directly parallel with the US stock market (since 2009). This is not just an accident. When the Fed buys assets, the sellers have money and, unless they wish to increase their cash holdings, they will attempt to spend the money on other assets. Unless there is a rise in liquidity preference, which is when investors want to hold more cash, this will necessarily push up asset prices.

The chart below demands careful examination. During the short period from 2009 to the present, the US Monetary Base via QE soared 369%, which fueled the S&P500 Stock Index up 145%. There is NO DENYING our Fed ‘jacked-up’ stock values by flooding the market with liquidity. To believe otherwise is to be totally naïve, or with the nefarious intention to distort the truth. Effectively, the US Fed provided the monetary muscle to artificially catapult the S&P500 Index to nearly daily new all-time highs. This is a Machiavellian attempt by the government to conger up Financial Adrenalin with a view to put stocks on artificial “life-support” for political purposes.

********

Let’s face it: QE is nothing more than Smoke and Mirrors used by the US Fed to trick the American people into believing all is well. QE is tantamount to a medical doctor pumping up his dying patient with steroids and narcotics to make the hapless patient’s last remaining days more tolerable. Ergo, it is an artificial treatment (indeed useless endeavor) to prolong life hopefully with less (financial) pain, knowing full well the illness is terminal. Weaning the US stock market by “Tapering QE, will only serve to exacerbate and magnify the forth-coming BEAR MARKET IN STOCKS.

History is testament that the longer and higher a bull market lasts, the more steep and severe will be the inevitable BEAR MARKET. Moreover, stocks will necessarily plummet with greater speed than they rose. The Roaring 1920s is a perfect example of this. During the 8-year period from 1921-1929, the Dow Index rose parabolically +495%. Then in October 1929, stocks turned on a dime and began to plummet. Consequently, the Dow Index was mercilessly hammered down 89% in less than three years (1929-1932). MOREOVER, IT TOOK THE DOW INDEX THE NEXT 25 YEARS (to 1954) TO AGAIN REACH ITS 1929 HIGH.

"The 'Recovery' Is A Mirage" Mark Spitznagel Warns, "With As Much Monetary Distortion As In 1929"

"Today there is a tremendous amount of monetary distortion, on par with the 1929 stock market and certainly the peak of 2007, and many others," warns Universa's Mark Spitznagel.

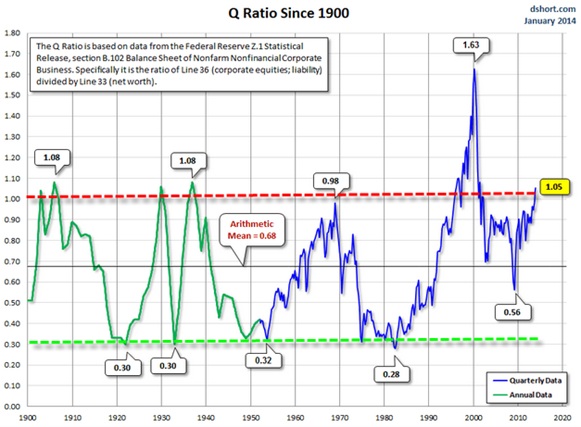

Spitznagel offers the following chart in support of his bearish prediction. Specifically, it is the ratio of Corporate Equities Divided by Net Worth.

It is imperative to appreciate the accuracy of this curve in signaling the beginning of bear markets in stocks:

- In 1907 it peaked at 1.08, which was followed by the Panic Crash of 1907 (where Dow fell nearly 50%)

- In 1929 it peaked at 1.06, which was followed by the Great Crash of 1929 (where the Dow Index eventually lost 89%).

- In 1937 it peaked at 1.08, which was followed by the Panic Crash of 1937 (where the Dow Index lost 49% in only 12 months).

- In early 1970 it peaked at 0.98, which heralded the 1972-1973 Crash (where the Dow lost 38%)

- In 2000 it peaked at 1.63, which was followed by the Crash of 2000-2003 (where the Dow dropped 45%).

- And today the ratio is peaking at 1.05.

To ignore all the above compelling data and market rationale is grossly illogical…and irresponsible.

Stocks are indubitably heading for a material correction in a best case scenario, or even a severe crash in the worst case.

To be sure there is a growing list of world prominent investors, analysts and market pundits who are also forecasting a Bear Market in Stocks:

-Marc Faber predicts that stocks will drop by 20 percent to 30 percent in the near future. “We are in a gigantic financial asset bubble,” warns Swiss adviser and fund manager Marc Faber. “It could burst any day.”

-Mike Maloney, host of Hidden Secrets of Money: "I think the crash of 2008 was just a speed bump on the way to the main event… the consequences are gonna be horrific… the rest of the decade will bring us the greatest financial calamity in history."

-Legendary investor Jim Rogers: "You saw what happened in 2008-2009, which was worse than the previous economic setback because the debt was so much higher. Well now the debt is staggeringly much higher, and so the next economic problem, whenever it happens and whatever causes it, is going to be worse than in the past, because we have these unbelievable levels of debt, and unbelievable levels of money printing all over the world. Be worried and get prepared. Now it [a collapse] may not happen until 2016 or something, I have no idea when it’s going to happen, but when it comes, be careful."

-Harry Dent, author of The Great Depression Ahead: "Our best long-term and intermediate cycles suggest another slowdown and stock crash accelerating between very early 2014 and early 2015, and possibly lasting well into 2015 or even 2016.

-David Stockman, former Director of the Office of Management and Budget under President Ronald Reagan "We have a massive bubble everywhere, from Japan, to China, Europe, to the UK. As a result of this, I think world financial markets are extremely dangerous, unstable, and subject to serious trouble and dislocation in the future."

Reversion To The Trend-line Chart Suggesting A Material Stock Correction:

Long-Term TREND Reversion Chart sees S&P500 Index falling to 850. As the S&P500 pulls within a few percentage points of its nominal all-time highs, despite macro-uncertainty and micro-delusion, perhaps (as UBS' Peter Lee notes) a longer-term perspective is warranted. For over 82 years (1932-2014), the S&P500 Stock Index has cyclically reverted to it its logarithmic trend-line growth. The last time the market pulled away from this bullish up-trend was in 1982 (and the previous period of cyclical reversion took 32 years from 1942 to 1974) and suggests the S&P500 could well fall (ie revert) to around an 850 level within the next year or so.

The 82-Year S&P500 Log Chart Reversion To The (Green) Trendline...

Chart Source: Bloomberg

In this event the S&P500 Index will have fallen -56% from today's 1960 level.