Surging US Dollar In 2017 Could Be A Catalyst For Gold Bottom

Gold has suffered recently in the wake of higher real interest rates, while thanks to higher yields the US Dollar Index has reached a 14-year high. Stronger real rates hurt gold. However, so does a stronger US Dollar, which remains the dominant global reserve currency. In addition to falling, gold likely needs the US Dollar to approach a major peak. It may sound perverse to gold bugs, but the sooner the US Dollar climbs and becomes even stronger, the closer gold could be to the start of a new bull market.

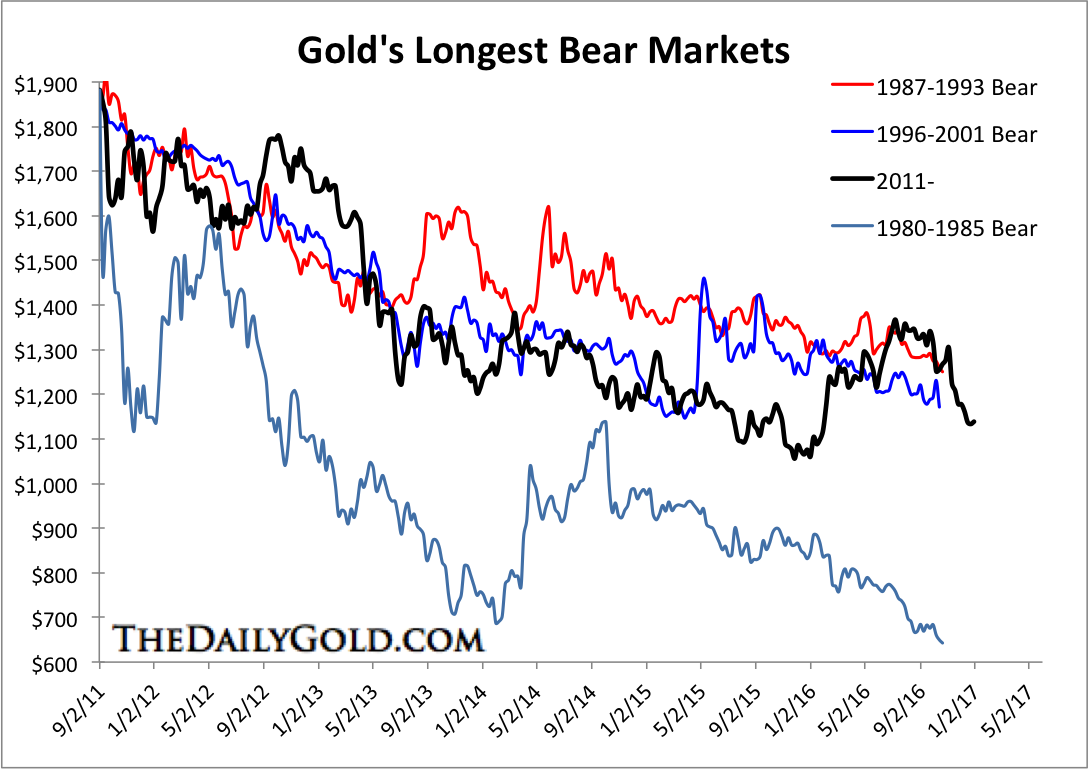

Gold is now officially in its longest bear market ever. If we define a bull market as a multi-year advance, then gold has endured five bear markets over the past 45 years. Four of the five are plotted in the chart below. The current bear market has followed the trajectory of the 1987-1993 and 1996-2001 bears…but with more downside.

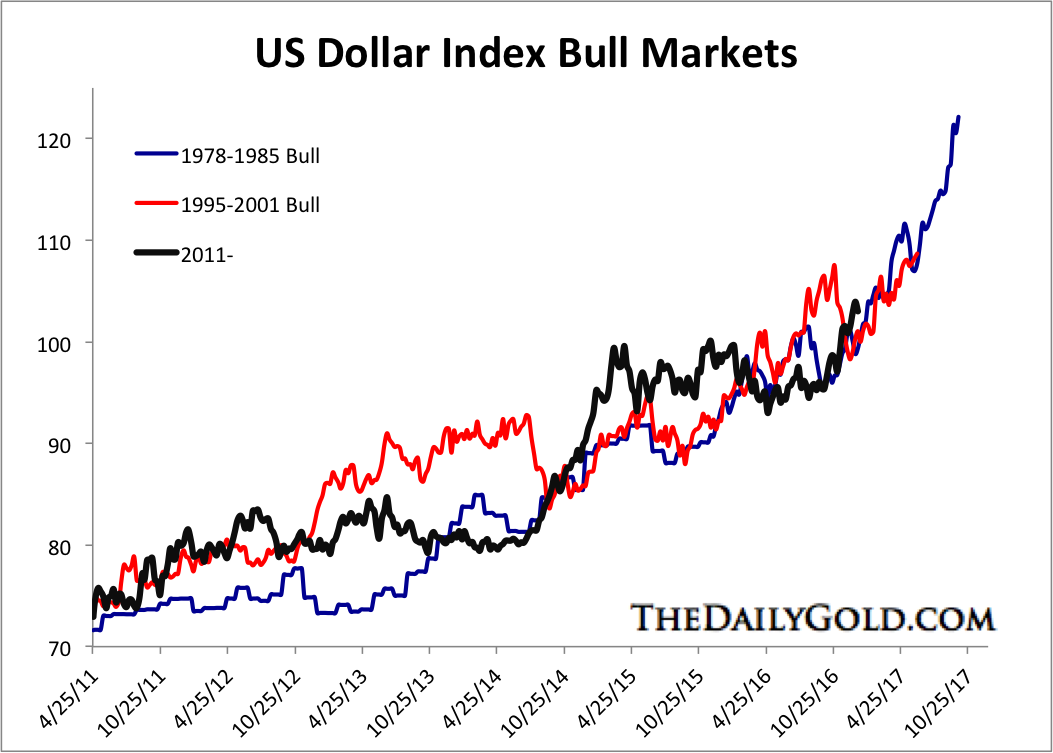

Although gold’s current bear market is the longest ever, its counterpart, the US Dollar is not yet in its longest bull market ever. It would need to rise for nearly another year to achieve that feat. The chart below shows that this run in the greenback has more room to rise. The trajectory of the current bull has closely mirrored that of the 1978 to 1985 bull. If that continues, then the US Dollar Index could reach 110 in the first half of 2017 - and 120 by the end of the year.

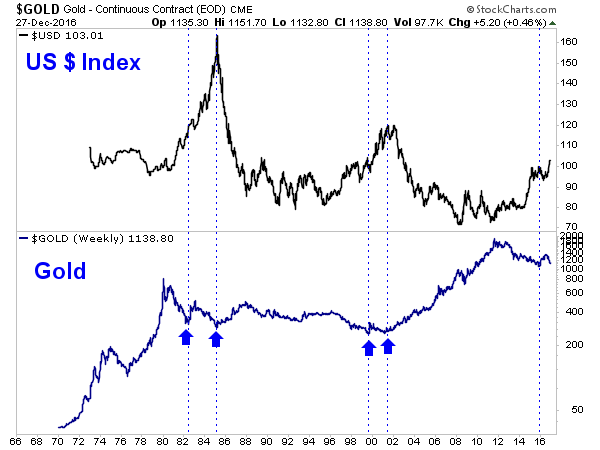

The two major peaks in the US Dollar (1985 and 2001) coincided with important lows in gold. However, it is important to note that essentially all of the price damage to gold during the corresponding bear markets occurred well before the US Dollar peaked. The chart below was inspired by an article from ReadTheTicker. After gold’s bottom in 1982, the US Dollar surged 37%, while gold only penetrated its previous low by 5%. From gold’s low in 1999, the US Dollar advanced 17%...although gold did not make a new low.

The bottom line is gold could be setting up for an epic bottom, when the US Dollar becomes strong enough to cause global problems and induce policy more favorable to the shiny yellow. History shows that the majority of price damage in gold bear markets has occurred in the earlier stages of US Dollar bull markets. A higher US Dollar will certainly push gold lower from here, but probably not too far below the 2015 low. A precursor to gold’s turn will be when it shows strength against foreign currencies and equities, while the US Dollar is rising.

We reiterate that we do not want to buy a bunch of investment positions until we see sub-$1100 gold price coupled with an extreme oversold condition in bearish sentiment. Nonetheless, we certainly see bearish sentiment and some good values in the gold stocks at present. However, some of these good values could become great values before next summer.

********

Jordan Roy-Byrne, CMT, MFTA