A Tale Of Two Economies: Singapore And Cuba (Update)

On Friday November 25, Fidel Castro died at age 90. The former revolutionary and hardline dictator of Cuba was among the 20th century’s longest-serving leaders, third only to Elizabeth II and Bhumibol Adulyadej, the King of Thailand, who passed away in October.

Castro’s death comes at a pivotal moment in US-Cuban relations. With trade between the two countries on the path to normalization, and with US airlines making scheduled flights to Havana for the first time in more than 50 years, President-elect Donald J. Trump has pledged to reinstate many of the Cold War embargos that were lifted by President Barack Obama.

“If Cuba is unwilling to make a better deal for the Cuban people, the Cuban/American people and the US as a whole, I will terminate deal,” Trump tweeted on November 28.

In light of Castro’s passing, we are rerunning this Frank Talk from March 2015, in which Frank compares and analyzes the widely divergent economies of Cuba and Singapore under their now-deceased leaders, Castro and Lee Kuan Yew.

It would be nearly impossible to find two world leaders in living memory whose influence is more inextricably linked to the countries they presided over than Cuba’s Fidel Castro and Singapore’s Lee Kuan Yew, who passed away this Monday at the age of 91.

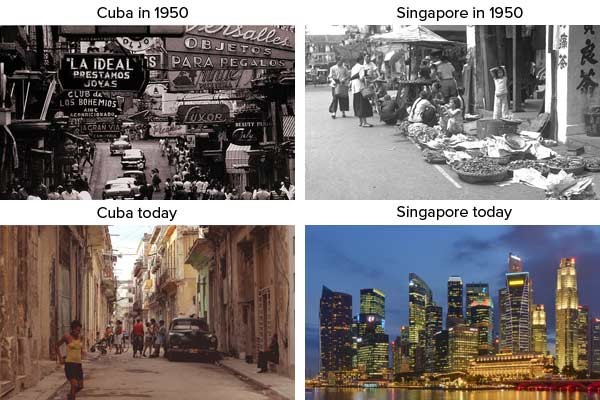

You might find this hard to believe now, but in 1959—the year both leaders assumed power—Cuba was a much wealthier nation than Singapore. Whereas Singapore was little more than a sleepy former colonial trading and naval outpost with very few natural resources, Cuba enjoyed a thriving tourism industry and was rich in tobacco, sugar and coffee.

Fast forward about 55 years, and things couldn’t have reversed more dramatically, as you can see in the images below.

The ever-widening divergence between the two nations serves as a textbook case study of a) the economic atrophy that’s indicative of Soviet-style communism, and b) the sky-is-the-limit prosperity that comes with the sort of American-style free market capitalism Lee introduced to Singapore.

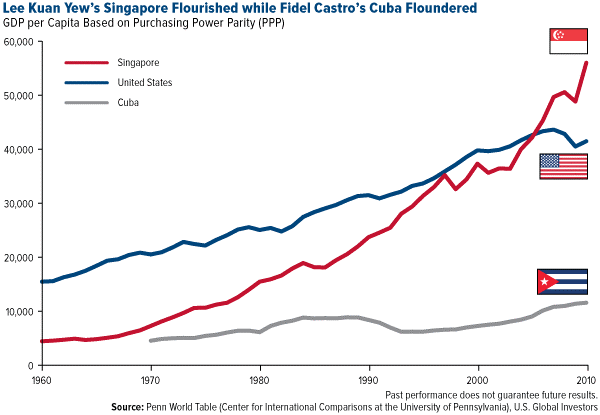

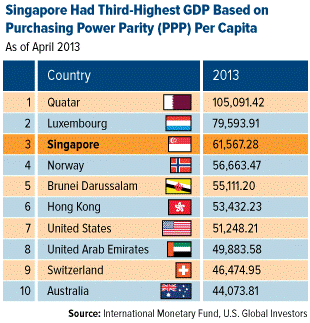

Sound fiscal policy, a strong emphasis on free trade and competitive tax rates have transformed the Southeast Asian city-state from an impoverished third world country into a bustling metropolis and global financial hub that today rivals New York City, London and Switzerland. Between 1965 and 1990—the year he stepped down as prime minister—Lee grew Singapore’s per capita GDP a massive 2,800 percent, from $500 to $14,500.

Since then, its per capita GDP based on purchasing power parity (PPP) has caught up with and zoomed past America’s.

Under Castro and his brother Raúl’s control, Cuba’s once-promising economy has deteriorated, private enterprise has all but been abolished and the poverty rate stands at 26 percent. According to the CIA’s World Factbook, “the average Cuban’s standard of living remains at a lower level than before the collapse of the Soviet Union.” Its government is currently facing bankruptcy. And among 11.3 million of Cuba’s inhabitants, only 5 million—less than 45 percent of the population—participate in the labor force.

Compare that to Singapore: Even though the island is home to a mere 5.4 million people, its labor force hovers above 3.4 million.

Because of the free-market policies that Lee implemented, Singapore is ranked first in the world on the World Bank Group’s Ease of Doing Business list and, for the fourth consecutive year, ranked second on the World Economic Forum’s Global Competitiveness Report. The Heritage Foundation ranks the nation second on its 2015 Index of Economic Freedom, writing:

Sustained efforts to build a world-class financial center and further open its market to global commerce have led to advances in… economic freedoms, including financial freedom and investment freedom.

Cuba, meanwhile, comes in at number 177 on the Heritage Foundation’s list and is the “least free of 29 countries in the South and Central America/Caribbean region.” The Caribbean island-state doesn’t rank at all on the World Bank Group’s list, which includes 189 world economies.

Many successful international businesses have emerged and thrived in the Singapore that Lee created, the most notable being Singapore Airlines. Founded in 1947, the carrier has ascended to become one of the most profitable companies in the world. It’s been recognized as the world’s best airline countless times by dozens of groups and publications. Recently it appeared on Fortune’s Most Admired Companies list.

We at US Global Investors honor the memory of Lee Kuan Yew, founder of modern-day Singapore. He showed the world that when a country chooses to open its markets and foster a friendly business environment, strength and prosperity follow. Even on the other side of the globe, the American Dream lives on.

The Global Competitiveness Index, developed for the World Economic Forum, is used to assess competitiveness of nations. The Index is made up of over 113 variables, organized into 12 pillars, with each pillar representing an area considered as an important determinant of competitiveness: institutions, infrastructure, macroeconomic stability, health and primary education, higher education and training, goods market efficiency, labor market efficiency, financial market sophistication, technological readiness, market size, business sophistication and innovation.

The Ease of Doing Business Index is an index created by the World Bank Group. Higher rankings (a low numerical value) indicate better, usually simpler, regulations for businesses and stronger protections of property rights.

The Index of Economic Freedom is an annual index and ranking created by The Heritage Foundation and The Wall Street Journal in 1995 to measure the degree of economic freedom in the world's nations.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 9/30/2016.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

US Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of