Too Much Debt, More Than Can be Serviced

The Dow Jones this week closed at a new all-time high, its 66th since entering scoring position (between the BEV 0% & -5% lines) below, twenty-three months ago. What is interesting, is since August 12th, the Dow Jones daily closed less than 1% from its last all-time high. That is seven weeks, over two months (Red Circle), where the Dow Jones has made ten new BEV Zeros. Nine of these ten new all-time highs, were made since the 8th of September.

This must be a hot market.

A hot market? Not really when we look at the Dow Jones in its daily bars below. Yes, since August 12th the Dow Jones has been going up. It has seen ten new all-time highs. But the Dow Jones current advance looks pathetic when compared to its advance seen last April to June below, an advance that took the Dow Jones from 38,500 to over 44,500, 6,000 points in less than three months.

Maybe the Dow Jones will finally begin to move, and start advancing as if it was serious about being in a bull market, and then maybe not. This Dow Jones’ advance began five decades ago in August 1982; maybe the bulls are just getting old and tired. I know what the past five decades have done to me! Dow Jones at 50,000? Looking at the chart below, maybe, but not anytime soon.

Keep in mind, the stock market is much more than just the thirty-dividend yielding, blue-chip stocks in the Dow Jones. So, let’s now go to my table below showing the BEV values (new all-time highs, and percentage claw-backs from them) of the major market indexes I follow.

This week was an excellent week for the stock market, as many of these indexes generate multiple new BEV Zeros, new all-time highs. And only three of the twenty indexes I follow, closed below scoring position, more than 5% from their last all-time highs.

One of these was the NASDAQ Insurance Index. Late last winter, and into spring this year, these insurance stocks were frequently in the top three spots in my performance table below. Now at this week’s close, it finished in the BEV table at #19, 7.22% below its last all-time high seen on 29 November 2024, and at #11 in the performance table below.

That was actually pretty good, when compared to the NASDAQ Banking Index’s BEV chart below. This week, these banks found themselves at the bottom of both the BEV, and performance tables below. This banking index saw its last all-time high in November 2021, almost four years ago, and have been underperforming the broad-stock market since then.

Is there anything that connects the insurance and banking stock indexes? Why yes there is; both are financial stock groups. As financial stocks, these groups have much to do with debt. The banks generate debt, while the insurance companies hold debt for their reserves. Humm; I need to think about that – debt.

Well, whatever problems the NASDAQ Banks and Insurance companies may now be struggling with, the NYSE Financial Index (#16 below) doesn’t seem to be sharing. Not yet anyway. When was the last all-time high for the NYSE Financial Index? Last September 19th, just a few weeks ago, and closed this week only 0.89% from that.

I have to have a theory of what to worry about, and what not to worry about with the market. My current market theory is; don’t let the NASDAQ banks and insurance companies poor performance make me too bearish for now. Possibly they may be leading the market towards the next big-bear market. But right now, the market in general doesn’t care about them, or their problems.

It's the NYSE Financial Index (Wall Street itself) that is key to this market advance, or so my current theory on the market would have me believe. As long as the NYSE Financial Index is advancing with the broad-stock market, things should be okay with the stock market. But when it begins to deflate far below scoring position, as one day it will, how will the other indexes below react to that?

Will the market ignore that, as it does now with the NASDAQ Banking and Insurance Indexes? My current market theory tells me no, it won’t. But what do I, and my theory know? In the months to come, we are all going to find that out.

Look at the top three in the performance tables above, the XAU, gold, and silver; they are on FIRE! And what do I see for Silver at #3 above? For the first time in over a decade, it closed this week in scoring position. Silver this week closed only 1.52% from its last all-time high of January 1980. What is with that?

The old monetary metals, and their miners are behaving very strangely. These once scorned assets, are now advancing as if they have forgotten how to go down. Since the beginning of 2025, precious metal assets apparently only go up, increasing the gap between them, and everything else in the performance tables above. It is as if a panic into gold, silver and their miners has begun. Should these gains in the old monetary metals continue, a panic may spread to other areas in the markets, and economy, but not the panic buying seen above.

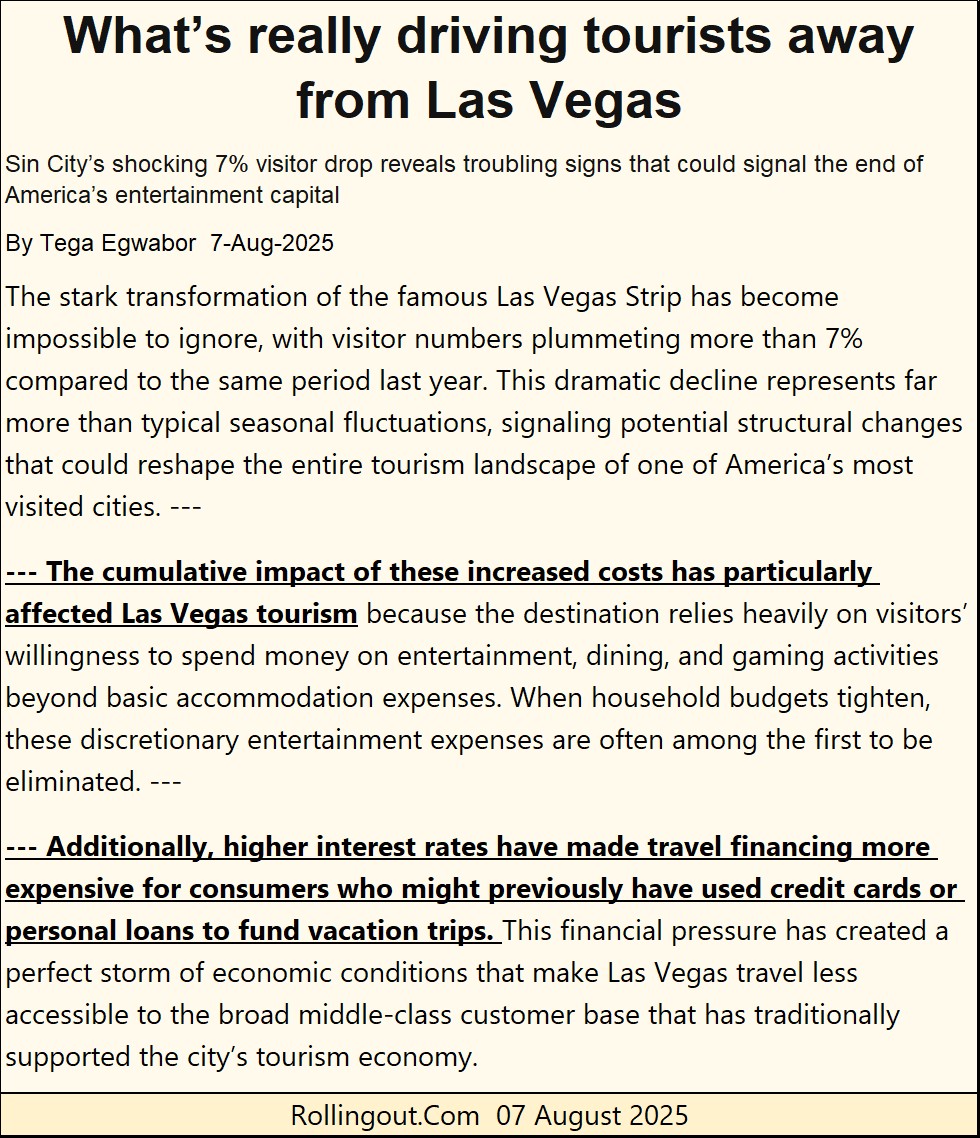

What’s this? Problems in paradise? So, what is really driving all of the suckers, sorry, I mean tourists away from Vegas? Read all about it below.

https://rollingout.com/2025/08/07/las-vegas-tourism-decline-behind-drop/

Hey, I’ve allowed myself to be a sucker, I mean a tourist in Las Vegas, and Reno Nevada too on more than just a few occasions, and I had a great time doing so. What makes Las Vegas, and let’s not forget Reno, ground zero for suckers?

On one trip to Vegas, I had a great time (with my mom) at the old Tropicana Hotel / Casino. What a nice hotel it was too, and everything was cheap. If someone visited the casino’s floor early in the morning, when things were slow, the dealers had the time to explain how a game like craps was played, all the does and don’ts of the game.

The casino wasn’t hiding it; out of 100 bets, mathematically the house was going to win at least 51 times. And that was for craps. How is that possible? Every game in a casino is rigged in favor of the house. Some of the other games people place bets on, the odds for a gambler were much worse than 49 out of 100. So, the house didn’t mind if someone won big, for as long as a gambler kept playing, the house was mathematically guaranteed to win 100% of whatever stakes the gambler was playing with – over time.

So, why do gamblers play a game they are guaranteed to lose? Because, on the next roll of the dice, or turn of the card, a gambler has as much chance of winning as does the house. People do make their point in craps, and are delt 21 in Blackjack, and can make big money when doing so, if they then walk away with it.

But face it, the huge hotels and casinos in Las Vegas didn’t get there because gamblers walked away from the table after winning big. So, why are they walking away now?

Looking at the article above, the reasons for Las Vegas’ problems were as follows;

- The Covid plandemic’s recovery, while vigorous, was fragile.

- Inflation is driving up expenses for vacations. Tourist want to come, but can’t afford to.

- For those who are willing to finance their vacation to Vegas on their credit cards, or a second mortgage, high interest rates are making financing trips to Vegas prohibitably expensive.

- The geopolitical climate (Trump) is keeping foreign visitors away.

Though #2 & #3 above touched on the real reason Vegas is entering a depression, the author of this article failed to catch the primary cause of all of these woes; the billions, and billions of dollars Vegas’ casinos owe to Wall Street and their bond holders.

Decades ago, going to Las Vegas was traveling to somewhere the hotels and food were not only excellent, but cheap, as was the entertainment. Very affordable accommodations, food and entertainment were the draws that got people into a hotel, and their casinos. There were also the free drinks, alcohol for all, for as long as anyone continued to gamble.

So, if the hotel lost a little money on the rooms, restaurants, and free booze, they didn’t care as they attracted the gamblers to game into their casinos. The hotel’s casinos paid the bills, and provided a very nice profit. And something we should note here, is the fact that it was the mafia that built Las Vegas after WWII.

Here is how the mafia ran things back then; a few million-dollar loan from the Teamsters Union for the real estate and infrastructure, and let the gaming tables do their thing to keep everyone, including the Teamsters’ pension fund happy. My mother sure loved the mafia era Tropicana!

I’m not a big supporter of the New York and Chicago Mafia. But the mob was the best thing that ever happened to Las Vegas. And the bosses made sure their operations were PROFITABLE. That was, and is the key; the enterprise as a whole MUST BE PROFITABLE!

Then the Department of Justice drove the mafia out of Vegas, and corporate America took over the Vegas Strip. Back in the day, the Golden Nugget was a top joint for gamblers. A beautiful place to lose your children’s college funds in a couple of hours. But the Golden Nugget was nothing like one of the mega-theme-parks, confuse for hotels, that now dominate Las Vegas.

However, and this is the important part; Las Vegas’ new management; Ivy League MBAs didn’t understand the business of gambling, as did the high school dropouts in the mafia. These MBAs weren’t satisfied with just providing excellent ambiance for a gambler to lose a few hundred-thousand dollars in.

No, they wanted to provide a Disney-Land Experience for the whole family in the middle of the Nevada desert. And then these wiz-kids let their egos compete with one another, to see who could build the largest, most expensive gaming monstrosity in the middle of nowhere. Wall Street could, and did provide as much funding as they demanded. What could go wrong with that?

The problem with that was, the gambling tables in these boondoggles’ casinos, couldn’t never service the debt burden of the billions-of-dollars it took to provide that family friendly experience.

Look at how much these hotels cost in the link below. Billions and billions-of-dollars. What were these people thinking of?

https://hotelchantelle.com/which-hotel-in-vegas-was-the-most-expensive-to-build/

Now with a downturn in business in Vegas, to service these hotel’s multi-billion-dollar mortgages, management is now forced to increase the cost of rooms, restaurants, anything and everything they can to generate the cash required for servicing their debts. But people aren’t having it, so they are avoiding Las Vegas, which only makes this desert debt-crisis worse.

The way to make Vegas Great Again, would be to allow these hotels / casinos in Vegas to go bankrupt. Sure, that would mean billions would be lost by the banks and bond holders that hold these hotels’ debts. No doubt there would be a crisis in the corporate bond market. I don’t care. Anyone foolish enough to risk perfectly good money, by the billions, to finance these desert boondoggles deserves to be taught a lesson. Unfortunately, no doubt much of this money came from pension funds and insurance companies.

These hotels should be sold, for ten, or maybe five cents on the dollar. So, a billion dollars of desert fantasy could be discounted to possibly only fifty million dollars. That may be extreme, but down to something the gaming tables in their casinos could once again support the debt used in purchasing the hotel. Rooms and restaurants could once again then be subsidized by the gamblers, to draw in tourists, exactly as the mafia had done it, and Vegas would be great again.

But the problem I see with this plan is; besides the fact they won’t allow the mafia to once again properly manage Las Vegas, the idiots at the FOMC don’t like seeing billions of dollars of debt used for, well anything including for Vegas boondoggles, to be defaulted on. Ultimately, all this debt came from the FOMC, and billion-dollar defaults, and runs on their banking system, makes them look bad.

No matter, if the idiots don’t allow these corporations to default on their debts, and allow the assets be auctioned off at deeply discounted valuations, Vegas may become another abandoned ghost town in the Nevada desert. I’m watching to see what happens in Nevada.

I’m bringing this up, as what is happening in Las Vegas, is a microcosm of another, much larger problem now plaguing much of the asset base in the United States. The unlimited credit creation by the Federal Reserve System, has inflated assets valuation near the point, where the asset in question is now struggling to service the debts used in its purchase. Be that a hotel’s casino, or a homeowner’s income to service their mortgages. Come the next economic downturn, comes the tsunami of debt defaults in the financial system.

That was the problem for the sub-prime mortgage crisis of 2007-09. In 2009, instead of allowing asset valuations to deflate, by allowing the very dubious mortgage used to purchase many of these homes to be defaulted on, and force their owners (Wall Street and other influential financial institutions) to take the loss, the idiots at the FOMC began their series of QEs, to keep housing prices inflated, and the current mortgage system “viable.”

This is exactly what the idiots at the FOMC do; using monetary inflation “injected” into the banking system, they inflate debt bubbles in the economy. When their booms go bust, they double down with a massive “injection of liquidity” called a QE, to keep debts of dubious asset classes “viable,” and asset valuations over inflated. These idiots have been doing this for decades, so now we got big problems, problems whose solutions can only be painful.

This makes me angry; the educational system in this country is so bad, people with a major in economics are clueless of what is about to happen to the financial system in the United States, and the world in general – a HISTORIC BIG BUST.

Today in 2025, there is too much debt, with insufficient means to service it. An empire of debt, built by the Federal Reserve System, which refuses to allow this bubble in asset valuations to deflate in a bear market. This is a situation Mr Bear won’t allow to go on forever. Mr Bear is a bad dude. Long ago, he took down the Roman Empire. Don’t think he doesn’t know how to deal with America’s massive debts.

With this anticipated bust of this massive bubble, the media will blame Trump, and sadly, most people will accept that. But these problems we are soon going to have to face, have been a long time coming. Since 1913, when Congress created the Federal Reserve System, and the dollar was defined as $20.67 to an ounce of gold.

Which brings up my next chart, the indexed value of gold and silver. What are we actually looking at below? Is this merely a bull market advance in gold and silver, or is there something else driving the valuations for gold and silver up. If you have never seen buying panic in a market before, this is what it looks like.

When are gold and silver, assets with Zero counterparty risks, finally going to correct; see a big pullback in valuation? Maybe not for a very long time.

The mining shares in the XAU below, also have that; “I’ve got to get the hell out of Dodge City” look to them too.

So, what did gold’s BEV chart look like at this week’s end? Gold’s BEV chart looks remarkable like the Dow Jones’ BEV chart. However, as noted above in their charts potting them in dollars, the differences between these markets are huge!

I still like looking at markets using the Bear’s Eye View (BEV), using new all-time highs, and the percentage claw-backs from them. But when studying a market, it is important to study it using different types of charts, to get the full view of the market. Which for the Dow Jones and gold in October 2025, their differences are very dramatic.

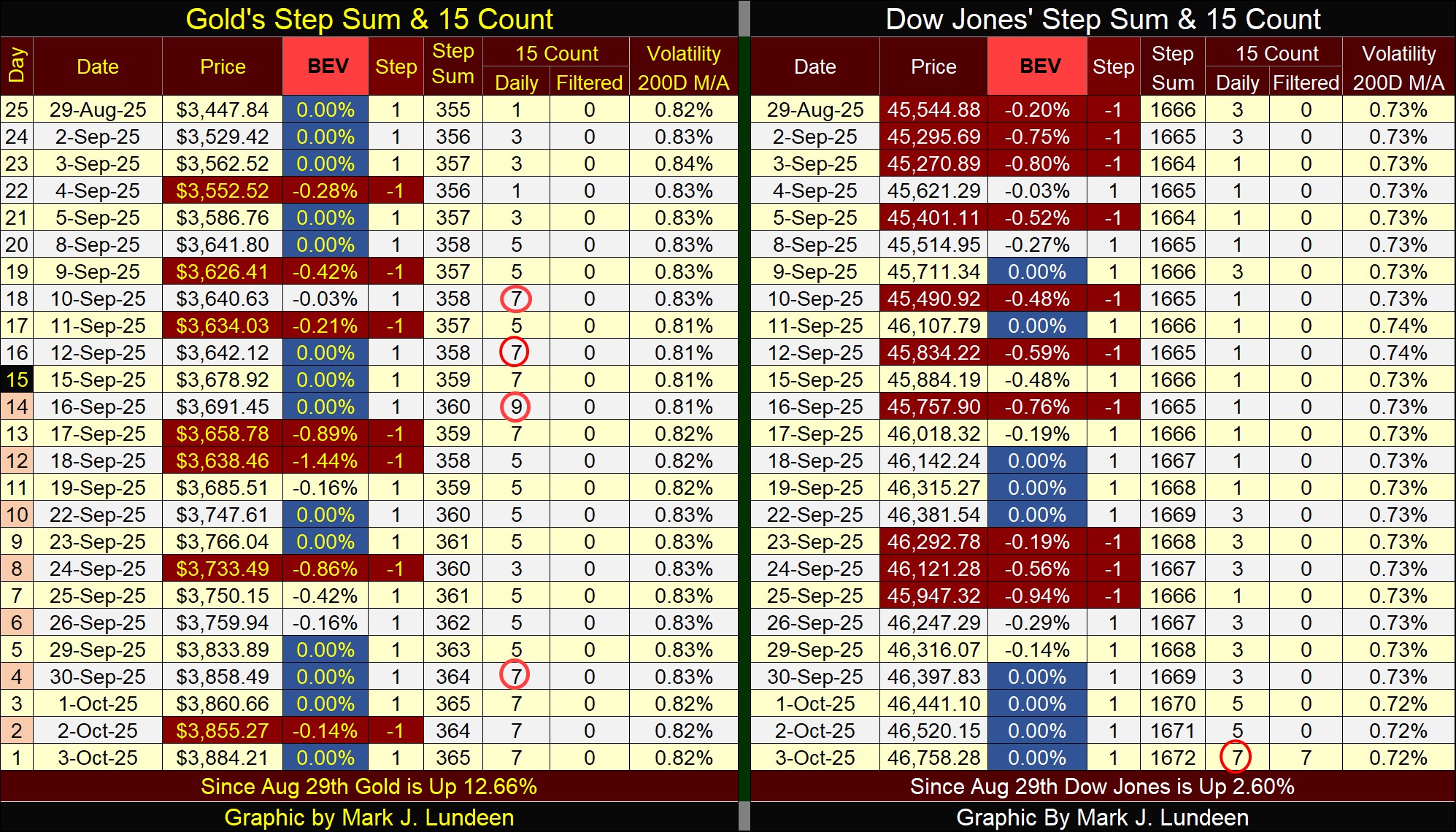

Now moving on to gold’s step sum table below, in the past twenty-five trading days, only eleven of them failed to close at a new all-time high. This is stunning. Reason, and my sense of prudence cries out that gold is approaching a top. With fourteen of the past twenty-five trading days closing at a new all-time high, pushing the price of gold up by 12.66% since August 29th, what else could this be but the panic buying seen at a massive market top?

The only problem with that theory is; massive market tops have massive public involvement in them. It is the NASDAQ AI stocks that currently have the massive public involvement, not gold and silver.

Also, gold’s daily volatility’s 200D M/A is only 0.82%, which suggests this isn’t panic buying at all, but the constant, and disciplined flow of funds from other areas of the market, into gold. When gold’s daily volatility 200D M/A (chart below) increases to something over 1.0%, then we can begin discussing the mindless, panic buying in the gold market.

So, what are we looking at in gold’s step sum table? The opportunity of a lifetime to buy gold, before the crowd comes into the gold market, at much higher prices.

But, what about gold’s 15-count being an overbought +7? Don’t markets hate being overbought, and tend to sell off when they get that way? Well, maybe in the weeks to come, gold will see an increase in daily declines. That would be a positive as far as I’m concerned. But gold, silver, and their miners are currently ignoring the old rules of the market. If the trend is your friend, and it usually is, you have to bullish on the old monetary metals for the foreseeable future.

For the Dow Jones in its step sum table, like gold, it too appears very bullish. Lots of blue BEV Zeros to be seen, low daily volatility, and like gold, its 15-count closed the week with a +7. Which isn’t a plus. But something that suggests an increase in daily declines in the weeks to come.

The big, and telling difference between gold and the Dow Jones step sum tables above, is seen in how much these markets have advanced since August 29th. Gold has advanced by 12.66% in the past twenty-five trading days; this is a hot market! The Dow Jones has advanced by only 2.60% in the past twenty-five trading days, an advance that I would call a more reasonable advance. To heck with that, I still like gold, silver and the gold and silver miners in the XAU.

Have you guys been following the travels of an interstellar object called 3i/Atlas in the news. It is really weird. Astronomers call it a comet, but it acts nothing like a comet, or anything else humanity has seen through a telescope.

A comet has a tail that points away from the sun. 3i/Atlas has a tail that points towards the sun. What’s with that? Also, 3i/Atlas is green. There isn’t anything colored green in outer space, or so nothing was before they pointed a telescope at 3i/Atlas. This is really weird; apparently, this interstellar object is changing its course as it travels in our solar system, in an intelligent fashion, or so some astronomers believe it is.

And fortunately for us Earthlings, 3i/Atlas may actually collide with Mars. As it is the size of Manhattan Island, and would result in an extinction event on Earth if it hit us, 3i/Atlas hitting Mars instead of us is a good thing, in my opinion.

I say that at the risk of offending you nihilists out there. Well, if someone doesn’t believe in God, they will believe in something else, as everyone has faith in something, sometimes even faith in nothing. Me, I’ll place my faith in Jesus.

We humans like to believe we have a good understanding of the world around us. And then something like 3i/Atlas comes into view, proving the limits of human science to understand the universe we live in. If you’re an atheist, someone who believes the god hypothesis is no longer valid, that visitors in UFOs are from another star system in another galaxy far, far away, well good luck with that when they finally come down to Earth in a very pubic way, to pay us a visit.

Personally, I believe these “aliens” are demonic entities, in a very biblical sense of the term. If you ever read the accounts of “alien” UFO abductions, you’d quickly understand that these “aliens” are liars, who have no love for the human race.

Here are some internet articles on 3i/Atlas. This thing is really weird, UFO type of weird.

https://duckduckgo.com/?origin=funnel_home_website&t=h_&q=3i+atlas+news&ia=web

Mark J. Lundeen

********