Trump’s First Month And Gold Price

Trump has been president for more than a month. What has he done so far and how will it affect the gold price ? Trump’s presidency has begun like no other – four weeks of conflict and chaos: travel ban, war with media and intelligence agencies, and the resignation of Flynn as a national security advisor. However, beneath the noise, Trump has been steadily fulfilling his campaign promises, or so it seems. The pace of actions has been very intense – so far, Trump has signed more than 20 executive orders or memoranda, submitted a few bills, nominated one Supreme Court justice, and talked to several foreign leaders. However, investors should be aware that there is a huge gap between what the new administration has said and what it has done in reality – most of Trump’s orders have not changed the reality in any significant way (For example: take the order authorizing the construction of a border wall – without Congress’ approval of funding for that purpose, the order is meaningless).

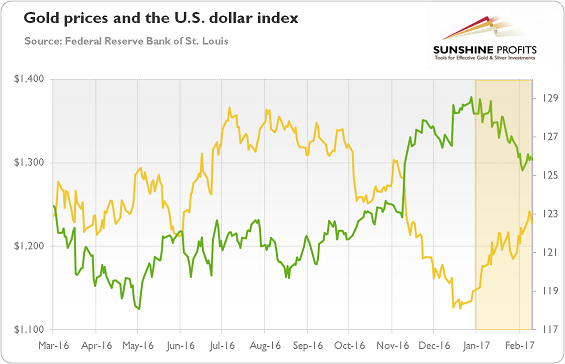

To be sure markets keep tracking Trump’s conflated words or actions with both trepidation and excitement. The point is that the new president is two-faced. Investors love his big promises about the deregulation and tax cuts, but tremble because of his foreign policy and protectionist stance. From the beginning, Trump’s presidency has been rather chaotic and filled with aggressive diplomacy. Although the transition period is always a rather nervous time, the past month was unique in that matter, which sparked some safe-haven demand for gold as a hedge against the unpredictability of Trump. Indeed, his diplomacy is turning geopolitics on its head (and there was even a small diplomatic crisis with Australia – one of the strongest allies of the US, can you believe it?), although he may just be using chaos as a tool to run the government and to negotiate better deals with other countries. In the meantime, investors started slightly correcting their excessive expectations of Trump boosting economic growth. Then there was a pullback in the US dollar, while gold rallied, as one can see in the chart below.

Chart 1: The price of gold (yellow line, left axis, London P.M. Fix) and the U.S. dollar (green line, right axis, broad Trade Weighted Index) over the last year.

However, we believe that there are more downward risks stemming from Trump for gold. Why? The reason is that the new president seems to be backing off his protectionist trade policies, which were the biggest market risk. You see, Japanese Prime Minister Shinzo Abe said after a meeting with the U.S. president that Trump shared his view that Japan's monetary policy was not currency manipulation. Similarly, in a phone call with China's leader Xi Jinping, Trump agreed to honor the ‘one China’ policy. And he has not yet labeled China a currency manipulator, suggesting perhaps some willingness to pull back from some of his more extreme ideas. It goes without saying that the softening of Trump’s stance toward China and Japan reduced the risk of a trade war and would be welcomed by the financial markets, but not necessarily by gold bulls.

Summing up, the first month of the Trump’s presidency is behind us. The transition has been quite dysfunctional so far, although Trump seemed to be determined to fulfill his promises (or to pretend to do so at least). He undertook a lot of executive actions, but most of them were just good for showing-off. The most important development during these weeks was backing off from the most extreme ideas about trade policies (which could trigger a trade war). Trump’s previous threats could have been a negotiating strategy only, his famous art of the deal. Surely, it may be too early to declare a withdrawal from protectionism, especially given the fact that Trump’s economic advisors are clearly against free trade with China, and Trump’s unpredictability itself. However, after Trump’s latest exchanges with Japan and China, the biggest risks associated with the new administration should dissipate a bit. It could be negative for gold, which may lose some of its safe-haven demand.

Arkadiusz Sieron