The Truth About Where Gold Is Headed

Every day hundreds of forecasters, investors and technical analysts tell us where the precious metals sector is headed. We are continually bombarded with trading and investment advice on how to trade gold, silver and miners. Unfortunately most of this advice does not play out which I’m sure you will agree with.

Every day hundreds of forecasters, investors and technical analysts tell us where the precious metals sector is headed. We are continually bombarded with trading and investment advice on how to trade gold, silver and miners. Unfortunately most of this advice does not play out which I’m sure you will agree with.

Today I would like to share with you the truth about where gold is headed because it’s not talk about much and for a good reason. The reality of trading and investing is that no one knows where the markets are truly headed next.

Yes you read that correctly, everyone including myself and those working at firms getting paid millions each year to analyze and forecast markets never truly knows where or when a market will rally, crash, or change direction.

With that said those with sufficient education and experience following various assets you can predict, trade and profit with a relatively high degree of accuracy at times. The key words are “at times”.

You see during a raging bull market one can make a lot of money buying assets. During a bear market you can do the same by short selling, buying inverse ETFs, or buying put options.

The key to long term success is understand the major market cycle (stage analysis) which all assets move through. There are times when you should be actively trading or invested and there are times when cash is one of the best plays.

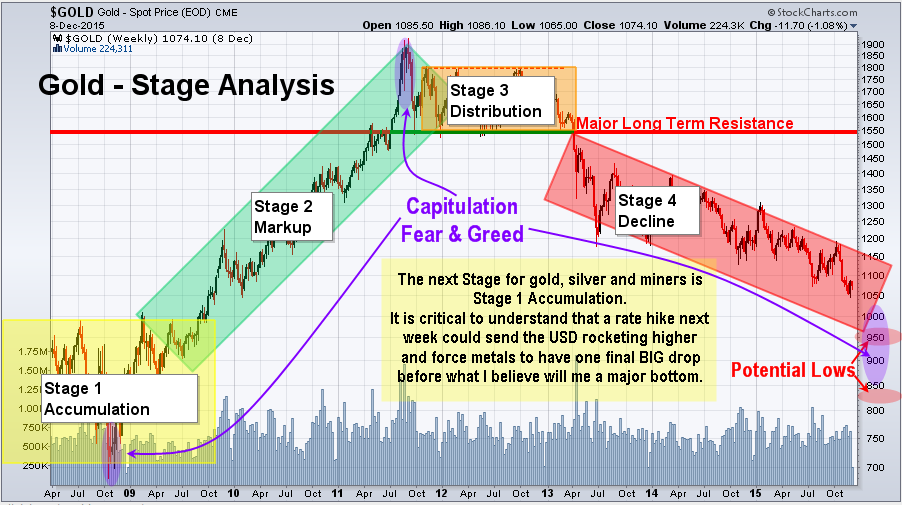

The chart below shows my gold stage analysis which clearly shows the stages which you want to focus on buying (Stage 2 Markup), and when you should be short selling, and trading inverse ETFs, and using put options (Stage 4 Decline). If you can identify what stage a market is in, then you have the potential to generate profits through trading and investing.

During the other two stages 1 and 3, these are transition periods which are very difficult to trade and profit from. This is when you are best to sit back and keep your hard earned money in cash, and/or look for other assets currently in a Stage 2 or 4 trending period to trade.

Currently gold is in a Stage 4 Decline. Although recently we have started to see signs within the sector that gold and silver are likely nearing a bottom and that means volatility is likely to pick up and price will have wild price swings much like we saw in the previous Stage 1, and Stage 3 transition periods. I think trading metals over the next few months will be tough and carry more risk than it would during the beginning of a stage 4.

I explain Stage analysis in greater detail in this article: http://www.thegoldandoilguy.com/articles/precious-metals-life-cycle-is-nears-an-end-final-stage-of-denial/

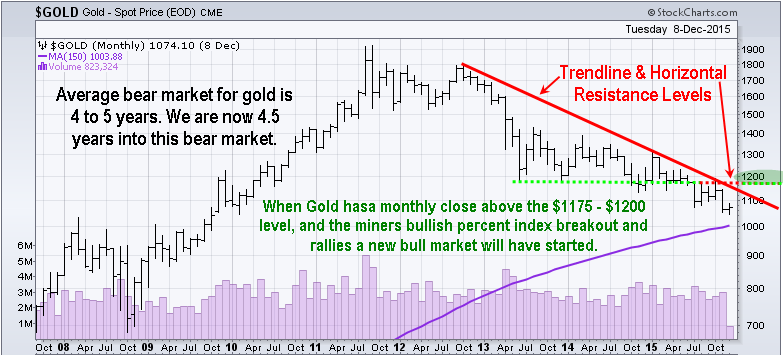

Monthly Gold Price Chart: Resistance

The chart below shows the price of gold and the key resistance levels for gold to break before we can start to consider a new bull market has truly started.

Looking back in time gold has only had a few bear markets which lasted 4-5 years in length, and currently we are well into year 4 of this bear market. Signs are popping up in the COT report and the relative strength of gold miners that the bear market in physical bullion is likely coming to an end. The end is not yet here and it is crucial for you to realize that some of the largest percent based moves happen in the last 10% of a trend (capitulation spikes) as shown in purple in the first chart above.

Bullish Percent Index: Leading Indicator

This chart should act as a leading indicator for physical bullion prices. Once gold miners can break above this down trend line and hold up above the 50% level we should see physical bullion price bottom a month or two later.

Truth About Gold Conclusion:

The truth is I don’t know when gold will bottom. But we do know that it’s still in a Stage 4 Decline and the odds point to lower prices until proven wrong.

By understanding the market stages, leading indicators like gold miners performance, COT data, and breaches in key resistance levels for the price of gold will allow you to adjust your portfolio, and follow the major trends as they unfold.

I can guarantee you won’t catch the dead bottom in gold, nor sell out at the exact top, but as a trader we can actively navigate the market trading with the trend. And as an investor we can strategically move our money from one asset class to another as these stages form and confirm.

Long term investing is not rocket science but because investing is so slow and boring to follow and as humans we tend to get emotional and fall in love with winning positions when in reality the analysis is telling us to move to cash and protect our capital, the average investor tends to be the one left holding the bag of high prices stocks and commodities when price falls. Don’t be that type of investor… Join my ETF trading and investing newsletter right now!

Follow & Trade Market Stages (SPECIAL OFFER) www.TheGoldAndOilGuy.com