UBS Raises Its Gold Price Forecast To $1,800

Strengths

· The best performing metal this week was platinum, up 3.45 percent despite hedge funds cutting their net-long positions to an eight-month low. However, platinum mines in South Africa are to remain closed for time being. ETFs added 73,044 troy ounces of gold to their holdings in the trading session ended Thursday – marking the 19th straight day of inflows. Gold rose toward $1,800 an ounce this week, a level last seen in 2011, before ending the week lower. Joni Teves, strategist at UBS Group, said in a note that “gold’s journey has been quite bumpy so far, but given the macro backdrop we think the destination remains higher.” The index of South African gold producers surged as much as 12 percent Tuesday to its highest level on record. The price of gold in rand rose as much as 1.6 percent to the highest since Bloomberg began tracking in 1971. South African gold producers were up big for the day with AngloGold up around 6 percent and Gold Fields up 13 percent.

· The logistics nightmare in the gold market should be easing, according to London Bullion Market Association (LBMA) CEO Ruth Crowell. In a Bloomberg Radio interview, Crowell said, “the gold market isn’t broken” and there have been no drops in trading volumes. Suppliers are turning to chartered flights and insurance companies are now covering those flights to carry the metal, helping ease disruptions in the market that have led to big spreads in the prices between New York and London futures. Crowell reiterated that London gold vault operators have an agreement to support each other if one were to go down.

· India’s central bank announced that it will issue sovereign gold bonds with a tenor of eight years and the option to exit after the fifth year. The bonds will be sold through commercial banks, stock exchanges and post offices. Bloomberg reports that they will be issued in six tranches from April to September of this year.

Weaknesses

· The worst performing metal this week was silver, down 1.65 percent with hedge funds cutting their net-long position to a 10-month low and the gold-to-silver ratio exceeding 100-to-1, when a 60-to-1 RATIO is more in line with historic averages. Gold fell on Friday after reacting to news that the U.S. plans to slowly reopen the economy, along with many other countries. The disconnect between London and New York gold futures continued this week. Bloomberg reports that the premium for New York futures over the London spot price rose above $70 – the highest in 40 years.

· India’s Malabar Gold & Diamonds said in a statement that the country’s gold jewelry industry is facing an impending liquidity collapse due to zero net sales and negative cash flows. Bloomberg notes that retail sales have collapsed due to the coronavirus lockdown cancelling weddings and postponing festive occasion buying – both usually big drivers of sales.

· Prime Minister of Thailand Prayuth Chan-Ocha says that the country’s gold stores are running out of cash because so many people are selling ornaments, jewelry and bars amid an economic slowdown, reports Bloomberg. “I’m asking people to sell gradually, not in large amounts, as ships may face a cash crunch.” With gold prices high, people are trying to raise money by selling after massive job losses. The U.S. Mint announced on Wednesday that it is temporarily halting production at its West Point facility in New York due to risk of employees catching the coronavirus. This comes after the Mint reported in March it sold out of American Eagle silver coins.

Opportunities

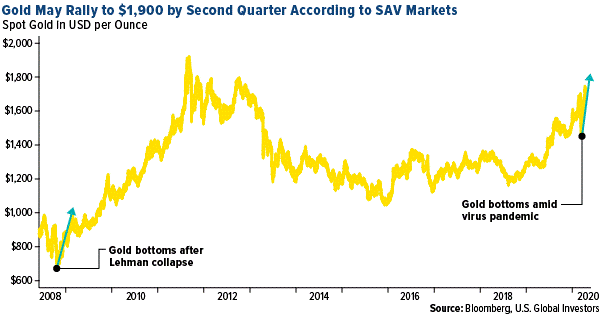

· UBS raised its gold price forecast to $1,800 an ounce after the Fed announced that it will expanding existing credit support measures. “The two most important determinants of the gold price are real U.S. interest rates and expectations for the purchasing power of the U.S. dollar, both inverse relationships, and we reiterate our negative views on both at this point,” said analysts including Wayne Gordon and Giovanni Staunovo in a note dated April 13. Others are bullish that gold could rally to $1,900 an ounce this year, back to its high reached in 2011, if gold has already found its crisis-bottom.

· Canadian Imperial Bank of Commerce foreign-exchange strategist Bipan Rai expects gold to benefit from an increase in diversification away from the largest developed currencies in the wake of the current crisis. “The increase in budget deficits and reduction in longer-dated yields will only increase its allure to central bank reserve managers,” Rai said in a note. Bloomberg writes that central banks have been steadily increasing gold reserves over the last few years.

· Torex Gold Resources reported gold production of 108,530 ounces in the first quarter, a 39 percent increase year-over-year. Yamana Gold said that it will resume operations at its Canadian Malartic mine on Wednesday, following Quebec’s decision to authorize the resumption of mining. Barrick Gold purchased more than 800,000 antibody testing kits to screen its workers and the communities around its mine for COVID-19, reports the Financial Times.

Threats

· On Thursday, President Trump unveiled a plan for states to reopen economies in three phases. Trump told governors that some could open by May 1 or earlier. The concern is that not enough testing has been done nor is available to get an accurate gauge of the virus’ spread in the U.S. Prematurely reopening businesses and easing social distancing measures could increase the number of cases and cause even more stress to health care systems.

· Impala Platinum Holding’s head of operations in South Africa appeared in court on Friday for allegedly violating the country’s lockdown orders, reports Bloomberg. A company spokesman said the executive was released on 60,000 rand bail and the charges relate to the company asking staff to report for work before amendments allowed them to return. On Thursday, the government allowed mining companies to resume at half their normal capacity on the condition that they screen and test workers for COVID-19. The mining industry employs over 450,000 people in South Africa who are especially vulnerable to the virus due to cramped working conditions and overcrowded living conditions.

· The number of negative-yielding bonds continues to surge amid the pandemic. Billionaire hedge fund manager Ray Dalio criticized this on a Bloomberg webcast this week. Dalio said investors are “crazy” to hold government bonds right now. “If you’re holding a bond that gives you no interest rate, or a negative interest rate, and they’re producing a lot of currency and you’re going to receive that, why would you hold that bond?”

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of