US Dollar Continues To Drive Precious Metals And Oil

After the beach grills cool and get covered for the season, a quiet reality sets in that summer is unofficially over and the first days of school are upon us. Our house remains filled with a thick bittersweet nostalgia from a perfect summer now passed, which joyfully took us from the shores of Alaska to Lake Placid and a few other memorable byways in between.

Certainly blessed to experience just a snapshot of what this country composes, the enduring anthem of America the Beautiful still resonates as a fitting testament to the best of which she offers.

And while the contrast today with the political and social backdrop is a poignant reminder of the complex environment that resides above, the reflection with nature reminds us that life – like the landscape behind it, rarely follows a straight line or that progress is often felt in the present through the repetitive peaks and valleys of a lifetime.

Smooth shapes are very rare in the wild but extremely important in the ivory tower and the factory. – Benoit Mandelbrot

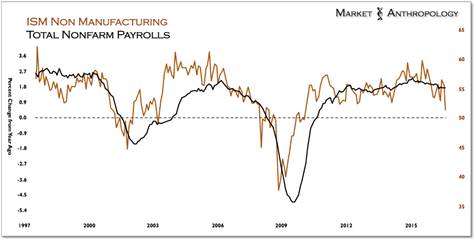

ISM Non-Manufacturing And Nonfarm Payrolls Chart

Speaking of which, and perhaps drifting somewhere between progress and a lifetime… the recent batch of lackluster US economic data over the past week lends greater probability that the Fed chooses to pass on raising rates this September. Moreover, taking a look back and weighing the respective trends of these volatile series, the high water marks for each were set more than a year before, with a growing probability that they’re leveling off at best and trending down at worst.

Although a painfully fluid transparency has provided lip service to both sides of the debate, one could argue the collegial window of academic deliberation within the Fed is narrowing each quarter, as the economy buts up against an expansion already long in the tooth in its 87th month. And while we don't foresee an imminent recession or one commensurate with the previous, a contraction is ultimately as inevitable as yesterday’s sunset.

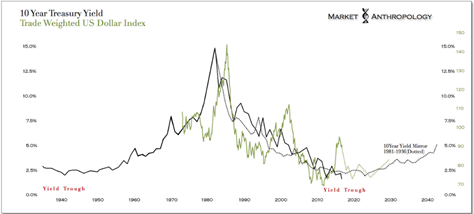

The almost fetish focus on rates by the media misses the mark, or more precisely – appears ignorant to cause and effect. Secularly speaking, rates would only be capable of leaving the trough on a lasting basis when growth materially picks up, which by most measures as well as historical precedence within the long-term yield and growth cycle – is likely years away.

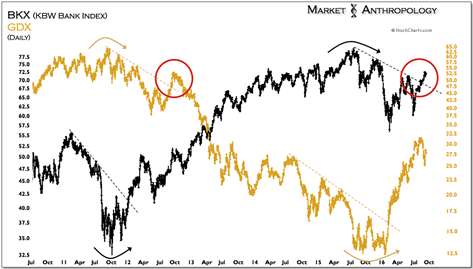

SPX, BKX Daily Chart

To this point and picking up on our thoughts in recent notes, despite equities drift higher this year, financials have largely underperformed the broader indexes, which is rarely a healthy condition to sustain.

From our perspective, the underperformance by the banks goes part in parcel with the upside limitations of the current cycle, which remains capped by the Fed’s capacity to materially raise rates, hence limiting bank profits and contributing to the contentious business environment they already operate within.

Simply put, the weakened investment climate in the financials runs counter to what you historically see in a more lasting equity breakout, where the foundation of the broader market is built on the sector’s sturdy fundamental underpinnings, as investors commit capital with expectations of future growth.

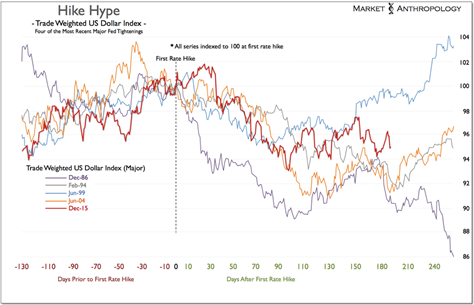

That said, this hasn’t curtailed recent animal spirits in the sector, which as the comparative alluded to could see the banks sharply rebound on hopes that the operating environment within the financials will finally improve. And although the market called the bluff last December after the initial rate hike, it pays to never underestimate the capacity for denial by participants still under the influence of the former trend.

BKX, GDX Daily Chart

In recent notes we contrasted and compared the nearly mirrored action with the gold miners in 2012, whose failed breakout was primarily driven by faulty causal assumptions with monetary policy and inflation that largely went unfounded through QE3.

Today, we suspect a similar reversal could materialize in the financials and across the broader equity space, as the economic expansion matures and growth continues to underwhelm expectations; limiting the Fed’s capacity to materially raise rates – despite an upturn in inflation.

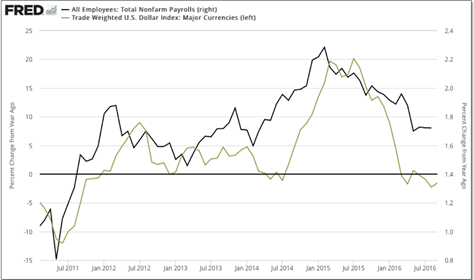

Total Nonfarm Payrolls

From our perspective, inflation today is less tied to growth than the direction of the US dollar, which significantly strengthened as the US led the world out of the financial crisis and has weakened as the expansion matures and rate hike expectations diverge from more contemporary tightening cycles.

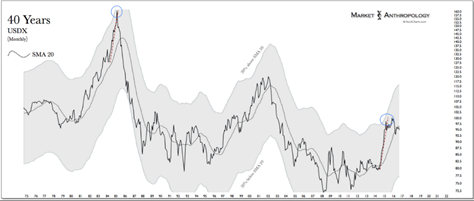

Until the growth cues of stabilizing and rising yields materialize for a considerable period, the notion of a more secular continuation of a stronger US dollar is as misplaced as the dot-plot projections have been towards rate hikes over the past two years.

As such, we expect the move in the dollar that strengthened to a relative performance extreme last year to largely retrace – leaving ample upside motivation for precious metals and commodities that exhibit a strong inverse correlation with the world’s most dominant reserve currency.

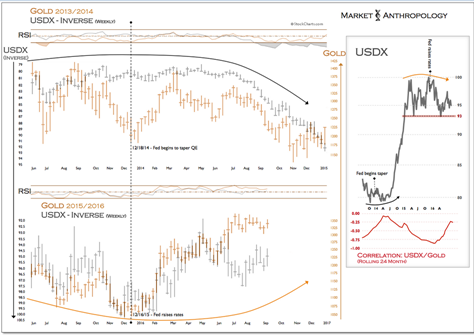

Gold 2013-2014

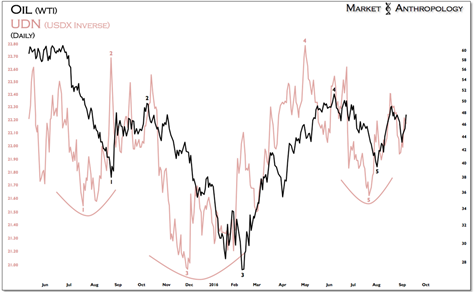

Oil UDN Daily Chart

Although we've carried an opportunistic and bullish lean towards the broader equity rally over the last several months, we suspect it has limited upside from here and would prefer to be sellers than buyers as the September Fed meeting approaches.

While the miners made their highs a week after the September meeting in 2012, we continue to like the prospects today in precious metals and commodities such as oil through Q4.

Overall, we remain vigilant of the US dollar as a guide towards our outlook in precious metals and oil, with the dollar index approximately sitting between its lows from May and highs in July. While we suspect the index to soon break through weekly downside support ~ 93, should the dollar rally above the July highs, we would reassess our bullish expectations through the end of the year.

Hike Hype

40 Year USDX Chart

10 Year Treasury Yield Chart

Erik Swarts is an independent trader and creator of the online market research site -- Market Anthropology. He uses a synthesis of technical and asset relationship analysis to determine a market's respective risk profile.

Erik Swarts is an independent trader and creator of the online market research site -- Market Anthropology. He uses a synthesis of technical and asset relationship analysis to determine a market's respective risk profile.