US National & Consumer Debt And Other Charts Of Interest

The Dow Jones ended the week with a small gain, but this is no big deal as it did so because the Federal Reserve made sure it did. Here is an article which quotes the President of the Dallas Fed admitting that the Fed is manipulating the stock market’s valuation higher.

Of course this is old news to anyone who has listened to what past Federal Reserve officials have said for over the past two decades. Doctor Bernanke admitted to manipulating the stock market two years ago.

“Policies have contributed to a stronger stock market just as they did in March 2009, when we did the last iteration of this. The S&P 500 is up 20% plus and the Russell 2000, which is about small cap stocks, is up 30% plus.”

- Doctor Benjamin Bernanke, CNBC Interview with Steve Liesman 13 Jan 2011 (1:40 PM).

Officials from the Federal Reserve have been contemplating managing the market higher since the late 1980s.

"The Fed could support the stock market directly by buying market averages in the futures market, thus stabilizing the market as a whole. --- The stock market is certainly not too big for the Fed to handle."

- Robert Heller, former Governor of the Federal Reserve, From a 1989 WSJ interview.

Anyone who believes that market prices for crude oil and US T-Bonds aren’t managed by the Fed are either not listening or have deliberately made the decision to remain ignorant of what is plainly obvious. Here is Greenspan from 1998 on how central banks planned to keep the price of gold down – leasing out their gold reserves, and Germany’s too, no doubt.

“Central banks stand ready to lease gold in increasing quantities should the price rise.”

- Alan Greenspan, 24 July 1998 Congressional Testimony

Gold on 24 July 1998 closed at $290.90. We can be sure that any gold leased to a bullion bank (JP Morgan or Goldman Sachs) before and after 1998 isn’t going to be returned to the central bank it belongs to, not after the price gains of the past fifteen years! And how many tons of gold are we talking about? The 1999 Washington Agreement LIMITED the total tonnage of central bank gold being sent to the market to 400 tons a year. How many tons were sold before the Washington Agreement?

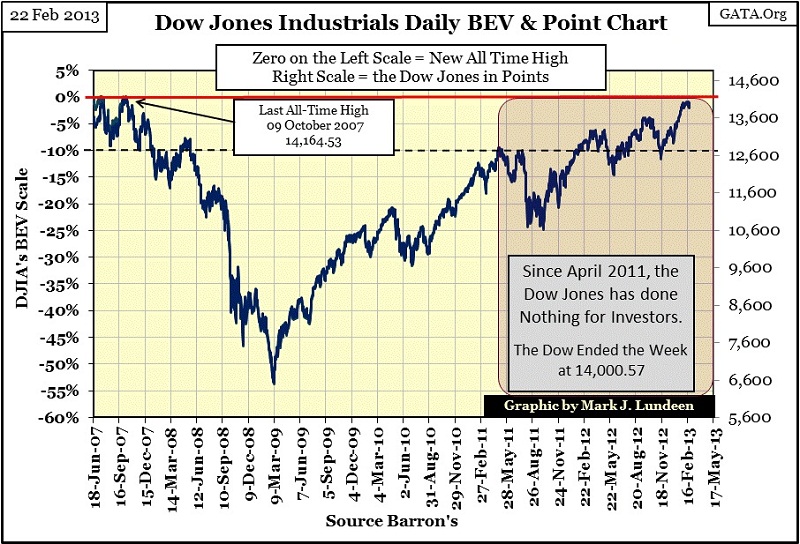

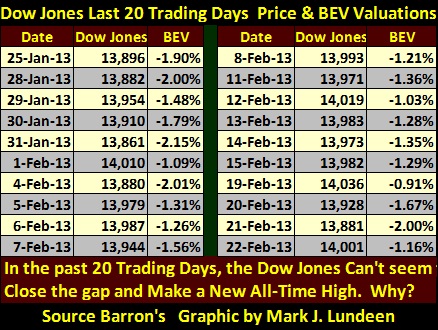

Back to the stock market; how much has the Federal Reserve forced the Dow Jones up? I don’t know, but the Dow saw its 09 March 2009 -53% low on record breaking volume. There is something is really, really wrong with that! It’s not at all extreme to believe that the Dow Jones would have fallen 70% or more below its October 2007 all-time high during the 2008-09 credit crisis bear market, had the Fed not intervened to support the stock market. And in light of past and recent comments from Federal Reserve officials on the stock market, it’s pretty clear that without the Federal Reserve “injecting” inflation directly into the thirty Dow Jones stocks since 2008, the stock market today would be nowhere near 14,000 with its volume down 70% from its March 2009 highs. Today, even with central bank manipulation, the Dow is struggling to make a new all-time high. For the past month, the Dow Jones has been range bound just 1% to 2% from a new all-time high. This next table tells me that the Federal Reserve isn’t in any hurry to see the Dow Jones break out and soar far above its old all-time high anytime soon.

So, whether the Dow Jones moves on from here to a new all-time high depends on what the idiot savants at the Fed think is best for “policy” and not for what is good for your retirement funds. I really don’t understand why anyone is still in the stock market. It’s actually a disaster waiting to happen. With the prices of gold and silver being driven ever lower, it makes more sense than ever to sell the stock market and buy gold and silver.

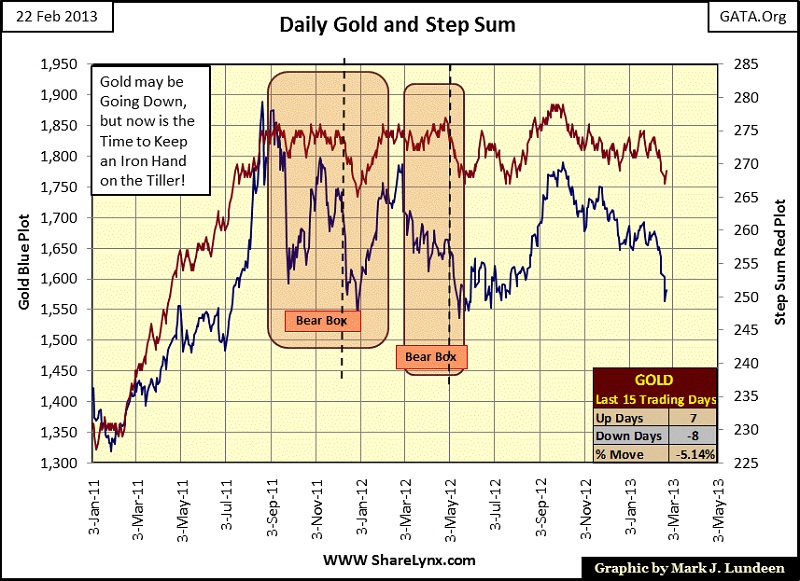

Let’s move on to gold and silver. Gold’s step sum chart is looking pretty bearish. As seen in my table on the chart, gold has fallen 5.14% in the last fifteen trading days. That’s a pretty steep decline on just one net down day for the past fifteen trading days. If everything was on the up & up, I’d say we were pretty close to a bottom. Though as it is, I think the safe thing to do is to expect deeper declines ahead of us. The “policy makers” are between a rock and a hard spot in the precious metals futures markets. So, they are now forced to continue selling gold and silver they don’t have, and can’t get, hoping to force the longs to exit their positions.

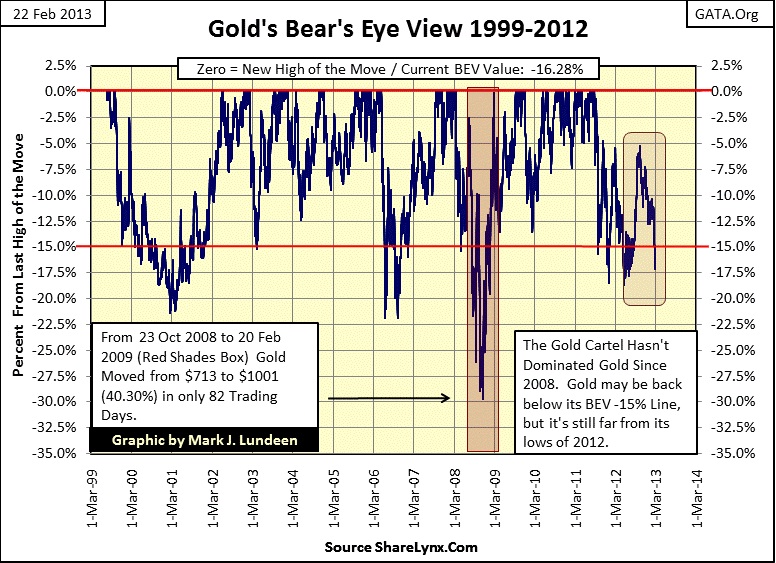

Gold’s BEV chart holds more promise than its step sum chart. For all the huffing and puffing the “policy makers” have been doing in the COMEX gold pits and the bearish “news” on CNBC, gold is only 16.28% from its last all-time high. That is a long way from the 30% decline gold saw in October 2008, and we can see what happened after that: gold gained 40% in only 82 trading days.

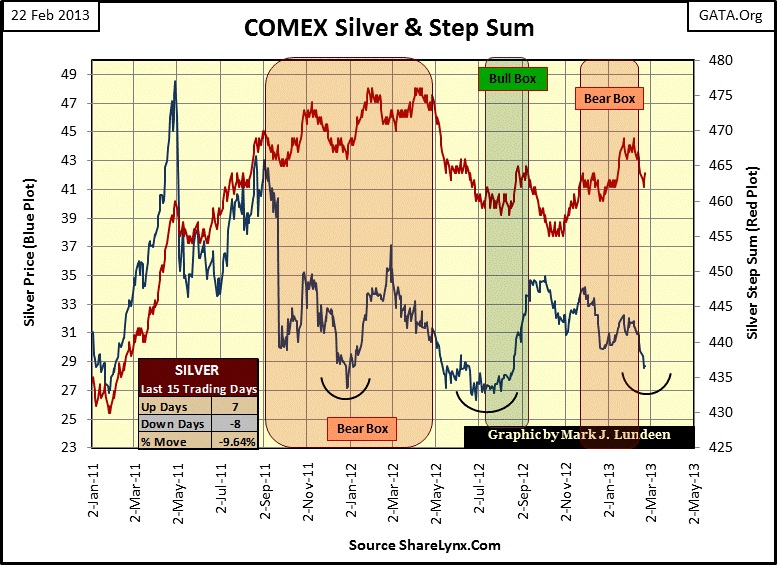

Here is silver’s step sum chart, and like gold’s step sum chart it’s bearish.

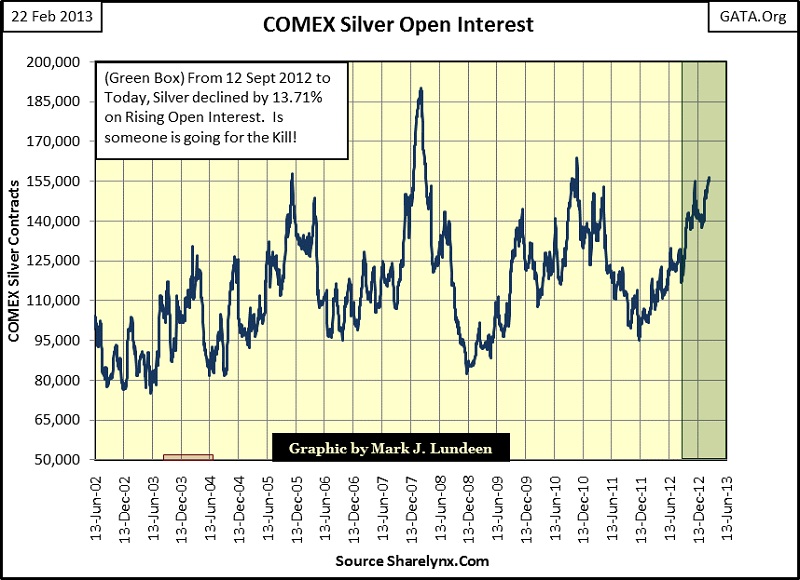

But there is something very unusual going on in the silver market; silver’s open interest continues to increase as the price of silver continues to decline. The longs (who make money on rising prices) are being bled dry with each decline in the price of silver. Yet they are standing firm and enduring the pain, refusing to close out their long positions.

How much pain have the longs endured? Since 12 September 2012, silver has fallen $4.56, or a decline of 13.71%. That doesn’t seem all that bad, but these are 5,000 ounce contracts. Each individual contract above has cost the longs $22,800 to maintain, had they entered the market six months ago and held on for life and limb until today. With the current open interest of 156,435 contracts in play, that amounts to a lot of money; the silver bulls have taken $3.56 billion dollars in paper losses. Now this is only a back of the envelope calculation, but nonetheless, the longs (silver bulls) are holding strong in the face of massive losses!

But I’ve been traumatized by the big banks in the gold and silver markets for well over a decade, so I have to admit that I expect the above gallant effort to break the banks by the silver bulls to fail, and eventually we’ll see silver’s open interest collapse with the price of silver. But I may be wrong. Mr Bear and China have no love for either Wall Street or Washington, and both are completely insensitive to any pain currently being inflicted on the longs.

China in the past few weeks has been doing some hacking of American business internet sites. That means they are feeling frisky in their need to express their displeasure of Washington. It may just be that in early 2013, China is now attempting to break J.P. Morgan, the largest short (Bear) in the silver paper market. If this is so, we’ll continue seeing open interest above rising on declining silver prices, until someone demands a few million ounces of silver from J.P. Morgan. Silver J.P. Morgan doesn’t have, and can’t get for delivery. In such a case silver could quickly move above a $100 an ounce in a week –which would be a huge profit for the longs, at the expense of JP Morgan and other Wall Street silver shorts. Is this going to happen? Don’t ask me! I’m just sitting in the peanut gallery cheering for the underdogs.

Here’s silver’s BEV chart. I’m a huge long-term silver bull, but I’m now bearish on silver’s short term prospects. The CFTC is staffed with yes-men will never step in to enforce their market regulations on Wall Street. So, I expect that J.P. Morgan will continue naked shorting the silver market until they have their way with the silver bulls. There’s a lot riding on how the above open interest situation resolves itself. If China isn’t going after Wall Street, Wall Street should then win this battle as they continue shorting the silver futures market into submission. If so, we may even see a larger decline in the price of silver than the 57% plunge we saw in 2008. That would take silver below $20.

Twenty-dollar silver? I can still sleep at night with that as my metal is fully paid for, that plus I’m in this war for the duration. And yes, this is a war between real money on the one side and counterfeit, fake money substitutes on the other. Real money that has its supply limited by what God has created, and fake money substitutes that governments issue in endless quantities, whose only limits are the whims of the “policy makers”. Currently, making short-term price predictions for gold and silver is something I’m going to avoid. But I will tell you something that you can count on; Mr Bear is the biggest gold and silver bull in the market. With each passing week, Mr Bear is growing stronger as Washington and Wall Street grow weaker. How are these people going to explain the missing “leased” gold from the Greenspan era? So silver at over $100 is a sure thing, but I can’t say that we won’t see $10 before that happens, and it might not.

Don’t get me wrong, if given the choice I’d still prefer $100 silver at the close of next week, but you and I don’t have a choice in the rigged casino called Wall Street. But I go to bed every night knowing that the day is coming when all of this frustration will bring me a huge payday.

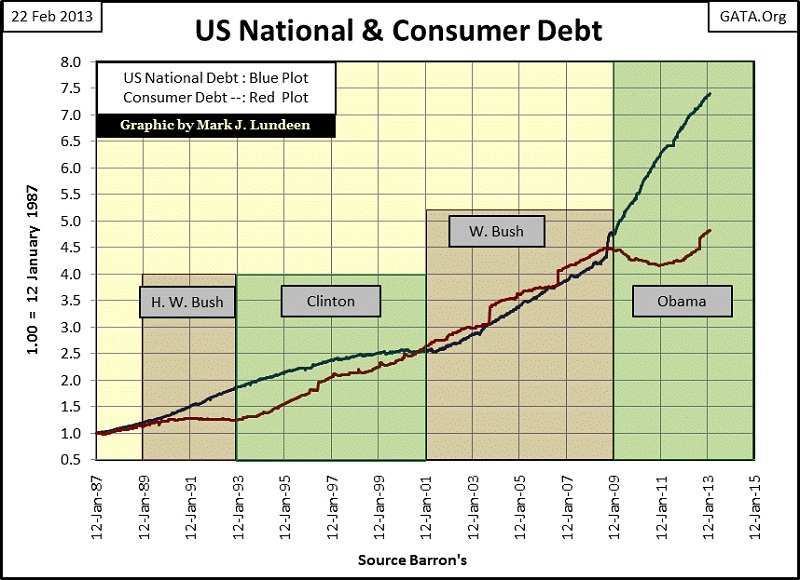

Below we see the indexed values for the US National debt (Blue Plot) and total consumer debt (Red Plot) from 1987 to the present. I indexed them so we could have a horse race with the plots, and the clear winner is Washington DC!

We should not be surprised that the average taxpayer lost this race, as Washington has one significant advantage denied to consumers. Debts carried by consumers are treated as liabilities. Growing liabilities will, at some point, curtail deeply indebted consumers’ access to more credit. So, consumers can live beyond their means, but only for so long as they can pay their bills to the bank. As we see in the Red Plot above, it’s pretty obvious that the American consumer has maxed out their credit cards in late 2008. But as we note in the Blue Plot, this is not a problem the Federal Government has to worry about. Thanks to the Federal Reserve; the deeper Washington goes into debt, the more money “our leaders” have to spend. Incredible but true!

The Federal Reserve is a clever little legal fiction Washington created in 1913. As a point of law created by Congress, the Fed’s financial affairs are distinct and separate from Washington’s finances. This creates a situation where Washington’s growing liabilities (Treasury bonds) become growing “assets” (these same Treasury bonds) when purchased by the Federal Reserve with money created out of thin air. So, the more Washington spends, the more Washington has to spend.

Using a nation’s debt to back its money is not an American invention. John Law’s bank of the Mississippi Scheme (18th century France) was the first to do this. Law’s bank purchased France’s huge national debt with its paper money. It was a risky thing to do. No one knew if it would work. But after King Louis XIV bankrupted France’s treasury with un-payable debts to fund his wars and private pleasures, there was nothing else to back France’s money other than the “Sun King’s” uncollectable debts. Amazingly, using the government’s liabilities as bank assets worked, until the regent of King Louis XV (who was still a child) saw that he could compel Law’s bank to loan him unlimited funds for his private pleasures too. The money supply soon began swelling grotesquely, and France soon found herself in a worse situation than she was in before John Law began his bank. This is a historical lesson mankind will never remember for more than a generation; when politicians enter the market place, eventually everything they touch dies from one loathsome fiscal or monetary disease or another.

But central banking doesn’t have to be this way. The Federal Reserve doesn’t have to curtsey to royalty as John Law was forced to do. If Doctor Bernanke was actually concerned about dollar inflation, he could refuse to “monetize” US Treasury’s debts. Doing so would force US interest rates to rise to punitive levels forcing Washington, and other irresponsible consumers to stop their destructive spending habits. This is why academics such as Doctor Bernanke always seem to become the Fed’s chairman; they will gladly “monetize” the dollar to death as their only other career option is to return to the classroom and teach their dismal science to 19-22 year olds undergraduates. It really is that simple a choice for any economist employed by the government. If we ever return to a true gold standard, these economists would become unemployed. This is why economists, as a class, are vocal opponents of a return to the gold back dollar.

So be wise, and expect to see the US National Debt continue expanding, and the Federal Reserve continue monetizing US Treasury debt (and abandoned mortgages as well) in ever increasing volume to “stimulate the economy” for a long time to come.

"We make money the old fashioned way. We print it."

- Art Rolnick, Chief Economist for the Minneapolis Federal Reserve Bank

That’s exactly right Art, the global reserve currency is no more than ink on paper (digital data on someone’s hard drive actually). The debt backed dollar has been a fact of life for so long that it has become an acceptable bad habit. Global commerce now takes the ever expanding supply of dollar for granted. In his rat hole, Saddam Hussein, who had no love for America, kept a few hundred thousand US DOLLARS, but no gold or silver. However, for your information, the producers and consumers in the economy never, not once demanded gold and silver be demonetized. It was the economists, politicians and bankers who saw the full potential of debt backed money.

- To the academics, the opportunity to test their pet-theories on a living laboratory (our economy) was too good to pass up.

- To the politicians, they couldn’t say no to the prospects of being funded by a potentially limitless supply of “money.”

- To the bankers, freeing themselves from the restraints gold imposed on credit creation was a dream come true.

All of the intractable problems in the economy today can be placed on the doorsteps of these people; people who made promises to the world they never intended to keep. But there are those in the world that are beginning to raise objections to the dollar as it is now managed.

“We hate you guys. Once you start issuing $1 trillion-$2 trillion we know the dollar is going to depreciate, so we hate you guys but there is nothing much we can do.”

- Luo Ping, a director-general at the China Banking Regulatory Commission , 11 February 2009

Mr. Luo Ping may take issue with American “monetary policy”, but in truth China, Japan, the European Central Bank, and everyone one else is in a race to devalue their currencies to worthlessness or suffer the consequences in their global trade accounts and rising unemployment. So whatever you do, don’t hide dollars, yen or euros under the mattress to “save money”, as one day all of the world’s currencies now in circulation will no longer pass as “money.”

Mr. Ping was not being completely honest when he said there was nothing much they can do. They can covertly convert as much fiat paper as possible to precious metals and other hard assets until the inevitable final collapse of fiat currencies, and then back their own currency with gold, and that is what many of us believe is going on. Maybe this is exactly what is happening in the silver market today. The politicians and Federal Reserve are cooperating with this large scale transfer of hard assets in order to placate the Chinese (for years of shipping valuable finished goods to the west in exchange for worthless paper) while at the same time perpetuating and prolonging their own power and the Ponzi scheme that is the US dollar.

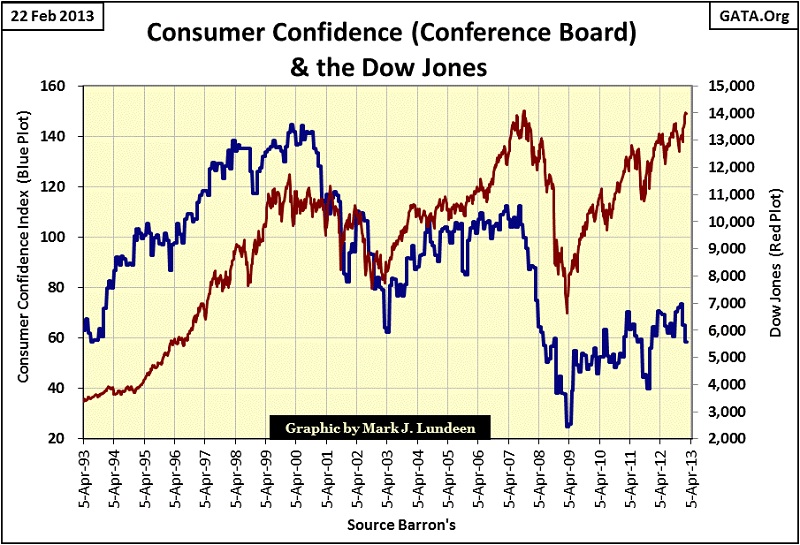

Here’s the chart for the Conference Board’s Consumer Confidence index (Blue Plot/Left Scale) plotted with the Dow Jones (Red Plot/Right Scale). In 1993, consumers were a bit down. Alan Greenspan had yet to “stimulate” the economy to a point past the “excesses” of the late 1980s. But that soon changed as our genius Fed chairman inflated a bubble into the stock market, or should I say into American consumer confidence? One of the nice things about these long term charts is that they frequently disclose patterns not obvious in shorter term charts.

The reversals in consumer confidence closely match the reversals (both up and down) in the Dow Jones since 1993. Yes consumer confidence, unlike the Dow Jones, is trending bearishly with a declining stair-step pattern. But since 2000 the banking system has burden working American’s with trillions of dollars of debts for mortgages, education, and credit cards. Being over 50 years old and burdened with a 30 year mortgage on a house falling in value is not good for moral. But even so, since 1993 Consumer Confidence does see its reversals follow the reversing trends in the Dow Jones.

Is this connection between the Dow Jones and consumer confidence news to you? Well, Washington has been aware of this relationship since October 1929. Presidential candidate Franklin Roosevelt ran on it in 1932. So, a Dow Jones bear market is no friend to any incumbent politician running for re-election! This gives the thirty stocks in the Dow Jones Industrials a “social-economic” importance that everyone in Washington fully understands. It also answers the question why the 1982-2000 stock bull market will never be allowed to go peacefully to its grave. At the best cocktail parties in Washington; it’s “politically incorrect” to even talk about letting the stock market find its free market levels. How low could the Dow Jones go if Doctor Bernanke wasn’t a slave to power? Low enough to drive this Consumer Confidence index below zero, or so I believe.

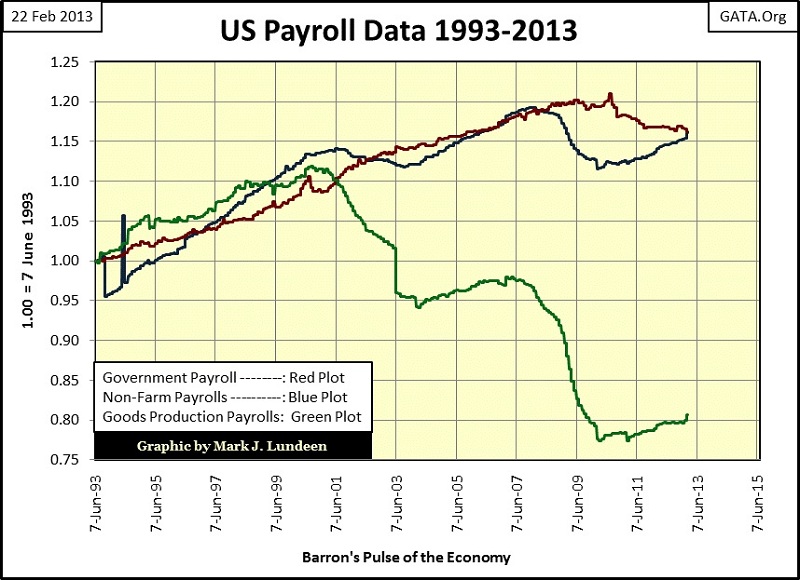

This next chart on payrolls is quite interesting. Even though government payrolls (Red Plot) are struggling, I’m sure this is due to a reduction of manpower in state and local government. The Federal Government only gets bigger. Non- Farm payrolls (Blue Plot) declined during the credit crisis of 2008-09, but have since recovered about half of the jobs lost. Unseen in the plot is how many managers lost their high-paying jobs in 2008, but are now managing a hamburger joint.

When I was younger, there were lots of good paying jobs available in manufacturing, but that was a long time, and many environmental regulations ago. For all the lip-service Washington pays us about looking out for the little guy, the fact is that politicians are the middle class’s worst enemy. If everything is now made in China, it’s only because Wall Street and Washington handed them our industrial base on a silver platter.

Mark J. Lundeen