Waiting For Double Bottom Support In Gold Stocks

Several weeks ago we wrote about the downside risk in the gold stocks.

After the various gold stock indices formed distribution-type tops, the subsequent selling has been swift. Miners have plunged through moving averages and short-term breadth indicators quickly reached oversold extremes.

While the gold stocks are oversold, it could be a little while before we can expect a sustained rebound.

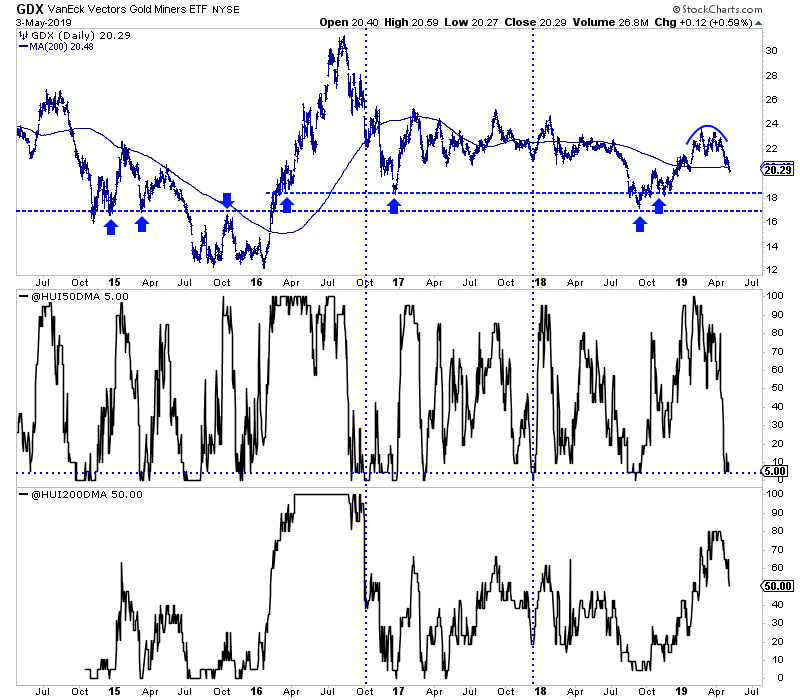

We plot GDX below along with the percentage of HUI stocks that closed above the 50-day moving average and 200-day moving average. (The HUI is essentially GDX sans royalty companies).

The breakdown from the rounding top projects down to $19.50 but strong support is unlikely to be found until $17 or the low $18s. Should GDX trade below $19.50, then the percentage of the HUI above the 200-day moving average (currently at 50%) will decrease materially.

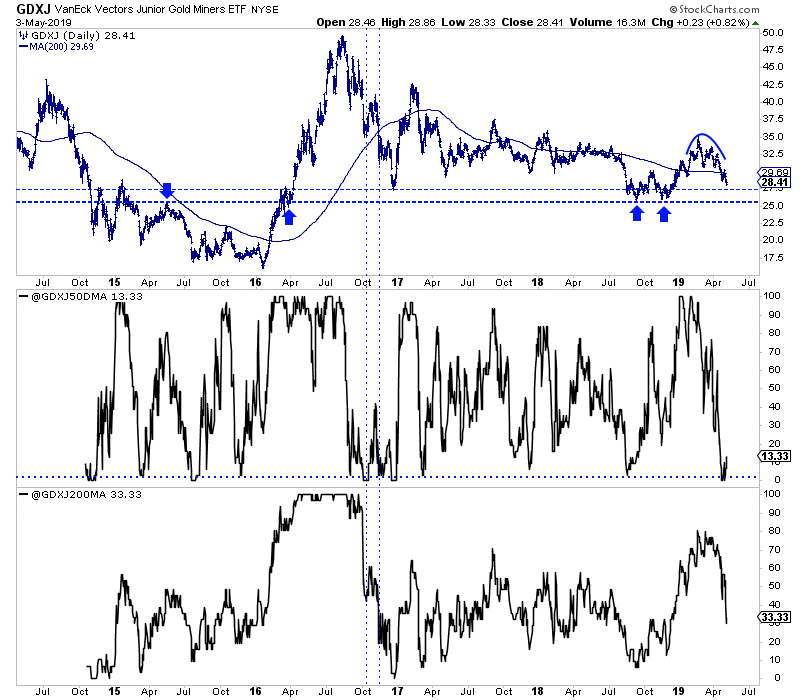

GDXJ, which closed the week at $28.41 has formed a larger distribution top that projects to a measured downside target of $26.50-$27.00. There is a confluence of strong support around $26.00.

Only 33% of GDXJ stocks are trading above the 200-day moving average. GDXJ could be closer to its low than GDX.

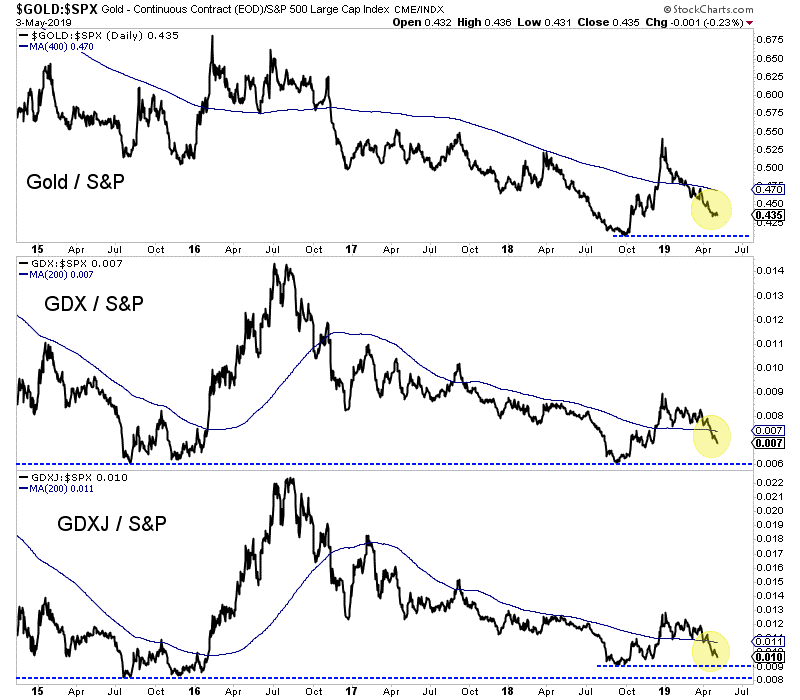

If GDX and GDXJ successfully retest their 2018 lows then their performance in relative terms could inform us on the sustainability of that rebound.

Below we plot Gold, GDX and GDXJ all against the stock market. These charts also have a chance to form double bottoms.

The gold stocks have broken down and have more downside potential until testing strong support levels. We don’t want to fight that breakdown until the market tests strong support amid an extreme oversold condition. That could entail GDX and GDXJ testing their 2018 lows with less than 10%-15% of the stocks trading above their 200-day moving average.

Sentiment indicators for gold and silver are trending in the right direction, but more selling and lower prices are likely needed before those indicators reach extremes.

As far as fundamentals, there could be some potential bullish developments waiting in the background. If these things come to pass then the gold stocks could be in position to rocket higher after forming a double bottom.

The weeks and months ahead could be an opportune, low risk time to position yourself. We are looking for deep values with catalysts and anything we missed in recent months than can be bought at a discount. To learn what stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

*********