We’re Close to Hitting the Debt Ceiling: Gold Doesn’t Care

Another fiscal year, another governmental fight to raise the debt limit. A failure spells a crisis, but gold turns a blind eye and continues its fall.

So, America has a new tradition! The government shutdown is coming. A new fiscal year starts tomorrow, and if Congress fails to agree on a budget by the end of today, the government will shut down.

What does it mean for the US economy? According to Treasury Secretary Janet Yellen, the failure to lift the debt ceiling could be a catastrophe:

If the debt ceiling is not raised, there would be a financial crisis, a calamity. It would undermine confidence in the dollar as a reserve currency (…) It would be a wound of enormous proportions (…) It is imperative that Congress swiftly addresses the debt limit. If it does not, America would default for the first time in history. The full faith and credit of the United States would be impaired, and our country would likely face a financial crisis and economic recession.

She also clarified in a separate letter sent to Congress that the Treasury could run out of money by October 18, 2021:

We now estimate that Treasury is likely to exhaust its extraordinary measures if Congress has not acted to raise or suspend the debt limit by October 18. At that point, we expect Treasury would be left with very limited resources that would be depleted quickly. It is uncertain whether we could continue to meet all the nation’s commitments after that date.

Her rhetoric was rather gloomy. As a result, the risk aversion softened, while stock prices dropped. So, gold prices had to increase, right? Well, not exactly. As the chart below shows, the price of the yellow metal continued its downward trend that accelerated in September, partially caused by more hawkish expectations for the tapering timeline and future path of the federal funds rate.

So, what is happening in the gold market? I would point out three crucial factors right now. First, the US dollar has appreciated recently. Yes, despite worries about the debt ceiling, the greenback has strengthened. It shows that there is simply no alternative. Another issue is that people have seen this movie before, and they know how it ends. At some point, Congress will pass a new debt limit and return to its spending spree.

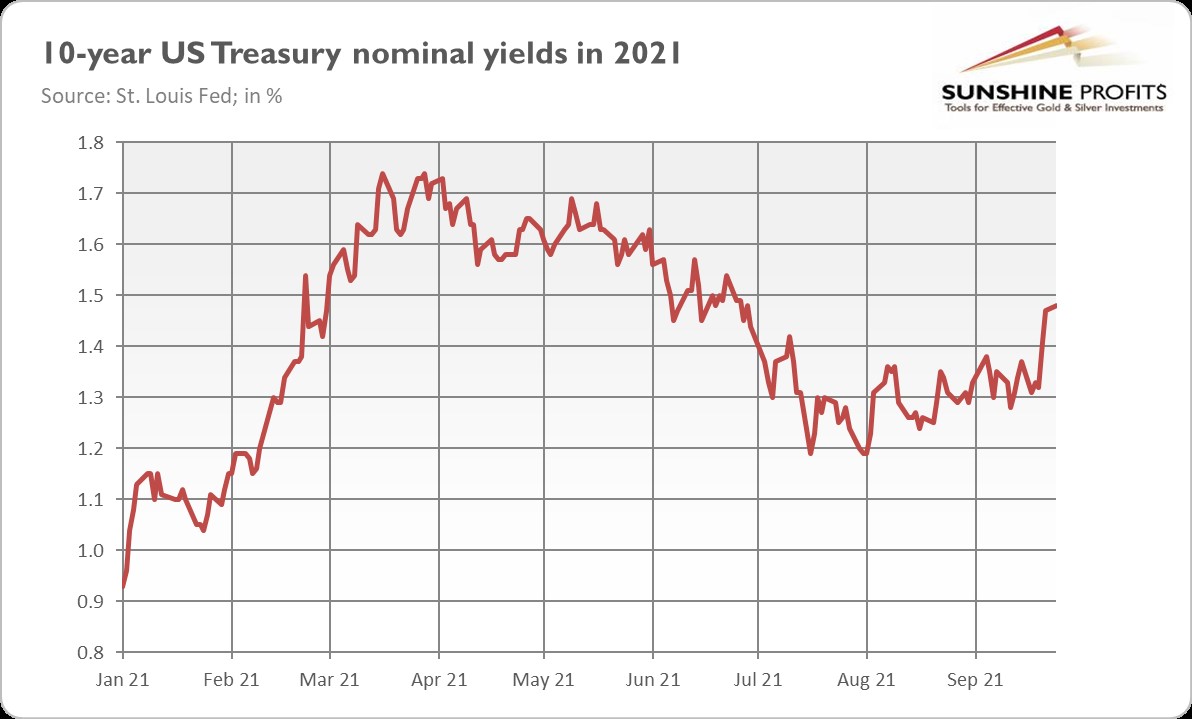

Second, the bond yields have increased. For example, the nominal yields on 10-year Treasuries jumped from about 1.3% last week to almost 1.5% on Monday (September 27, 2021), as the chart below shows. The recent dot-plot revealed that the FOMC members want to raise the federal funds rate earlier than previously thought, which has been transmitted into the yield curve, creating downward pressure on gold. Higher interest rates imply higher opportunity costs of holding bullion.

Third, the market sentiment still seems to be negative toward gold. It’s partially justified by the macroeconomic environment — namely, the rapid recovery from the pandemic recession. As the global economy is improving, the central banks are about to tighten their monetary policy.

Implications for Gold

What does it all imply for the gold market? Well, the environment of strengthening dollar and rising bond yields is negative for the yellow metal. Higher interests make bonds more attractive relative to gold. The worries about the debt ceiling will likely be short-lived and won’t provide gold with a needed lifeline. The current downward trend in gold shows that the market simply doesn’t care about the government shutdown. The only hope is an inflationary crisis, but (so far) worries about inflation have been entailing higher interest rates rather than strong demand for gold as an inflation hedge.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care

********