Weekly Market Observations

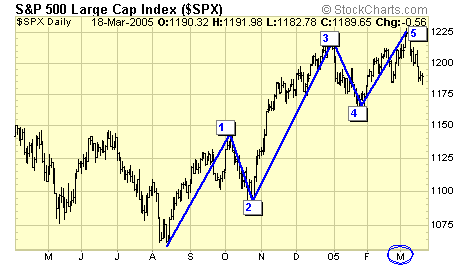

Two weeks ago, my article titled " March reversals" pegged the $SPX at 1222.

Today, the $SPX closed at 1189, down 33 points. However, I'm not claiming victory yet, as anything can happen in the markets. Lets look at the bigger picture.

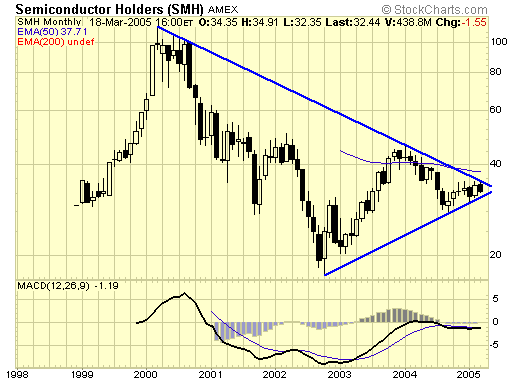

The semis are the driver of the tech sector, and the suspense continues. Prices have to breakout or break down from this apex very soon, and whichever way it breaks, that could establish a trend for the coming weeks and months.

The tech sector is the driver of the broad market, and we are looking at three influences here.

- Prices broke down from a bear flag this week.

- We are currently in a major sell signal (BRSS), ending the major buy signal issued on Oct 11/2002.

- A clear five wave advance since Oct 2002 has ended near the 200ema resistance, a simple 50% retracement should see the cube down to $30.

Summary

There are times when we should be in the market, and times when we should not be. From Oct 2002 to Dec 2004, market was friendly to investors. But now is time to leave the party if you haven't already done so, or rotate some of your funds into the sectors which are out performing the markets. If you don't know which sectors they are, you'll need some help…..

Jack Chan at www.traderscorporation.com

19 March 2005