What A Higher Budget Deficit Means For Gold

Strengths

-

The best performing precious metal for the week was palladium, down slightly by 0.42 percent. Germany’s BASF noted that the automotive industry appears to be responding to the price surge in palladium this year and are slowing down purchases. According to Bloomberg, gold traders and analysts are bearish for the first time in four weeks as the dollar strengthens. The passing of the U.S. budget by the Senate lifted hopes by boosting risk sentiment and pushing yields higher. Joni Teves of UBS says a large fiscal package is a key downside risk for gold as it would result in a higher policy rate path.

-

Even though there has been a pullback in gold prices, large buy orders came into the market two times this week and spiked prices higher. On Monday, 18,1792 gold contracts were traded in a span of five minutes and on Wednesday another 21,129 contracts were traded. Tai Wong, head of base and precious metals trading at BMO Capital Markets, bets the dollar is going to retrace and it will be good for gold.

-

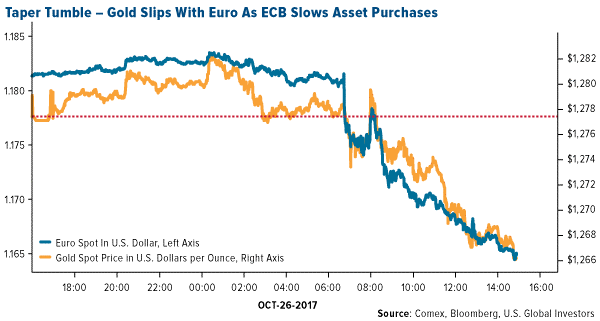

Paul Wright, former CEO of Eldorado Gold Corp., will resign from his board position after 20 years at the company and just months after resigning as CEO. Although stock value tripled during his tenure, Wright’s late career was marked by a high-profile dispute with the Greek government after investing over $2 billion in the country. Following the results of the European Central Bank meeting, gold is seeing some selling pressure and trade surging after the dollar index rallied.

Weaknesses

-

The worst performing precious metal for the week was silver, down 1.05 percent. Gold declined for the sixth week out of seven to trade near the lowest close in more than two months, writes Ranjeetha Pakiam. In addition, China’s purchases of gold from Hong Kong dropped to an eight-month low in September as wholesalers have ample stocks and imports will likely remain weak.

-

European Central Bank President Mario Draghi outlined plans to cut monthly bond purchases in half beginning in January and indicated that zero percent interest rates could remain at current levels. The euro slid down in value taking gold with it as the dollar seems to be the only currency in the near-term to potentially see an interest rate hike.

-

Eldorado Gold plunged more than 28 percent after cutting its annual production forecasts for its flagship mine in Kisladag Turkey for the second time this year after struggling with low gold recoveries. Production guidance is down to 170,000-180,000 ounces from 230,000-245,000 ounces, citing lower-than-expected recovery, writes Aoyon Ashraf. Turkey contributed about 91 percent of Eldorado’s 2016 revenue.

Opportunities

-

The U.S. posted its largest budget deficit since 2013 in the fiscal year that just ended and the Senate also approved a budget resolution that would fast-track up to $1.5 trillion in tax cuts. These measures would worsen the deficit situation, writes Saleha Mohsin. Despite this threat of higher interest rates, rising budget deficits have historically been associated with higher gold prices.

-

Ray Dalio, founder of Bridgewater Associates, shared that the top 0.1 percent of households now holds about the same amount of wealth as the bottom 90 percent – similar to the wealth gap from 1935 to 1940 in the “era of populists” much like we are seeing today. Dalio continued to say that the Federal Reserve should more closely monitor the economic struggles of the bottom 60 percent of the economy and look beyond average statistics.

-

Gold may climb back above $1,300 per ounce this year prompting investors to buy or increase their holdings as insurance, according to Gold Fields Mineral Services. Construction of Fruta del Norte, Ecuador’s first large gold mine, owned by Lundin Gold Inc. is underway while other companies continue to rush to the country after the government lifted a moratorium on exploration concessions last year. Additionally in South America, Mirasol Resources announced that one of its Argentine subsidiaries signed an exploration agreement for a gold-silver project.

Threats

-

Chinese millennials are demonstrating a different taste toward gold from their elders as they pull away from traditional 24K gold in favor of exclusivity and individuality in their jewelry, writes Ruonan Zheng of the Jing Daily. Gold jewelry sales fell 3.6 percent in the first half of 2017 compared to the same period in 2016. Millennials are buying low caret value gold where more uniquely designed jewelry can be fabricated for younger taste versus a simple pure gold chain.

-

With few deals completed and negative investor relations, the total value of mining deals involving North American companies is $3.7 billion, down 40 percent from the same time in 2016. Nate Trela writes that possible explanations are displeasure with results of transactions in recent years and traders taking advantage of arbitrage opportunities.

-

Barrick Gold settled a dispute between its Acacia Mining unit and the Tanzanian government by agreeing to hand 50 percent of the economic benefits over to the country. This grew criticism from mining investors saying Barrick may have set a baseline for what nations may demand from mining companies.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of