Why Isn’t Gold Rallying Along With Inflation?

Inflation is high and doesn’t seem to be going away anytime soon. However, gold is not rising. The question is – what does the Fed have to do with it?

Inflation is not merely transitory, and that’s a fact. Why then isn’t gold rallying? Isn’t it an inflation-hedge? Well, it is - but gold is a lazy employee. It shows up at work only when inflation is high and accelerating; otherwise, it refuses to get its golden butt up and do its job.

All right, fine, but inflation is relatively high! So, there have to be other reasons why gold remains stuck around $1,800. First of all, central banks are shifting their monetary policy. Global easing has ended, global tightening is coming! Actually, several central banks have already tightened their stance. For example, among developed countries, New Zealand, Norway, and South Korea have raised interest rates. Brazil, the Czech Republic, Hungary, Mexico, Poland, Romania, and Russia are in the club of monetary policy hawks as well. Even the bank of England could hike its policy rate this year, while the Fed has only announced tapering of its asset purchases.

So, although central banks will likely maintain their dovish bias and real interest rates will stay negative, the era of epidemic ultra-loose monetary policy is coming to an end. We all know that neither the interest rates nor the central banks’ balance sheets will return to the pre-pandemic level, but the direction is clear: central banks are starting tightening cycles, no matter how gentle and gradual they will be. This means that monetary policy is no longer supportive of gold.

The same applies to fiscal policy. It remains historically lax despite fiscal stimulus being pulled back. Even though Uncle Sam ran a fiscal deficit of $2.8 trillion in fiscal year 2021 - almost three times that of fiscal year 2019 ($0.98 trillion) - it was 12% lower than in fiscal year 2020 ($3.1 trillion). This implies that the fiscal policy is also tightening (despite the fact that it remains extravagantly accommodative), which is quite a headwind for gold. Investors should always look at directional changes, not at absolute levels.

What’s more, we are still far from stagflation. We still experience both high inflation and fast GDP growth, as well as an improving labor market. As a reminder, the unemployment rate declined from 5.2% in August to 4.8% in September. The fact that the labor market continues to hold up relatively well is the reason why the so-called Misery Index, i.e., the sum of inflation and unemployment rates, remains moderate despite high inflation. It amounted to 10.19 in September, much below the range of 12.5-20 seen during the Great Inflation of the 1970s (see the chart below).

So, the dominant narrative is about both inflation and growth. When people got vaccines, markets ceased to worry about coronavirus and started to expect a strong recovery. Commodity and equity prices are rising, as well as real interest rates. These market trends reflect expectations of more growth than inflation – expectations that hurt gold and made it get stuck around $1,800.

Having said that, the case for gold is not lost. Gold bulls should be patient. The growth is going to slow down, and when inflation persists for several months, the pace of real growth will decline even further, shifting the market narrative to worrying about inflation’s negative effects and stagflation. Gold should shine then.

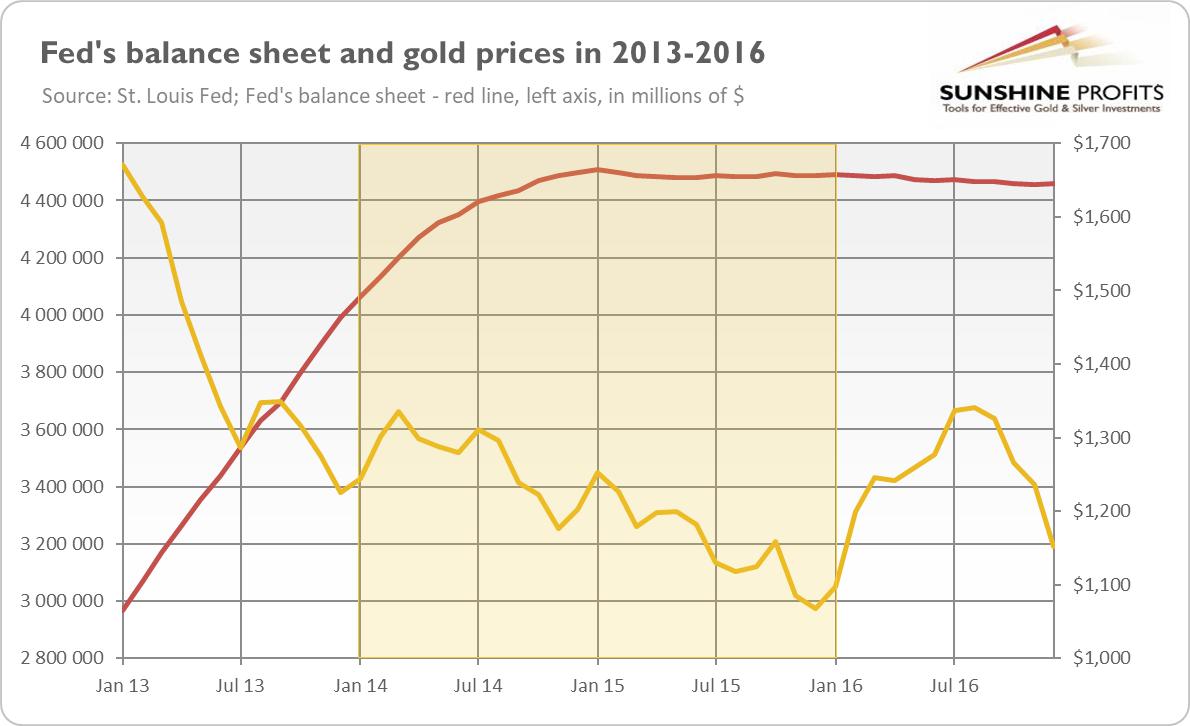

Wait, when? Soon. The Fed’s tightening cycle could be a turning point. The US central bank has already announced tapering of quantitative easing, which could erase some downward pressure on gold resulting from the anticipation of this event. Additionally, please remember that every notable market correction coincided with the end of QE, and every recession coincided with the Fed’s tightening cycle. Moreover, don’t forget that gold bottomed in December 2015, just when the Fed started hiking the federal funds rate for the first time since the Great Recession, as the chart below shows.

However, when it comes to tapering, the situation is more complicated. The previous tapering was announced in December 2013, started in January 2014, and ended in October 2014. As one can see in the chart above, the price of gold initially increased, but it remained in its downward trend until December 2015 when the Fed started hiking interest rates. Hence, if history is any guide, there are high odds that gold may struggle further for a while before starting to rally next year, which could happen even as soon as June 2022, when the markets expect the first hike in interest rates.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.

*********