Will Brexit And Coronavirus End The EU?

The EU and euro face a sudden deterioration in economic conditions due to the coronavirus, which seems certain to widen the differences between Germany and the spendthrift Mediterranean members. But a more immediate problem is the increasing likelihood that the ECB will lose control over financial asset prices, particularly those of government bonds.

In the short-term, it seems likely the euro will rise against the dollar as currency and financial distortions, principally in the fx swap market, are unwound. However, the eurozone faces a developing financial crisis comprised of the following elements: a collapse in economic activity, escalating payment failures, a drastic contraction of bank credit and a collapse in bond prices, as well as the medium used to buy them (the euro).

Eventually, Germany is could go it alone by introducing a gold-backed mark, which will only happen after the European Project is finally abandoned.

Introduction

Brexit came as a shock to the political bureaucracy that comprises the European Union. They had, and still have an ostrich-like stance with their heads in the sand and their rear ends exposed to passing dangers. Their economic incompetence has been exposed for all to see as well as their political ineptitude.

Professional politicians with any semblance of a democratic mandate do not work in Brussels but run the nation states that comprise the union. We can criticise national politicians for their ignorance on what makes their electorates wealthier and happier. They are elected by the ignorant for their own ignorance, but soon learn the political ropes that keep them in power. Or they fail and are rapidly ejected, often ending up in Brussels.

The EU is divorced from the need for realistic political representation. It is the collective dustbin for the power-seekers who have either been ejected by their own national electorates, or who are simply unelectable. It is heaven for power wannabes unwilling to face the consequences of their actions. And as the body of these dangerously inept individuals has grown, they have ensured a bureaucratic cancer has spread into national administrations. You can’t do this minister, because Brussels over-rules it. A bureaucratic statis has spread throughout the administrations of member states.

This was what Brexit challenged and exposed. The establishments in Whitehall and Westminster have become full-on eurocrats, dismissive of Britain’s own parliamentary democracy and remain fully committed to the European project.

Our dictionaries tell us that a moral statis is a condition where things do not change, move or adapt, which is definitely true of the EU’s economic policies. Other than the one change, which is its relentless acquisition of power to intervene and distort, this describes Brussels to a tee. The Eurocrats despise free markets, the source of external change, and seek to control them through mountains of suffocating regulations. As arch-protectionists they find it impossible to permit free trade except under duress. The overwhelming majority of the EU’s free trade agreements are with small insignificant states which are immaterial to the bigger picture. As an entrepôt, Britain’s escape will show by comparison just how much the EU has become a socialising command economy. It has too much in common with the old, centralising USSR and its satellites, a lighter touch perhaps and without the gulags.

However, change is a fundamental part of the human condition, and it is coming from a wholly unexpected direction. The spread of the coronavirus is shutting down the European economy. In increasing numbers people are no longer travelling. The spread of the virus, whether through fear or fact, is sharply reducing both production and demand. Indebted businesses will not have the cashflow to pay debt interest and supply chains will be riddled with payment failures. Previously acceptable debt is becoming junk. Banks will need to be rescued from defaulting customers and the euro’s future will be increasingly questioned.

For the moment, eurocrats might be able to get tables in their favoured restaurants more easily while national governments take it on the chin. But this is a temporary situation, which could easily evolve into a threat against the union, serious enough to either end or emasculate it when diametrically opposed interests are enhanced by the course of events and become unreconcilable.

Following Britain’s exit, the squabbling will now begin. Germany, with some commonality with the Netherlands, Austria and Finland has suffered the pain of unsound money to see its citizens’ savings taxed by negative interest rates and having them recycled into supporting bad debtors in the Mediterranean states. The Mediterranean states will demand even more money, taking their debt-to-GDP ratios into the stratosphere. The new boys in the East, Poland, Hungary, the Czechs, Slovaks, Bulgarians, and Romanians, who still think they can change Brussels will realise that as the subsidies from Brussels dry up, they have been sold a pup.

The eurocrats in Brussels lunching on their langoustines will conclude nothing need change and the ECB can deal with it.

If only it was so simple.

The euro – can it survive?

A dusty concept called the regression theorem suggests the most fragile of the major currencies is the euro. This states that in the users’ collective mind its validity as money is derived through experience. The fact it was money yesterday, and in the days, weeks, months and years in the past confirms its status: the longer the better. For the fiat currencies with the longest history, their status as money was derived from their role as a gold substitute, linking their credibility to sound money in the distant past.

In the euro’s case, it derived its original status from the fiat currencies it replaced and is only twenty-one years old. In a generally stable economic and monetary situation the lack of a longer history of regression may not matter, but it could be more easily destabilised than a more established currency at a time of crisis. Despite the Lehman catastrophe, the subsequent banking crisis in Europe and negative interest rates, the euro has so far survived intact.

The fact it has done so is in large measure due to the lack of any alternative for the 340 million eurozone residents. Perhaps its survivability has been enhanced by the convenience of non-cash transactions. In any event, a population mandated to use a state issued currency finds it is in its interests to accept its validity as a circulating medium and only abandons it as a last resort. It is when approaching that point that the regression theorem will matter.

That is a consideration for domestic users of the euro. Meanwhile, foreigners have voted with their feet, driving the rate down in recent years from $1.60 in 2008 to $1.05 in 2016, and from $1.24 in 2018 to $108 recently. It has been the principal counterpart to a rising dollar expressed in the latter’s trade weighted index. Behind these moves there is the net effect of trade balances and speculative flows.

In 2019 the Eurozone’s balance of trade was a positive $175bn, while the US trade deficit was $667bn. The sharp difference between the two economies represented a strong headwind in favour of the euro and against the dollar, but since 2018 it was more than overcome by the pull of interest rate differences. While the ECB maintained a negative deposit rate, US-based hedge funds through the fx swap market shorted the euro and bought dollars to benefit from interest rate differentials.

Since April 2018, when it became clear that President Trump’s tax policies would stimulate the US economy the FX swap trade was on. There can be no knowing the true size of it, but it was significant enough to force the Fed to intervene in the repo market to provide extra liquidity from last September to this day.

The Fed has now reduced its funds rate by fifty basis points to 1.0-1.5% and the 13-week T-bill is leading the way to yet lower yields by yielding only 0.675%. Given that prime brokers fund their inventory at the fed funds rate, they are still losing money, so the Fed will be forced to lower the FFR again to 0.5%-0.75% to avoid disrupting the T-bill market. Even that assumes no further fall in T-bill discounts, but it does mean that interest differentials between dollars and euros will fall again, with consequences.

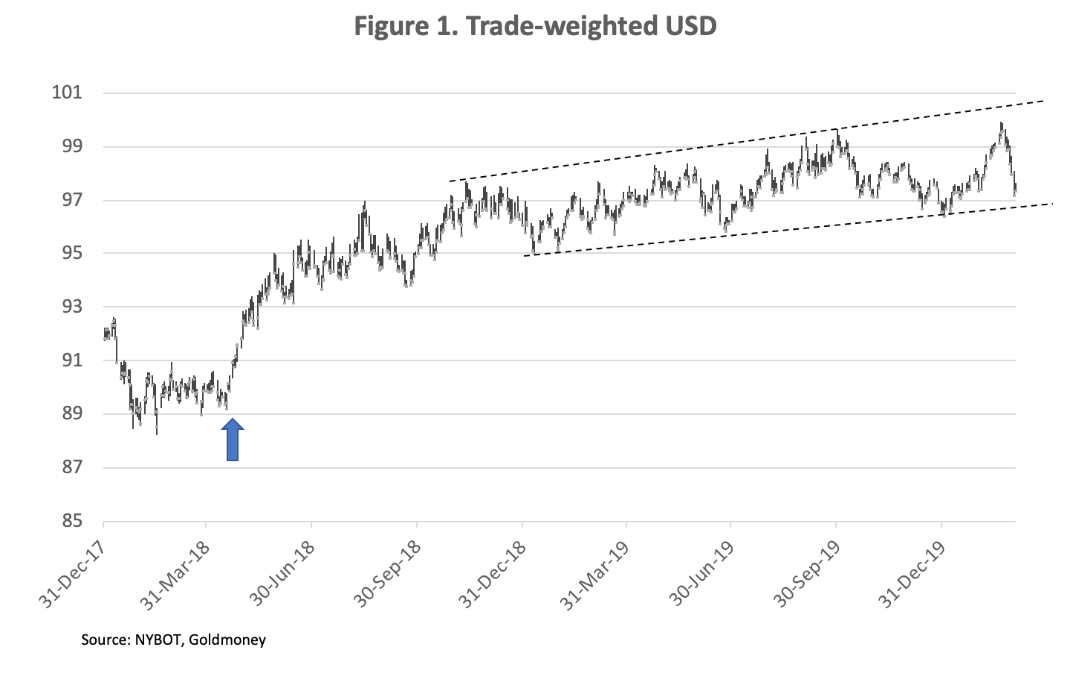

The declining profitability of FX swaps out of both euros and Japanese yen and into dollars plus increasing liquidity and counterparty risks means hedge funds should be aggressively unwinding their positions. Already, in recent days we have seen the yen rise from 112 to the dollar to 106.9 (note that a decline in the rate signals a stronger yen). And the euro against the dollar has gone from under 1.08 to 1.1175. The effect on the dollar’s trade weighted index has been dramatic, as shown in Figure 1 below.

The start of the fx swap trade for hedge funds is highlighted by the solid arrow, when in April 2018 it became clear that President Trump’s fiscal policies would lead to higher dollar rates and bond yields relative to both those of the euro and the yen, but particularly against the euro due to the index’s weighting in favour of it. While the bull market persisted, for most of the time it has been in the form of a weak broadening top delineated by the pecked lines. It is in this context we can see the impact of the coronavirus on dollar exchange rates, with the TWI suddenly falling by about 2½%. If it breaches 96.5, we will have technical confirmation the dollar is due to fall significantly, possibly quickly, against the euro.

In the short term, the unwinding of fx swaps combined with the relative trade imbalances with the dollar are the reason their closure could drive the exchange rate for the euro higher, likely to provoke the ECB into attempts to offset it. Policymakers enamoured of the Taylor rule will argue for deeper negative rates, a move that favours spendthrift governments but does nothing for the real economies in the EU. Worse, it comes at a time when overleveraged eurozone banks will be reducing outstanding bank credit, as loans reflecting dollar swaps positions taken out by both hedge funds and commercial entities are being wound down. And they will also be trying to reduce their loan exposure to businesses whose cashflows are being undermined by the coronavirus. In short, bank credit faces an imploding pull.

The walking shadow of Credit Anstalt returns

Not only will the ECB be trying to kick life back into a dead beast of burden, but commercial banks will be caught in the vice of rising payment failures, bad debts and falling collateral values. It will be read as a highly deflationary situation. To counteract it will surely be a massive expansion of base money by the ECB.

Today’s proxy for an earlier crisis, the Credit Anstalt bank failure in 1931, could be any one of dozens of banks today, significant and less so, throughout the eurozone. What the Austrian banking crisis of eighty years ago showed was the banking system can hide insolvency behind liquidity for considerable periods. In other words, so long as they are not forced to write off non-performing loans and central banks continue to provide them with liquidity banks can continue to trade regardless, which is what eurozone banks and the ECB have been doing for the last ten years.

For this reason, the ECB is should favour forms of quantitative easing, rather than expanding its outright purchases, as the principal means of strengthening bank balance sheets while funding fiscal deficits. It is bank reserves that now need bolstering as well as maintaining bond prices. This assumes it can run a steamroller over any legal challenges from inflation-averse German litigants; if not it will be snookered.

We can be reasonably sure that this forms the basis of contingency plans currently being discussed behind closed doors by the ECB’s panjandrums. They are certain to assume they can still control market prices of national government debt, And until the coronavirus spread, they were even encouraging member states to run yet greater deficits to provide the ECB with feedstock for what has become a monetary system out of control.

There do not appear to be independent estimates of price inflation to guide us as to how remote bond yields have become from reality. No matter. Instead we should note the interdependence between the expansion of the quantity of euros in circulation and asset inflation particularly with respect to government bonds. The future of bond prices has become bound up with the future for the euro itself because purchases of them have been by issuing raw money through the ECB’s asset purchase programmes. One collapses, they will both collapse.

Frenchmen with a sense of history may care to note the similarities between the ECB’s support scheme for eurozone government bonds by buying them with newly minted euros and that of John Law three hundred years ago. Law set up his own bank, which became the government’s bank, and he printed livres, which had become the government’s currency, to buy shares in his Mississippi venture. When his scheme began to falter in late-1719 his Mississippi venture subsequently collapsed, and his livres became valueless by the following September. There is nothing to say that once it commences, a collapse of the euro need take any longer that Law’s livres, particularly given their common provenance in the context of the regression theorem.

The sudden collapse of a fiat currency’s purchasing power is a difficult concept to comprehend, because we naturally think of price volatility to come entirely from the goods and services we buy, and not the money. We automatically assume that higher prices are the consequence of increased demand relative to supply and falling prices the reverse. So how can we say that prices will rise in a recession, or slump, which appears to be in prospect?

The key to understanding this conundrum is that money has an objective value for the purpose of individual transactions only. Its efficacy as a store of value is a separate issue. If the collective users of a currency see it as a poorer store of value today than they perceived yesterday, they will alter their preferences against it accordingly. It is in that context we must understand that a fiat currency can lose the public’s faith in it over a short period of time. But first, we must address changes emanating from the foreign exchanges.

Changes in the euro’s purchasing power are likely to be bound to what happens to the dollar, at least initially. When they unwind, the speculative flows out of the dollar and into euros and yen will give both latter currencies a temporary boost. As noted above, this is likely to encourage the ECB to become more aggressively expansive with respect to monetary policy than it would be otherwise. Deeper negative deposit rates may or may not be introduced. When the speculative flows have unwound, the euro will then face an adjustment to EU bond prices informed by the American experience, with markets then realising that the only buyer is the ECB, funded by the expansion of the quantity of euros while the banks are trying to aggressively reduce their balance sheets. It is similar to the problem John Law faced in January 1720, when his scheme was overwhelmed by sellers.

If, as postulated in an earlier Goldmoney article, the Fed loses control over the pricing of US Treasuries, then the ECB will face similar unsurmountable difficulties. And if, as seems very likely, the ECB responds initially by accelerating its bond price support programme, it will merely succeed in undermining its currency relative to sounder currencies, and particularly gold.

With every passing day, this outcome becomes less remote. The only way it can be stopped is for the ECB to mobilise its own gold reserves and those of its national central banks to return to a gold standard, while ceasing to fund EU governments’ deficits. Apart from wondering if there is some salvation in its gold reserves, it is unlikely the ECB will abandon easily its role in funding government spending.

EU banks at the end of the road

Since the EU’s debt crisis over Greece in 2009 and the subsequent problems with Italy, Spain and Portugal eurozone banks have dedicated their balance sheets to financing government deficits. At a cost to the commercial banks’ own cash flows, negative deposit rates at the ECB have ensured no material losses have arisen from holding short-term government bonds on their balance sheets. And the only other beneficiaries have been the large corporations which through bond issues have managed to lock in zero or even negative interest rates on their debt.

Officially, this has not been the reason behind the ECB’s monetary policies. The stated objective has been to kick-start the EU’s non-financial, non-government sector into economic growth, a policy that has not succeeded and has merely increased unproductive debt at the expense of predominantly German savers. But the problem ahead will now be the ECB’s ability to sustain the government bond bubble.

The coronavirus will make this more or less impossible, because productive output in the real economy is now collapsing. The implications for government borrowing are extremely worrying. All those debt problems of eleven years ago will resurface. This time, Greece’s debt to GDP starts at over 180%, compared with 146% in 2010; Italy at 135% (115%); Spain at 95% (60%); Portugal 122% (96%); and France 98% (85%). And that’s what is on balance sheets. The situation is simply unsustainable, given the combination of a new systemic crisis coupled with likely shut-downs due to coronavirus.

Not only will banks face a rapid escalation of non-performing loans and payment failures, but the bland assumption that the Eurosystem with its TARGET2 imbalances guarantee that the debt rating for Italy or Greece is similar to that of Germany is sure to be challenged. That being the case, not only the commercial banks but the ECB itself will have to contend with substantial losses on their bond holdings from widening spreads.

Nor is the eurozone immune to developments elsewhere. US Treasuries are wildly overpriced when a realistic rate of price inflation is taken into account, instead of the goal-sought 2% approximation of the CPI. With foreigners and the hedge funds liquidating dollar exposure as the Fed begins to lose its grip on the US’s financial markets, US Treasury bond prices are set for a significant derating and eurozone bond markets are sure to be adversely affected.

The scale of banking difficulties already in the pipeline but catalysed by the coronavirus are immense. There are bound to be squabbles over whether to bail in, as the law now requires, or to bail out. The possibility of bail-ins is bound to scare bank bondholders into selling out of all bank-issued bonds and preference shares, spreading a systemic crisis more effectively than traditional bail-outs ever could, where bond holders are protected.

Whichever way you analyse these dynamics, the eurozone’s bond bubble with its negative yields has almost no further upside, and like Icarus is bound to crash, taking not only the Eurosystem and the TARGET2 settlement system with it, but the currency as well.

The demise of the EU

The euro is not the only currency whose future is tied to financial asset bubbles. As described above the first to fail is likely to be the dollar, because the US Government’s finances are more obviously linked to a twin bond and dollar bubble. A more detailed analysis of the dollar’s problems is available here.

For a brief period, the euro should rally against the dollar, if only because foreigners and speculators are up to their necks in dollars and short of euros, positions that will be reversed as the fx swap market implodes. It will be after that imbalance has worked its way out that the euro will be in freefall against sound money, which is gold, and to everyone’s surprise its purchasing power measured in basics, such as food, energy and commodities, will begin to slide.

For now, the Brussels machine is ploughing on regardless. As the nation states take the brunt of their economic collapses on the chin, they will begin to realise that the EU super-state is little more than an obstructive and costly irrelevance. Brexit will increasingly be seen as the precedent for others to leave the sinking ship.

One needs to have little sympathy with the spendthrift member states, whose finances will irretrievably collapse. The former members of the Soviet Union which are now EU members will have lost their subsidies and observe comparative monetary stability in a gold-centric resource-rich Russia and conclude that for them it has been out of the frying pan and into the fire. But the greatest disappointment will be in Germany, suffering their third currency wipe-out in a hundred years.

It is very likely Germany will seek to restore its own currency, utilising her gold reserves in some way. Doubtless she will attempt to reclaim the gold she re-allocated to a failed ECB, but none of it is located in Frankfurt. But even without it she has sufficient gold reserves at home in Frankfurt to turn a future mark into a proper gold substitute. And importantly, there are a few old-school operators at the Bundesbank who understand the importance of an enduring monetary reset.

That will be primarily for Germany, but some other EU member states in the north who have reasonable fiscal control could join them, establishing a new Hanseatic League based on sound money. But it cannot happen while they remain members of a failed European project.

Alasdair Macleod

HEAD OF RESEARCH• GOLDMONEY

Twitter: @MacleodFinance

MOBILE: +44 7790 419403

Goldmoney

The Most Trusted Name in Precious Metals tm

NEW YORK | ST. HELIER | TORONTO

Publicly Traded Symbols: CA: XAU | US: XAUMF

© 2020 GOLDMONEY INC. ALL RIGHTS RESERVED. THIS MESSAGE MAY CONTAIN CONFIDENTIAL OR PRIVILEGED INFORMATION. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE ADVISE US IMMEDIATELY. THIS MESSAGE IS FOR GENERAL INFORMATION ONLY AND SHOULD NOT BE CONSTRUED AS AN OFFER OR SOLICITATION OF AN OFFER TO BUY SECURITIES OR ANY OTHER FINANCIAL INSTRUMENTS. WE DO NOT PROVIDE TAX, ACCOUNTING, OR LEGAL ADVICE, AND RECOMMEND THAT YOU SEEK INDEPENDENT PROFESSIONAL ADVICE IF NECESSARY. WE CONSIDER INFORMATION IN THIS MESSAGE RELIABLE BUT WE DO NOT REPRESENT THAT IT IS ACCURATE, COMPLETE, AND/OR UP TO DATE AND IT SHOULD NOT BE RELIED ON AS SUCH. OPINIONS EXPRESSED ARE OUR CURRENT OPINIONS AS OF THE DATE APPEARING ON THIS MESSAGE ONLY AND ONLY REPRESENT THE VIEWS OF THE AUTHOR AND NOT THOSE OF GOLDMONEY INC OR ITS SUBSIDIARIES UNLESS OTHERWISE EXPRESSLY NOTED.

Notice: This email may contain confidential or privileged information. If you received this email in error or believe you are not the intended recipient, please notify the sender immediately and delete this email without forwarding or opening any attachments. Thank you for your cooperation and attention.

********