Will Gold Continue To Rally Into The Chinese New Year?

Strengths

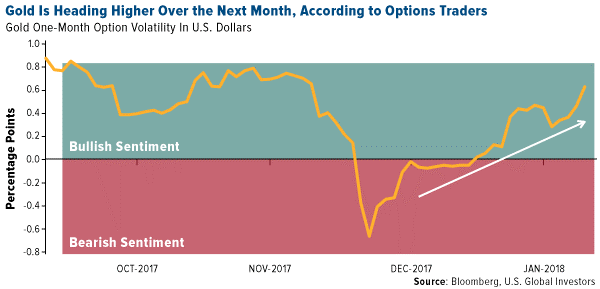

·The best performing metal this week was platinum, up 1.92 percent as traders boosted their net long position. Gold traders remain bullish on the yellow metal for a second week as gold reached the highest since September on Monday, reports Bloomberg. The U.S. dollar posted five straight weekly losses, even as U.S. Treasury yields rose. Earlier in the week, 5,000 call options with a strike of $1,650 on gold were purchased, indicating a bullish view on the price of the metal.

·Bullion is up in reserve currencies such as yen, euros and pounds, which might show there is some instrinsic value in gold’s rally. This could be due to concerns of global inflation or an imminent stock market correction, according to Fawad Razaqzada, an analyst at Forex.com.

·This week ETF holdings rose to their highest since 2013 and holdings in gold ETFs jumped to 13.7 tons, the most since September. Indian gold imports rose 53 percent in 2017, from 550 tons imported in 2016, to 846 tons last year.

Weaknesses

·The worst performing metal this week was palladium, down 1.59 percent as traders lowered their longs this past week. Bloomberg Intelligence highlighted that conditions favor platinum over palladium based on history. The top three North American gold producers – Barrick Gold, Newmont Mining and Goldcorp – have all seen their bondholders reap greater rewards for less risk than their equity investors, according to Bloomberg. Share performance of the three companies has been mixed for a year with their bonds outperforming their stocks.

·SQM, one of the largest lithium producers, secured a deal with the Chilean government to boost annual capacity at its mine from 66,000 tons to 216,000 tons. This could potentially flood the market, as other lithium stocks fell sharply this week at the news of potential oversupply.

·The U.S. Treasury views digital currencies as an evolving threat and it might be pulling money away from investors in gold, according to Bloomberg. When Bitcoin fell below $10,000 briefly this week, investors sharply turned to see if they could invest in gold. This demonstrates gold as being seen as a safe-haven investment versus volatile cryptocurrencies, however, it also shows investors may have left gold for the new currencies.

Opportunities

·According to Bloomberg, silver may stand to benefit the most from cryptocurrency falls, thanks to strong global PMIs and a weak U.S. dollar. Bart Melek from TD Securities released a 2018 outlook saying “Considering silver’s underperformance, its traditionally higher volatility and historic relative strength during periods when investors are building gold exposure; the white metal is on track to outperform.”

·Gold might continue to rally as demand in China is strong during this year’s Chinese New Year buying season. The yellow metal is also trading near the cheapest relative to crude oil in more than two years, according to Bloomberg. Bloomberg Intelligence analyst Mike McGlone said the gold-oil ratio has backed up into the key support zone favoring gold.

·Institutional investors are showing renewed interest in gold due to a weakening U.S. dollar and higher bond yields. Speaking to Bloomberg News, Sprott Asset Management’s CEO John Ciampaglia said that investors don’t think there will be a gold price rally; rather, they are seeking a safe haven for their assets. Sprott also said it is seeing increasing interest in investing in mining and gold ETFs.

Threats

·The world’s major gold producers have cut back on mergers and acquisitions with industry transactions totaling just $8.95 billion in 2017, tumbling by a third from the previous year, according to Bloomberg. In a rush to boost output in 2011 when gold was at an all-time high of $1,921.17 an ounce, companies spent a record $38.7 billion on acquisitions. The lack of takeovers may signify that the gold market is nowhere near a top at this point.

·Bond traders are piling into Treasury Inflation Protected Securities, TIPS, as a measure to purchase inflation protection. This could potentially backfire as the flattening of the U.S. yield curve have sent the spread between 30- and 10-year breakeven rates below zero for the first time since 2013, writes Bloomberg. When this spread turns negative it’s colloquially referred to as the “widowmaker” trade as it has led to quick and sharp losses such as during the taper tantrum which gripped bond markets in 2013.

·Since the recently passed tax overhaul, large corporations have stated they will be bringing back to the U.S. billions in cash stored overseas. This significant unloading of cash might strengthen the dollar, which is historically bad for the price of gold. Many think the repatriating of money will lead to distributions to shareholders, rather than promises of the Trump administration for companies to reinvest in their own businesses.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of