Will President Trump Stand By The US Debt Obligation?

Raising the debt ceiling is how we ended up with a $20 trillion debt. Is the debt ceiling becoming a joke? It is the same theory as a speed limit sign that is never enforced. Short-term, there are positive consequences to raising the debt ceiling. The US will continue to pay its bills and avoid a total debt crisis. This debt ceiling was implemented as the only restraint to be enforced on out-of-control government spending.

Social Security and Medicare are the two premier federal entitlements that are the primary drivers of the long-term debt.

The government is now hitting it’s limit on borrowing to cover revenue shortages and, therefore, must raise the debt ceiling or suffer the consequences of a first time ever default by the US Treasury.

Any failure to raise the debt ceiling will cause irreversible damage to the US credit rating. This would trigger an uproar in both the US and global markets. The future cost of borrowing, postponing Social Security payments and tax returns, as well as forcing layoffs of non-essential government workers, will certainly take the steam out any new future highs of the stock markets.

In August 2011, Standard & Poor’s downgraded the government’s Triple-A rating after Congress and the White House became deadlocked for weeks over a budget deal. The US Treasury came extremely close to defaulting. It took the intervention of Vice President Joe Biden and Senate Republican leader Mitch McConnell of Kentucky to avert an economic crisis.

In 2015, President Obama and Republican congressional leaders agreed to suspend the federal debt ceiling until March 15th, 2017. After this date, the Treasury will surpass its $20 trillion borrowing authority.

Treasury Secretary Steven Mnuchin is expected to order “emergency measures” to buy more time for the government to pay its creditors and cover revenue shortfalls in order to keep the government operating. The increasing global debt is contagious.

Equities Bull Market To Continue Surging As Historic Breakout Patterns Start To Form

Here are the three reasons:

1. The US dollar is a world currency, remaining stable even as the US continues to print money.

2. The Federal Reserve can keep interest rates low through quantitative easing.

3. The power of the US economy means that US debt is a relatively safe investment.

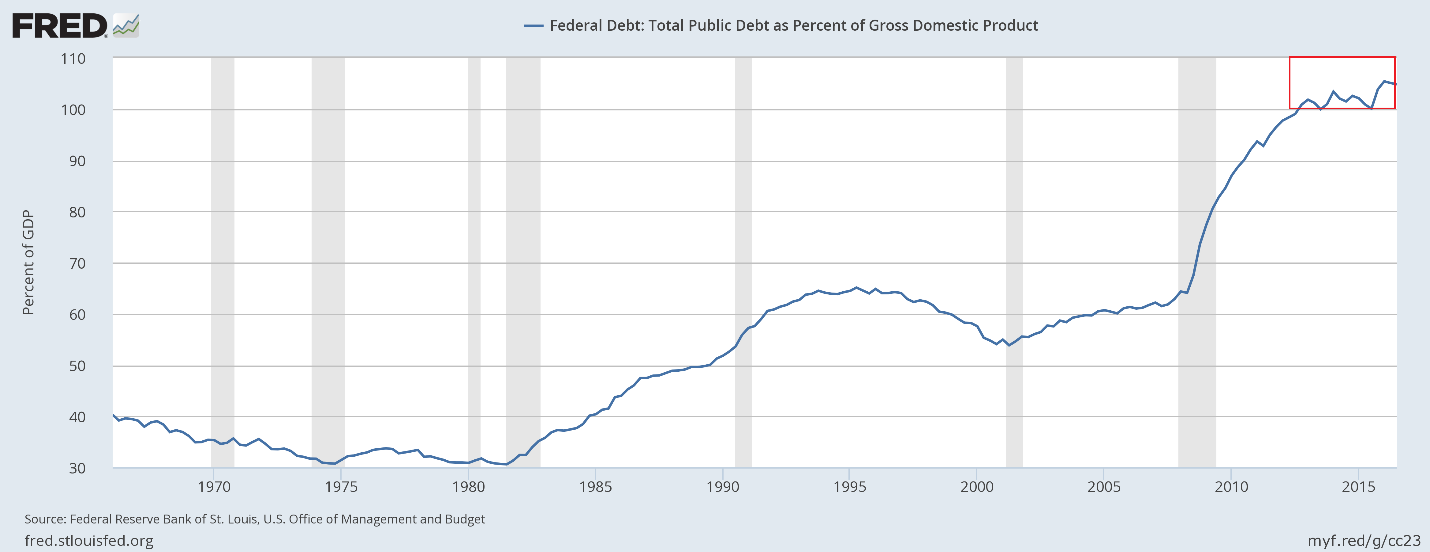

The graph below shows the federal debt as a share of GDP. There has been a marked increase in debt in response to the past Great Recession Of 2007. It has reached over 100% of the annual GDP. I consider that to be too high!

We are currently living during the greatest debt bubble in the history of the world and our financial engineers must keep calculating methods to keep it growing much faster than global GDP because, if it ever stops growing, it will burst and destroy the entire global financial system. President Trump is going to discover how challenging it will be to find the votes which are necessary to raise the debt ceiling. Many Republicans are absolutely against raising the debt ceiling without major spending cut concessions.

If the debt ceiling is not raised, it will certainly mean that a major political crisis and a severe economic downturn are imminent.

Concluding Thoughts

The next big trade is almost here! You should take advantage of my insight and expertise as I can help you grow your trading account by tuning in every morning for my video analysis and market forecasts on all ‘asset classes’ and new trade opportunities.

We always take half off of the table on all positions to lock in quick solid gains and then we ride the other half for much higher returns! We reduce our risk while keeping our gains!

It looks as though we are a couple days away from major trade setup that could last several months with the potential for 51-55% return. Be sure to tune into my newsletter at www.TheGoldAndOilGuy.com