Into Year End With Gold And Silver

It has been an odd and frustrating year for COMEX Digital Gold and Silver. However, conditions exist that could drive prices back to unchanged or even slightly positive by year end.

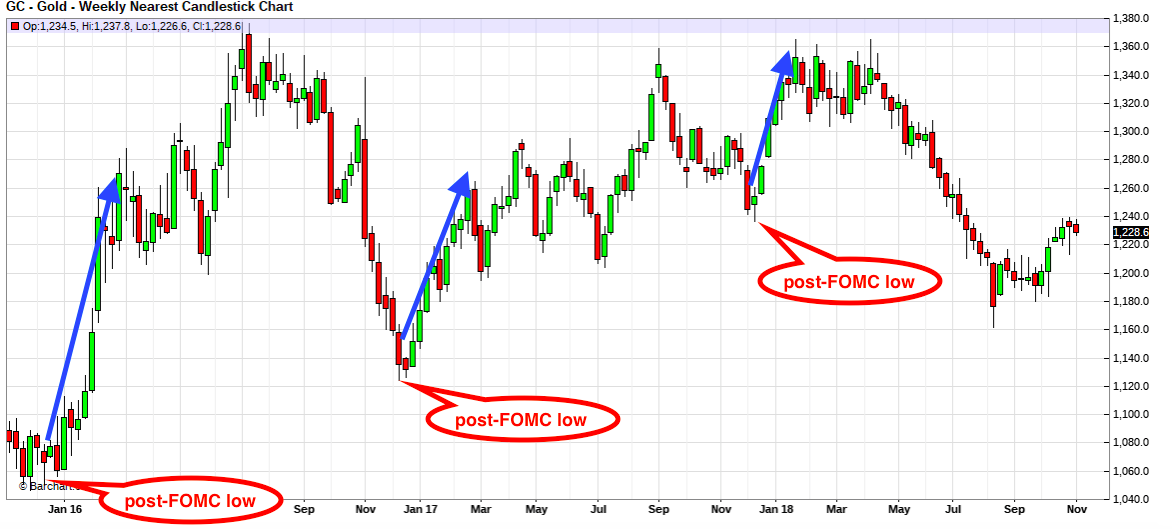

Let's begin by noting why and how this year got sideways on us. We were on the record stating that COMEX gold would break out of its 5-year "bowl" pattern by late 2018. Why did we think this? See the chart below from early March. While it appeared that a temporary breakdown was possible, everything looked on track for a move to the high 1300s by late in the year.

And while things looked really good through late April, a funny thing happened on the way to a successful forecast. Suddenly, COMEX gold began tracking the yuan-dollar exchange rate almost tick-for-tick. We've written about this on multiple occasions since June. Below are just two examples:

• https://www.sprottmoney.com/Blog/has-the-pboc-take...

• https://www.sprottmoney.com/Blog/trade-wars-tariff...

And so, instead of rallying as we expected, COMEX gold began to fall. Sharply. And, as you can see below, the dollar price of gold was moving in tandem with the dollar "price" of the yuan:

As you can see, though, there has recently appeared a slight disconnect between the pair. Additionally, with global equity markets struggling, global bond markets stabilizing and potential change in Fed policy looming in 2019, perhaps we can see a rally into year end that can bring COMEX metal prices back to unchanged—or even positive—for 2018. And wouldn't that be a pleasant surprise? Especially considering the historically poor sentiment in the sector at present.

And there is precedent for such a year-end rally. As you can see below, each of the past three years have seen lows in mid-December, coming at around the time of the December FOMC. This year, the last FOMC meeting for 2018 is scheduled for December 18th and 19th. Could we see a similar rally in the final weeks of 2018? Why not? Most tax-loss selling will be completed, and just as in the previous three years, global investors will be once again looking ahead to the new year and seeing multiple possible catalysts for COMEX gold.

In my mind, the key to a year-end rally in 2018 is the $1240 level. This is where COMEX gold bottomed in December of 2017 before charging nearly $70 into year end and finishing last year at $1309. Thus, being above $1240 on December 19th would seem to be an important milestone this year too. Below, you can clearly see the resistance that COMEX gold has found at this level on multiple occasions since July:

Additionally, it is important for COMEX gold to regain a position above its 200-week moving average. This level has been supportive of price for the past several years, and crawling back above it in the days ahead would be a positive technical signal. Once a beachhead above $1240 has then been established, the chart looks clear for a return to $1300 and a near-breakeven settlement for 2018.

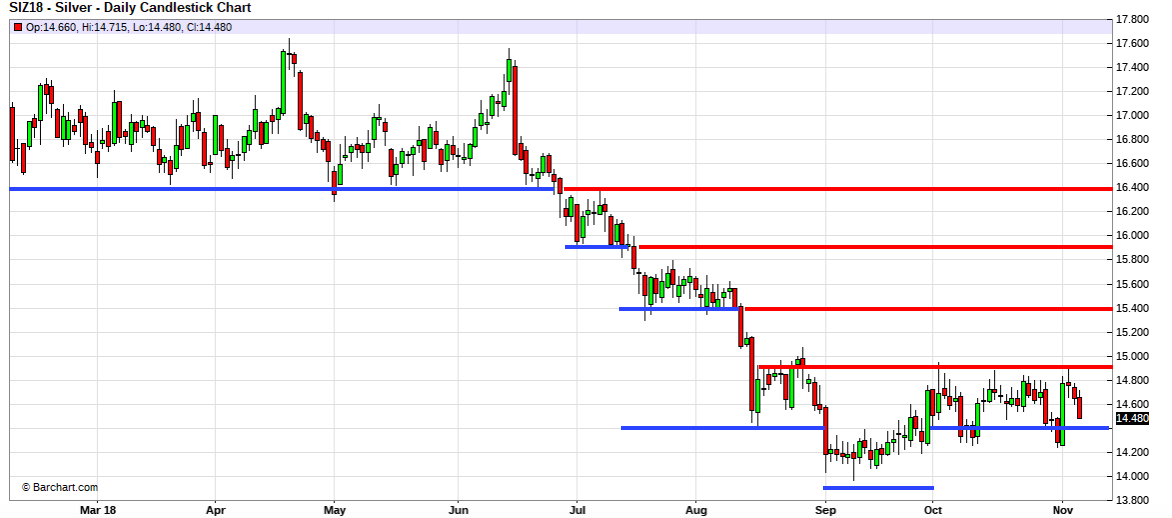

COMEX Digital Silver has its own set of challenges, but it shares many of the same possibilities into year end. The key for silver is to begin besting many of the same 50¢ intervals that offered support during the fall that began in June and ended in September. Key support for the first half of this year was consistently found near $16.40, and it is this level that will offer the most stout resistance on any move back upward. This same area is where silver will find its own 200-week moving average, a technical level you may recall as being strongly enforced as resistance since mid-2016.

So, we'll watch to see how the year finishes for both COMEX metals. The year 2018 has been another challenging and frustrating one for many of us in the sector, but with change and uncertainty looming for the months ahead, 2019 promises to be a different animal. How prices finish in 2018 will again set the tone for the first quarter of the new year; thus watch closely to see if prices can close this year in an uptrend.

The views and opinions expressed in this material are those of the author as of the publication date, are subject to change and may not necessarily reflect the opinions of Sprott Money Ltd. Sprott Money does not guarantee the accuracy, completeness, timeliness and reliability of the information or any results from its use.You may copy, link to or quote from the above for your use only, provided that proper attribution to the author and source is given and you do not modify the content. Click Here to read our Article Syndication Policy.

********