Inflation, Deflation And Gold

Are we headed for rampant inflation or crippling deflation in 2016? What will both scenarios imply for the gold market?

Are we headed for rampant inflation or crippling deflation in 2016? What will both scenarios imply for the gold market?

Some analysts expect that the 2016 will be about inflation. They argue that the low inflation in 2015 was caused by a plunge in commodity prices. But the potential for further declines is limited, so we can expect inflation. Actually, there is a noticeable divergence between the overall price index and the core price dynamics.

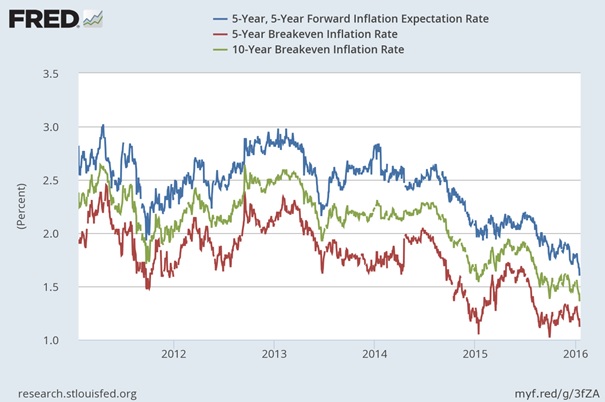

However, investors are not expecting inflation so far. As the chart below shows, the inflation expectations have been declining since 2013. Importantly, they moved lower in January 2016.

James Bullard, the president of the St. Louis Federal Reserve Bank, called this drop “worrisome”. He said that inflation expectations are a key factor and “if they continue to decline I would put increasing weight on that”.

Chart 1: Long-term inflation expectations from 2011 to 2016.

Undoubtedly, markets often underestimate inflation risk. But many people underestimate deflation either. Quantitative easing was believed to trigger massive inflation, but it did not – partially due to strong deflationary forces. Investors do not realize that deleveraging exerts a deflationary pressure. Actually, debt deflation is a very deflationary process. Given the Chinese pile of debt, we so far do not expect rampant inflation in 2016.

Although unexpected, high and accelerating inflation would probably be the best scenario for gold, the deflation scenario would also be good for the metal. Surely, deflation increases real interest rates, which is negative for bullion, but debt deflation and deleveraging would imply lower demand for loans and, thus, lower interest rates. Moreover, deflationary pressures or persistently low inflation would induce the Fed to loosen its monetary policy.

The take-home message is that inflation expectations are declining. It means that markets forecast stronger deflationary forces (to a large extent imported from China) in 2016. According to popular belief, inflation is positive for gold, while deflation is negative. However, this is not true. Inflation does not always push up the price of gold, and the yellow metal often shines during deflationary periods (remember 2009?).

If you enjoyed the above analysis, we invite you to check out our other services dedicated to the precious metals investors. We invite you to join our gold newsletter today – you’ll also gain 7-day trial of our premium Gold& Silver Trading Alerts. It’s free and if you don’t like it, you can easily unsubscribe.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor