US Retail Sales Weak in October. Will The Gold Price Be Affected?

U.S. retail sales barely rose in October. They increased 0.1 percent, below the expectations of a 0.3 percent rise. What does it mean for the gold market?

October is the third month of weakness in retail sales, a sign that consumers do not want to boost their spending, despite the cheap fuel and improved labor markets. The reasons may be the debt overhang and uncertainty.

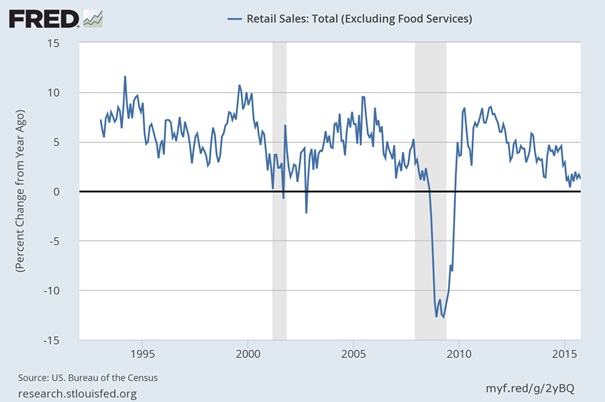

Three months of weak data is not a disaster yet, but retail sales are in a downward trend since 2011, as you can see in the chart below. The slowdown would’ve been deeper, but motor vehicle sales propped up retail sales. Thus, the end of the automotive bubble could drag retail sales down.

US Retail Sales (excluding food services, as a percent change from year ago) from 1993 to 2015.

Weak retail sales caused entrepreneurs to pile up inventories. Business inventories increased 0.3 percent in September (higher than expected), mainly due to a rise in inventories in the retail sector. It signals demand weaker than expected by retailers, and lower future production and consumer inflation (retailers will be forced to offer discounts to sell off stocks). The 0.4-percent decline in producer prices in October also reflects weak demand and signals weak consumer inflation in the nearest future.

The weakness in retail sales calls into question whether GDP growth will rise above 2 percent in the fourth quarter. The recent data may provide an excuse for the Fed to postpone an interest rate hike, but FOMC members seem to be quite determined to raise interest rates right now, regardless of the condition of the economy. Therefore, the disappointing data on retail sales should not significantly affect the gold market.

To sum up, retail sales were weak for a third month in a row. The odds for a Fed hike declined from 69.8 to 65.9 percent. However they are still at elevated levels. Therefore, the price of gold will be still under downward pressure. Gold bulls have to wait for the end of automotive boom. If motor vehicle sales decline, retail sales will no longer support the US economy.

If you enjoyed the above analysis, we invite you to check out our other services dedicated to the precious metals investors. We invite you to join our gold newsletter today - you’ll also gain 7-day trial of our premium Gold & Silver Trading Alerts. It’s free and if you don’t like it, you can easily unsubscribe.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor