The Cycle Of Falling Interest, Gold And Silver Prices

Over the past few weeks, we have looked at the effects of falling interest rates: falling discount applied to future cash flows (and hence rising stock and bond prices), and especially falling marginal productivity of debt (MPoD). Falling MPoD means that we get less and less GDP “juice” for each new dollar of borrowing “squeeze”.

Last week, we proposed an economic law: if MPoD < 1 then the economy is unsustainable.

MPoD has been falling since at least 1950, and is currently well under 0.4 (having had a temporary boost in the wake of the crisis of 2008). 0.4 means a new borrowed dollar adds 40 cents to GDP.

Under irredeemable paper currency, debt cannot be extinguished. So that dollar of debt—which bought a shrinking and temporary shot of GDP—lingers forever in the system. That is the very meaning of the word irredeemable.

This is one reason why MPoD is falling. Each time that a bond is rolled, the amount is increased by the accumulated interest. This incremental debt is not productive and does not add to GDP. And also, all that debt accumulated over many decades has to be serviced, which reduces debtors’ capacity to borrow for productive purposes.

And this leads us to a discussion of the trend of falling interest. Has the cause ceased? Have we, as many say, entered a new era of rising rates? Does the Fed have the power to make it so? Is there going to be a resurgence of inflation?

We must take a moment to address the term inflation, which is generally used to mean rising prices. California just enacted a tax hike on gasoline. Right now, while it’s fresh in everyone’s minds, blame for rising gas prices is placed squarely where it belongs: Sacramento (the state capitol). But soon enough, memory will fade, and people will just think “look at how expensive gas has become.” The price of trucking will go up too, and hence the price of goods are retail. And people will blame the Fed for inflation, so called.

The word inflation is a package-deal combining two dissimilar and unrelated things together into one word. Fiscal (including regulatory) policies can drive prices up. Just look at the cost of health insurance in the US. These should not be confused with monetary effects. Milton Friedman famously said “inflation is always and everywhere a monetary phenomenon.” This is misleading, at best.

Let’s begin our analysis with an observation. If debt is rising faster than GDP, then the typical business accumulates debt faster than it grows profits. On top of that, each tick down in interest rates creates additional incentive for its competitors to invest in additional production. The result is overcapacity.

So let’s say you are a farmer in Iowa. What can you do about your debt? Grow and sell more wheat. That is, sell wheat at the bid price.

Suppose you are a restaurateur with 5 burger joints. What can you do? Cook and sell more burgers. That is, sell burgers on the bid.

If you are a recent college graduate, with college loans to pay off, what can you do? Work and sell more of your labor. That is, dump labor on the bid.

And we wonder what supports the value of the dollar! It is the struggles of the debtors. Every debtor is busily working to increase the quantity of every kind of good and service, which is dumped on the bid. Dumping on the bid tends to push the bid down.

The result of monetary policy in a falling interest rate environment is that prices are falling too (unless fiscal policy can add costs commensurately).

Most miss the trees for the forest. They miss the bid-dumping for the quantity of dollars. As interest and MPoD fall, and as debt rises, the producers must work even harder to sell even more goods and services. At lower prices, which they themselves cause.

Rising asset prices, which goes along with falling interest rates, is a related problem. The asset price, or the price of the bond in this case, is the cost to liquidate the debt. If you sell a 10-year bond into the market, and then subsequently the rate of interest falls, it will cost you more to buy it back.

So in addition to debts rising faster than income, the burden of each dollar of debt is rising. No wonder prices are soft, if not falling outright.

In Keith’s theory of interest and prices, he discusses the rising cycle and the falling cycle. The central bank wants lower interest (to enable the government and its cronies to borrow more than it could otherwise). But it sets an interest rate cycle in motion. Normally, the market rate of interest is above marginal time preference and below the marginal return on capital.

When the central bank pushes down interest rates, it violates marginal time preference. The consumers and businesses react by borrowing to hoard. A cycle of rising prices and rising interest is born. It is a ratchet, and keeps going in one direction.

This is what many believe is happing today, or will happen imminently. The dollar is getting cheaper, so might as well buy consumer goods now. You know, before they get expensiver. And by this logic, businesses should sell bonds to buy more raw materials and expand inventories at every level in the system (hint, if you’re an aspiring management consultant: do not pitch this to the board).

However, we are not in that part of the cycle. That ended in 1981. Interest rates finally got above time preference. Unfortunately, they also got above marginal return on capital. This results in dishoarding—called just in time inventory management in business. With falling interest, rising debt, and rising liquidation value of debt, businesses react with increased demand for cash. If you own your meager capital outright, you may not need a large cash buffer. But if you have the same equity, but leveraged up your balance sheet 10 times larger, then you need a bigger cash buffer.

In the rising cycle, cash is trash. In the falling cycle, cash is king. Not to mention, if a good asset suddenly goes on sale under stress, it’s good to be there with cash.

We have shown that the trend of falling MPoD has been going on for decades. We have argued that the driver for it is the accumulation of debt which occurs when there is no extinguisher of debt in the system (as the domestic US economy has lacked since 1933). This trend is not going to change. Since 1981, MPoD has had an uncanny correlation with interest rates, not just generally falling but tracking every blip and dip.

We have shown that to compensate for falling MPoD, the central bank can lower interest rates. This does not fix anything fundamentally, but it does buy time as debts get relief in the form of lower payments. However, at the same time, the ever-lower rate provides an ever-greater incentive to borrow for nonproductive purposes. Such as Ikea buying TaskRabbit, substituting the founders’ and investors’ equity with Ikea debt.

The savings of the people (the ultimate source of all this credit of falling productivity) are casually disposed of, due to monetary policy. Can this trend end? Can the Fed decide to reverse falling interest rates? Keith argues in this theory of interest and prices, it cannot. The market is bigger than the Fed. But supposing the Fed could do that, whither MPoD?

There are many drivers for falling interest and soft, if not falling, prices. If there are any drivers for rising interest and rising prices (monetary, not fiscal) we would like to hear what they are.

…

The prices of the metals were up slightly this week. But in between, there was some exciting price action. Monday morning (as reckoned in Arizona), the prices of the metals spiked up, taking silver from under $16.90 to over $17.25. Then, in a series of waves, the price came back down to within pennies of last Friday’s close. The biggest occurred on Friday.

One thing that is worth noting. Although people think it is gold that goes up and down against a constant, stable dollar, it’s the other way around. This means that when people use leverage to speculate that gold is going up, they are actually betting the dollar will go down.

Gold is unique that way. For example, in times of stress or crisis, it is always the bid that is withdrawn. There are always plenty of offers. Suppose the US Geological Survey says that “there will be an earthquake in Los Angeles, 15 on the Richter scale. Nothing taller than a dollhouse will be left standing.” You will not find any bids to buy real estate in LA. We suspect not from Santiago, Chile to Vancouver, Canada and as far eastward as the Mississippi River.

On the other hand, offers will be plenty. Some people will set their offer close to what they expected before the announcement. Others will desperately try to unload at a far lower price.

Gold, on the other hand, behaves opposite. Suppose the Fed announces that it is “on the brink of insolvency, of failing to pay timely its obligations.” And, further, it adds, “the US government itself is at high risk of a failed bond auction imminently.”

You would not find a lack of bids to buy gold. You would find a lack of offers to sell it.

This is because the nomenclature (and the thinking) have it exactly backwards with gold. One is not buying gold. One is selling dollars! One is not selling gold, one is buying dollars. This may seem like a semantic argument, but it is vitally important to understand the distinction. We are not going to reiterate yet again that gold is money and the dollar is irredeemable credit. We have a different point.

Gold is the thing people want to own when the debtors—and the mother of all debtors, the US government—default. This is because a defaulted credit instrument is worthless. Gold cannot be impaired.

Intuitively, our remark about long gold futures position being a dollar short should make sense. What do gold promoters most often talk about as the driver for gold to go up? Threats to the value of the dollar, the reserve status of the dollar, the existence of the dollar, the use of the dollar outside the US, etc. They say “gold is going to go up” but they argue “the dollar is going to go down.”

We will look at gold and silver supply and demand fundamentals, and also we have charts for Friday’s price and basis moves. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

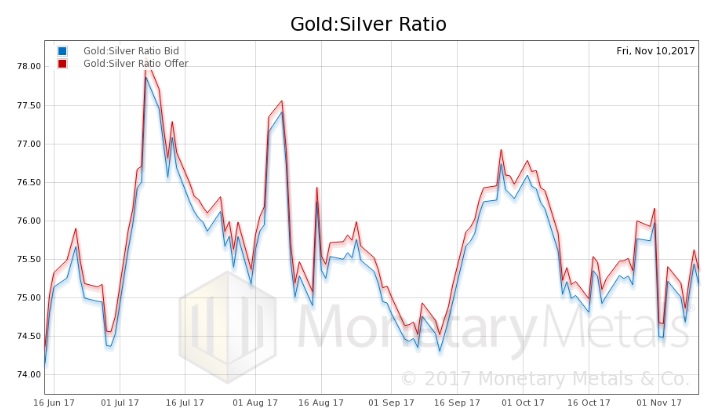

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose a hair.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

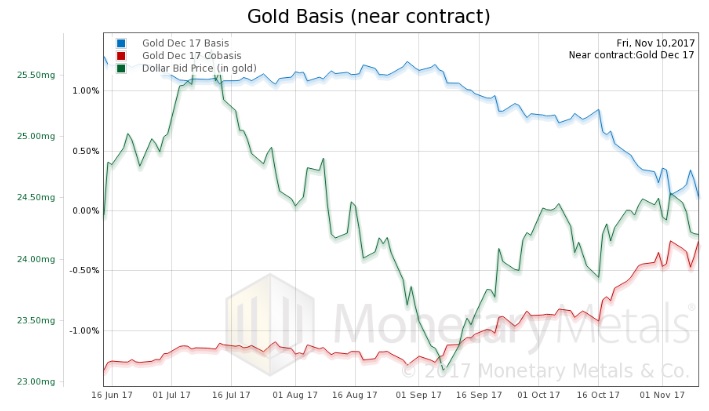

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph showing gold basis and cobasis with the price of the dollar in gold terms.

The cobasis (our measure of scarcity) continues to track the price of the dollar (inverse of the price of gold, in dollar terms). Keep in mind that the December contract is nearing expiry, and so will tend to have a rising cobasis. This is, as we said to Ted Butler, because the short positions are held by arbitragers and not speculators.

Our calculated Monetary Metals gold fundamental price moved down, but not by a lot.

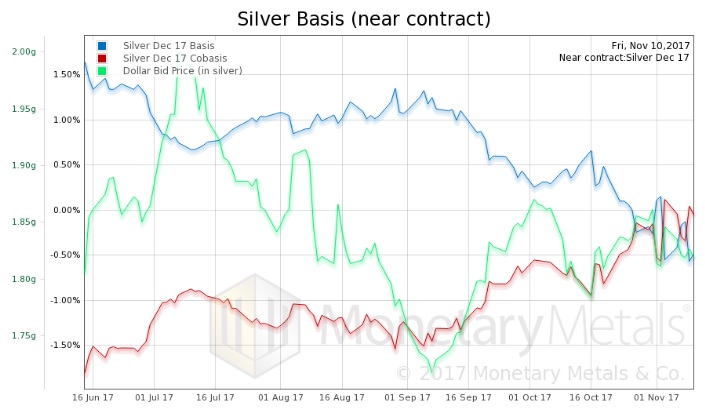

Now let’s look at silver.

We also see the cobasis tracking the price of the dollar, keeping in mind that contract roll distortions are larger in silver than in gold owing to its lesser liquidity.

Our calculated Monetary Metals silver fundamental price rose insignificantly.

Now, on to Friday’s crash. Is it like last Friday’s crash?

In Part II of this article, we show intraday graphs for both metals.

© 2017 Monetary Metals

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the